Life Expectancy: How Long Will You Live?

If we knew how things would unfold in the future, then financial planning would be easy.

If we knew things like future investment returns and future inflation rates, then that would remove a lot of uncertainty in a financial plan.

If we also knew when we’re going to die, then we could make sure that we spend every penny and “bounce the last check”.

But because of all the unknowns, we have a lot of uncertainty within a financial plan. To create a great financial plan, we have to evaluate and plan for that uncertainty. We have to understand both the average and the extremes. We don’t want to run out of money in the future, so it’s important that we manage this uncertainty properly and avoid making bad assumptions.

Life expectancy is one of those assumptions and it’s a big assumption within a financial plan. Assume a life expectancy that is too short and there could be years (or possibly decades) of meager retirement income.

When it comes to life expectancy, we can’t just assume the average, we need to know how much longer our money needs to last. Is it 5-years past the average, 10-years, 20-years, or more? Hopefully it’s for a very long time.

Life Expectancy At Birth

Most people when talking about life expectancy are referring to something called life expectancy at birth.

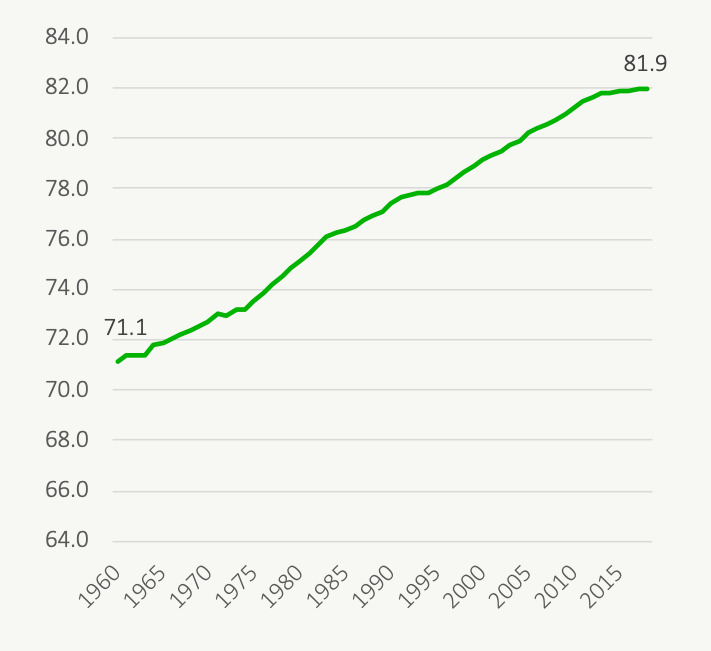

This figure (which is 82.0 years in Canada) represents the average lifespan for all people born at the same time. It includes all early deaths and therefore is somewhat misleading.

Those early deaths bring down the average to 82.0 years. It’s a good way to measure and compare life expectancy over time or between countries, but it’s a bad way to measure life expectancy for a financial plan.

Life Expectancy At Birth Over Time

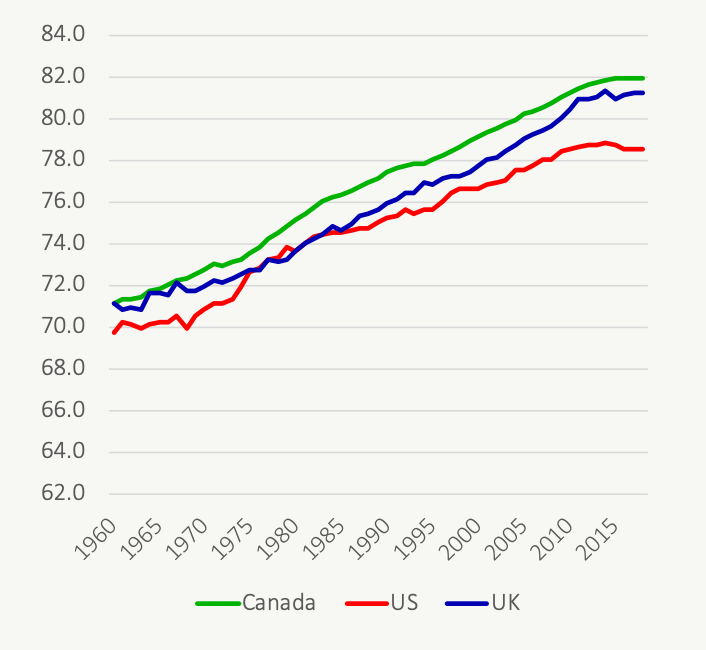

Life Expectancy At Birth Between Countries

Data From: datacommons.org

Future Life Expectancy

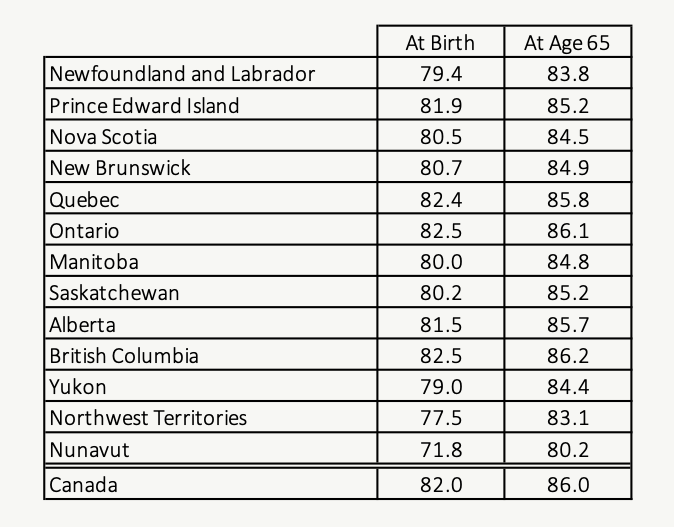

When it comes to financial planning, we’re more interested in future life expectancy. This life expectancy is based off your current age and looks forward.

This life expectancy includes the fact that you’ve already past certain risks that could have cause an early death. By surviving those risks your future life expectancy actually increases.

According to statistics Canada, the life expectancy for someone age 65 today is actually 86.0 years.

Life Expectancy For Couples

Couples have an additional complexity because the chance of one partner surviving the other is quite high. When we look at a couple together, this leads to a higher combined life expectancy.

Chances are that in a couple, at least one partner will exceed age 86.0. This means that for partners, we need to assume a life expectancy that is even greater than an individual. For couples we need to plan for money to last even longer.

Couples With An Age Gap

This becomes even more complicated when couples have an age gap. Depending on the size of the gap this may require additional years of retirement income.

This is an important consideration and shouldn’t be ignored.

But it can get very complex when factoring in current age, age gap, sex, and life expectancy.

Using A Life Expectancy Calculator

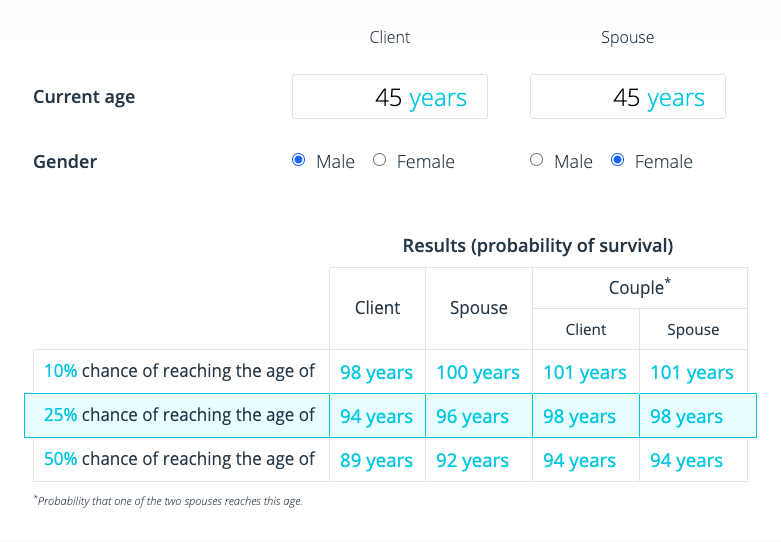

A life expectancy calculator can be a great tool to help understand these life expectancy assumptions, especially for couples, and especially couples with an age gap.

The IQFP (the group that manages the CFP designation in Quebec) has created an online calculator to help explore life expectancy assumptions.

It is simple to use and is based on the projection assumption guidelines that are updated every year.

By entering information like current age, partners current age, and sex. The calculator provides the life expectancy based on the current financial planning standards.

For example, for a couple who are both 45, the calculator suggests there is a 50% chance of one partner living until age 94, a 25% chance of living until age 98, and a 10% chance of living until age 101!

Find out what your life expectancy is using the IQFP calculator.

Avoid Running Out Of Money

To help avoid running out of money in the future it’s important to choose the right life expectancy for a financial plan. Assume a life expectancy that is too short and there could be years or decades of meagre retirement income.

Don’t use life expectancy at birth because that is an average of all deaths and includes all early deaths. It will provide a life expectancy that is too low.

Similarly, don’t use future life expectancy because it only represents the average. By assuming the average there is a 50% chance of living longer.

To determine life expectancy for your financial plan, use a life expectancy calculator to help evaluate the life expectancy at different probabilities, 50%, 25%, and 10%. Most people have a 25% chance of living into their mid 90’s and most people have a 10% chance of living into their late 90’s. Planning for anything earlier is simply too risky.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Looking for a Canadian Retirement Calculator.

Can you recommend one.

Thanks