Why You Might Want To Withdraw MORE Than The RRIF Minimum

At some point every person with an RRSP is going to need to make a decision about converting their RRSP to a RRIF. The Registered Retirement Income Fund (RRIF) works very similarly to the RRSP with a couple notable exceptions.

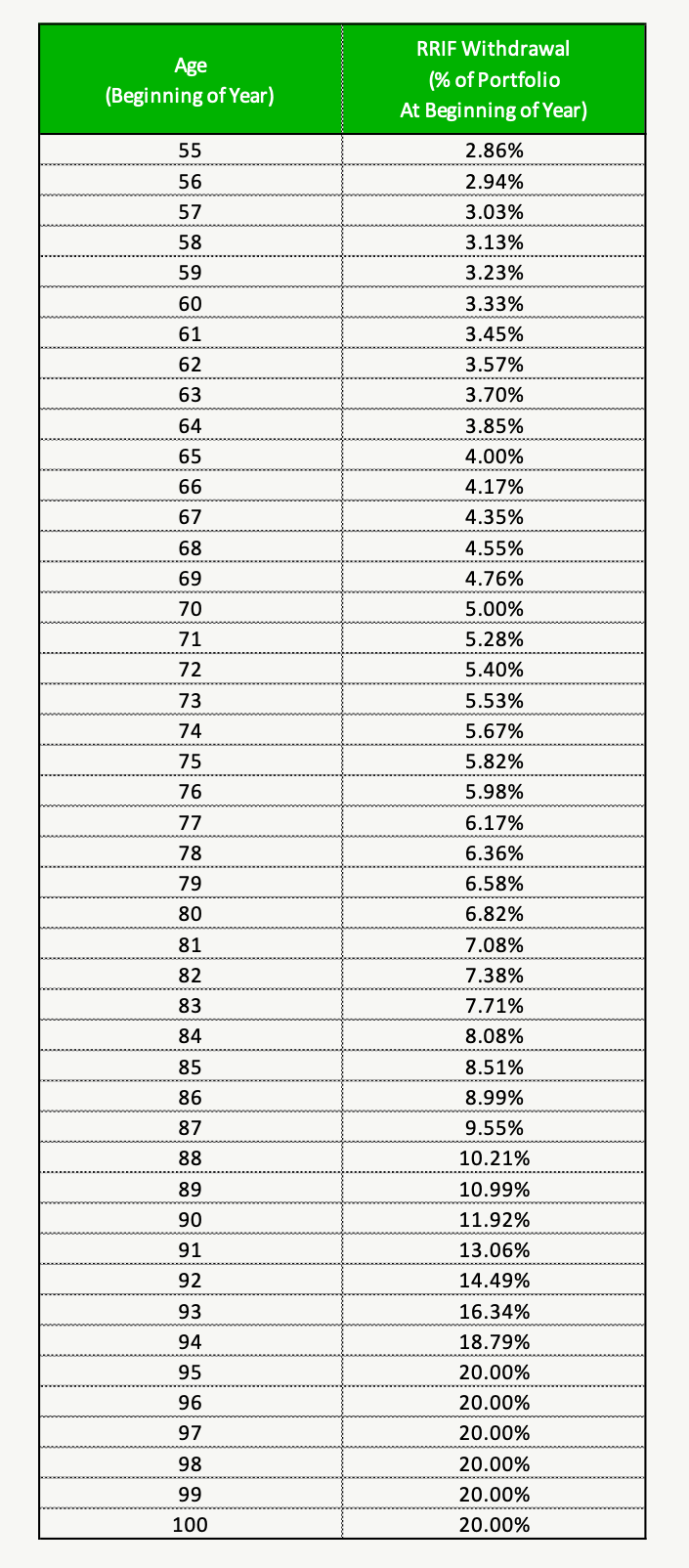

One of those exceptions is that there is a minimum RRIF withdrawal each year. Retirees need to make this minimum withdrawal from their RRIF each year and this minimum will slowly increase from year-to-year. The RRIF minimum will escalate each year as a retiree gets older. By the time a retiree reaches their mid-90s they are forced to withdrawal 20% of their RRIF each year!

Because the withdrawal is a minimum, and conversion from a RRSP to a RRIF is mandatory, this often leads people to believe that keeping money in a RRIF is a good idea. After all, if they’re being forced to take money out, wouldn’t that suggest that keeping money in is a good idea?

For many people, taking out only the minimum RRIF withdrawal each year is actually a bad idea. Many people would benefit from a different RRIF withdrawal strategy. Many people would benefit from taking out more than the minimum each year. They would increase their financial flexibility, they would decrease the tax on their estate, and they could even qualify for certain benefits late in retirement.

In this post we’ll look at RRIF withdrawal rules, the minimum RRIF withdrawal percentage by age, and we’ll explore two scenarios where we show how a retiree can benefit from RRIF withdrawals that are larger than the minimum.

We’ll also explore how this strategy is even more impactful after a large stock market correction.

RRIF Withdrawal Rules And Tax Planning Opportunities

RRSPs need to be converted to a RRIFs by the end of the year you turn 71. As an example, if you turn 71 on July 3rd then you would need to convert your RRSP to a RRIF by Dec 31st of that year.

But just because age 71 is the last possible year to convert an RRSP to a RRIF this doesn’t mean that you need to wait that long. There are a few reasons you may want to convert to a RRIF earlier.

The year after you convert from an RRSP to a RRIF you must begin minimum withdrawals. Minimum withdrawals are based on your age at the beginning of the year. In the next section we have details on how those minimum withdrawals are calculated. Continuing our example from above, this would mean that a minimum withdrawal must be made the year you turn 72.

Similarly, if you converted an RRSP to a RRIF the year you turn 64 then minimum withdrawals would start the following year, the year you turn 65.

Converting an RRSP to a RRIF earlier than age 71 can be an attractive tax planning strategy for three reasons.

- RRIF income is eligible for income splitting after age 65

- RRIF income is eligible for the pension income tax credit ($2,000 credit)

- Minimum RRIF income is not subject to withholding tax upon withdrawal*

The other reason why converting from an RRSP to a RRIF is attractive is that RRIF withdrawals are often free for retirees. Many brokers charge a partial de-registration fee on RRSP withdrawals but RRIF withdrawals often have this fee waived.

*Note: Income tax is still payable on the withdrawal. Withholding tax is a pre-payment of income tax. Retirees are able to withhold tax on a RRIF withdrawal but there is more flexibility to manage the amount of tax withheld.

RRIF Withdrawal Rates

If you’re age 70 or younger, the RRIF withdrawal rate is determined by the following formula: 1 / (90 – age) where age is the age at the beginning of the year.

You can also elect to have the minimum RRIF withdrawal based on your spouse’s age if your spouse is younger. This provides more flexibility, but as we’ll see below, it may not be a good idea to just withdraw the lowest possible amount from a RRIF.

After age 95 the minimum RRIF withdrawal is a steady 20%.

To determine the dollar amount to be withdrawn the withdrawal rate is multiplied by the account balance at the beginning of the year. A retiree who is 65 years old at the beginning of the year, with a RRIF balance of $100,000, will need to make a minimum RRIF withdrawal of $4,000 that year (4% x $100,000).

Why You Might Want To Take Out MORE Than The RRIF Minimum

There is a lot of focus put on the RRIF minimum. This may be the result of financial planning advice that is focused on very high net worth households. For very high net worth households the tax deferral makes this attractive in certain cases.

Because of this advice, many people want to wait until the last possible moment, at age 71, to convert to a RRIF. They also want to withdraw the absolute minimum possible. This might be a good strategy for some, but for many this will lead to less flexibility and more tax down the line.

To highlight why taking out the RRIF minimum might be a bad idea we’ll look at an example.

In this example we have a retiree in Ontario. They’ve converted their RRSP to a RRIF and will take out the minimum at age 65. With a paid off house they have enough income from CPP, OAS and minimum RRIF withdrawals to fund their retirement lifestyle. But should they withdraw just the minimum?

Because they already receive CPP and OAS, we’ll assume that the RRIF withdrawal, as well as any extra withdrawal, falls entirely in the 20.05% tax bracket.

Like many retirees we’ll also assume they have some unused TFSA contribution room. Many retirees are in a higher tax bracket before retirement and this makes RRSP contributions more attractive, they’ve likely been focusing on using up RRSP contribution room and could have a lot of TFSA contribution room to use up.

Let’s explore two scenarios. One where our retiree takes out just the minimum from the RRIF and a second where they withdraw more than the minimum and invest the excess in a TFSA each year as they earn more contribution room.

In both cases we’ll assume extra withdrawals are invested immediately in the TFSA. Therefore there is no time out of the market and investments still grow tax free inside the TFSA. A retiree who withdraws more than the minimum and puts the excess in their TFSA is still benefiting from tax free growth. We’ll assume a balanced 60/40 portfolio with a growth rate of 5.0% and inflation of 2.1%.

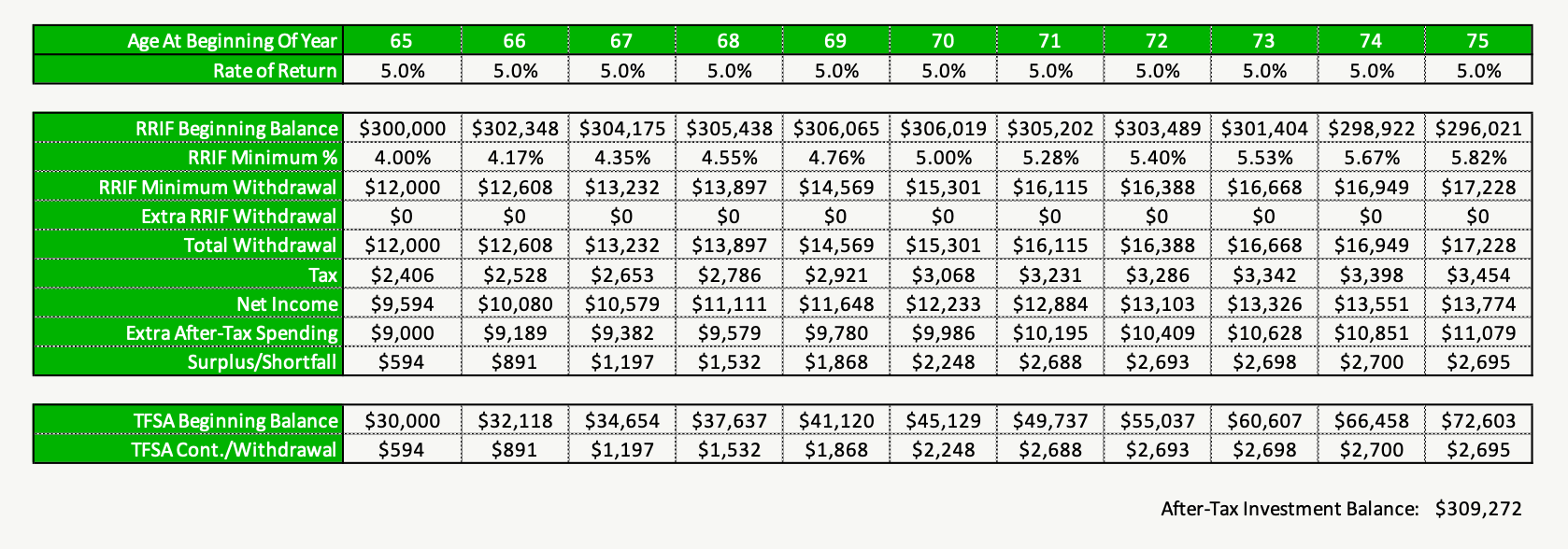

Scenario 1: Withdrawing The RRIF Minimum

In this scenario we withdraw the RRIF minimum and nothing more. Our retiree doesn’t quite need to entire RRIF minimum so a small amount is invested in the TFSA each year. This amount increases as the minimum required withdrawal increases.

Because we have investment assets that are a mix of pre-tax (RRSP) and after-tax (TFSA) we’ll look at after-tax investment balance and reduce the value of the RRSP by the marginal tax rate of 20.05%. The value after 10-years is $309,272.

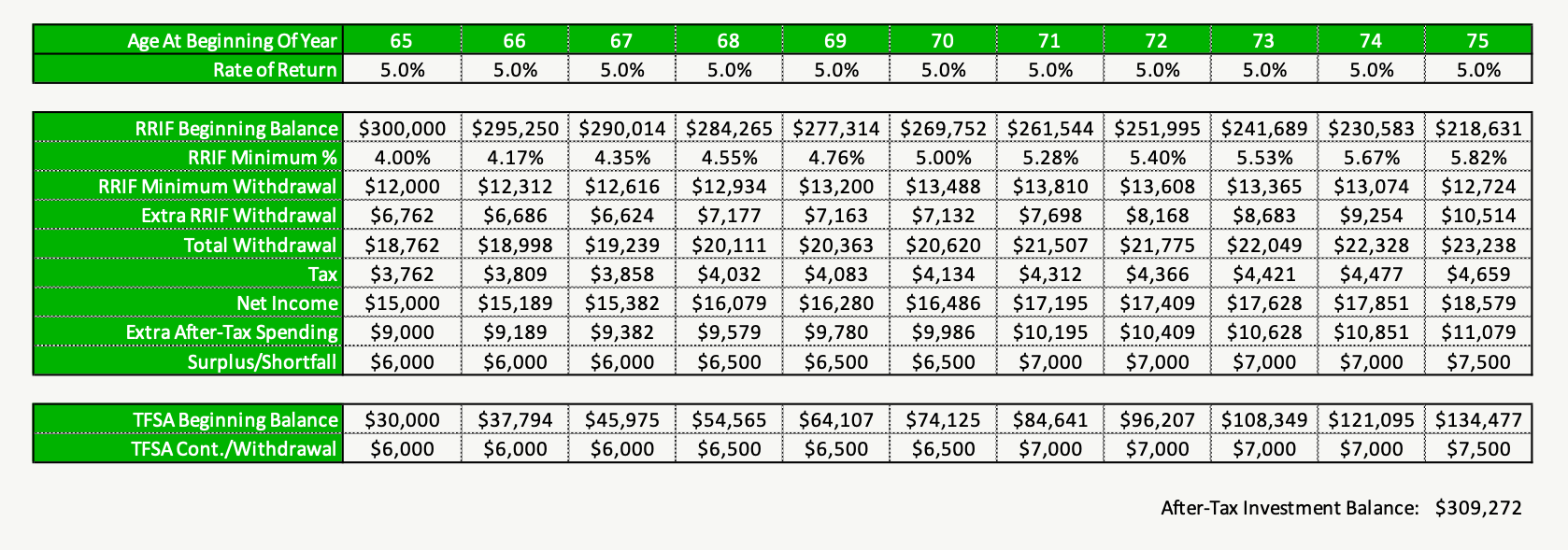

Scenario 2: Withdrawing More Than The RRIF Minimum And Investing Excess In A TFSA

In this scenario we withdraw MORE than the RRIF minimum each year, we’ll withdraw enough to use up the new TFSA contribution room each year. After paying tax the extra income is invested in the TFSA to continue growing tax-free.

Again, because we have investment assets that are a mix of pre-tax (RRSP) and after-tax (TFSA) we’ll look at after-tax investment balance and reduce the value of the RRSP by the marginal tax rate of 20.05%. The value after 10-years is $309,272.

This is the same value as in scenario 1. This makes sense because when someone is in the same tax bracket the RRSP/RRIF and the TFSA work similarly. The tax benefit is the same between the two accounts.

But in this scenario there are a couple of advantages. One is that the retiree has more flexibility. More investment assets end up in the TFSA, almost 2x as much, which makes them more accessible. In an emergency the retiree could draw from the TFSA and not trigger higher marginal tax rates.

This scenario also has an advantage for estate planning. As part of the estate, the entire value of the RRIF is taxed all at once. This can trigger some high marginal tax rates. By slowly shifting the RRIF to the TFSA we improve the after-tax value of the estate.

The final advantage in this scenario is that this retiree could now qualify for income tested government benefits later in retirement. This could help pay for extra health care or long-term care if required. By drawing down the RRIF faster we’ve created another layer of protection should they be faced with an unfortunate series of changes later in retirement.

RRIF Withdrawals During A Recession/Recovery

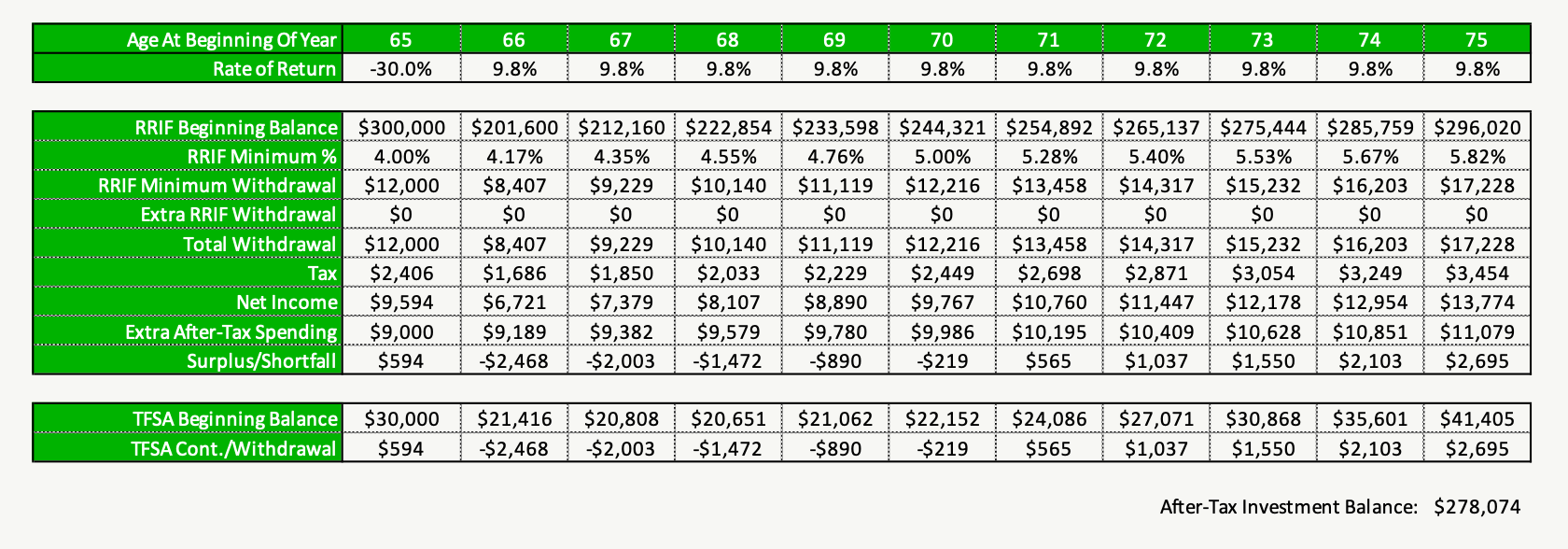

The advantages between scenario 1 and scenario 2 are increased even further after a stock market correction. After a large drop in stock market value it’s actually easier for a retiree to shift assets from the RRIF to the TFSA. Withdrawing the same dollar value from the RRIF now means more shares can be transferred to the TFSA. This means assets can recover their value in the TFSA, increasing the TFSAs size even further.

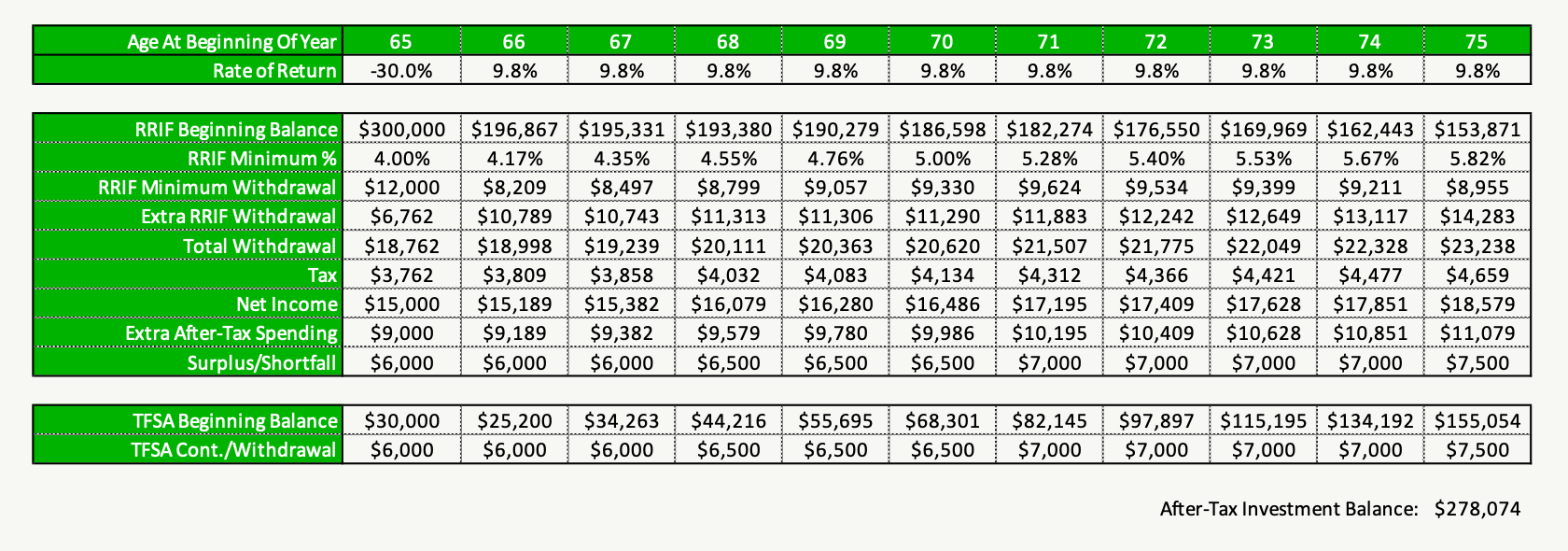

Here we assume a 30% correction/recession followed by a 10-year recovery with above average returns.

By making more than the minimum RRIF withdrawal and investing the excess in the TFSA, even more of this retirees future investment assets are transferred to the TFSA.

Scenario 1: Minimum RRIF Withdrawals

Scenario 2: MORE Than Minimum RRIF Withdrawals

(The TFSA is nearly 4x larger)

Factors To Consider When Planning RRIF Withdrawals

It’s important to highlight that this strategy will work for some people but not all. There are some important factors to consider before deciding if this strategy makes sense for you. Every situation is unique. It’s best to speak with an advice-only financial planner to understand if making larger RRIF withdrawals is truly right for your situation.

1. Marginal tax rate – When extra RRIF withdrawals push a retiree into a higher tax bracket, or OAS clawbacks, this triggers extra tax and makes this strategy counter productive.

2. TFSA contribution room – For high net worth retirees, who have significant non-registered assets, there won’t be any extra TFSA room to take advantage of.

3. Pension income tax credit – Drawing down the RRIF too fast may deplete the RRIF early and the retiree would lose the pension income tax credit*

*This factor could be minimized by leaving enough assets in the RRIF to maximize the $2,000 pension income tax credit each year.

Why You Might Want To Withdraw MORE Than The RRIF Minimum

In many situations withdrawing more than the RRIF minimum is an attractive strategy. It can shift investment assets into the TFSA which makes them more accessible in the future and decreases taxes on the estate.

Moving investment assets into the TFSA also means that a household may qualify for additional government benefits in the future. This extra flexibility could be especially helpful if faced with poor investment returns, the need for extra health care, or the need for long-term care.

But withdrawing more than the RRIF minimum isn’t a strategy that will work for all people. Some people will want to keep as much as possible in their RRIF. But these households typically have higher net worth, with maxed out TFSAs, and may not represent the majority of retirees.

Tax and benefit rules are complex, and when planning over a 30-40 year retirement period it can be especially challenging. To determine if this strategy is right for you we recommend speaking with an advice-only financial planner. Only by looking at your full financial situation will it be possible to optimize your withdrawals for tax and benefits.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

I plan to withdraw more than the minimum and stay within the 1st tax bracket to first fill our TFSA room, then non-reg because the estate tax would be over 50% if we just left it in the RRIF unless we lived past our mid 90’s. We would pay less tax if we used the minimums but that 54% rate really annoys me 🙂

Fantastic idea Mark, that will likely be a good strategy. Everyone is different, but often making those strategic RRSP/RRIF withdrawals in early retirement when taxes are low can be beneficial, especially when there is TFSA contribution room to take advantage of. You may enjoy this post if you haven’t read it already, it explores different drawdown strategies between RRSP, TFSA, and non-reg for a hypothetical couple… https://www.planeasy.ca/retirement-income-start-drawdown-with-rrsp-non-registered-or-tfsa/

Not sure how you got the “After Tax Investment Balance $ 309,272 in scenario 2

when I add up the two balances it is more

Hi Andrew, the balance of $309,272 is the after-tax value of both the RRSP and TFSA. When it comes to RRSPs, it’s best to think about part of that balance belonging to the government, how much belongs to the government depends on the marginal tax rate the RRSP withdrawals are subject to in retirement. This is how we arrive at the combined after-tax balance of $309,272…

From the post: “…because we have investment assets that are a mix of pre-tax (RRSP) and after-tax (TFSA) we’ll look at after-tax investment balance and reduce the value of the RRSP by the marginal tax rate of 20.05%. The value after 10-years is $309,272”

Qwen, I was thinking, when one has exhausted all TFSA room, where can you put the additional withdrawn RRIF funds where it can potentially grow tax free; a new kitchen or bathroom in the primary residence! My wife likes this strategy.

Hi Bob! We would call that a QoL investment, or Quality of Life, and it can pay dividends : )

But if someone needed another place to park extra RRIF withdrawals, Canadian dividends are taxed very favorably thanks to the dividend tax credit. Depending on the tax bracket and province, it can even provide a negative tax rate. This strategy would forgo some tax free growth in the RRIF, but it might be a good idea from an overall drawdown perspective and could avoid a large amount of tax if the RRIF is wound down all at once in the estate.

Thanks Qwen. Great point about the dividend tax credit.

I wonder if the government would realize more tax revenue in the long run if they removed the minimum rule? Many estates would likely end up paying 54% rather than 20% or so with a slow withdrawal plan.