Three Ways Investors Negatively Impact Their Investment Returns (With Examples)

Behavioral investment pitfalls can have a significant impact on investment returns for the average investor. The impact can be anywhere from 0.5% to 1.0%+ per year. But that’s the average impact on the average investor. The reality is that this impact will manifest differently for each investor and it could be years or even decades before an individual investor gets trapped by one of these behavioral pitfalls.

An average impact of 0.5% to 1.0% makes it sound like this happens every year. While this is true on average, it actually reflects many different experiences for many individual investors.

The truth is that some investors will experience no behavioral impact on their investment return for years and years before suddenly experiencing a negative effect. The AVERAGE impact of 0.5% to 1.0% means that in a given year some people experience no impact and others experience a small or large impact.

The problem is that this can lead investors into a false sense of security. It can make it seem like everything is going well until suddenly it’s not.

In this post we’ll provide three examples of how behavioral investment pitfalls can actually manifest in an investor’s portfolio and how they impact long-term investment returns.

One Large Investment Loss

Experiencing one large investment loss is the fastest way to see a long-term impact on average investment returns.

This large loss typically happens due to a lack of diversification, “putting all your eggs in one basket”, and then experiencing a loss on that single investment.

A large, permanent loss of 25%+ is very possible when there is a lack of diversification.

We would expect 25%+ losses on a broadly diversified portfolio too, but with a diversified portfolio this is unlikely to be permanent, eventually one part of a diversified portfolio will offset weakness in another part of the portfolio. This high level of diversification helps avoid permanent losses and it reduces risk.

With a highly concentrated portfolio, if one bad investment goes bankrupt, gets bought out at unfavorable terms, or experiences a shift in consumer demand that causes a decrease in enterprise value, this can cause a large and permanent loss for the portfolio. This results in a long-term impact on investment returns.

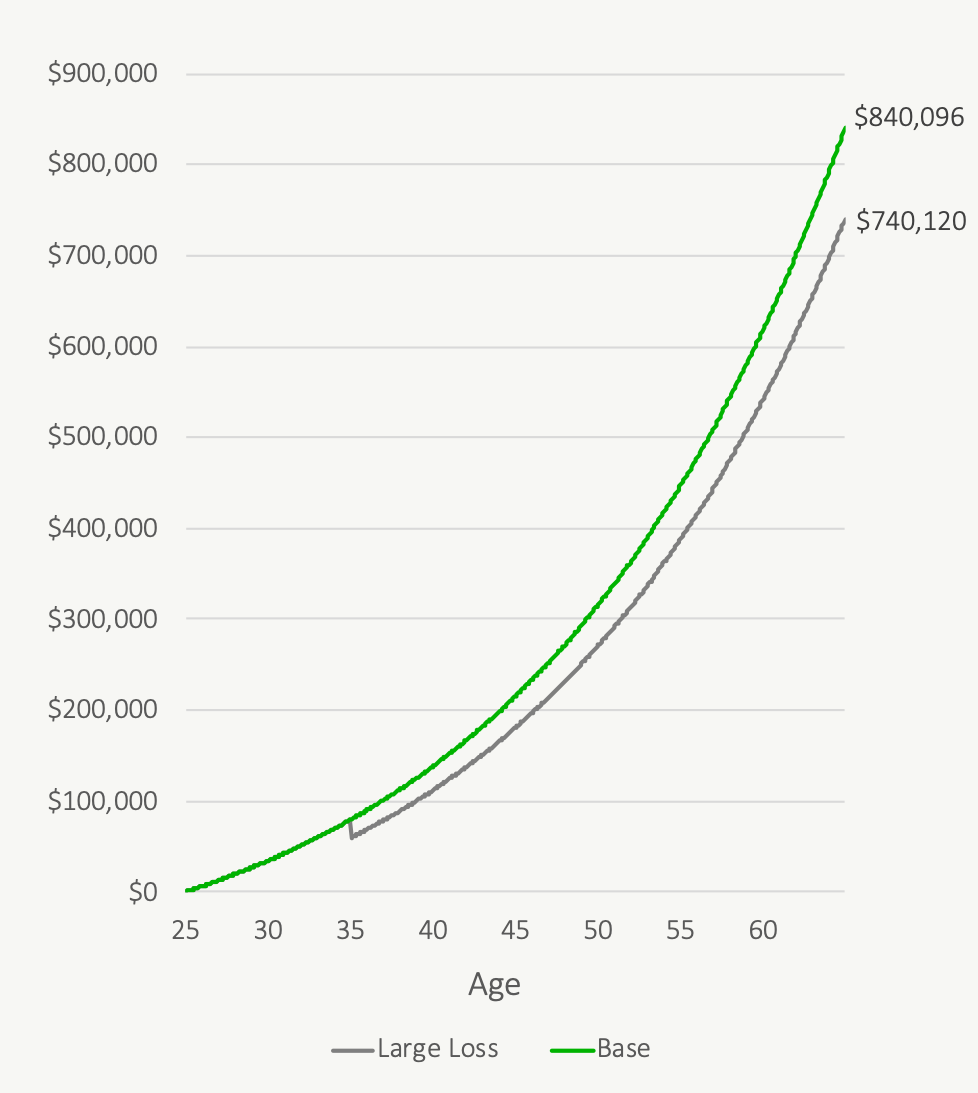

In the example below we have two investors, one who invests $500 per month for 40-years in a highly diversified investment portfolio earning 5.5% per year compounded monthly. The second is an investor who invests the same $500 per month for 40-years, and gets the same 5.5% return, but at age 35 experiences a one-time permanent loss of 25%.

In the grand scheme of things this loss is quite modest in dollar terms, about $19,795. The portfolio drops from $79,181 to $59,386. In fact, the investor is back to their original $79,000 balance in just 2-years thanks to new contributions and investment growth.

But that 25% permanent loss has a large impact on their long-term returns. The loss, although modest and quickly recovered in 2-years, leads to a much larger gap over time due to compounding. The ending balance at age 65 is nearly $100,000 less for the second investor!

This loss, when averaged over the whole investment period, is equivalent to a 0.51% decrease in investment returns! Just one mistake and lifetime investment returns are now 0.5% lower!

Building Up Cash And Investing Lump Sums

Cash is the enemy of long-term investment returns. It is important to keep some cash-on-hand in the form of an emergency fund or for future spending on infrequent expenses, but otherwise cash is bad.

Cash in general doesn’t provide an investment return that can keep pace with inflation (although some high interest savings accounts come close). As a result, cash slowly loses value over time.

Compare that with a broadly diversified investment portfolio which is expected to increase above inflation over the long-term.

The best way to avoid accumulating cash is to invest regularly. This is often called “dollar cost averaging” because investments are purchased regularly, typically every month, and the cost of those investments is averaged over time. Some months investments are bought at higher prices, some months at lower prices.

This steady investment strategy is simple and easy to maintain, but sometimes investors accumulate cash on top of regularly monthly investments. Maybe this is by accident or maybe this is on purpose because of a behavioral pitfall. Whatever the reason, this cash can quickly decrease long-term returns.

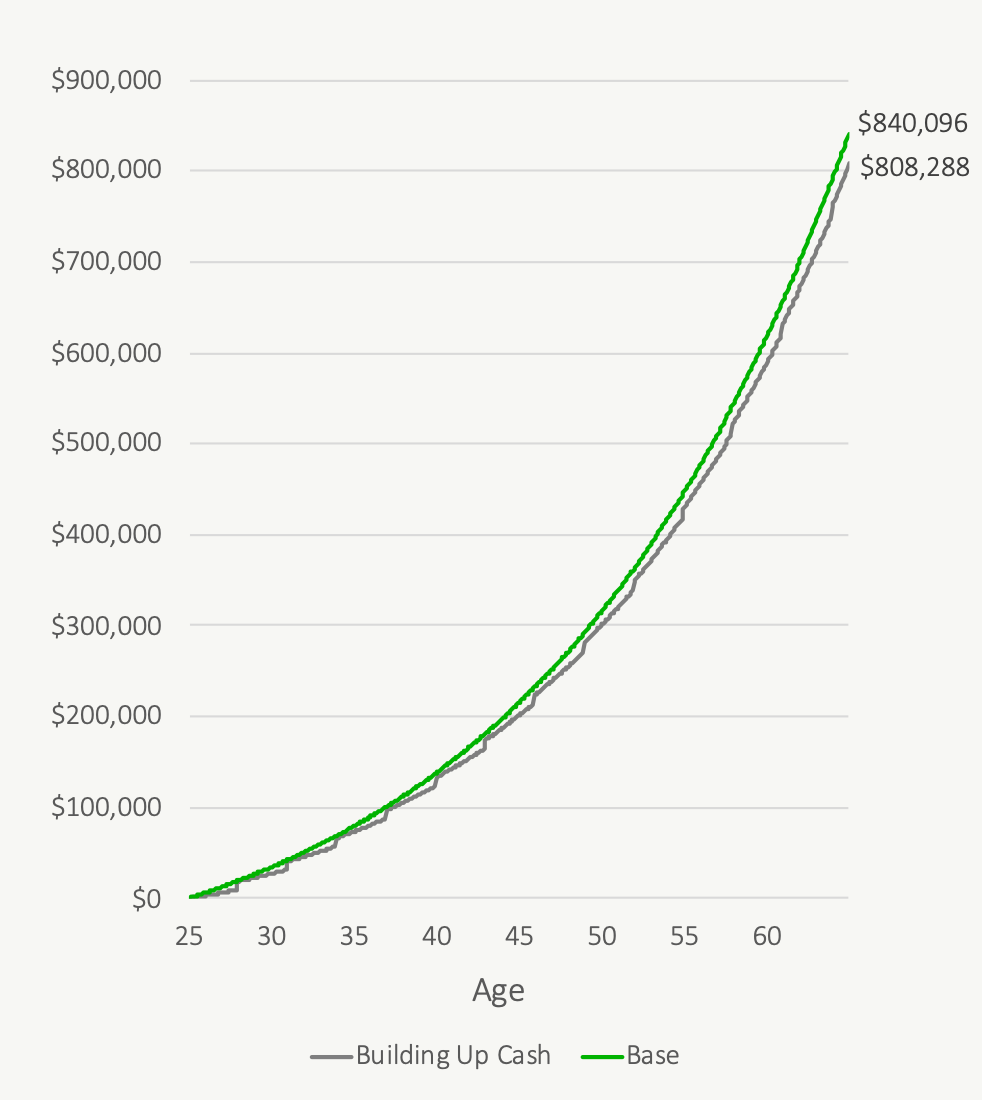

Let’s assume an investor contributes $500 per month to a TFSA and another investor invests $250 per month but accumulates $250 per month in cash until it’s invested every 3-years in a $9,000 lump-sum. On average, both investors add $6,000 to their portfolio each year, but the second investor accumulates a bit of cash and invests as a lump-sum every few years.

This accumulation of cash is quite easy to do. Without a good plan in place it can be hard to figure out the right amount to invest each month to achieve financial goals. The second investor, who is only adding $250/month, may never realize the impact they’re having on their long-term returns. They may even be happy with accumulating $250/month in cash without understanding the cost.

Over time the delay in getting cash invested has an impact on long-term returns. The accumulation of cash, although quite modest in this example, brings down the average investment return. Over time this leads to a gap of almost $32,000 which is the equivalent to a 0.15% reduction in long-term investment returns.

Trying To Time The Market And Missing Out On Gains

Timing the market is a common behavioral investment pitfall. It can FEEL very easy to identify peaks and valleys when looking at historical investment returns, but in reality, it’s impossible for the average investor to accurately predict future investment returns (and even professionals are susceptible to trying to time the market).

This risk is so common that it’s repeated almost daily in investing and personal finance forums. There are almost daily questions from “market timers” about moving into cash during a period of uncertainty.

Market timers may move into cash for a few months with the goal of selling at a market peak and buying back in at a market valley. The risk of course is that the market continues to gain over that period, which over the long run it is almost certain to do.

The other risk is that getting back into the market is incredibly difficult, especially if investments have gained over those few months. The “market timer” is always second guessing if now is the right time to re-enter the market, or if a drop is just around the corner. This second guessing can often lead to extended periods of time where investors are sitting on the sidelines with piles of cash just waiting for the “right time” to invest.

During this time spent waiting, investment values could have grown significantly, and these investors have likely missed out on dividends and interest income as well.

The impact of trying to time the market is the opportunity cost of lost investment returns. The longer the wait, the larger the opportunity cost.

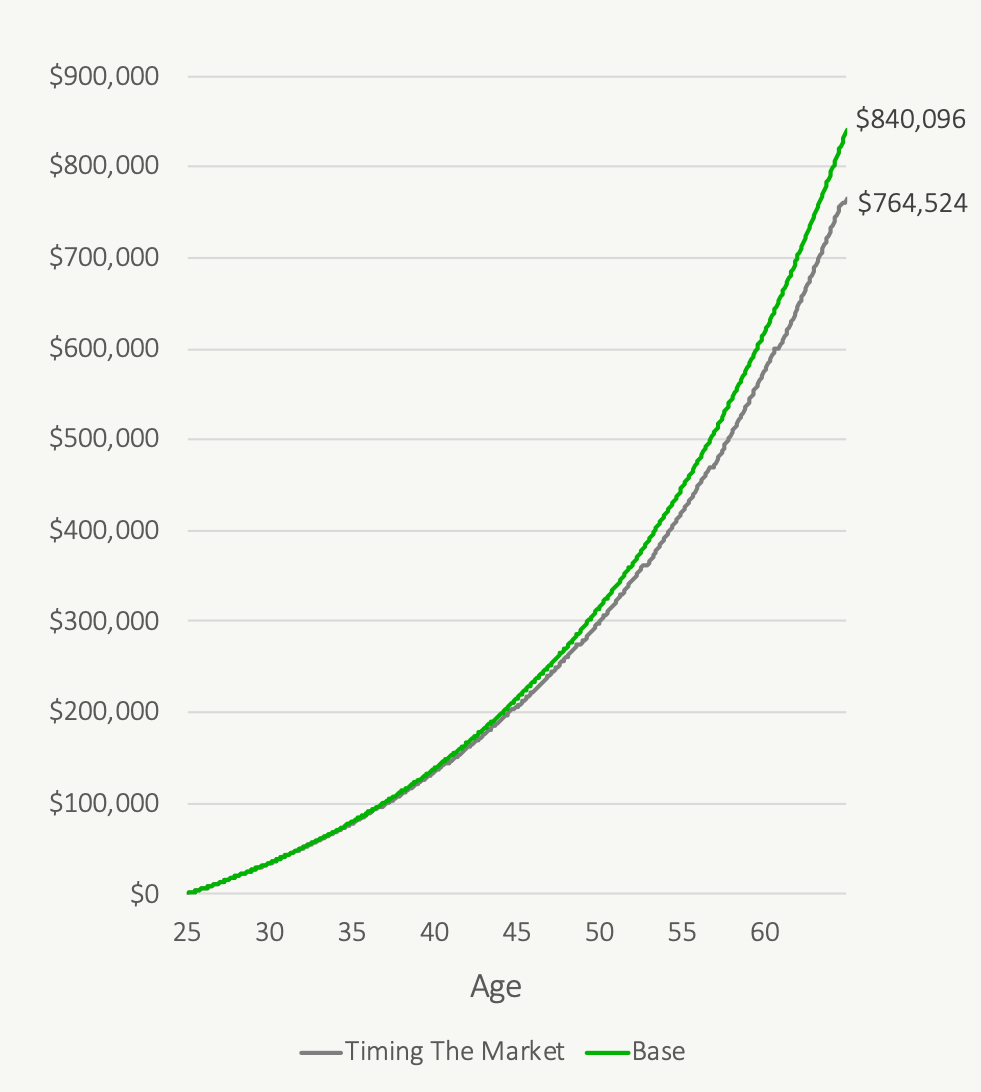

Let’s assume two investors again. One investing regularly every month, and a second who invests regularly every month but moves into cash on average every 4-years for a period of 3-months (perhaps during the lead up to a contentious election…).

The result of the market timing is large. Over time the opportunity cost of sitting in cash for a few months every few years is $75,571 for the second investor (either from lost investment gains or lost dividends/interest). That’s equivalent to a 0.38% reduction in long-term investment returns.

How To Avoid Behavioral Investment Mistakes

These three examples, if added together, are on average worth more than 1% in lost investment returns each year. That loss has a significant impact on wealth accumulation and peace of mind. To make up for these behavioral investment mistakes may require a higher savings rate, lower spending, or additional years of work to catch up.

So how can someone avoid these behavioral investment mistakes?

First, it’s important to understand why some of these mistakes happen. Sometimes it’s out of fear and uncertainty. There are a few personal finance best practices that can help reduce this fear and uncertainty. A good emergency fund, a solid budget, paying off debt etc. etc. These are all things that can improve financial well-being and make an investor less susceptible to emotional investment decisions.

Second, it’s important to have a long-term plan. A good financial plan will put everything into perspective. It will provide a road map of what to do (and what not to do) over time. How much to invest each month, what account to use TFSA vs RRSP, when to rebalance, the right asset allocation for your risk profile etc. etc.

Third, is regular checkpoints. Whether that’s with a financial planner or on your own. Reviewing your plan at least once per year is a great way to feel secure with your personal finances. There are certain things that are important to “benchmark” each year, income vs plan, spending vs plan, savings/investments vs plan, and investment return or account balance vs plan. We would expect these to vary somewhat from year to year, especially investment returns, but over time it’s important to track your progress versus your plan. Not only will it provide some great insights into your actual progress, but it will provide some significant peace of mind as well.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments