How To Invest A Large Sum Of Money

(Two Common Methods)

At some point in their life many investors are faced with deciding how to invest a large sum of money. This large sum of money could be from something like an unexpected bonus, or the proceeds from downsizing a home, or from something unfortunate like the passing of a family member.

Investing a lump-sum can be a daunting experience for even the most experienced investor. There can be a lot of fear and worry when it comes to investing a large lump-sum. Fear of what could happen if the market drops right after you invest.

Often this fear and worry can cause delays. Sometimes these delays can extend for months or even years, with large piles of cash sitting in a savings account waiting for the “right time” to invest.

These fears are understandable. There is a fairly good chance when investing a lump-sum that you could see the balance drop in the future. In the example below you’ll see that during approximately 67.3% of historical periods investing all at once is the better financial decision, but that means 32.7% of the time it is not.

There are two main methods when it comes to investing a lump-sum. Which method you choose will depend on how you’re feeling. Are you worried about what might happen if you invest a lump-sum all at once? Or are you ok with the risk because there is a good chance of higher financial gain?

When deciding how to invest a large lump-sum there are two common methods. One method is to invest the entire lump-sum all at once. This is mathematically the best option. The other is to dollar cost average smaller amounts into the market over time. This is psychologically often the best option.

Psychology is one consideration when choosing how to invest a large sum of money. Probability and expected return is another consideration. These are two important considerations when choosing how to invest a lump-sum.

What To Consider When Investing A Lump Sum

When investing a lump sum its important to consider a few factors. These factors are important because they’ll help determine which method you may want to choose. Choosing the right method will help you feel better about your finances and often the way you feel is the most important consideration.

Personal finances are very personal, so there is never one “right answer” for everyone. When deciding how to invest a large sum of money this is very true.

Time In The Market

The say that “time in the market is better than timing the market” and this goes for lump-sum investing as well. As individual investors we’re terrible at picking the right time to invest, we’re terrible at identifying the top or bottom of the market, and so the best bet is usually to get money into the market as soon as possible.

“Time in the market” means that mathematically the best choice (on average) will be to invest the entire amount at once. This provides the highest expected monetary return (but only on average!)

If you were to invest a lump-sum all at once then in most years you would have done well, but in some years you would have experienced a decline. If we were to repeat this decision 100 times over the last 100 years then over all those years you would experience positive return on average, but some years would be negative and some years would be positive.

How You Feel

Investing a large lump-sum can be daunting and it’s important to understand how you feel. It can be nerve wracking to invest all at once and possibly see your balance drop the next month, or the next year.

This is a common feeling many people face when investing a lump-sum. Often the result of these feelings is that we simply choose to do nothing, paralyzed by fear of losing money in the future.

Sometimes the money can sit in cash for a long period of time before being invested which means we’re leaving potential investment gains “on the table”.

If you’re worried about feelings of regret if you invest the lump-sum all at once then this is an important thing to consider.

Method 1: Invest The Entire Lump-Sum At Once

Mathematically the best method is to invest the entire lump-sum all at once. Putting everything into investments at one time means you’ll get exposure to the market sooner. This is typically a good thing.

Putting the entire lump-sum into the market all at once means your money will be put to work sooner. It’ll start to earn dividends, capital gains, and interest income right away. Over a long period of time these returns are typically positive, but not always.

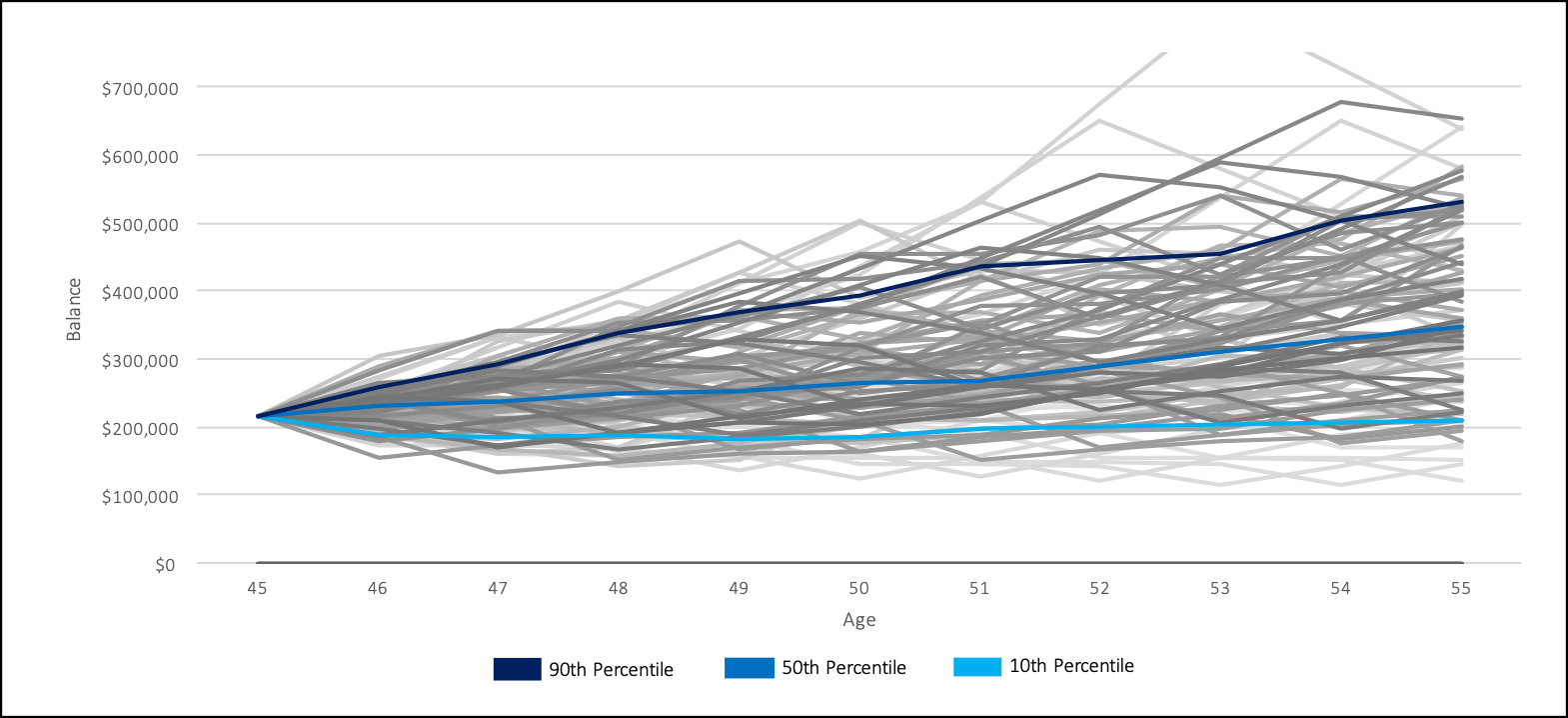

The chart below shows what would have happened if you had invested a lump-sum of $216,000 in a diversified portfolio of 75% equities and 25% fixed income. Each line represents one period of historical stock, bond and inflation rates.

As you can see, most lines start at $216,000 and keep going up, but some lines dip below the initial amount. In this example we’re typically better off investing the lump-sum all at once, but this doesn’t happen in every historical period.

Method 2: Dollar Cost Averaging Over Time

Dollar cost averaging is an investing strategy where an investor makes small contributions to their investment account on a very regular basis. This is a great investing method for anyone earning a steady income because it spreads investment purchases over time. This takes advantage of the volatility in the stock market. Over time you buy low, high, and everywhere in between.

We can use this same strategy for investing a lump-sum. We can split the lump-sum into smaller amounts, maybe 24 or 36, and invest these smaller amounts each month until the entire lump-sum is invested.

Although mathematically dollar cost averaging a lump-sum isn’t as good financially, it does provide a huge psychological advantage.

The benefit of dollar cost averaging is that if the market increases you already have some money invested and will benefit from this increase (even though you’re now making future investments at a higher price).

On the opposite side, if the market drops then you’ll benefit because you can invest more at a lower price in the future (even though you did lose a bit on the money you already had invested).

In each scenario, if the market goes up, or if the market goes down, the dollar cost averaging strategy creates some positive feelings. For some people this can be an advantage, even if mathematically it may lead to a slightly lower investment balance in the future.

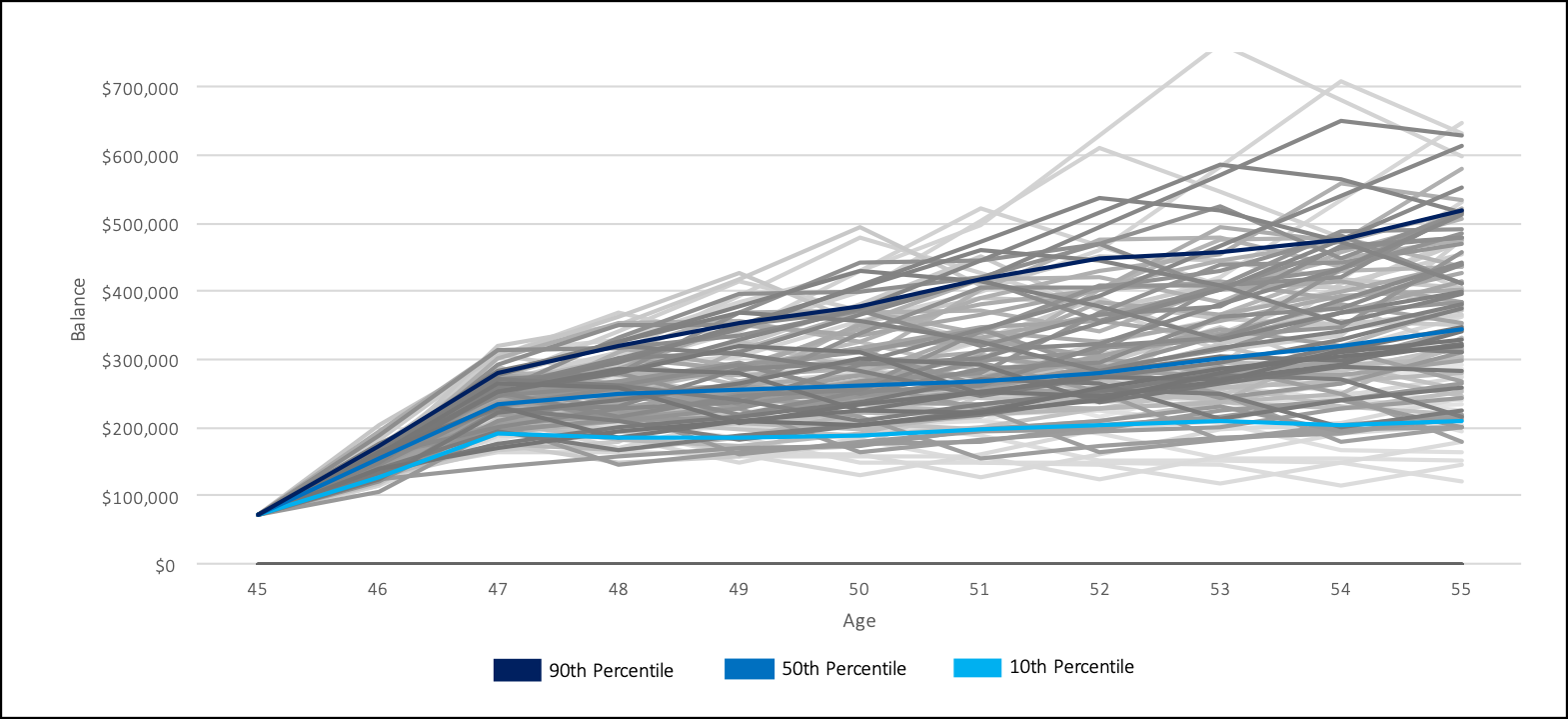

The chart below shows what would have happened if you had invested a lump-sum of $216,000 over the course of three years into a diversified portfolio of 75% equities and 25% fixed income. In this example we put $72,000 into the market each year. This also could be $36,000 every 6-months, $18,000 each quarter, or $6,000 per month. Each line represents one period of historical stock, bond and inflation rates.

As you can see, we build up to the full $216,000 over three years. Some lines still drop in year two and year three, but the psychological benefit of dollar cost averaging is that we’re purchasing at a reduced price during those years.

Don’t Delay: Choose One Method And Stick With It

Mathematically, investing a lump-sum all at once is often the best option, but using the two examples above this only happens in approximately 67.3% of historical periods.

The fear being in the other 32.7% is what keeps many investors from investing a lump-sum right away. The fear of seeing a lump-sum investment drop directly after being invested can be daunting for many investors. This can cause even the most experienced investor to second guess, try and time the market, or just delay the decision.

The biggest problem is when this delay lasts a long time. We want to avoid keeping a large lump-sum in cash for a long period of time.

Instead, we want to make a plan and stick with it over time. Whether that be investing a lump-sum all at once, or dollar cost averaging over time, making a plan will help ensure that this money gets invested as soon as possible.

The best plan for investing a lump-sum will include specific dates and specific amounts. What we want is a very mechanical process, one that you can stick to regardless of what may happen in the market in the future.

Whatever method you choose, making a plan in advance will help avoid delays. It will also help avoid the emotions of regret or fear that may keep us from investing in the first place.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments