Low Income Benefits That Are Not Automatic

There are a large number of benefits available to low and moderate income households. These government benefits provide direct income support based on household income. But some benefits are a combination of government & private benefits. They’re delivered by private corporations. They can help offset specific expenses but they must be applied for individually.

Many government benefits are automatic based on annual tax filing. As long as an income tax return is filed on time each year, these benefits are automaticity calculated and paid based on adjusted family net income (aka. AFNI… this is essentially line 23600 of your tax return).

But there are other benefits that are available to low and moderate income households and these benefits must be applied for individually, and are not automatic based on annual tax filing, but they can still provide a significant benefit for low and moderate income households.

Most of these non-automatic benefits are delivered with help of private companies and they help offset specific types of expenses. These benefits are a combination of government/private and must be applied for every 1-2 years.

The problem with these low income benefits is that they’re hard to find if you’re not specifically looking for them. They can provide hundreds or even thousands per year in financial support but many get overlooked by low income households. Here is a list of the available programs…

Low Cost Internet: Connected For Success, Internet For Good, Connecting Families

Internet For Good, Connected For Success, and its sister program Connecting Families are three programs that help provide low-cost internet service to households who receive either disability benefits or specific government benefits.

The qualification criteria differ by province, but in most cases if you’re eligible for support from programs like Ontario Works (OW), Ontario Disabilities Support Program (ODSP), and Guaranteed Income Supplement (GIS) then you’ll qualify for Connected For Success.

For families who receive the maximum Canada Child Benefit (so families earning below $32,797 in 2022) there is the sister program called Connecting Families which is specific to low-income families. If household income is below this threshold then families with children who may not be receiving OW, ODSP or GIS can also qualify for this low-cost internet service.

These three programs provide internet service that is at least 10mbs and 100GB per month. This program is delivered through private partnership with telco companies like Rogers, Bell, and Telus. The cost to the household is only $9.99 per month to $19.95 per month and if you go over 100GB per month the extra cost is typically quite reasonable (varies by provider and could change in the future).

This is a great program and can help reduce internet costs for eligible households from perhaps $500+ per year to only $120.

Low Cost Cell Phone: Mobility For Good

Mobility For Good provides low-cost cell phone service to households who receive low-income seniors benefits like the Guaranteed Income Supplement. The program provides cell phone service for only $25/month. This includes unlimited talk and text and 3GB of data each month.

There are no contracts for this service and it can be cancelled at any time. To apply, all you’ll need a T4OAS statement that shows GIS benefits being paid (Box 21).

This is a great program and can help reduce cell phone costs for eligible households from perhaps $500+ per year to only $300.

Subsidized Electricity Cost: Electricity Support Program (Ontario)

The Ontario Electricity Support Program (OESP) is a program that provides support to low and moderate income households who are customers of a local electric utility. Anyone who is paying their own electricity bill will be eligible for this program.

Unfortunately, renters who have their electricity bill covered as part of their rent are not customers and therefore are not eligible.

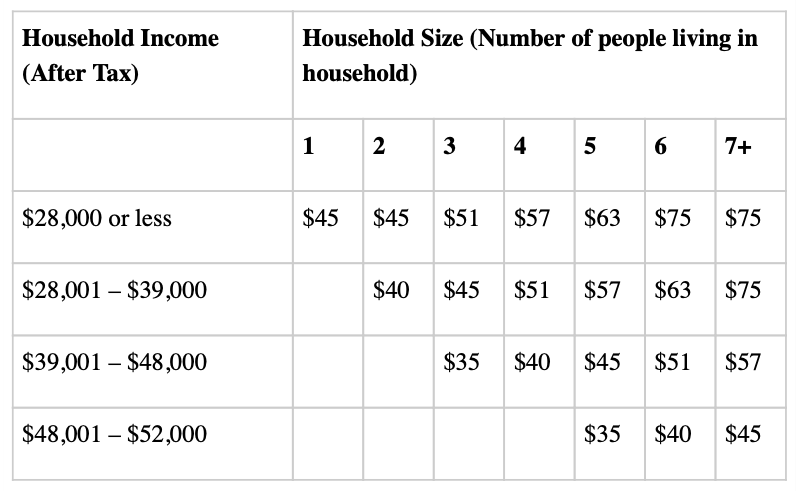

The program provides an automatic rebate on your monthly electricity bill. The amount of the rebate depends on the size of the household and the household’s after-tax income.

For example, a household of 2, with after-tax income below $39,000 per year will receive a $40/month rebate on their electricity bill. A household of 4, with an after-tax income below $48,000 per year will also receive a $40/month rebate but if income is below $39,000 per year that rebate jumps to $51/month. Here is the rate table for 2021 (there is also a higher benefit for households with high electricity use, such as households with electric heat or high consumption medical devices)

Notice how there are some steep “cliffs”? At some point as income increases you go from receiving the benefit to receiving nothing. This is unlike other government benefits which phase out slowly based on a “clawback” rate (more details on government benefit clawbacks here).

To see the latest rate table and apply for the rebate you can visit the Ontario Electricity Support Program website and visit the FAQ.

Subsidized Dental Care: Healthy Smiles Program and Seniors Dental Care Program (Ontario)

The Health Smiles Program is a free dental program aimed at lower income families with children under the age of 17. The program helps cover the cost of regular check-ups, routine care, preventive and emergency treatment.

The Ontario Seniors Dental Care Program is a similar program but covers low-income seniors over the age of 65.

Here are some of the services covered…

- Examinations/assessments

- Radiographs (X-rays)

- Preventive Services

- Restorative Services

- Endodontic Services

- Periodontal Services

- Prosthodontic Services

- Oral Surgery Services

- Anaesthesia

Although Healthy Smiles is a great program, the income thresholds are unfortunately extremely low. For example, the income cutoff for a family with two children is $26,189.

Households who receive Ontario Works (OW) and Ontario Disabilities Support Program (ODSP) will automatically qualify for Healthy Smiles but otherwise the income cutoff makes it very difficult to qualify for Healthy Smiles.

More details regarding the program and the eligibility requirements can be found on the Healthy Smiles website.

For seniors over the age of 65 there is a sister program called the Ontario Seniors Dental Care Program. This program is available to those over 65 and who have net income below $22,200 for an individual and $37,100 for a couple. More details regarding the program and the eligibility requirements can be found on the Ontario Seniors Dental Care Program website.

Low Income Benefits That Are Not Automatic

The low-income benefits above are not automatic, but they can provide a substantial benefit each year. When combined, these three programs could help offset anywhere from $1,000 to $1,500+ in expenses each year.

The challenge with these benefit programs is that they are not automatic, they must be applied for individually, and then renewed every 1-2 years.

The other challenge with these benefits is that they do not slowly phase out as income increases but have an income qualification “cliff”, when income crosses that cliff the benefit disappears all at once.

Despite the extra paperwork, these programs can be significant for low and moderate income households. Even if you do not qualify this year, you may qualify in the future if income changes. It also may be possible to qualify for these benefits if strategic RRSP contributions or withdrawals are made. This can be especially helpful when a household is right on the “edge” of receiving some of these benefits.

Understanding how these benefit programs work and planning your personal finances carefully can help ensure that you qualify both now and in the future. Receiving these benefits can help free up cash flow and ease the pressure on other areas of your personal finances.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments