Is It Safe To Use Your HELOC As An Emergency Fund?

Is it safe to use your HELOC as an emergency fund? A typical emergency fund is between 3 months and 6 months of expenses, but that’s a lot of cash to have lying around!

Cash is the enemy of long-term goals. Holding too much cash makes it more difficult to achieve long-term goals like retirement. The more cash-on-hand there is, the lower the average investment return.

Holding some cash is good. A certain amount of cash-on-hand protects us against unexpected emergencies like a job loss, a disability, a health emergency etc. etc. But holding too much cash is bad.

For homeowners with a certain amount of home equity there is another option. This option allows homeowners to decrease the size of their emergency fund and put more into RRSPs and TFSA sooner. This can provide more investment growth and potentially a reduction in income tax and an increase in government benefits.

Homeowners with a certain amount of home equity could choose a hybrid option, with a smaller amount of cash-on-hand but leaning on a Home Equity Line of Credit (HELOC) for larger emergencies.

But is this hybrid option safe? Is it safe to use your HELOC as an emergency fund? Let’s take a look at why, and why not, to use your HELOC as an emergency fund.

Why Have An Emergency Fund?

Why even have an emergency fund?

An emergency fund is a small pot of money that is set aside for unexpected emergencies. This could be a job loss, a disability, a health emergency etc. etc.

The typical advice is to set aside between 3-months and 6-months of expenses in an emergency fund. If expenses are $5,000 per month that means $15,000 to $30,000 in an emergency fund. If expenses are $10,000 per month that means $30,000 to $60,000 in an emergency fund. (Learn more about emergency funds here)

That’s a lot of money!

A typical emergency fund is held in a high interest savings account. That ensures this money is available quickly when needed. But the rate of return on a high interest savings account is very low. An emergency fund is great, but holding $60,000 in cash has a large opportunity cost, what if there was a hybrid option using a HELOC?

What Is A HELOC?

A Home Equity Line Of Credit, or HELOC for short, is a type of revolving credit that is extended to homeowners who have a certain amount of home equity.

A HELOC is considered a “secured line of credit”. This means that the loan is secured against the value of the home. Because the loan is secured by an asset, which could be sold to cover the loan if necessary, the interest rate provided on HELOCs is typically quite good.

The interest rate on a HELOC is often around the prime rate, but could sometimes be as low as prime – 1.0% or prime – 0.5% in situations with very good credit, or prime + 0.5% or prime + 1.0% with average or below average credit.

This makes a HELOC a very inexpensive loan relative to other types of debt.

A HELOC is also typically “revolving” which means money can be taken out and then repaid at any time, as long as the total never exceeds the maximum amount.

This flexibility means that a HELOC can be in place for years and never cost a penny until it’s used.

Qualifying For A HELOC

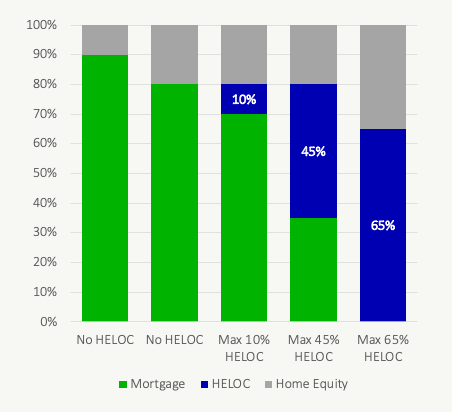

Between a mortgage and a HELOC the total debt tied to the home cannot exceed 80% of the home value. This is called the loan to value (LTV) ratio. This means HELOCs are not available to every homeowner and only those with a certain level of home equity will qualify.

Another important criteria to highlight is that the total value of a HELOC cannot exceed 65% of the home value. This means if you have a low mortgage, or no mortgage, you cannot borrow the full 80% of your home value with a HELOC alone.

Here are a few examples of the maximum HELOC available as a % of home value…

Using Your HELOC As An Emergency Fund

A HELOC can be used as a source of funds in an emergency. The HELOC can then be repaid in the future.

The HELOC can be used in conjunction with a smaller emergency fund. This hybrid option allows for a smaller cash emergency fund that can be used first, and then for larger emergencies the HELOC would pick up the slack.

The hybrid approach leaves a small amount of cash in an emergency fund but relies on the HELOC for larger emergencies.

Why Use A HELOC As An Emergency Fund?

Using a HELOC in conjunction with a smaller emergency fund allows more cash to be invested now. This cash can be used to maximize RRSP or TFSA contribution room faster.

And, depending on the situation, RRSP contributions can be very attractive. For families with young children, an RRSP contribution not only provides a large tax refund but also an increase in Canada Child Benefit too.

The combination of tax refund and increased benefits can provide a “return” on RRSP contributions of 50%-70%+ for families.

Plus, when an emergency fund is smaller, and more cash is invested, these investments grow into a much larger amount in the future. Depending on the asset allocation and type of investment an investment portfolio could provide a real return (after inflation) of 3-5% per year.

If an emergency fund of $60,000 is reduced to $30,000 the extra $30,000 can be invested. That extra $30,000, if invested for 30-years, will grow to $72,818 to $129,658!

(Learn more about the magical effects of compounding!)

What To Watch Out For!

Using your HELOC as part of an emergency fund isn’t entirely risk free however. A HELOC can be reduced or recalled at any moment.

Although this doesn’t happen often, it did happen in the US during the 2008/2009 financial crisis. The combination of economic uncertainty and falling home prices led some financial institutions in the US to reduce or recall Home Equity Lines of Credit.

The risk of a HELOC being recalled is probably highest for homeowners with only a small amount of home equity. If you’re right on the edge of qualifying for a HELOC then there is always a risk of it being recalled or reduced.

Also, if you’re switching from a full emergency fund to a hybrid option then it’s important to consider that investing part of your emergency fund will also mean that this amount gets reduced significantly during a recession as investment values fall.

It’s important that the portion of the emergency fund that gets invested is invested for the long-term and is not needed for short or medium term goals. Once this cash is invested it’s important to stop thinking of it as part of your emergency fund and instead think of it as part of your long-term investments.

Lastly, the interest rate on a HELOC is typically a variable rate tied to prime. If the prime rate were to increase rapidly that could quickly increase the cost of an emergency.

Using Your HELOC As An Emergency Fund

Using your HELOC to supplement your emergency fund is an attractive strategy for homeowners with a large amount of home equity.

A hybrid strategy is a good option to consider. The idea is to have a small emergency fund in cash but then use a HELOC for larger emergencies.

Having some cash-on-hand is a good thing, but having too much cash-on-hand comes with a high opportunity cost. Using a HELOC for part of your emergency fund allows you to keep a smaller amount of cash-on-hand and makes it easier to maximize RRSPs and TFSAs.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments