When it comes to paying off your debt there are two basic approaches. The trendy approach is called the debt snowball. The classic approach is called the debt avalanche.

For reasons that we’ll describe later in this post, both options can help you pay off your debt quickly. The key is to figure out which option is best for you and your debt situation.

Just blindly following one approach could leave you in debt longer than you should.

There is also a third approach called the snowball/avalanche hybrid that takes the best of both methods.

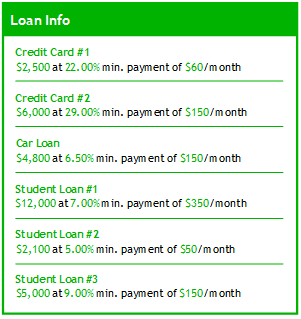

To explain these three different approaches to paying off debt, we’ll set up a quick example. Meet John, he has $32,400 in debt. Most of his debt is related to school which is at a low interest rate but he does have two credit cards that carry a balance. These credit cards have a high interest rate of above 20%.

To explain these three different approaches to paying off debt, we’ll set up a quick example. Meet John, he has $32,400 in debt. Most of his debt is related to school which is at a low interest rate but he does have two credit cards that carry a balance. These credit cards have a high interest rate of above 20%.

John has six different loans in total all with various interest rates. In this example John wants to know what the best method is to pay off his debt.

He’s pretty good with his finances but he likes the idea of paying off one loan quickly (rather than making equal payments on all of them simultaneously). He thinks this will be a good boost to his confidence. He also doesn’t want to be in debt forever so paying off all the loans as soon as possible is important to John.

Option 1: Debt Snowball

The term ‘debt snowball’ is very descriptive. To use this approach, you order your debts from the smallest dollar amount to the largest. You pay the minimum amount on all debts while putting any extra cash towards the smallest debt first. As you pay off your small debts, you slowly work up to the largest. Hence the ‘debt snowball’.

Pros:

One of the main benefits of the debt snowball is that you get to the first loan payoff the fastest. By starting with the smallest debt, you can wipe out an entire loan faster than other methods. This is a huge psychological boost. It feels great to knock off those debts and this helps to solidify your debt payment routine.

Another small benefit of the debt snowball is that you have more flexibility. By knocking off debts faster, your minimum payment decreases and you free up more cash flow in case of emergencies.

Cons:

Using the debt snowball means you’re likely paying more interest on your debt. This is an undeniable fact. By putting the focus on the size of the loan instead of the interest rate accruing on the loan, you could very well be paying more interest than you need to for longer. How much extra interest you pay depends on your loans and your interest rates.

In some cases, the extra interest can be thousands or tens of thousands extra. Think of all the extra days you need to work to pay that interest. It might not be worth it.

This extra interest also extends your debt freedom date by weeks, months or even years. Ouch.

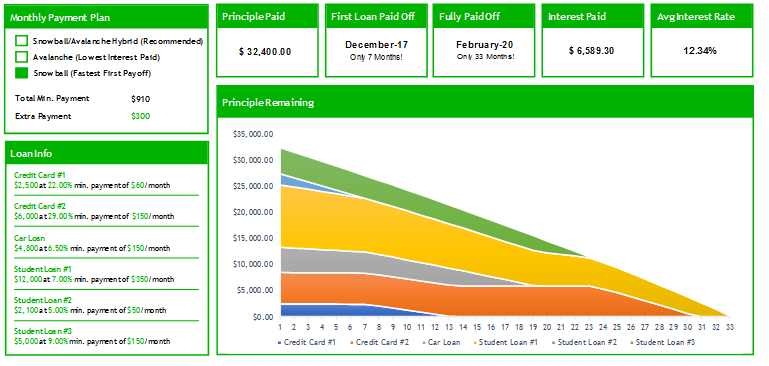

Let’s look at how John would do if he were to use the debt snowball approach:

As you can see, the debt snowball approach lets John pay off his first debt in only 7 months. That’s pretty fast. But his total interest paid is $6,589. That’s quite a bit higher than other methods we discuss below. It also takes John 33 months to pay off all of his debt. That’s pretty quick for having $32,400 in debt but it could be faster using the other methods.

Option 2: Debt Avalanche

The debt avalanche takes a different approach. To use this approach, you order your debts from the highest interest rate to the lowest. You pay the minimum amount on all debts and put any extra cash towards the highest interest rate debt first. As you pay off your high interest debts, you slowly work down to the lowest. You start way at the top and work down to the bottom. Hence the debt avalanche.

Pros:

The main benefit of the debt avalanche is that you pay the least interest. By starting with your highest interest debt you pay the least amount in interest over the course of all your loans. Depending on your debt and interest rates this could be a lot.

You also pay off your debt sooner. By paying less interest you get to reach your debt freedom date much faster. Maybe weeks, months or years earlier.

Cons:

It takes longer to get to your first loan payoff. You delay that psychological boost from paying off your first debt. Depending on your personality, the lack of feedback can be very detrimental. The difference in the timing of your first loan payoff could be months or even years. Imagine waiting another few months or a year to pay off your first loan. Waiting another few months before that scrimping and saving pays off. That could be too long for many people.

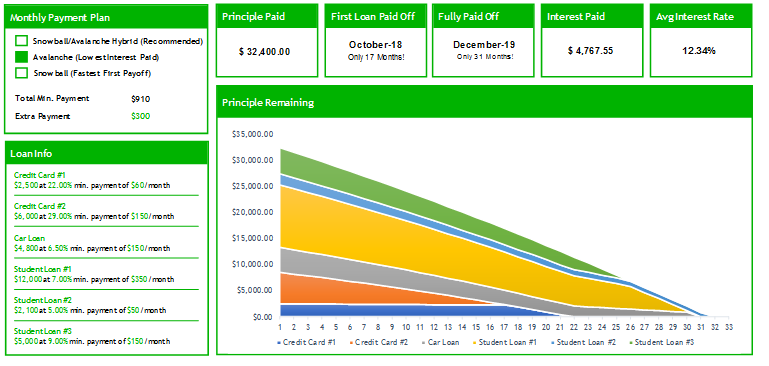

Let’s look at how John would do if he were to use the debt avalanche approach:

With the debt avalanche John pays way less interest, only $4,768. That’s over $1,700 less than the debt snowball! This is why John was smart to evaluate the different debt payment methods. That extra interest is about the same price as a vacation John wanted to take. The only problem with the avalanche method is that John’s first loan payoff doesn’t happen for 17 months. That’s a bit too long for John. The good news is that this method lets John pay off all his loans in just 31 months, 2 months less than the debt snowball.

Option 3: Debt Snowball/ Avalanche Hybrid

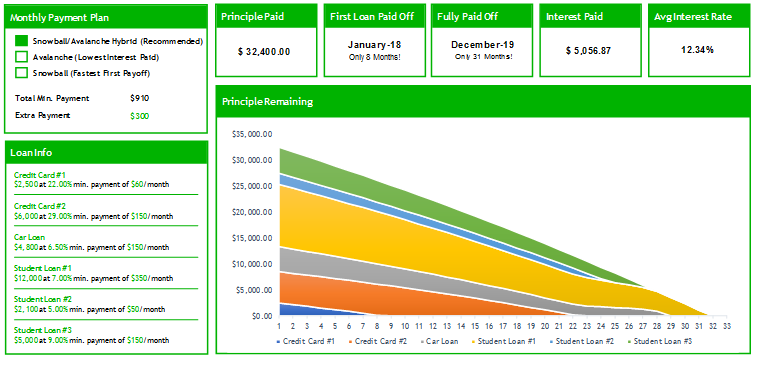

This is a hybrid version of the snowball and avalanche. This method is built into PlanEasy’s debt planner. Our artificial intelligence algorithm helps evaluate multiple scenarios to find a recommended method that delivers a fast first loan payoff but also reduces the amount of interest you pay. This recommendation is tailored to you based on your personal profile.

The benefit of the hybrid method is that you get to experience some of the psychological benefit of the debt snowball, but you also get to reduce your total interest paid like the debt avalanche.

How this works is quite complicated but what isn’t complicated is the debt paydown ‘hit list’ you get when selecting this method. After making all minimum payments you start directing any extra cash flow to the loan at the top of the ‘hit list’. Once you take down that loan you move on to the next.

Let’s check back with John, with the assumption that this time he’s using the hybrid approach:

The hybrid apporach looks like the best one for John. He pays off his first loan in just 8 months, that’s 9 months faster than the debt avalanche method. Plus he pays less interest than the debt snowball method, about $1,500 less. Still enough to take that vaction he wanted. The best part is that he still takes just 31 months to pay off all his debt.

The snowball/avalanche hybrid is the approach John ends up choosing.

If you wanted to evaluate your debt payment options start planning with PlanEasy and let us do all the tough calculations. All you need to do is answer some simple questions about your debts.

Owen Winkelmolen

Founder of PlanEasy Inc.

An avid traveler, father and personal finance expert. Owen's goal is to make financial planning easy. He believes that objective and straightforward financial planning is something that every Canadian should have access to. Find out why.

I definitely like the hybrid option! Most people seem to be stuck choosing one or the other. Choosing between the mathematical approach or psychological approach. Why not have both!

Me too. Like most things, going to one extreme or the other usually isn’t the best choice.

Intresting never heard of the avalanche method before. We did the ramsey debt snowball, like u said the physiological effects of paying off debts faster does wonders. I didn’t really understand the hybrid. Are you refinancing to a better intrest rate?

Hi PCI. Snowball is a very powerful method, the psychological boost can easily make up for the extra interest.

The hybrid is a mix of the snowball and avalanche methods. You order your debts from smallest to largest, the same way as the snowball method, but when debts are similar in size you would focus on the high interest one first.

So out of six loans if your two smallest debts were $2,100 at 5% and $2,500 at 22% you’d start paying extra against the $2,500 loan first. It’ll take an extra month to pay off vs the smaller $2,100 loan, so the psychological boost is slightly delayed, but you will save a lot in interest.