The 24-Hour Budget

Doing something for a month is hard, doing something for a week is difficult, but doing something for 24hrs…. well that’s not so bad, it’s achievable, it’s realistic.

When trying to do something difficult, something huge, something never done before, we’re often given the advice that you should “eat an elephant one bite at a time”.

To overcome a big challenge you need to break down your problem into smaller, more manageable pieces.

Budgeting isn’t different…

Sticking to a budget for a month can be hard, super hard. Sticking to a budget for a week is hard, but not impossible. Sticking to a budget for 24hrs…. that’s achievable.

It’s HARD to control your spending day-in-day-out for a month straight but with the daily budget you only have to control your spending for the next 24hrs. After 24hrs your budget resets and you have a new amount to spend for the next day.

That’s the beauty of a 24hr budget. Once the money is gone it doesn’t take a month to come back. With a daily budget you get to spend a new chunk of money tomorrow!

The 24hr budget is like an allowance except instead of $1/week you’re getting $20/$30/$40 per day! This is how you create a 24hr budget…

Creating A 24hr Budget

The 24hr budget should only cover personal day-to-day spending. Money for monthly bills, rent, mortgage, savings, debt payments etc need to be put aside first. This is called “paying yourself first” and its partially why the daily budget work so well.

To create a 24hr budget the first thing you need to do is estimate your monthly fixed expenses, things like bills, rent, mortgage, savings, debt etc. These are expenses that don’t change month to month. Fixed expenses would also cover infrequent expenses like annual vacations, vehicle repairs, home repairs, random emergencies etc. For once per year expenses you should take the annual amount and divide by 12 to get a monthly value. Estimates are fine.

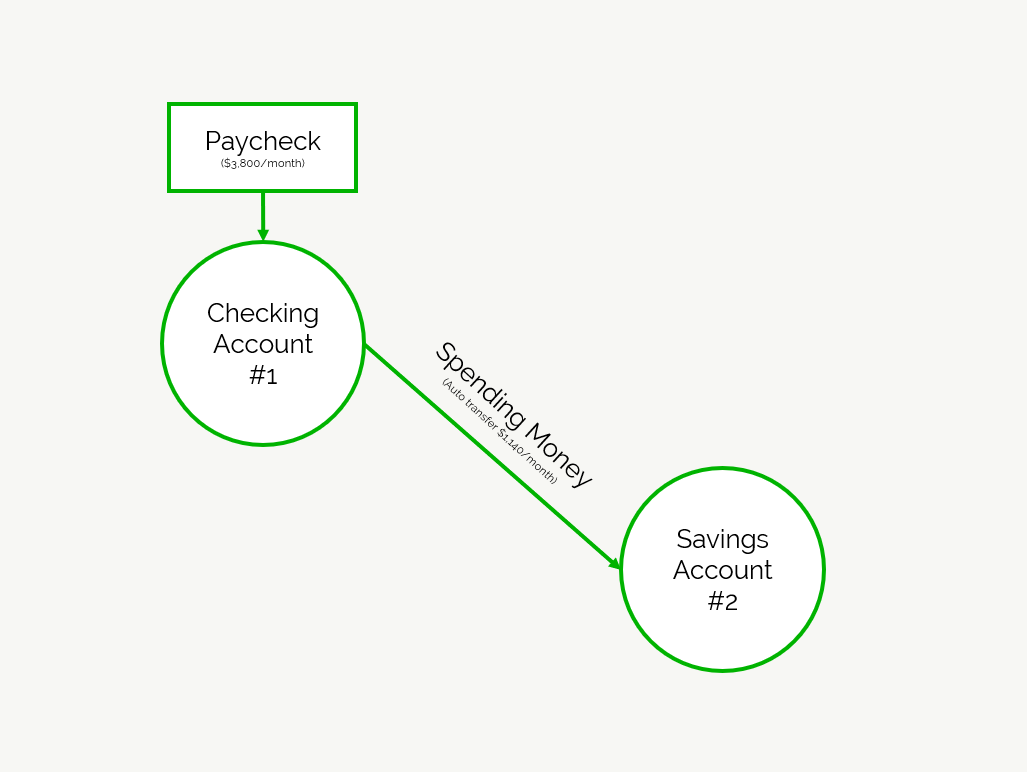

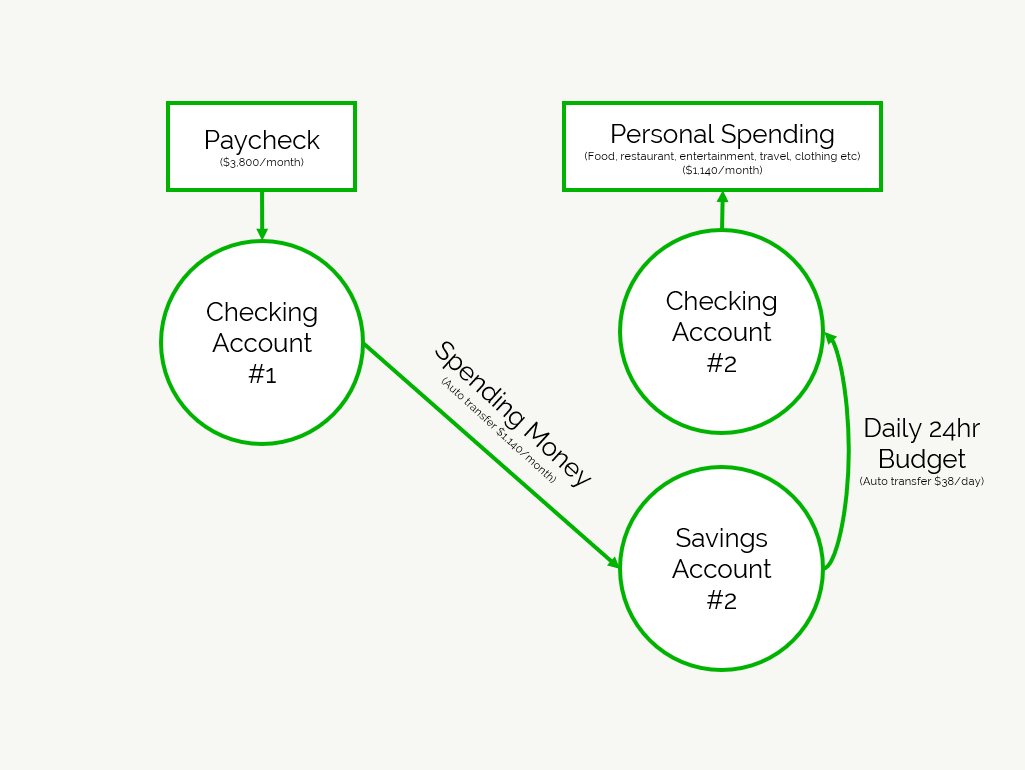

After you’ve estimated your fixed expenses, savings and debt payments, you need to take your monthly net-income and subtract this amount. If you get paid $3,800 per month and your fixed expenses are $2,660 then you have $1,140 left over for personal spending. This amount should be around 30% of your net-income. This covers things like food, restaurants, entertainment, clothing etc.

Now that you have your monthly personal spending you just need to divide by 31 to get your 24hr budget. If we have $1,140 for personal spending each month that means our 24hr budget is $36.77.

Tip: By dividing by 31 you’ll actually have a bit extra by the end of the year ; )

Now for the best part, automation…

Automate Your 24hr Budget

The beautiful thing about the 24hr budget is that it can be automated!

Automating your 24hr budget is easy to do. Most bank accounts allow you to set up automatic transfers between accounts so its super easy to automate everything!

Personally, I like to use a separate no-fee online account for this. Either Simplii or Tangerine will work.

Using a separate no-fee account for your 24hr budget will keep your spending money separate from money for bills, rent, mortgage etc.

First you want to transfer your spending money into your savings account. You savings account is where your 24hr budget will come from each day. After each paycheck you need to transfer money to your savings account to cover your 24hr budget until next payday.

Now that your spending money is in your no-fee savings account you need to send it to your no-fee checking account once per day. Take your monthly budget and divide by 31, this is your 24hr budget. If we had $1,140 for personal spending each month then our 24hr budget would be $36.77 per day.

Not all banks allow daily automated transfers so you may need to setup a weekly transfer for each day (a total of seven repeating weekly transfers).

That’s it! Now you have a steady stream of money coming into your no-fee checking account to cover your daily personal spending!

The 24hr budget is a great way to keep yourself on track with your budget. If you’ve tried but hated other budgeting methods, then maybe the 24hr budget is the one for you!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments