How Fast Will Your Income Increase In Your 20’s and 30’s?

When it comes to personal finance, one of the most important things is how your income compares with your expenses. Are you living within your means? Or are you living beyond your means? Are you spending less than you earn? Or are you going deeper and deeper into debt?

Living below your means is one of those ‘keystone’ financial habits.

Living below your means lets you save a bit of money each month. It gives you flexibility during emergencies. It provides you with some financial ‘room to breathe’.

Living below your means is important because a healthy saving rate is the only way to reach your financial goals. No amount of ‘financial engineering’ is going to help you unless you can save a small portion of your income each month.

That being said, saving a lot of money while your young can be tough.

Saving money while your young can pay off big time. If you can save money while you’re young, you basically let compounding do most of the work for you.

Unfortunately, when you’re young there are also a lot of demands on your income, and these compete with your ability to save.

Thankfully, as your income grows your capacity to save increases… that is… as long as you can avoid lifestyle inflation. A good rule of thumb is to put half of any salary increase towards your financial goals, and the other half can go towards increasing your lifestyle.

By estimating your future income you can plan to save more in the future and put less strain in your current budget. But what is the right amount to assume for income increases in the future? The answer really depends on your current age.

How Fast Will Your Income Increase In Your 20’s and 30’s?

Canada’s income statistics can provide us an interesting insight into how much we can expect from income increases in the future.

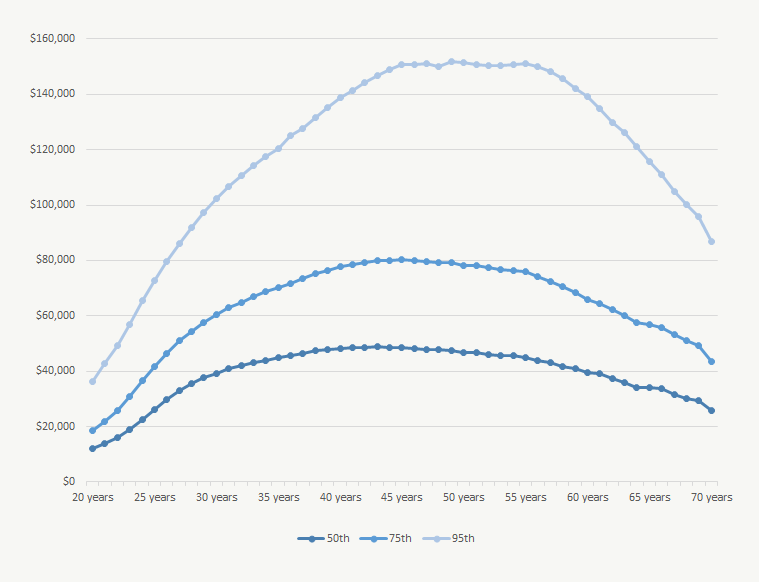

Look at the 50%, 75% and 95% income brackets, the median income increases rapidly through ages 20 to 40.

Interestingly, all brackets grow at around 7% per year through ages 20 to 40 (this is after inflation because it’s all 2016 data). The only reason the 75% and 95% brackets end up at a much higher income is because they start at a higher base. The compounded growth rate between age 20 and 40 are all in the 7% range.

In the 50% income bracket the median income increases by 7.1% as we go through ages 20 to 40.

In the 75% income bracket the median income increases by 7.3% as we go through ages 20 to 40.

In the 95% income bracket the median income increases by 6.8% as we go through ages 20 to 40.

Based on this information, planning for a 7% income increase in your 20’s and 30’s seems reasonable, but be warned… those income increases start quick but slow down just as fast.

Things slow down in our 30’s (and basically stop in our 40’s)

Income increases slow down dramatically in our 30’s and basically stop altogether in our 40’s. We may get cost of living increases each year, but on average we can pretty much forget about income increases above inflation during our 40’s and 50’s.

Of course, there are exceptions, high performers might still get salary increases, but 50% of the population won’t see their median salary increase above inflation after the age 43. After age 43 its basically downhill for median income.

If you’re planning your finances far out into the future, don’t plan for big income increases in your 40’s and 50’s, at least not at the same pace you experienced in your 20’s and 30’s.

Planning for big increases in your 40’s and 50’s may leave you with a big gap in your financial plans : (

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Related Posts…

2 Comments

Trackbacks/Pingbacks

- Data on TFSA Adoption and Usage – Wallet Bliss - […] can check his post about how average income increases more rapidly in 20’s and 30’s […]

That is super interesting! So if you’re poor in your 30s, you’ll likely still be poor in your 40s 😐

I hope not! Unfortunately the gap between income brackets definitely gets bigger as we age. It would take a bigger $ increase to move up an income bracket in your 40’s vs your 30’s.