Retirement Planning: Tax Strategies For Retirement

Taxes and benefit claw backs are one of the largest expenses that a retiree will face. But with some careful planning we can minimize the impact of these expenses in retirement. Minimizing taxes and benefit claw backs will mean that a retiree can retire on less, spend more in retirement, and have a more secure retirement.

The median income for a retiree is around $36,050 for an individual and $64,800 for a couple but each source of income is taxed very differently. Even with the same income, one retiree could pay way more tax than another retiree even with the exact same income.

When it comes to retirement planning there are a couple of important strategies that we always want to follow. We always want to aim for 50/50 income splitting in retirement and we always want to be very careful about the types/amounts of retirement income when a retiree is eligible for GIS.

When planning tax strategies for retirement we always want to look at the marginal effective tax rate, not just income tax rates. Marginal effective tax rate (METR) is the combination of income tax rates and government benefit claw back rates. METR is the combined impact of tax & benefits on the next $1 of income.

METR is the most important factor to consider when creating tax strategies for retirement. At the end of this post we’ll look at marginal effective tax rate for a couple of specific retirement scenarios.

Always Aim For 50/50 Income Splitting

When it comes to retirement income we always want to aim for perfect income splitting as a couple. This will always minimize the amount of income tax payable.

For post-65 seniors, income splitting is a bit easier because certain types of income can be “split” on the tax return. In this case, we’re not actually splitting cash, we’re just splitting the amounts reported on the tax return. This means that income from RRIFs, annuities, pensions etc can be reallocated on the tax return to the lower-income spouse, thus reducing overall tax paid.

There are also options to share other types of retirement income like CPP. Unlike income splitting, sharing CPP income reallocates the monthly CPP payment between spouses so that is a bit more equal. There is a specific (and somewhat complex) formula for CPP income sharing but thankfully with regular income splitting for other retirement income CPP income sharing is rarely necessary.

Pre-65 retirees don’t have quite as many options to split retirement income so we want to (as much as possible) ensure that early retirees have equal amounts of RRSP/LIRA assets. Having equal amounts in RRSP/LIRA means that an early-retiree couple can draw down their assets equally, splitting income 50/50, and therefore reducing tax as much as possible.

Sometimes there is a large income gap between spouses, in this case we want to use a spousal-RRSP well before retirement to help equalize RRSP/LIRA assets.

The side benefit of income splitting is that the average retiree will never need to be concerned with OAS claw backs. A couple can have a retirement income of $150,000 and if split evenly they will never have to worry about OAS claw backs.

One Third Of Seniors Receive GIS (And Experience 50%-75% Clawbacks)

One of the most important thing to consider when creating a tax strategy for retirement is that almost 1/3rd of seniors receive GIS benefits. There are 6,220,519 OAS recipients in Canada and of this 2,006,142 also receive GIS benefits. That’s a huge number of people experiencing GIS claw backs!

When it comes to retirement planning for low- and moderate-income retirees, the most important thing to remember is that there are MASSIVE claw backs on GIS benefits. These claw backs range from 50% to 75% of net taxable income.

There are lots of retirement income sources that trigger these claw backs, employment income, CPP payments, RRSP withdrawals, RRIF withdrawals, LIRA/LIF withdrawals, annuities funded from registered accounts, taxable capital gains, dividends (including gross up), and interest income from GICs and savings accounts.

Because 1/3rd of seniors in Canada receive GIS that also means 1/3rd of seniors are experiencing these massive claw backs. These seniors are losing 50% (or more) of every $1 they receive from other income sources and they may not even realize it.

About the only type of income that doesn’t trigger GIS claw backs are withdrawals from a TFSA, and the portion of non-registered withdrawals that represent the adjusted cost base (and even these non-registered withdrawals can trigger taxable capital gains income when investments are sold)

Because of the high claw back rates on GIS it is extremely important for retirees to carefully plan their retirement income sources and timing. This includes when to start CPP and when to withdraw from registered assets like RRSPs vs TFSAs vs non-registered accounts.

It might also mean a retiree is better off “melting down” their RRSP/RRIF/LIRA quickly, paying a bit more income tax, and placing the proceeds in a TFSA or non-registered account. It might also mean a retiree is better off adjusting up their cost based on non-registered investments before age 63 to incur those capital gains before GIS begins (GIS benefits are based on prior year income, so we don’t want to rebase non-registered assets at age 64).

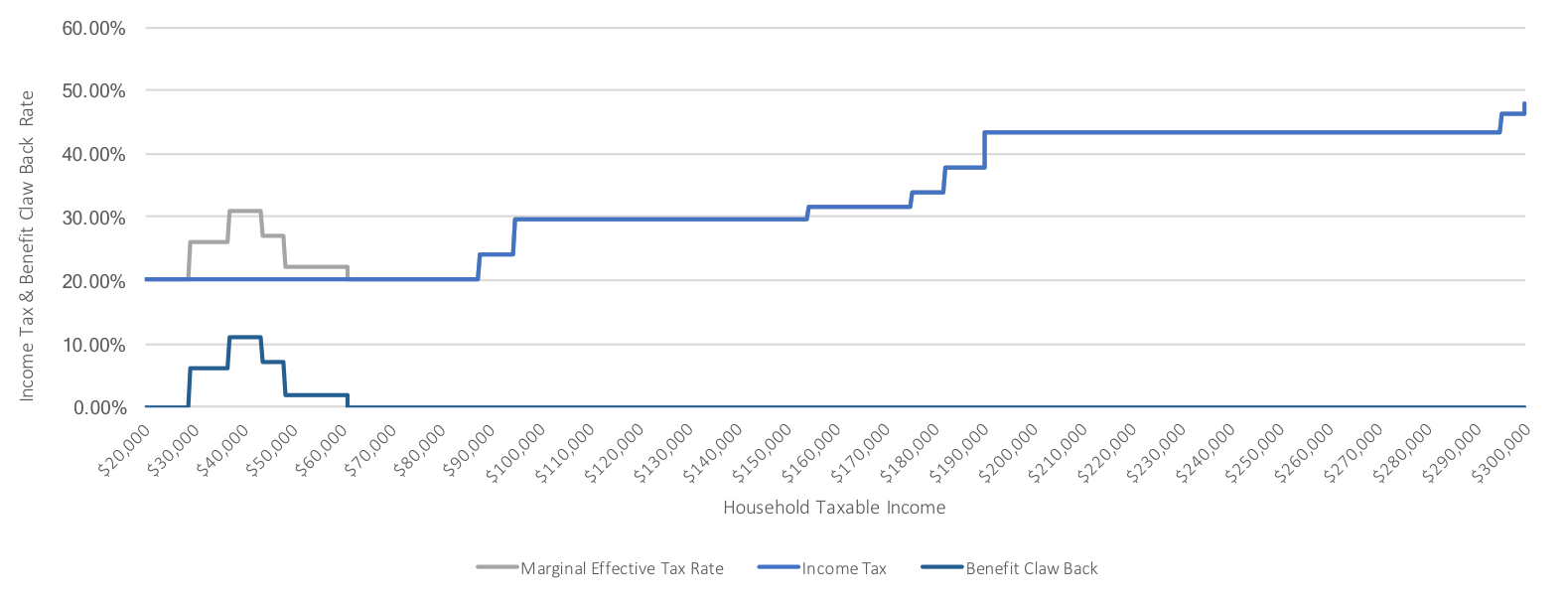

Retired Couple (Pre-65)

When it comes to early retirement, anytime before age-65, there aren’t many government benefits we need to watch out for. After family income crosses the $60,000 range most government benefits are no longer available. But, for couples who have retired before age-65 and have income in the $30,000 to $60,000 range they may experience claw backs from benefits like the GST/HST credit and Trillium benefit in Ontario.

Avoiding these clawbacks with some careful tax & benefit planning could boost their retirement income by 10%+.

(Note: We assume income is split 50/50 between adults. If income is split differently the METR will be even higher in some cases.)

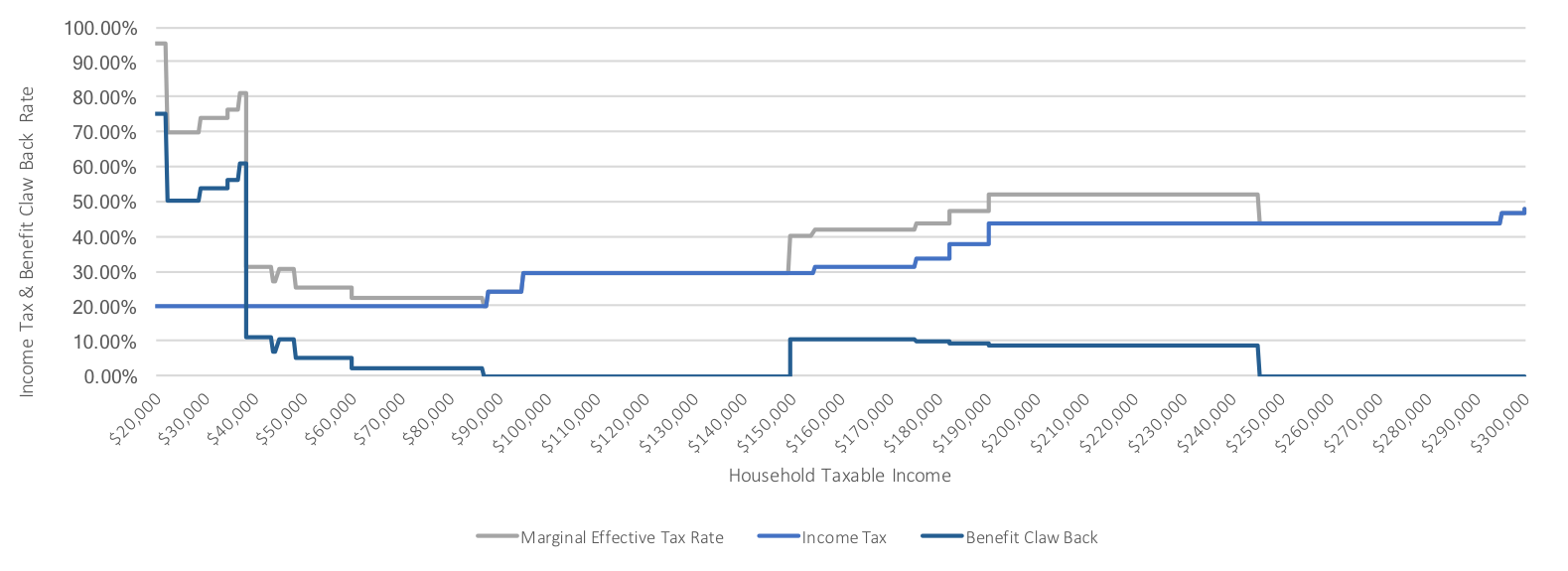

Retired Couple (Post-65)

After age-65 the number of benefits available to seniors increases, with the main one being GIS benefits. GIS has claw back rates in the 50% to 75% range, so for senior couples with income below $39,000 per year, (assuming full OAS benefits) this is a major concern.

Any senior with income in the GIS claw back range needs to carefully plan their income sources and timing. Just a few changes could mean thousands of dollars in reduced claw backs each year.

Some of this income planning is best done before retirement. Soon to be retirees who might be within or close to this income range should seek out professional help to plan out their income sources in retirement.

(Note: We assume income is split 50/50 between adults. If income is split differently the METR will be even higher in some cases.)

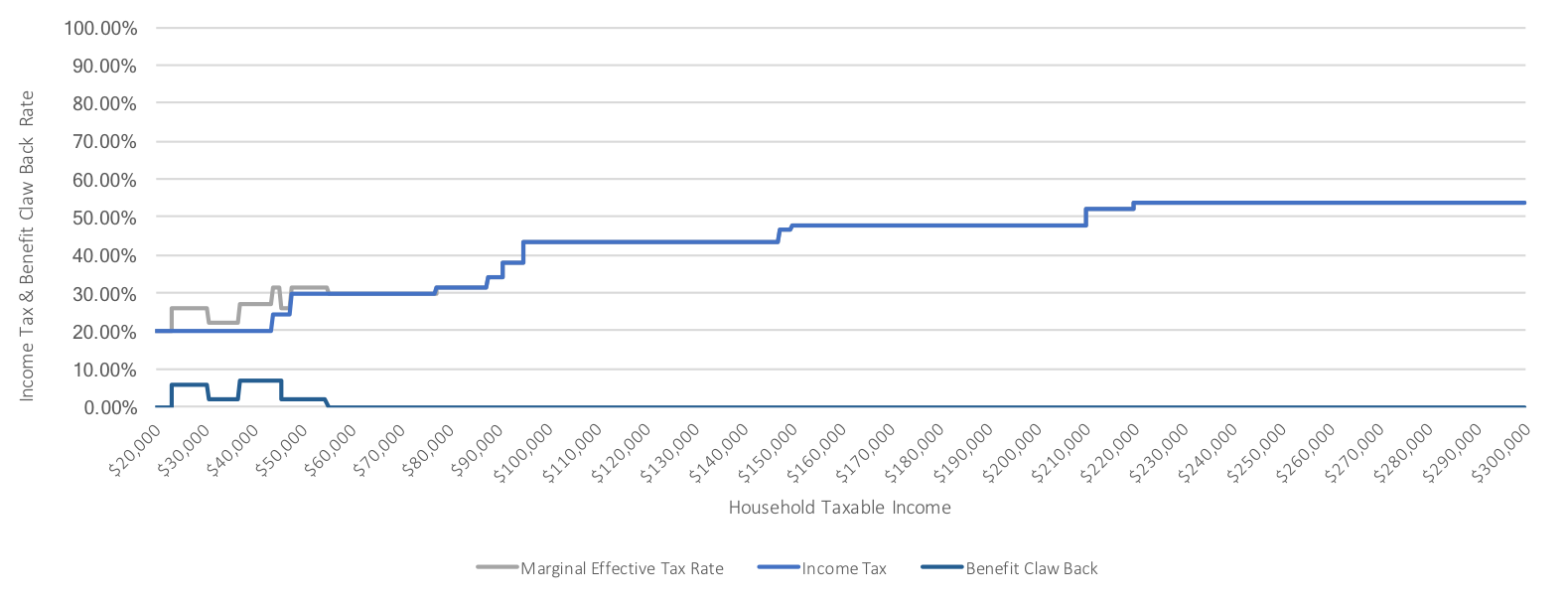

Retired Individual (Pre-65)

Similar to senior couples, when it comes to early retirement, anytime before age-65, there aren’t many government benefits we need to watch out for. After income crosses the $45,000 range most government benefits are no longer available. But, for individuals who have retired before age-65 and have income in the $23,000 to $45,000 range they may experience claw backs from benefits like the GST/HST credit and Trillium benefit in Ontario.

Avoiding these clawbacks with some careful tax & benefit planning could boost their retirement income by 7%+.

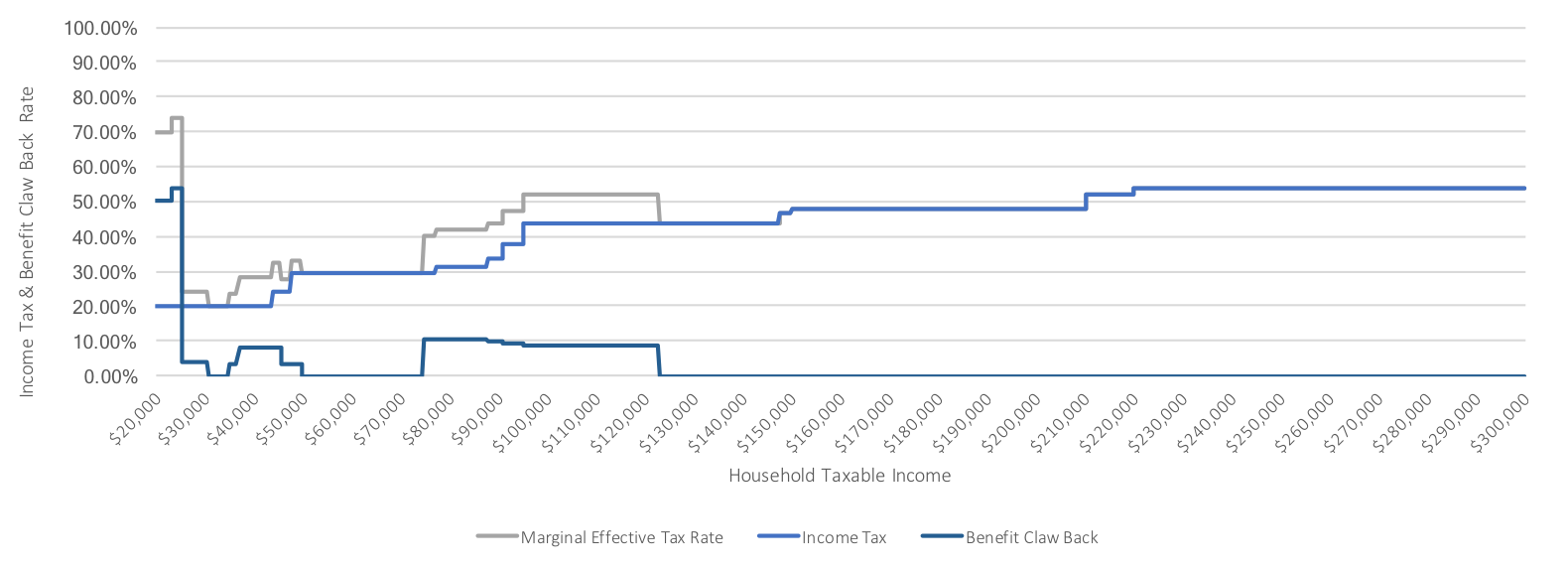

Retired Individual (Post-65)

Similar to senior couples, after age-65 the number of benefits available to senior individuals increases, with the main one being GIS benefits. GIS has claw back rates in the 50% to 75% range, so for retired individuals with income below $26,000 per year, (assuming full OAS benefits) this is a major concern.

Any senior with income in the GIS claw back range needs to carefully plan their income sources and timing. Just a few changes could mean thousands of dollars in reduced claw backs each year.

Some of this income planning is best done before retirement. Soon to be retirees who might be within or close to this income range should seek out professional help to plan out their income sources in retirement.

Disclaimer: These are examples only, specific to Ontario, and should not be used for financial planning purposes. Income tax and benefit rates are very dependent on family income, income split, ages of children, province of residence etc. To understand the impact for your family we recommend building a custom financial plan with an advice-only financial planner.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments