Family Financial Planning: Tax Strategies For Families With Children

Families in Canada have a very unique financial planning opportunity that isn’t available to other Canadians. This opportunity can help boost their savings and provide them with more cash flow to save in the future. With a bit of careful planning families can reduce their overall marginal effective tax rate and save more money.

First, a little background…

In Canada, there are two types of “tax rates”. The first is income tax. This one is easier to understand. As your income increases you pay more income tax. The second tax rate is actually a “benefit claw back rate” and it works the same way as tax rate, the more your income increases the less you receive in benefits. In Canada, most government benefits are “clawed back” based on household net income. This means that as you earn more income your benefits will be reduced, or “clawed back”, and the effect is the same as income tax.

Families have a unique tax and financial planning opportunity because some government benefits don’t get clawed back until family income is well into the $100,000+ range. This means there are certain tax strategies that are unique to families, even those with above average incomes.

All families with children under the age of 17 are eligible for the Canada Child Benefit (CCB). The Canada Child Benefit is one of the most generous benefits in Canada, it’s even available to high-income earners, but it also has one of the highest claw back rates too. But, with careful planning it’s possible to avoid some of these claw backs, increase your annual benefit, and as a result increase your annual savings as well.

Claw back rates on the Canada Child Benefit range from 3.2% to 23% for each extra dollar you earn. The exact claw back depends on the number of children and your household net income.

The claw back means that if you earn an extra $1,000 this year, your benefit could be reduced by $32.00 to $230.00 next year!

This is even higher for low-income families who also receive other government benefits, like the GST/HST credit or Trillium benefits in Ontario, which all have claw back rates as well.

The opportunity for families is that RRSP contributions will DECREASE their taxable net income and will INCREASE their benefits. That means that a $1,000 RRSP contribution this year will INCREASE your Canada Child Benefit by $32.00 to $230.00 next year!

This means that families in particular can strategically save using an RRSP instead of a TFSA and boost their government benefits. This is counter to most financial advice that suggests low-income Canadians should prioritize their TFSA first. While this advice might be true for many low-income Canadians, it’s not necessarily true for families.

We’re going to take a look at four examples to show you just how impactful this type of financial planning can be.

Note: These are examples only, specific to Ontario, and should not be used for financial planning purposes. Income tax and benefit rates are very dependent on family income, income split, ages of children, province of residence etc. To understand the impact for your family we recommend building a custom financial plan with an advice-only financial planner.

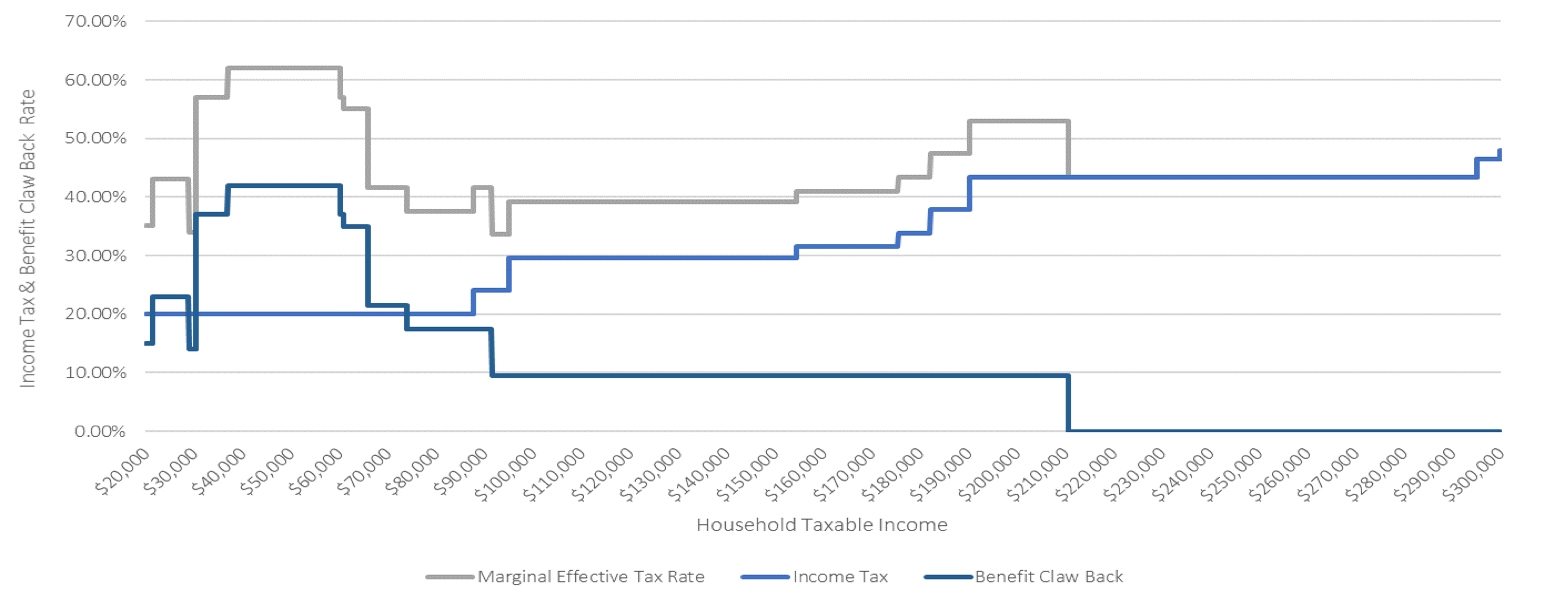

Example: Family With 4 Children Between Ages 6 and 17

A family with two adults and four children will have one of the highest tax rates in Canada. Even at higher income ranges their Canada Child Benefit has a claw back of 9.5% of marginal net income. This continues all the way up to a family income of $210,800 after which the benefit is no longer available.

This is even worse at lower income ranges. If this family has net income between $37,000 and $60,200 per year, their claw back on government benefits is 42% of each incremental dollar earned. When combined with income tax, their marginal effective tax rate (METR) is 62.05% for any income earned in this range. That means if they earn an extra $1,000, say from $57,000/year to $58,000/year, they will only see an increase of $379.50 in their bank account.

But! The opportunity for this family is that any RRSP contributions will create a large tax refund + benefit increase. A $1,000 contribution to RRSPs will create a tax refund plus benefit increase of $620.50!

(Note: We assume income is split 50/50 between adults. If income is split differently the METR will be even higher in some cases.)

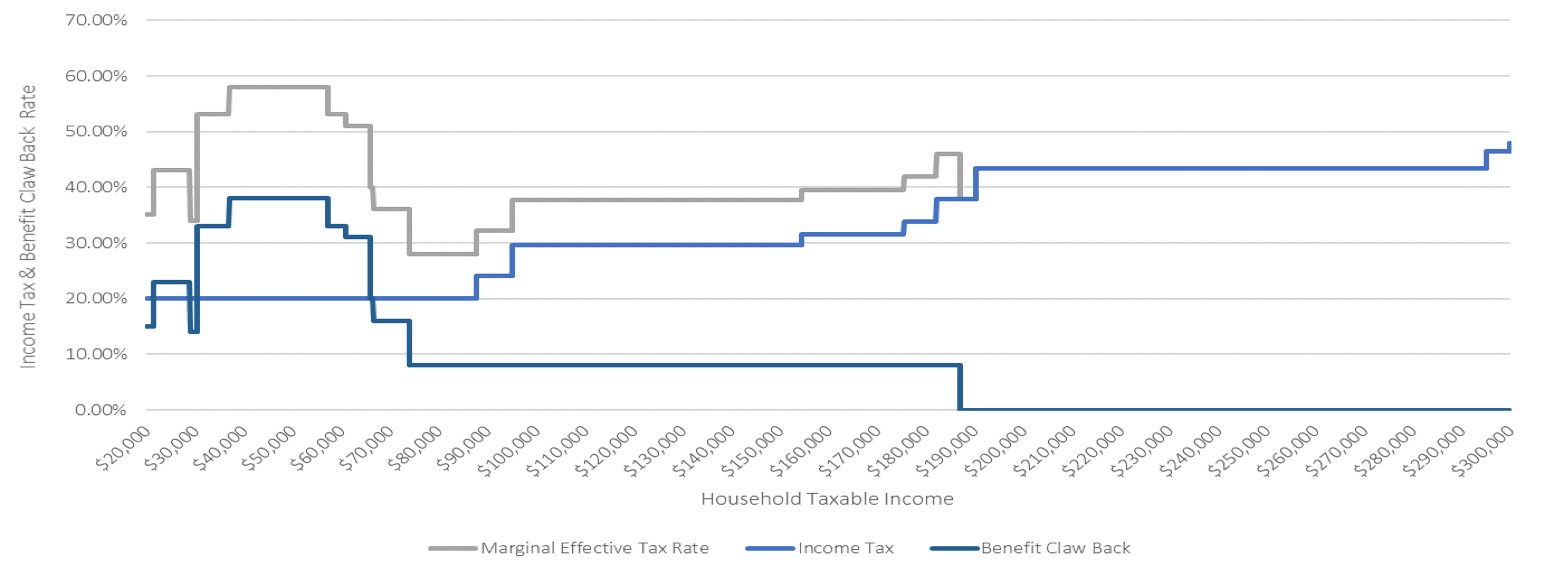

Example: Family With 3 Children Between Ages 6 and 17

A family with two adults and three children will also have a very high tax rate. At higher income ranges their Canada Child Benefit has a claw back of 8.0% of marginal net income. This continues all the way up to a family income of $187,200 after which the benefit is no longer available.

This is even higher at lower income ranges. If this family has net income between $37,000 and $57,200 per year, their claw back on government benefits is 38% of each incremental dollar earned. When combined with income tax, their marginal effective tax rate (METR) is 58.05% for any income earned in this range. That means if they earn an extra $1,000, say from $55,000/year to $56,000/year, they will only see an increase of $419.50 in their bank account.

But! The opportunity for this family is that any RRSP contributions will create a large tax refund + benefit increase. A $1,000 contribution to RRSPs will create a tax refund plus benefit increase of $580.50!

(Note: We assume income is split 50/50 between adults. If income is split differently the METR will be even higher in some cases.)

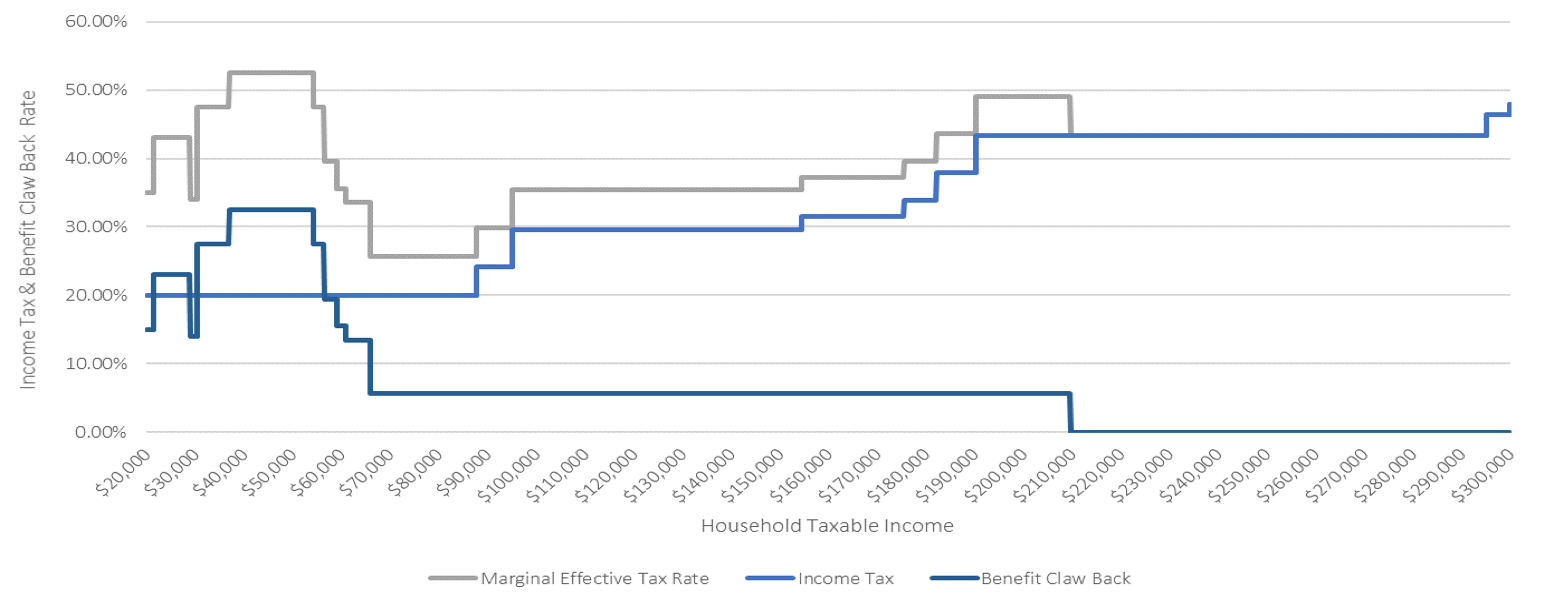

Example: Family With 2 Children Under Age 6

A family with two adults and two children will also have a very high tax rate but the effect of government benefits has started to decrease in this situation. At higher income ranges their Canada Child Benefit has a claw back of 5.7% of marginal net income. This continues all the way up to a family income of $209,800 after which the benefit is no longer available.

Similar to the scenarios above this is more extreme at lower incomes. If this family has net income between $37,000 and $54,200 per year, their claw back on government benefits is 32.5% of each incremental dollar earned. When combined with income tax, their marginal effective tax rate (METR) is 52.55% for any income earned in this range. That means if they earn an extra $1,000, say from $52,000/year to $53,000/year, they will only see an increase of $474.50 in their bank account.

But! The opportunity for this family is that any RRSP contributions will create a large tax refund + benefit increase. A $1,000 contribution to RRSPs will create a tax refund plus benefit increase of $525.50!

(Note: We assume income is split 50/50 between adults. If income is split differently the METR will be even higher in some cases.)

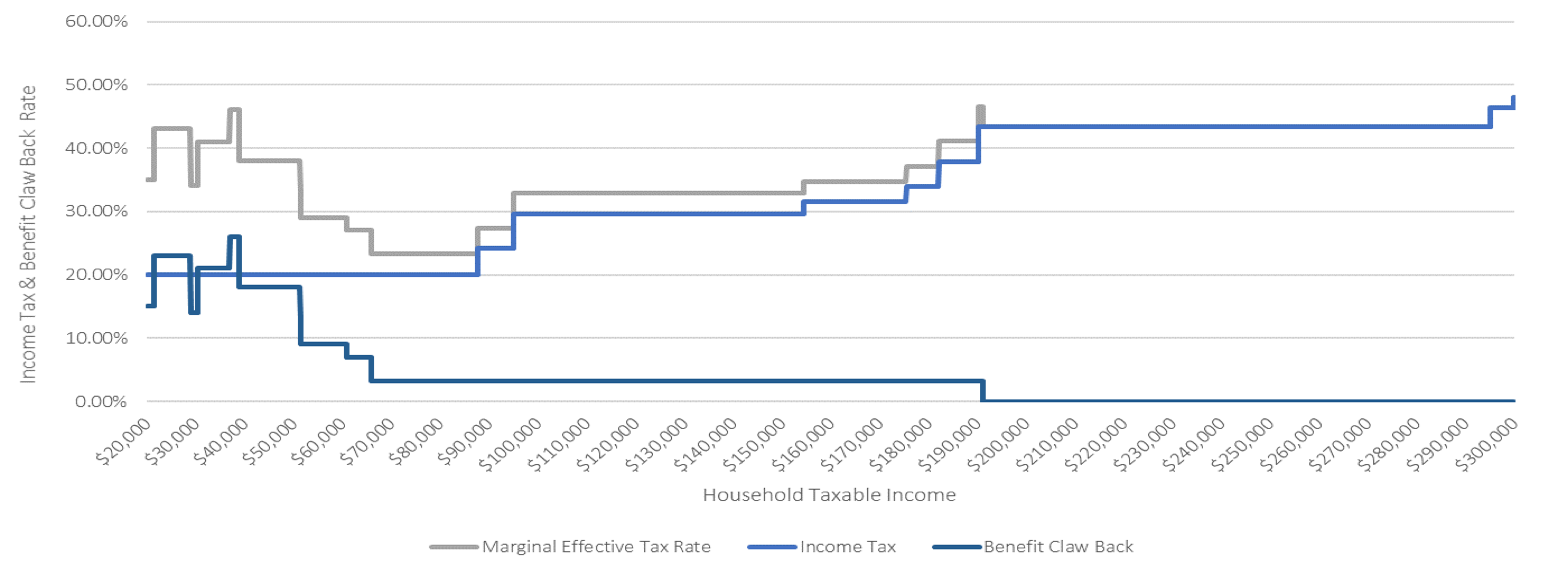

Example: Family With 1 Child Under Age 6

This last example is for a family with two adults and one child under age 6. At higher income ranges their Canada Child Benefit has a claw back of 3.2% of marginal net income, which isn’t quite as drastic. This continues all the way up to a family income of $191,300 after which the benefit is no longer available.

Similar to the scenarios above the effect of government claw backs is more extreme at lower incomes. For a very short range, when family income is between $37,000 and $38,900 their claw back on government benefits is 26.0% of each incremental dollar earned. But between $38,900 and $51,300 it’s slightly lower at 18.0%. When combined with income tax, their marginal effective tax rate (METR) in this income range is 38.05% for any income earned. That means if they earn an extra $1,000, say from $50,000/year to $51,000/year, they will see an increase of $619.50 in their bank account.

This still presents an opportunity for this family if they can make RRSP contributions. Any contributions will create a tax refund + benefit increase equal to 38.05%. A $1,000 contribution to RRSPs will create a tax refund plus benefit increase of $380.50!

(Note: We assume income is split 50/50 between adults. If income is split differently the METR will be even higher in some cases.)

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Wow fancy graphs and all! Its pretty shocking the clawback- really gives the incentive to lower that net income!

Thanks GYM! Huge incentive to lower your net income through RRSP contributions. But once that money is in your RRSP the next trick is to get that money out without incurring a lot of income tax and claw backs in retirement. That’s my next post 😉