When To Convert RRSP To RRIF?

When to convert RRSP to RRIF? What is the right time to convert? What are the advantages of converting?

Converting an RRSP to a RRIF is mandatory by the end of the year you turn age 71. This triggers mandatory minimum withdrawals the following year and each year after that. The minimum withdrawal is based on the ending balance the previous year and the account holder’s age.

There is a common misconception that you should wait until the last possible moment to convert an RRSP to a RRIF. Maybe this is because it’s a “forced” conversion? Something that’s forced couldn’t be good right? Perhaps it’s because RRSPs grow tax free? Why not delay withdrawals as long as possible, why voluntarily make withdrawals by converting to a RRIF early?

Despite the misconceptions above, in many cases, converting an RRSP to a RRIF should be done much earlier than age 71.

There are many reasons for a retiree to convert an RRSP to a RRIF well before the mandatory age of 71. In this post we’ll highlight some of the considerations when deciding when to convert RRSP to RRIF.

Draw Down Planning In Retirement

One very important reason to convert an RRSP to a RRIF is that you probably want to make registered withdrawals as part of the overall draw down plan anyway.

Draw down planning is an important part of any retirement plan because it can help manage taxes and government benefits in retirement.

In many cases we want to start registered withdrawals from RRSPs, RRIFs, LIFs to help “use up” lower tax rates in early retirement. We want to take advantage of personal tax credits, dividend tax credits, pension tax credits, low tax rates etc. etc.

We may also want to shift assets from registered accounts into other tax advantaged accounts like TFSAs before higher tax rates in later retirement. TFSAs are more flexible but still allow for tax free growth.

Waiting until the last possible moment to draw down an RRSP/RRIF might just mean paying more tax later, sometimes much more due to higher marginal tax rates.

Avoiding OAS Clawbacks (Especially For Couples)

Waiting until the last possible moment to draw down an RRSP/RRIF may also mean triggering OAS clawbacks in mid/late retirement.

The OAS clawback is 15% of individual income above a certain income threshold (Read more about the OAS clawback)

Waiting to convert an RRSP to a RRIF until age 71 might mean the RRSP has grown so large that minimum withdrawals now push an individual into higher income tax rates PLUS OAS clawbacks, a “double whammy”.

This is especially important for couples in the event of an unexpected death.

In a survivor scenario, registered assets “rollover” to the survivor and could create a “monster” RRIF. Because income can no longer be split, that monster RRIF, and the monster mandatory minimum withdrawals that result, could now mean OAS clawbacks for the survivor. Strategically drawing down the RRSP and converting to a RRIF earlier in retirement can help avoid this awful scenario.

Splitting Pension Income

Couples have another reason to convert RRSPs to RRIFs, pension income splitting.

After age-65 couples can split pension income on their tax return. RRIF withdrawals count as pension income, RRSP withdrawals do not.

It’s possible to split income without converting to a RRIF. Couples who have planned ahead may have used a spousal-RRSP to help evenly split registered assets before retirement. But even then, it might not be possible to split income perfectly in retirement. This is when converting to a RRIF can be extremely beneficial for couples.

Waiting to convert an RRSP to RRIF could mean missing out on income splitting between age 65 and 72.

Pension Income Tax Credit

Pension income from a RRIF after the age of 65 qualifies for the pension income tax credit. This $2,000 tax credit provides another small incentive to convert an RRSP to a RRIF before the mandatory age 71.

Because pension income can be split, this also means couples can both take advantage of the tax credit, that’s $4,000 in tax credits for a couple that may go to waste if an RRSP to RRIF conversion is delayed.

No Withholding Tax On Minimum Withdrawals

Converting an RRSP to a RRIF can also help manage income tax timing better. RRSP withdrawals have a mandatory withholding tax that depends on the size of the withdrawal. This could mean paying more tax up front and getting a tax refund later. Not ideal.

A RRIF on other hand has no mandatory withholding tax on the minimum withdrawal. This provides more flexibility to manage the timing of tax payments and cash flow in retirement.

Reduced Or No Fees On Withdrawal

Withdrawing from a registered account is called a deregistration. Withdrawing some of the assets inside an RRSP is called a partial deregistration.

Most brokerages and financial institutions charge a fee for partial deregistration and a higher fee for a full deregistration.

Although it’s not necessary to convert an RRSP to a RRIF to make withdrawals, the RRSP withdrawal fee could be anywhere from $50 to $75 to $125+

The advantage of converting an RRSP to a RRIF is that RRIF withdrawals often avoid these partial deregistration fees or have lower fees.

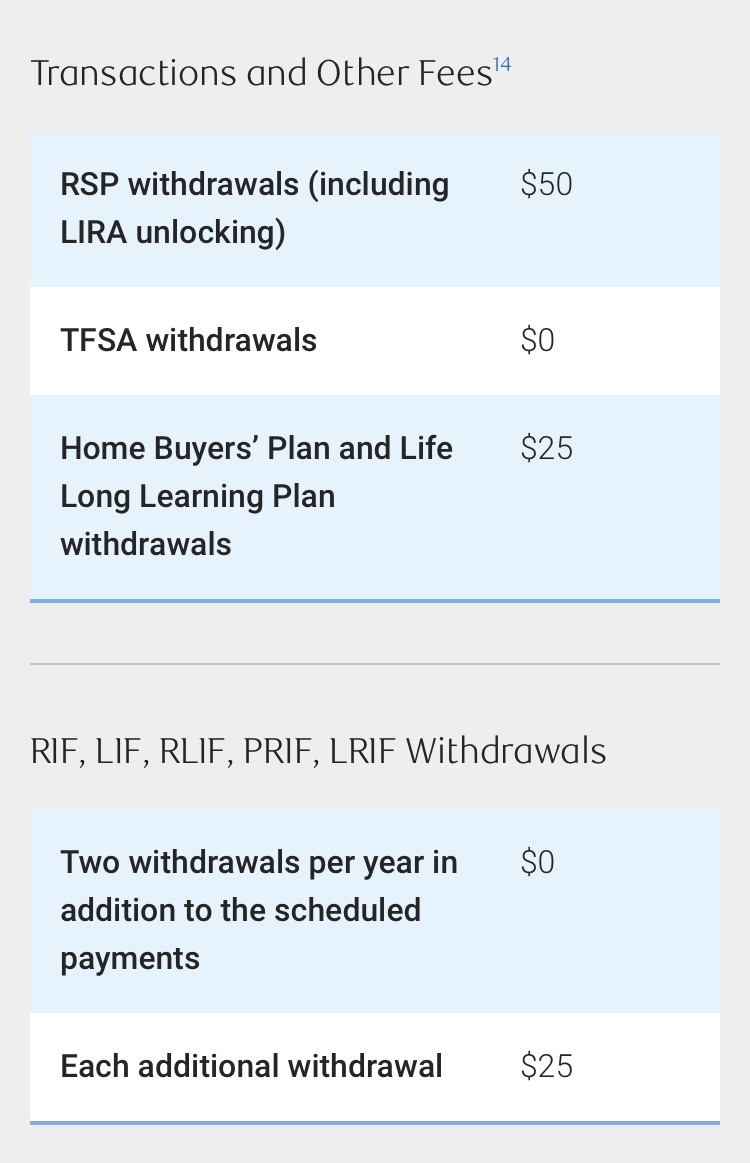

For example, as you can see below, RBC Direct Investing charges $50 for a partial deregistration from an RRSP, but for a RRIF it allows two free partial deregistrations each year and subsequent withdrawals are only $25 each.

A couple making semi-annual withdrawals from their registered accounts could save $200 in withdrawal fees each year just by converting to a RRIF.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments