The Best Way To Invest Short Term

When planning to reach a financial goal, one very important aspect is the timeline. How much time do you have until you want to meet your goal? Is it 1-year, 3-years, 5-years, 10-years or maybe it’s a long-term goal like 25+ years.

Your timeline is a very important factor to consider. Your timeline is going to help inform decisions about how much risk you should be taking and the best way to invest.

One common mistake people make is that they make investment decisions without thinking about their timeline. They’re mostly focused on getting the highest return, making the most of their money, and not leaving anything on the table. But they don’t fully appreciate the short-term risk associated with a decision to “maximize returns”.

Over the long-term, taking on more risk can be a smart decision, but over the short-term that extra risk can cause some wild swings.

If you need access to money within a few years then you need to choose a good way to invest short-term.

Maybe it’s for a down payment, or maybe it’s to pay for post-secondary education, maybe it’s to pay for an expensive once-in-a-lifetime trip in retirement, or perhaps it’s a wedding gift for your daughter and soon to be son-in-law. Whatever the reason, if you need access to a large amount of cash within the next 3-5 years then you need a good short-term investment.

Long-Term Investments: Greater Return But Greater Risk

Over the long-term a higher risk investment can provide a higher return. After all, the greater the risk the greater the reward. But over the short-term this extra risk can create some large investment losses.

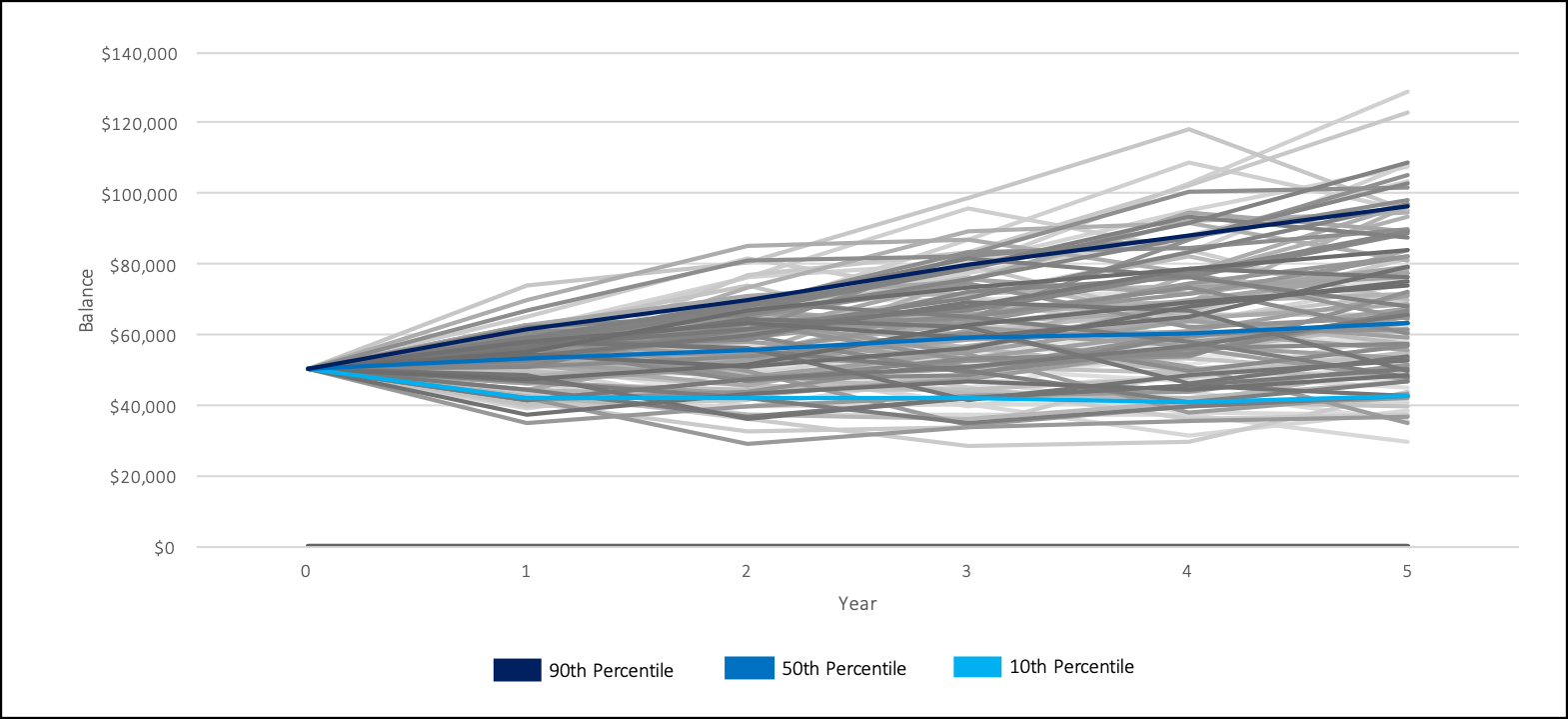

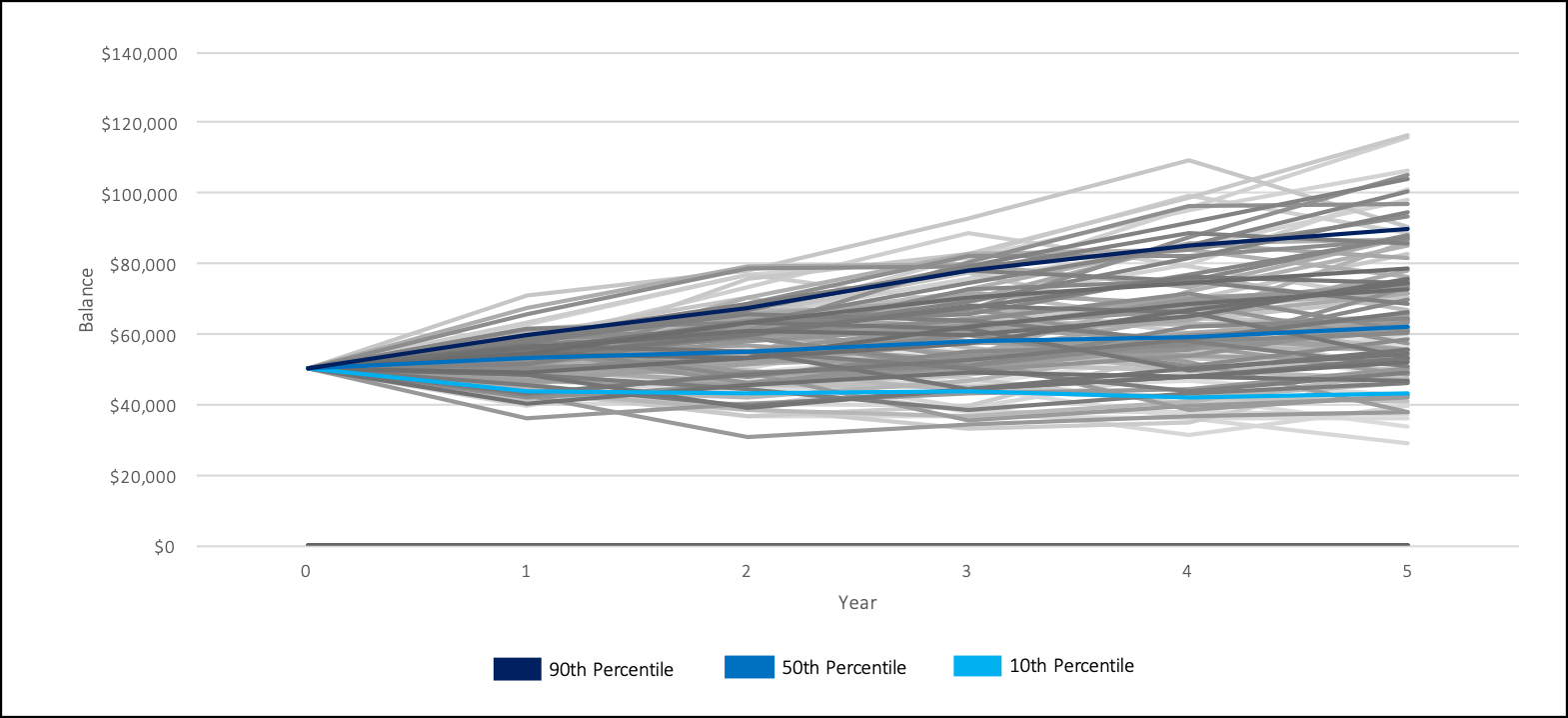

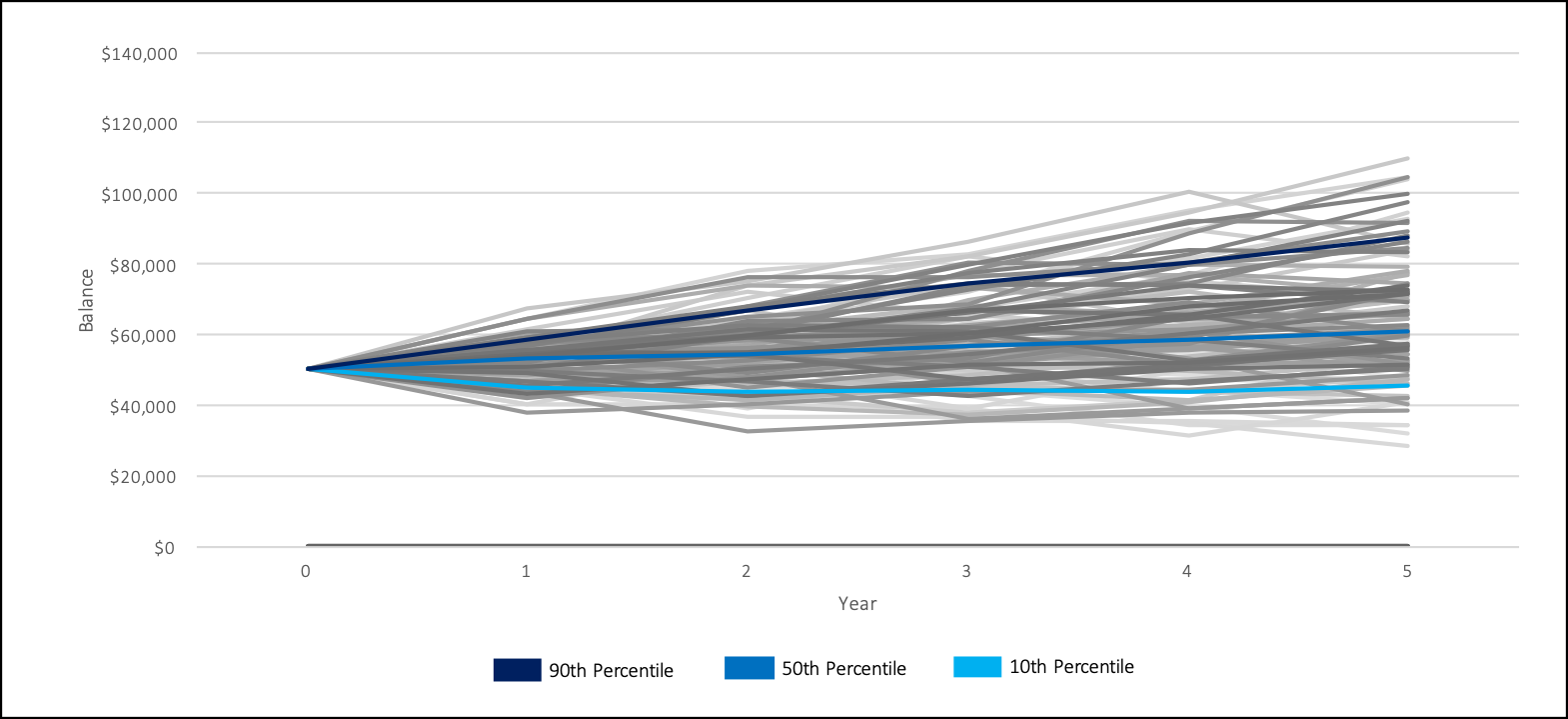

In the charts below we look at a few different investment portfolios and how they would fare over a 5-year investment period. They all start with $50,000.

Perhaps this $50,000 is for a down payment in a few years or perhaps it’s for a once-in-a-lifetime trip at the start of retirement. Whatever the reason, this money will be needed in a few years time.

Each line in the chart below represents one historical period of stock returns, bond returns, and inflation rates. These charts are in ‘real’ dollars, which means that we’ve taken out the impact of inflation and $50,000 today is worth the same as $50,000 in 5-years.

As you’ll see in the charts below, even a balanced 60/40 portfolio experiences some wild swings over the short-term.

Some scenarios end higher, absolutely, but many scenarios end lower, some much lower. This is why high risk investments make poor short-term investments. And even a 60/40 “balanced” portfolio can incur some sizable losses.

These charts clearly show the risk of investing in the wrong way for a short-term investment. It’s reasonable to expect that an initial $50,000 could drop by 40%+ and not recover within 5-years. It’s going to feel pretty awful to lose such a large chunk of the money you’ve been saving towards your goal (and I speak from experience).

Sequence of Returns Risk

Aggressive 90/10 Portfolio

Sequence of Returns Risk

Assertive 75/25 Portfolio

Sequence of Returns Risk

Balanced 60/40 Portfolio

Best Way To Invest Short Term

As you can see in the charts above, we need a better way to invest short-term. Even a 60/40 portfolio could lead to some considerable losses. We want an investment option that won’t have a chance of losing money.

Generally, an investment can be considered short term if it is 3-5 years or less. Although long-term investments usually provide greater growth, the benefit of a short-term investment is that you have access to the money almost right away, you also don’t have to worry that your investment might lose value.

Here are two examples of good short term investments:

A High Interest Savings Account

- These are a good option as they are easy to set up and have little risk

- Just be aware of any account charges, a no-fee option is best!

Guaranteed Investment Certificate

- Many require an investment of at least $500

- Sometimes a GIC can provide more interest than a savings account

- Money is locked in for 90-days, 1-year, 2-years, 3-years, 4-years or 5-years

The Best Place To Invest Money Short-Term

It’s not exciting, you might even say it’s boring, but a safe investment is the best place to invest money short-term. A safe investment is one that guarantees your principal and has zero chance of an investment loss.

Stocks, ETF, mutual fund, even bonds and bond funds can all lose principal over a period of a few years. These are not safe investments for a short-term goal.

The best place to invest short-term is in something safe like a high-interest savings account or GIC. This is the only way to guarantee your principal will be available when you need it.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Agree that short-term investing requires that you put it someplace safe. With interest rates as low as they are, it does feel like you’re losing money to get 1-2% back as inflation cuts in that much or more. We do not keep a large reserve but we do keep a HELOC open. It takes discipline not to draw that down but for anything big we may need — like that $50k example, as opposed to $1k for a home repair — I opt for the HELOC first than leaving money somewhere where it loses value, for a just in case.