Three Ways To Transfer Retirement Risk To Someone Else

Retirement is full of risk. There is longevity risk, spending risk, health risk etc. But two of the largest risks in retirement are investment risk and inflation rate risk.

What if you could transfer some (or all) of that risk to someone else? That would make retirement that much more enjoyable, less to worry about and less to stress over. There would be more time to enjoy retirement itself rather than worry about retirement finances.

The problem with risk is that it’s hard to understand and hard to quantify. We’re pretty bad at assessing risk and probability. We might look back at the accumulation phase and think that we can manage the emotional impact of investment risk and inflation risk. After all, we’ve been managing those risks for 30-40+ years before retirement, why would that change in retirement?

The difference during the decumulation phase is that those risks are exacerbated by annual investment withdrawals. In retirement, these withdrawals, necessary to support retirement spending, multiply the effect of fluctuations in investment returns and inflation rates.

During the accumulation phase, investment contributions help reduce the impact of fluctuations (dollar cost averaging is a big benefit during accumulation). During the decumulation phase however, investment withdrawals multiply the impact of fluctuations.

As you’ll see below. The based on historical standards, the variation during the accumulation phase is nothing compared with the variation that’s possible during the decumulation phase.

So, transferring retirement risk to someone can become quite appealing when transitioning into retirement. It can help reduce that variation. Transferring even a small amount of retirement risk to someone can significantly improve peace of mind. Plus, it can help create a “floor” of retirement income that is virtually guaranteed.

What Is Retirement Risk?

There are two main types of risk we’re typically concerned with in retirement, investment risk and inflation rate risk.

Both types of risk can have a very negative impact on a retirement plan.

Low or negative investment returns, especially in early retirement, can have a very negative impact on how much income can be generated from an investment portfolio during retirement.

Similarly, high inflation rates can make it more difficult to keep up with inflation in retirement. It becomes harder to produce enough income to meet retirement spending goals as the price of goods and services rise rapidly year over year.

These risks exist during the accumulation phase as well but are more pronounced during the decumulation phase.

During the accumulation phase investors are adding to their investment portfolio on a regular basis, this helps mute the impact of low or negative investment returns. Likewise, during the accumulation phase income from employment will likely keep pace with inflation through annual cost of living adjustments or merit increases. Over time this will minimize the impact of high inflation.

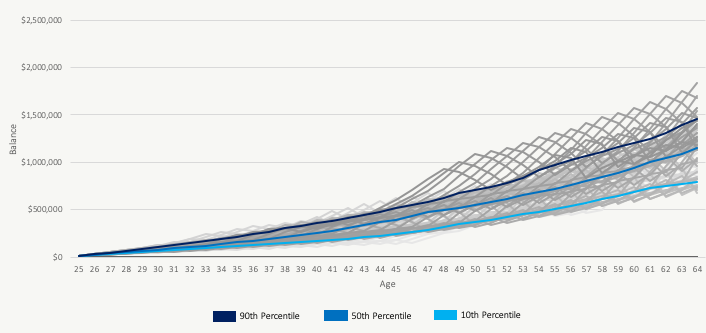

If we look at a typical household who is saving $12,000 per year, we can see that based on historical stock returns, bond returns, and inflation rates, that for the most part the investment portfolio experiences a steady march upwards. Each line in the chart below is one 40-year historical period but the same $12,000 contribution adjusted for inflation. There is some variation depending on actual investment returns from year to year but for the most part the results are somewhat consistent.

During the decumulation phase however, investors are now drawing from their investment portfolio on a regular basis, this exacerbates the impact of low or negative investment returns. Likewise, during the decumulation phase, income from the portfolio needs to keep pace with inflation. During periods of high inflation this increases the draw on the portfolio.

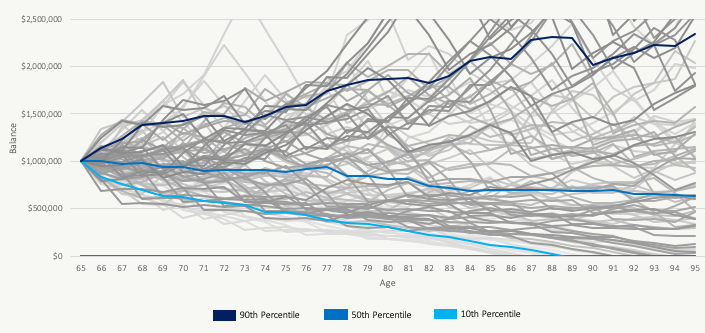

If we look at a typical household who is drawing $40,000 per year, we can see that based on historical stock returns, bond returns, and inflation rates, that the investment portfolio experiences dramatically different paths in retirement. There is a lot of variation. Each line in the chart below is one 30-year historical period with the same $40,000 annual withdrawal adjusted for inflation. There is a large amount of variation depending on actual investment returns and inflation rates from year to year. There are many different “paths” a retiree could take depending on the actual investment returns and inflation rates they experience year-to-year. This is known as sequence of returns risk.

So, what can the average person do about investment risk and inflation risk? There are three important ways to transfer these retirement risks to someone else.

Delay CPP

The easiest and best way to reduce investment risk and inflation rate risk is to delay CPP. Delaying CPP essentially transfers investment risk and inflation rate risk to the government (CPP specifically).

CPP is a benefit that every Canadian has access to. The exact amount of the benefit will depend on contributions to the Canada Pension Plan over the contribution period. It will also depend on when CPP actually begins.

The opportunity with CPP is that benefits can start at any time between age 60 and age 70. The longer CPP benefits are delayed, the higher the benefit is once it actually starts (Related: See how long it takes to reach breakeven if delaying CPP).

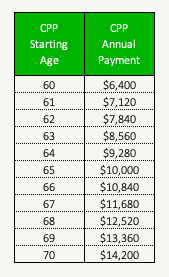

Between age 60 and age 65, each month of delay adds 0.6% to the benefit. After 65, each month of delay adds 0.7% to the benefit. Here is how CPP might look if delayed in one-year increments from age 60 to age 70 with a hypothetical $10,000/year at age 65.

Delaying CPP has a cost however. By delaying CPP other investments must be drawn down to replace that income. If we look at delaying from age 60 to 61 as an example, the “cost” is $6,400 in lost CPP benefits for 1-year. The benefit is that lifetime CPP payments are now 11% higher, not a bad return on investment. In this example the cost of delaying CPP is $6,400 and the benefit is that annual income from CPP is now $720 higher.

The other benefit of delaying CPP is that investment risk is now reduced. Investment assets are lower, and in exchange, lifetime CPP payments are higher. Similarly, inflation rate risk is also reduced. CPP will keep pace with inflation through annual increases with CPI. Larger CPP payments means more inflation protection in the future. This helps reduce the risk of high inflation. (Related: Read more about the “soft” benefits of delaying CPP)

Buy An Annuity

Another way to transfer retirement risk to someone else is by purchasing an annuity. There are many different types of annuities but in general an annuity is an insurance product sold by an insurance company. When purchasing an annuity, the insurance company guarantees a certain annual income for life. This transfers investment risk to the insurance company.

Insurance companies sell thousands of annuity policies each year and “pool” the risk. This allows them to provide a reasonably high income per $1,000 of annuity purchased.

When buying an annuity, the money is transferred to the insurance company, it’s now theirs, and in exchange they provide a lifetime of payments. (Related: Read about how to reduce the “risk” of a long and health retirement)

The exact amount that gets paid will depend on a number of factors, one of the largest is the annuitants age when the annuity was purchased. It depends how old you are because younger people will require more annual payments for a longer period of time.

Purchasing a $100,000 annuity at age 60 might provide $5,109 per year. If purchased at age 65 the same purchase might provide $5,962 per year. And if purchased at age 70 might provide $6,853 per year (“might” is a key word, annuities are also very sensitive to interest rates at the time of purchase, so actual income from an annuity will depend on the interest rates at the time). This annual income represents a “return on investment” of 5.1%, 6.0% and 6.9% respectively. Less than delaying CPP, but still attractive in certain situations.

Although annuities help transfer investment risk to the insurance company, they’re not very helpful when managing inflation rate risk. Although there are annuity options that have “cost of living” adjustments, those are typically set in advance at 1%, 2%, 3% etc per year and will not fluctuate with actual inflation, so they’re little help when trying to manage the risk of moderate to high inflation.

Defined Benefit Pension

The last and perhaps best way to transfer retirement risk to someone else is through enrollment in a solid defined benefit pension plan, especially when the plan provides inflation adjustment.

Unfortunately, this option requires working for an employer that offers a defined benefit pension. It also requires many, many years of service before a large pension is accumulated. This has also become more challenging in recent years as companies transition away from defined benefit pensions to defined contribution pensions or Group-RRSPs (which transfers investment risk to the employee).

But for those with a defined benefit pension, they have arguably done the best job at transferring retirement risk to someone else, and should think very carefully before giving up that benefit.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments