These 3 Retirement Tax Credits Equal Up To $50,000+ Per Year In Tax Free Income

When we talk about retirement planning with our clients one topic that inevitably comes up is tax planning.

Income tax is often the single largest expense in retirement. Larger than travel, food, or medical expenses.

Income tax often comes up when we talk about retirement planning because many people are worried about paying too much tax in retirement and negatively impacting their retirement spending goals.

Many people do not realize that in retirement there are new tax credits that can help reduce income tax, sometimes to zero. It’s understandable that people aren’t aware of these tax credits because they’re mostly available to those over age 65, so they’re not necessarily on someone’s radar if they’re under age 65.

Paying less tax in retirement is nice, but what if you could pay NO TAX at all in retirement? With some pre-retirement planning that is easily possible.

There are three important tax credits that can help you earn over $25,000 per year as an individual, or over $50,000 per year as a couple, and pay zero tax in retirement.

In this blog post we’re going to look at three important tax credits in retirement, two of which, for most people, are only available after age 65. We’re also going to work backward to craft a retirement plan that provides $75,000 per year in spending with zero tax.

Retirement Tax Credit #1: Basic Personal Amount

The first and largest tax credit is the basic personal amount. At the moment, in 2023, the basic personal amount is worth $15,000 per person at a federal level.

This tax credit is available to everyone, and it helps reduce tax to zero on the first $15,000 of taxable income.

It is available to everyone regardless of age or type of income. It’s a key part of tax planning in retirement. An individual can have $15,000 per year in retirement income, or a couple can have $30,000 per year in retirement income and pay zero tax.

Retirement Tax Credit #2: Age Amount Tax Credit

The second important tax credit in retirement is the Age Amount tax credit. The Age Amount is only available to those over the age of 65 but it is worth $8,396 per person at a federal level.

This amount just happens to be about the same amount as the maximum OAS benefit, which also happens to start at age 65.

So at age 65 you can start to receive OAS benefits and at the same time you start to receive a new tax credit that is nearly equal in size. This provides another $8,396 in income per person with no tax.

There is one important caveat with the Age Amount, it has a clawback if your retirement income is above a certain threshold, this clawback is equal to a tax rate of 3.01% (Ontario and Federal combined).

Retirement Tax Credit #3: Pension Income Amount Tax Credit

The third and last important tax credit in retirement is the Pension Income Amount tax credit. At a federal level this tax credit is worth $2,000 per person but it is only available for eligible pension income. After age 65 this includes income from a RRIF.

So in retirement, and after age 65, a $2,000 RRIF withdrawal each year will enjoy an equal amount in tax credits at the federal level.

While the Pension Income Amount is an attractive tax credit, it’s important to look at the big picture, if you’re receiving GIS benefits then those $2,000 in RRIF withdrawals will cause $1,000 to $1,500 in GIS reductions while only gaining $300 in tax savings from the tax credit, so be careful when doing tax planning because it’s easy to be “penny wise but pound foolish” when it comes to tax and benefit planning in retirement.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

$75,000 In Retirement Income With No Tax!

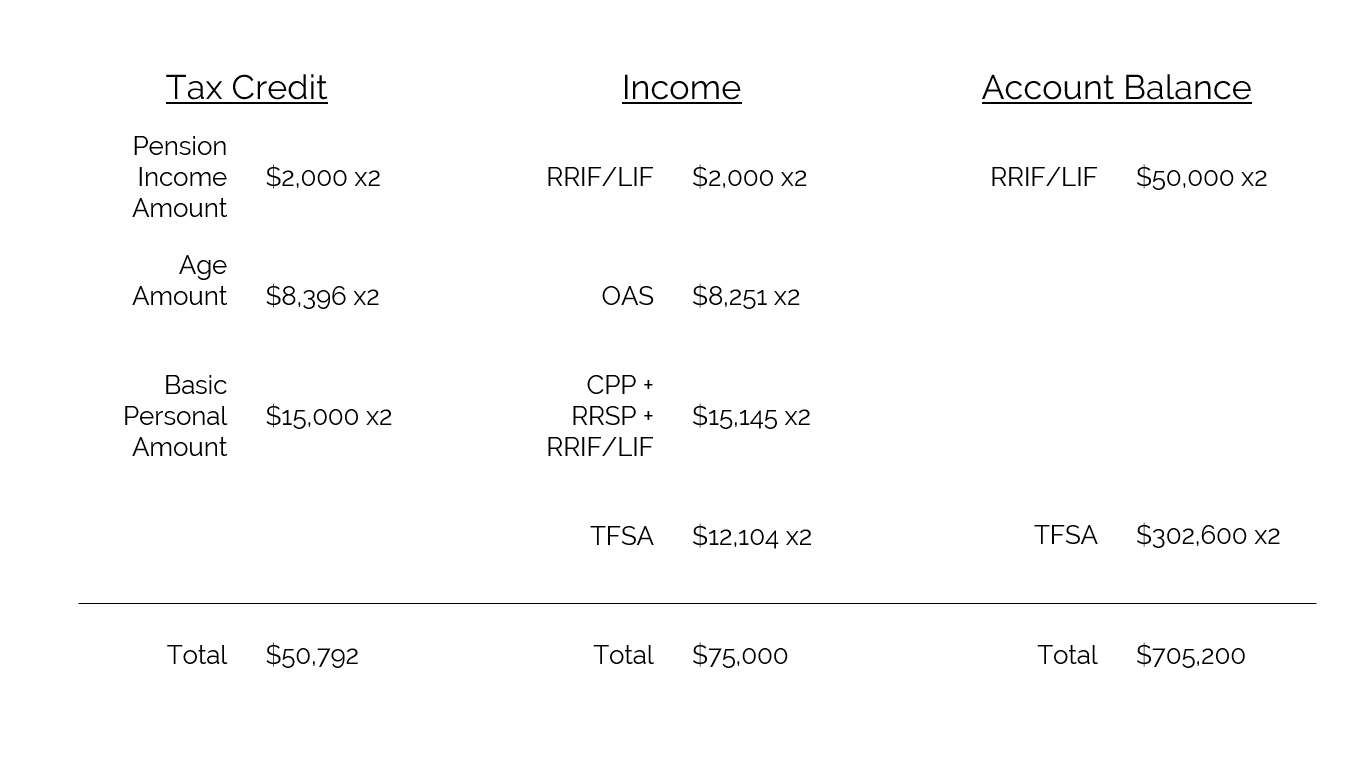

Let’s work backwards using these three tax credits to create a retirement plan that provides $75,000 per year in retirement income for a couple with no tax at all.

First, let’s plan for RRIF withdrawals of $2,000 per year per person to take advantage of the Pension Income Amount. With a 4-5% withdrawal rate this will require approximately $50,000 in RRIF assets each. This provides a total of $4,000 in retirement income with no tax.

Second, let’s plan for maximum OAS benefits of $8,251 per year as of 2023. The Age Amount tax credit will cover this whole amount with an additional $145 remaining. This provides $16,502 in retirement income with no tax.

Third, we have the Basic Personal Amount worth $15,000 each (plus $145 in credits left over from the Age Amount tax credit), so let’s plan for $15,145 in CPP benefits retirement (or a combination of CPP benefits and RRSP/RRIF) withdrawals.

Having $15,145 per year in CPP benefits would either mean having very close to the maximum CPP benefit or it would mean delaying CPP past 65 and perhaps using RRSP/RRIF assets in the meantime. Either way we’ll assume this provides $30,290 in retirement income with no tax.

In total we now have $50,792 in retirement income and $50,792 in tax credits, so no tax so far! To reach our income goal of $75,000 per year we need an additional $24,208 in retirement income with no tax.

The easiest way is through TFSA withdrawals. To reach $24,208 in annual TFSA withdrawals we would need TFSA assets of around $605,200 or a little over $300,000 per person. This may not be possible for current retirees but could easily be possible for those retiring in 10-15 years.

An alternative for those retiring soon could be $150,000 in a TFSA and $150,000 in non-registered assets. The dividend tax credit can make non-registered investment income very tax efficient as well. The non-registered assets can also be slowly shifted to the TFSAs as new contribution room is earned.

In total that is $75,000 in income and zero tax!

Even though this seems like a great tax strategy this is not likely the best overall strategy. There may have been unintended consequences in terms of government benefit clawbacks or earlier loss of tax-free growth, so please make sure you have a retirement plan for your specific situation as this example was purely for illustration purposes only.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Other credits: Provincial Pension Income and Provincial Age Amount

Also, they could easily net $500+ annual income from credit card cash backs, plus the carbon tax refund at around $750 a year (in Manitoba).

I always assumed that tax credits for income tax purposes were a percentage of the total credits mot the full amount

You are correct Andrew, at a federal level each tax credit is worth 15% of the total credit amount, this will reduce income earned in the first tax bracket which is also taxed at 15%. So as long as income is within the first tax bracket the two “cancel each other out” in a sense.