What Is The Best & Worst Province For Your Personal Finances? Take A Guess

One of the amazing things about financial planning and retirement planning is how much the details matter. One detail in particular is very important and that is the province you live in.

It’s not even about the difference in cost of living, or the difference in average salary. Even with every factor being equal, just the difference in tax rates and provincial benefits are enough to impact your financial plan over time.

We’ve worked with clients who are nearly identical in every detail except for the province they live in. One client is very successful, while the other will run out of money in the future.

Which Province Is Best?

To figure out which province is best for your personal finances we’re going to take the same situation and just change the province to see the impact over time.

In our example we have Marie and Dan, both age 45. Marie earns $87,000 per year with bonus and Dan earns $82,000 per year. They have a home worth $650,000 with $210,000 left on their mortgage with an interest rate of 4.87%.

They have a combined $567,000 in investment assets with $382,000 in RRSPs and $185,000 in TFSAs. They do not have pensions or employer matched retirement programs, so they save 20% of their annual net income for retirement.

They currently spend $75,795 per year and hope to spend around $97,000 per year in early retirement until age 80 and then $80,200 per year from age 80 onward.

Overall, it’s a good plan, but let’s see which province leads to the higher net worth and higher success rate at the end of retirement.

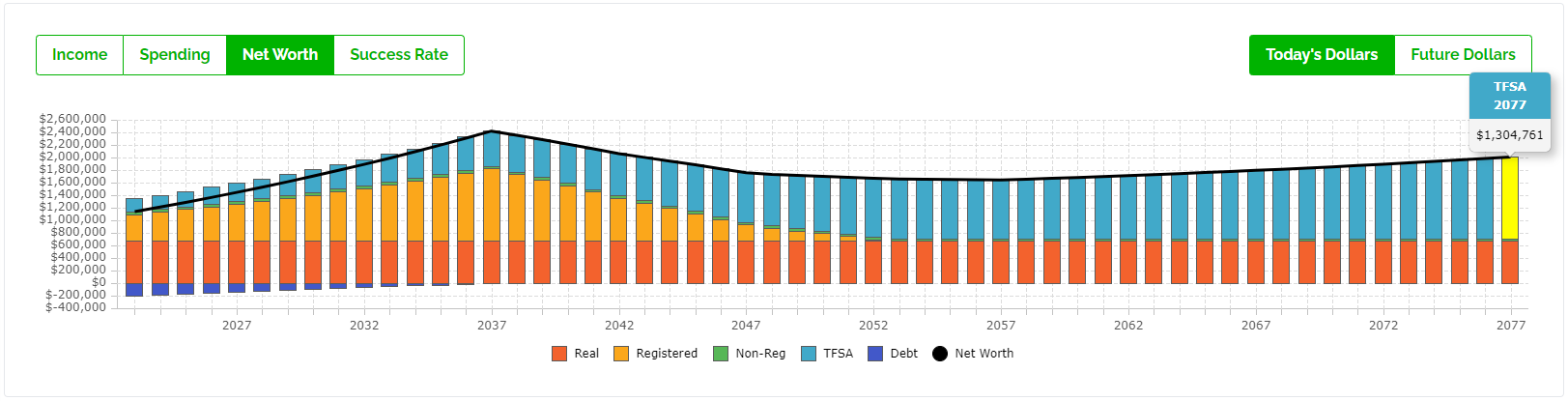

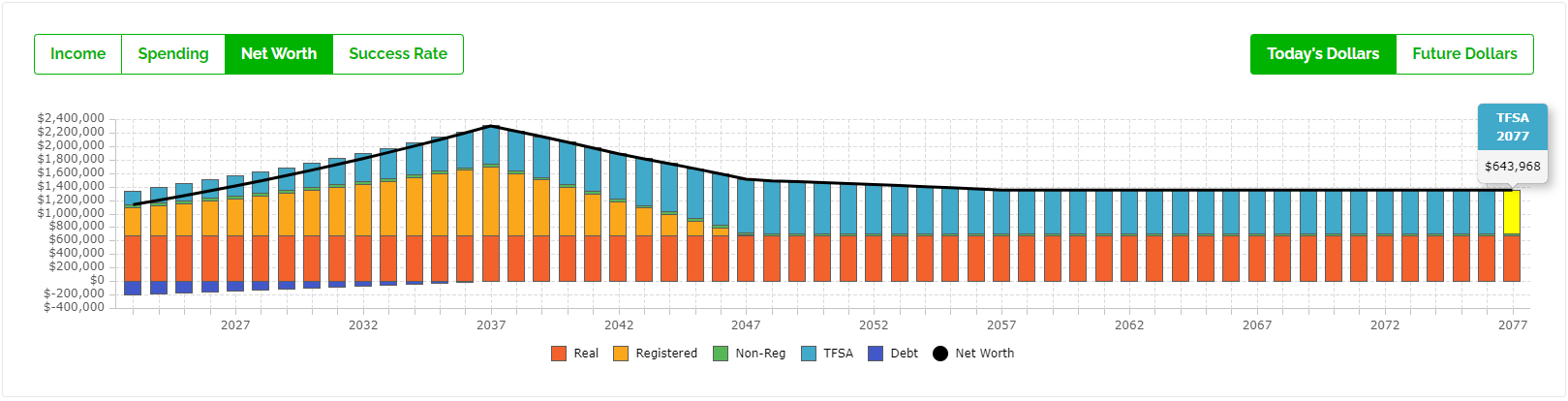

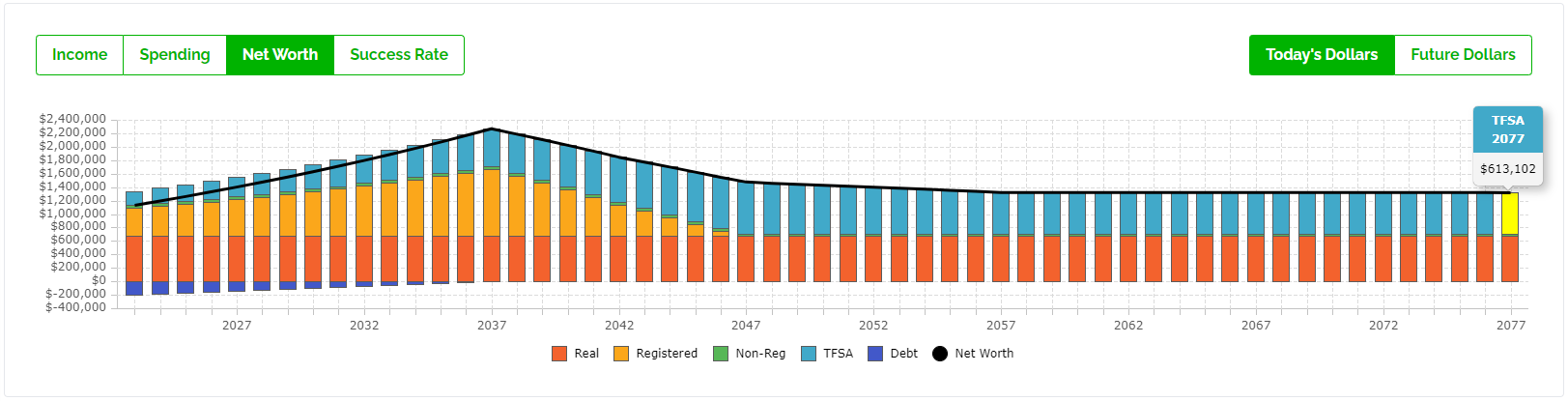

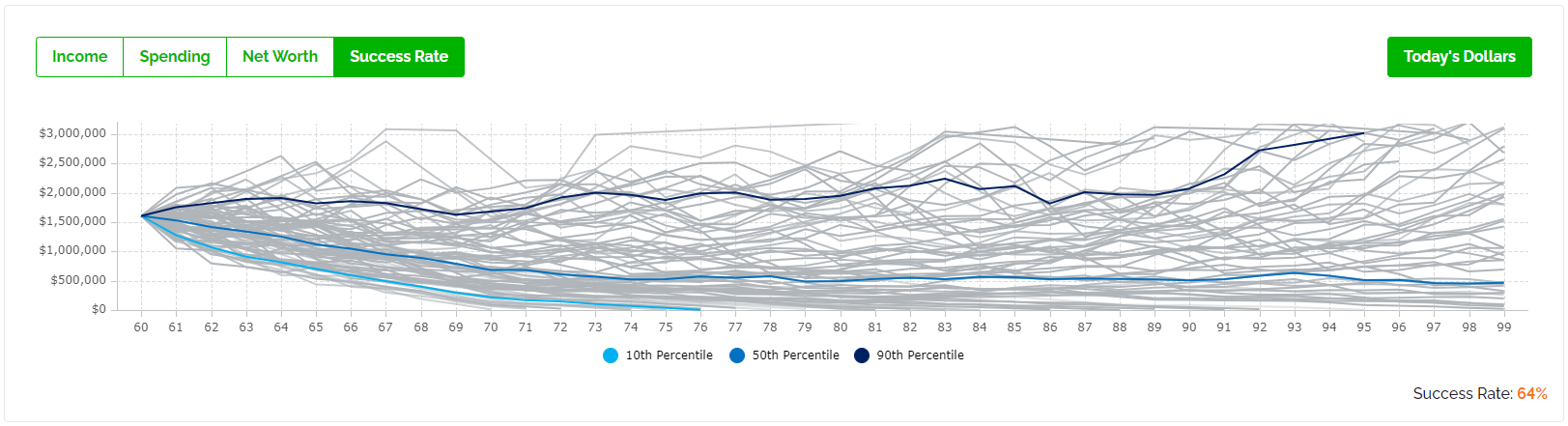

British Columbia

Check out this plan in detail: https://public.planeasy.ca/dashboard/365d-gTxAoxouMRaB

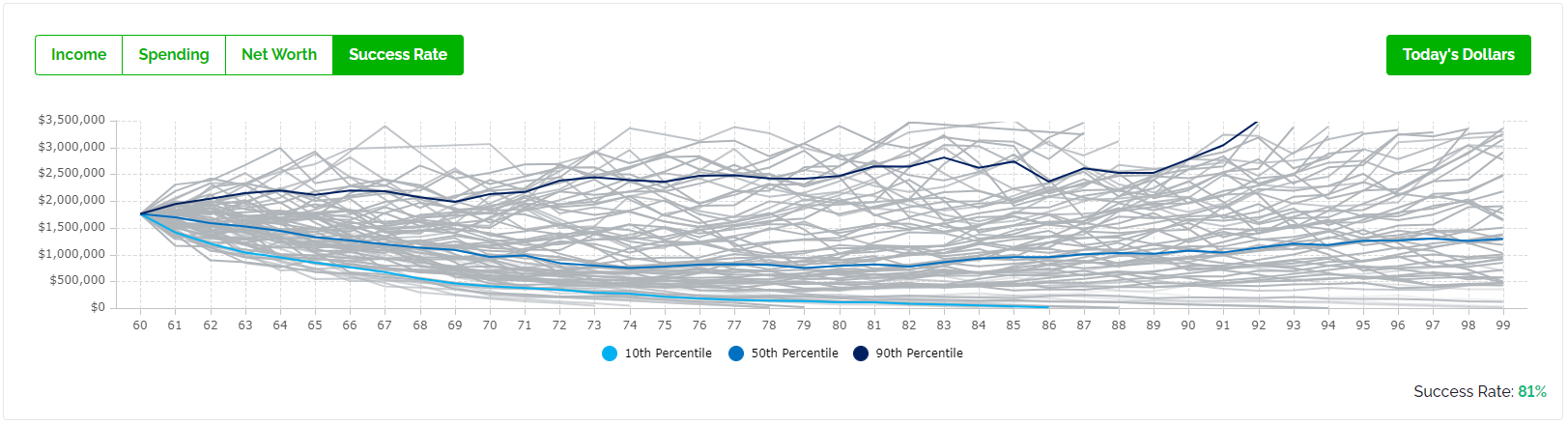

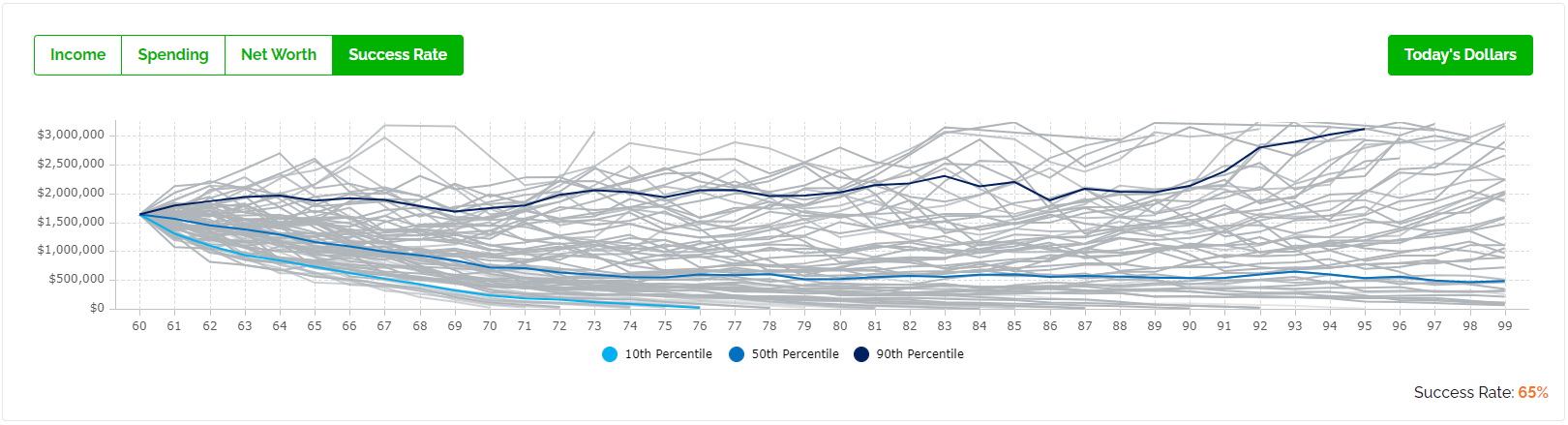

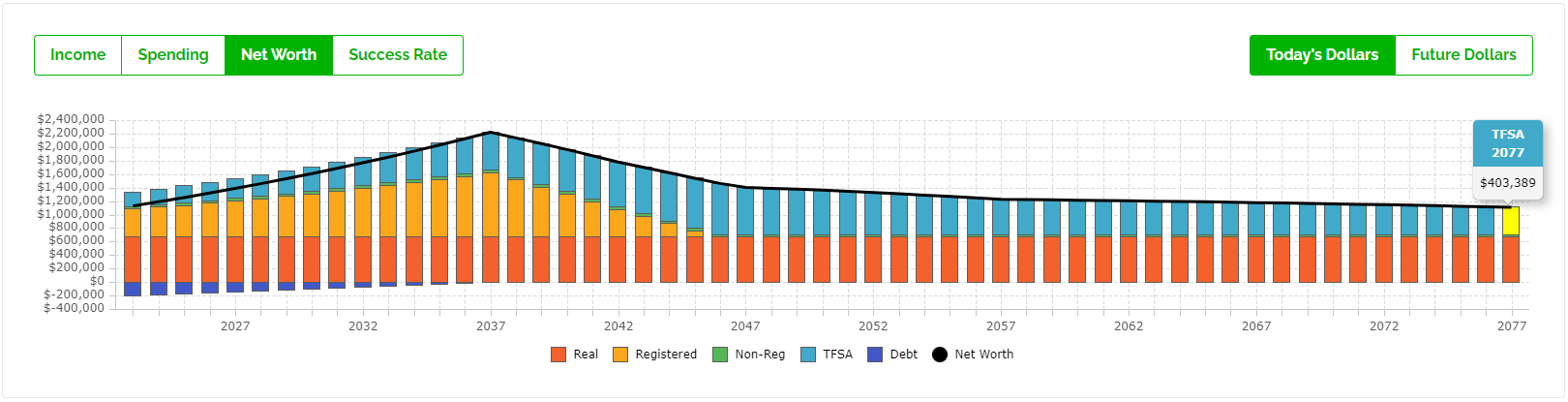

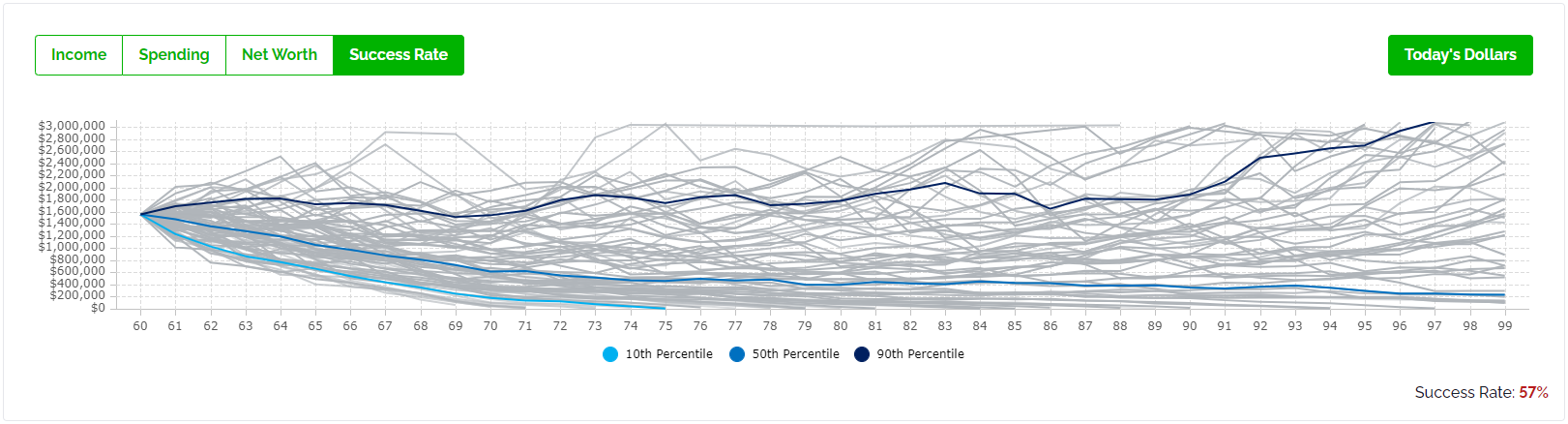

Prince Edward Island

Check out this plan in detail: https://public.planeasy.ca/dashboard/365d-9OrFFpdxtqq4

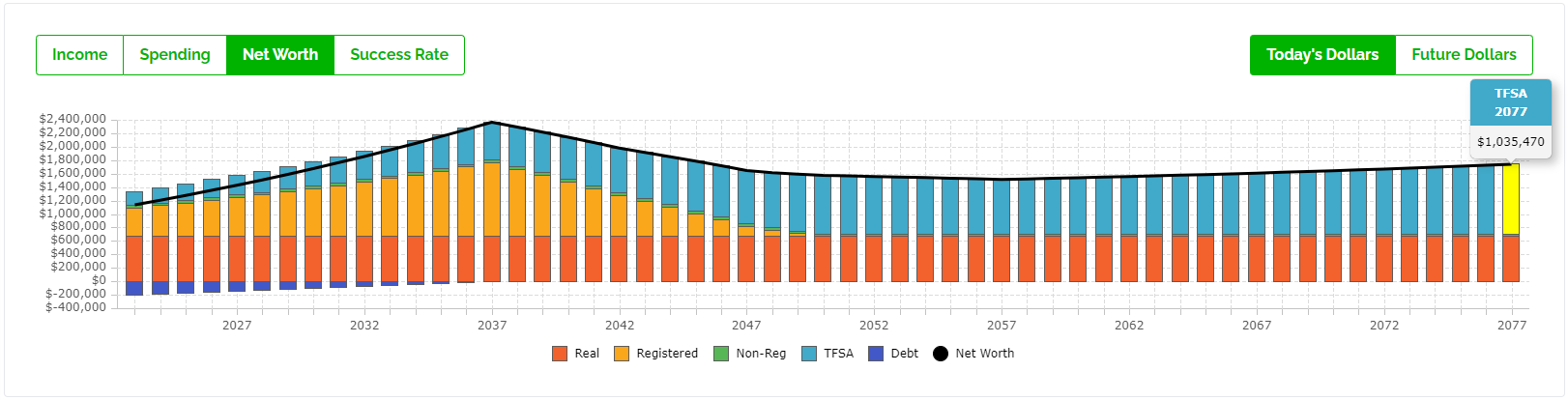

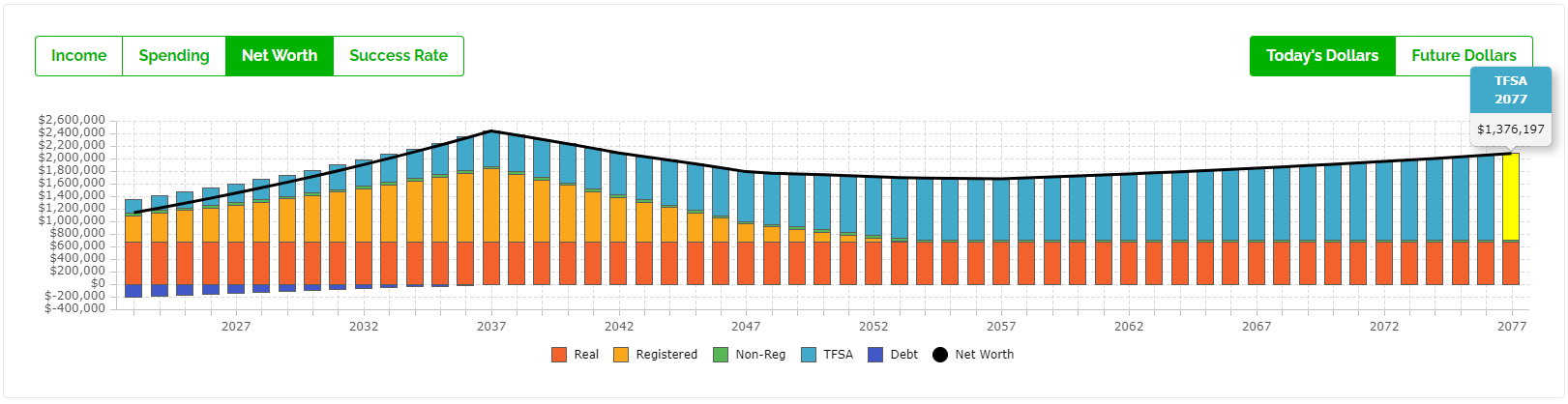

Newfoundland and Labrador

Check out this plan in detail: https://public.planeasy.ca/dashboard/365d-GnsagASYeX2Q

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

The Problem With General Financial Advice

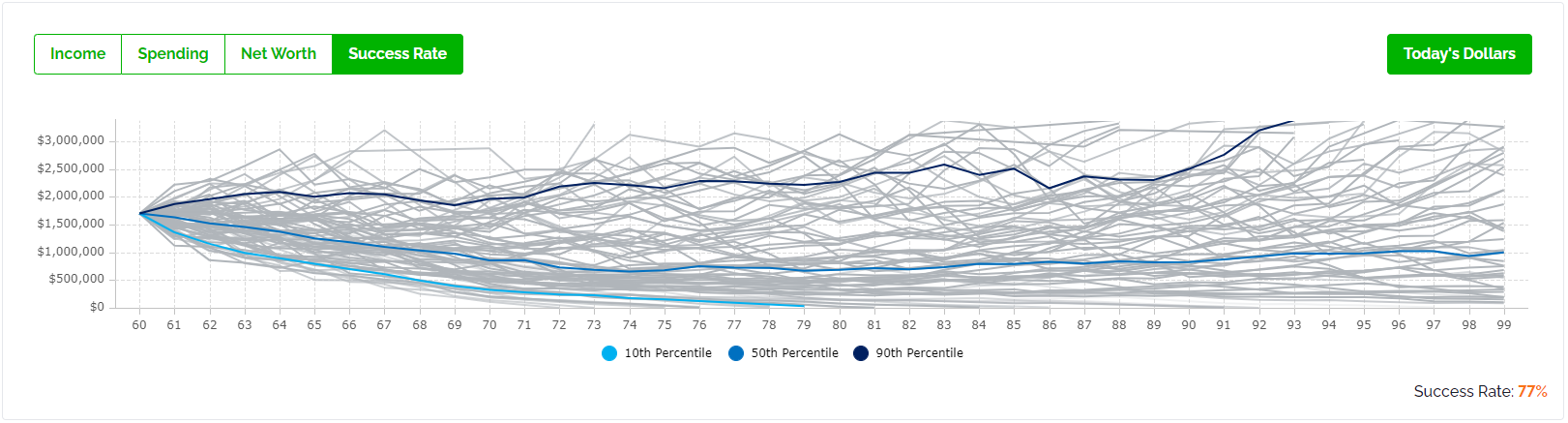

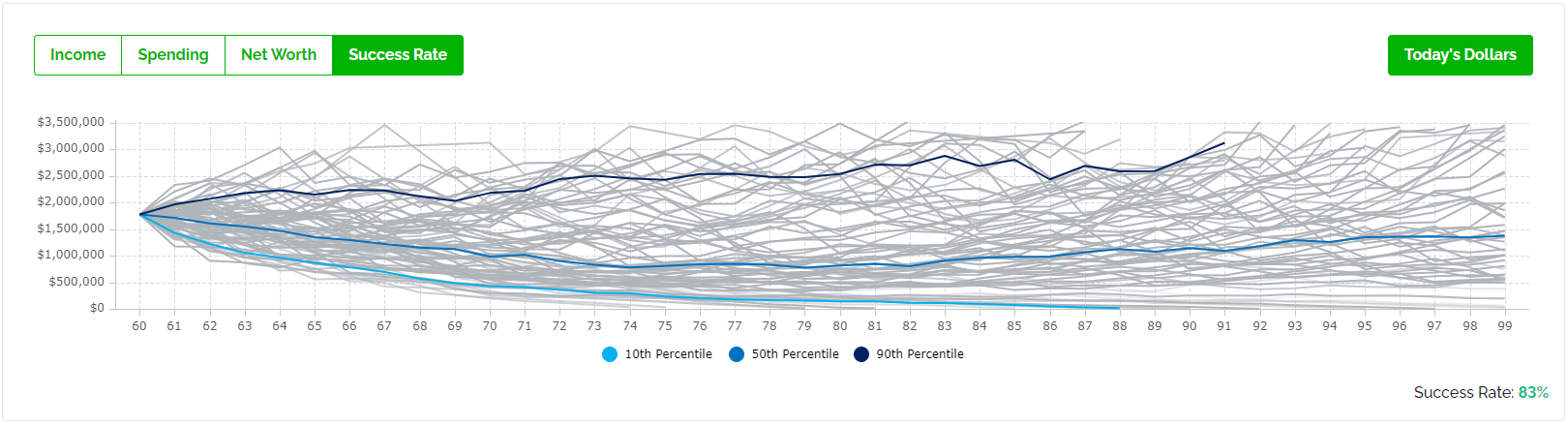

Based on the example above, the best province for your personal finances is British Columbia and the worst is Nova Scotia.

BUT! The problem with general financial advice, and the problem with the example above, is that every situation is different!

A different level of income or spending can have a dramatic impact on your plan. Having higher or lower CPP and OAS can have a big impact. Being eligible for different benefits can also have a big impact.

Employing different strategies around tax planning, benefit clawbacks, income splitting, tax credits can also have a big impact.

General financial advice should always be “taken with a grain of salt”.

What works for your friend may not work for you, what works for you may not work for your neighbour, what works for your neighbour may not work for your sibling in another province etc. etc.

If just changing your province can have such a dramatic impact, imagine what even more detailed tax planning or benefit planning could do?

It’s always important to have a custom financial plan built for YOU… otherwise you might be making things harder than necessary or creating a big risk of running out of money in the future.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Are the differences based solely on income tax differences? ie: AB taxes would be ~3200 more than in BC for this couple in 2023

The numbers are somewhat overwhelming. It may be useful to have a summary sheet comparing all provinces at a glance for total taxes paid, total TFSA, RRSP etc in 2077 or earlier. Most glaring omission, of course is not accounting for the difference in real estate prices.

In this example it’s mostly driven by tax, but there are some benefit calculations in there too. In a different situation government benefits could have a larger impact.

You’re right that real estate differences are not factored in, just another example of how every situation is unique. You could also look at provincial childcare programs, other spending/expenses, differences in salary/income etc. etc. This was more of an illustrative exercise, a different situation may lead to different results.