Best Way To Save Money For A House? Save or Invest?

What is the best way to save money for a house? This is an interesting question and the old advice might require a new perspective given the reality of the current housing market. Home prices have changed dramatically over the last few years and this is impacting how people are making decisions around home ownership.

Over the last few years we’ve seen the average home price increase faster than our ability to save for a down payment. This can make it difficult to save money for a house and this can push home ownership to later stages in life.

This trend in home ownership has been happening for decades, with home ownership shifting later and later. This may be due to a number of factors but there is a definite trend towards purchasing a home later in life.

In 1981 approximately 55.5% of those who were over age 30 lived in their own home.

In 2016 approximately 50.2% of those who were over age 30 lived in their own home.

With the continued increase in home prices since 2016 it’s reasonable to assume that home ownership will continue to shift into the 30+ age group.

So if purchasing a home is happening later in life, does that change the way we save money for a house? Does that change the way we build up our down payment?

Conventional financial advice would suggest that any savings required in the next 1-5 years should be kept in something safe, like a GIC or a high-interest savings account. Historically this meant that savings for a down payment would go into one of these safe investment vehicles.

But what if someone is starting their career in their early 20’s and isn’t planning to purchase a home until their early 30’s, late-30’s or maybe even their 40’s? Should they still be saving for a down payment in a safe investment like a GIC?

Maybe, or maybe not. In this post we’ll explore a different way to save money for a house. A way that is perhaps more reflective of purchasing a home later in life.

How Much Do You Need For A Down Payment?

Currently the minimum amount you need for a down payment is 5% of the purchase price. This is the absolute minimum that you need for a down payment, however many people aim for a higher amount.

Buying a home with a 5% down payment means that you’re triggering mortgage insurance fees. These range depending on the % down payment but generally decrease as the % down payment gets larger. Mortgage insurance fees decrease as the downpayment crosses the 10%, 15% and 20% thresholds.

Home purchases with over 20% down payment may not need mortgage insurance at all (although it can still happen where a lender requires mortgage insurance even with 20%+ down)

This means that having a 20% down payment has historically been the goal for many potential homeowners.

But when home prices are increasing, especially when they’re increasing above the rate of inflation, reaching a 20% down payment can be more difficult. It requires a higher savings rate and there is always the risk of getting “priced out of the market”.

Timelines Are Important

Timelines are important when it comes to financial goals, and purchase a home is no different. For shorter time frames we want to decrease the financial risk. We want to ensure we have the money available when we need it. This usually means using a safe investment vehicle like a GIC or a high-interest savings account. Both have a lower rate of return, typically in line with inflation or perhaps a bit more.

For longer time frames we want to allow our savings to grow and compound. This makes it much easier to reach our goal. This usually means investing in a portfolio of stocks and bonds. Over the long-term this can provide a rate of return above inflation. With a higher rate of return there is more risk, there might be large swings in the short-term, but over the long-term we hope to see a higher return.

Traditionally when saving for a house we would consider that a short time frame. We’re typically saving up a down payment over 1-5 years before buying a house and for that reason we would typically recommend a safe investment vehicle to hold that down payment.

But if a home purchase isn’t on the immediate horizon perhaps we should be taking a bit more risk with our down payment, or at least a portion of it. What if we split our down payment goal into two.

One down payment goal could be for 5% of our down payment. This is the minimum. This amount should be invested in a safe investment vehicle.

The second down payment goal couple be for the remaining 5% to 15% of our down payment. This is the “nice to have” portion of our down payment and could be invested in a low-cost portfolio and allowed to grow more quickly over time.

Let’s explore what this looks like with actual investment returns from the past… but first, where is the best place to hold your down payment…

TFSAs And Saving Up A Down Payment

TFSAs are a great way to save up for a down payment. The TFSA allows contributions to be invested and grow tax free. Withdrawals can be made at any time and that contribution room comes back the following January.

TFSAs are a great way to save up a down payment.

TFSAs are also interesting because they can be used as an investment account too. It’s possible to have two TFSAs, one for safe investments like GICs or a high-interest savings account, and a second for investing in a low-cost investment portfolio.

RRSPs And The Home Buyers Program

RRSPs are another option for saving up for a down payment but it becomes a bit more complicated. In general RRSPs are a prefered investment vehicle when you have a high tax rate now and expect a lower tax rate in the future. This isn’t necessarily the case for individuals saving up for a down payment.

Using an RRSP instead of a TFSA may not be the best choice, especially if you expect your earnings to increase rapidly in the future (which is a reasonable expectation for new grads in their first job).

RRSPs are appealing when buying a house for one reason, the Home Buyers Program. There are some qualification criteria around the Home Buyers Program but essentially it allows individuals to withdraw up to $35,000 from their RRSP without triggering income tax. This amount needs to be repaid to the RRSP over 15-years. For a couple this means a potential $70,000 in RRSP withdrawals that can be used for a home purchase.

Depending on your current tax rate the RRSP Home Buyers Program could be a great option. It can also be a good option when you’ve already maximized your TFSA.

Saving Up A Down Payment vs Saving And Investing Hybrid

Let’s look at two options for saving up a down payment. One where we save the full 20% down payment in a high-interest savings account earning 2.1% and a second where we save the minimum 5% down payment in a high-interest savings account but then invest the rest in a low-cost investment portfolio.

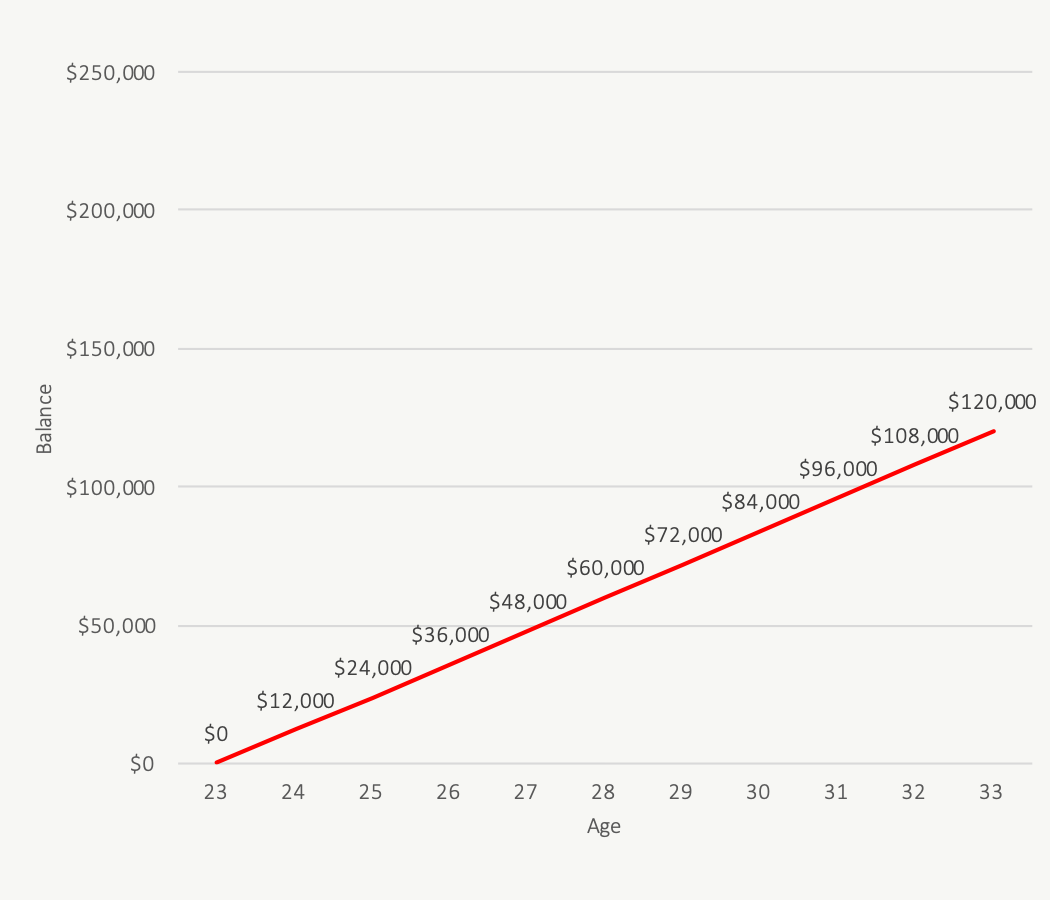

We’ll assume a couple (or two individuals) who are each putting $500/month toward their down payment goal. They want to purchase a home worth $600,000 in today’s dollars and ideally have $120,000 for their down payment.

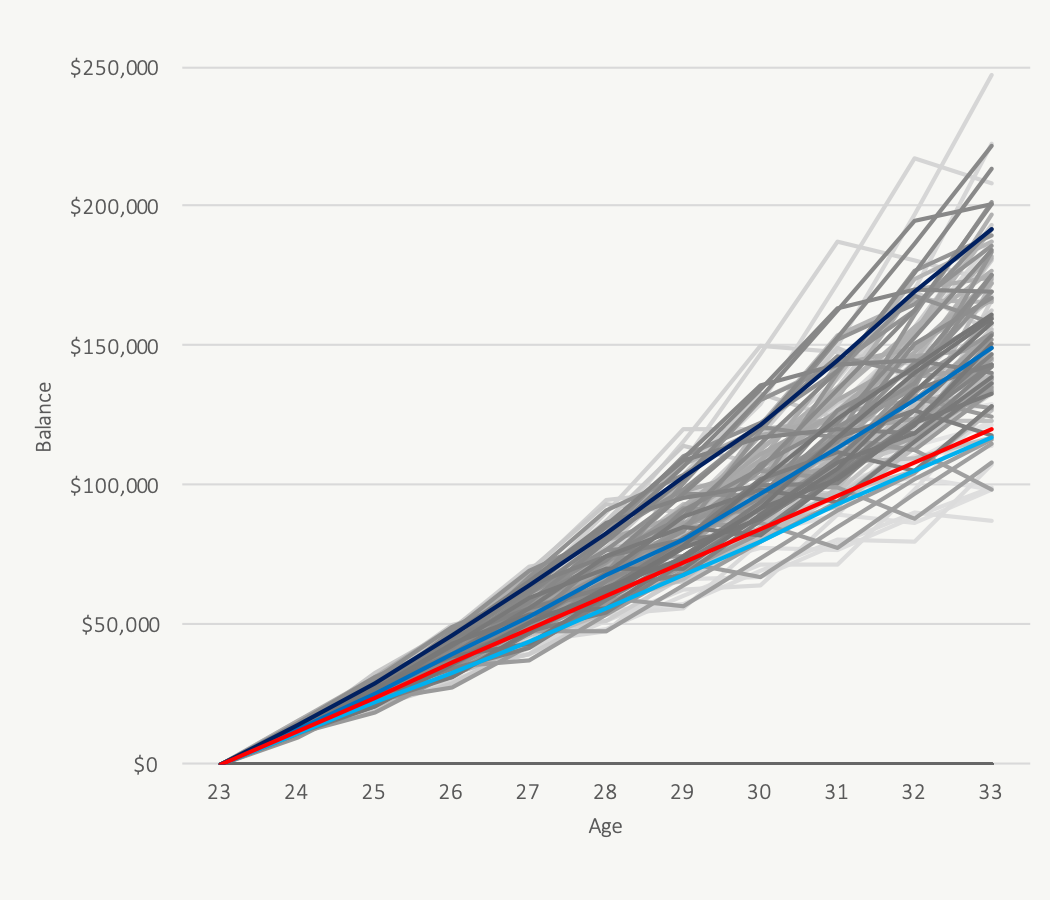

Obviously with the investment option we’re taking on a lot of extra risk. But we’re going to assume we have a 10-year horizon before purchasing a house. But even with a 10-year time horizon we might see our strategy fail in some periods of poor stock/bond returns.

Lastly, we’re going to look at everything in today’s dollars, so we’re going to remove inflation. We’ll assume inflation is 2.1%, essentially equal to the interest rate on the high-interest savings account.

Saving Up A Down Payment Over 10 Years

Because we’re looking at today’s dollars (real dollars) the balance in the high-interest savings account goes up by the contributions each year. If we were to look at this in future dollars (nominal dollars) then we would see this balance increase with the interest rate (which we’ve assumed to be equal to inflation).

Saving And Investing Hybrid Over 10 Years

Each line in this chart represents one historical period of stock, bond, and inflation rates. Notice how some lines end up below our red “savings only” line? This is the risk of investing a portion of the downpayment. Even over a 10-year time horizon there is still a pretty good chance that we’ll end up with less than we would have if we had just saved in a high-interest savings account. This becomes worse when you consider than in these cases we would also incur CMHC mortgage insurance fees.

About 10% of historical periods end up below the “savings only” line, which a pretty good chance of ending up with less than if you had just played it safe, but there are quite a few periods that end up higher. So is the saving/investing hybrid a good strategy? Maybe for some, probably not for others, and definitely not when the time period is shorter.

Best Way To Save Money For A House?

What is the best way to save money for a house? That depends on your time frame and your personal risk tolerance. If you have a longer time frame you may consider investing some of your annual savings, especially if you don’t have a clear goal for when and where you’ll buy your future home. But you should always keep at least 5% of your down payment in a save investment vehicle like a high-interest savings account or a GIC.

For anyone with a short time frame (less than 5 years) the best way to save money for a house is with a high-interest savings account or GIC. A safe investment vehicle like these two options will ensure that you have the money ready to go when you need to make the final purchase. Anything else would be too risky.

Disclaimer: Historical results are a good test but they don’t fully capture the range of investment returns we may expect in the future. As they say “past performance does not guarantee future results” so be ready to end up with less if you’re going to take on extra risk.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments