Three Ways To Spot A “Bad” Financial Plan

As an advice-only financial planner we often see financial plans created by the big financial institutions. We provide a second opinion to new clients who have created one of these financial plans. These clients have received a financial plan from their investment advisor, or sometimes a separate financial planner within the bank, but they’re skeptical of the results and the recommendations.

Often, they want more detail, more discussion, more process, more scenarios, more peace of mind etc.

They want an unbiased second opinion.

Now let me preface this blog post by saying there are many excellent financial planners at the big banks.

In fact, many have moved into advice-only financial planning where they can spend more time doing financial planning instead of selling products.

The problem is that, for the most part, the financial services industry doesn’t prioritize financial planning.

Planning is not their product, investments, insurance, and mortgages are their product, and unfortunately, financial planning is sometimes just barely good enough to secure a new client or keep an existing one.

There is often a lack of tools, time, or process to create a really detailed financial plan.

So, when reviewing a generic “bank plan” and helping clients build a new one there are a few things to look out for. These things are signs that perhaps the financial plan needs a bit more work.

There are three ways to spot a “bad” financial plan.

Number 1: Rounded Spending Assumptions

When was the last time your annual spending was a perfect round number? Probably never.

Someone probably doesn’t spend $40,000 per year, they probably spend $38,732 or $37,992, or $40,509 per year.

In a financial plan, rounded spending assumptions like $40,000 per year or $6,000 per month are a red flag. It shows there was no real effort made to understand the clients actual spending.

Example of a Round Spending Assumption

Round numbers often mean that there is no detail and no insight into household spending.

What if instead of spending $40,000 per year, the actual category by category spending added up to $42,003 per year or $38,132 per year? Those are two very different spending numbers.

Spending is the most important factor in a financial plan. It’s the largest lever we have. And that means spending assumptions need to be as accurate as possible.

For example, spending an extra $4,000 per year in retirement could require an extra $5,000 per year in pre-tax withdrawals from a registered account at a 20% tax rate, which then requires an extra $125,000 in registered investments to support that spending.

So yeah, spending is important!

A rounded spending assumption is one way to spot a “bad” financial plan. It’s a problem in itself, and it’s a sign that perhaps other parts of the plan also received some high-level hand waiving assumptions.

Number 2: Using An Assumption For CPP Benefits

For the average retirement plan, CPP is a very important part of future retirement income.

So, when a financial plan includes a basic assumption for future CPP benefits, like assuming average CPP, that’s another red flag.

At the moment, average CPP is around $9,000 per year, while max CPP is around $15,000 per year. That’s a big difference. Very big.

For a couple, the difference between average CPP and max CPP is the cost of a nice vacation each year.

When creating a financial plan your CPP estimate is not something to be taken lightly. So, if your financial plan includes a basic assumption for CPP, without considering your past CPP Statement of Contributions, or your future income assumptions, that’s a sign of a “bad” financial plan.

For every $1,000 per year that your future CPP benefit has been underestimated you could be told you need to save an extra $25,000 in investments by the time you retire. You can see the conflict of interest in that assumption, right?

By underestimating CPP you could receive a recommendation that leads to you saving too much and results in missed opportunities for spending today.

Example of Basic CPP Assumption

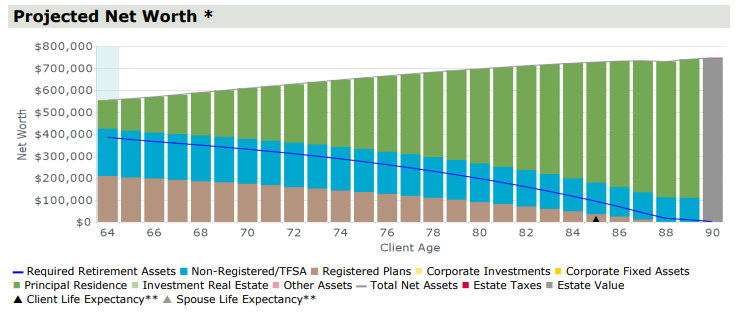

Number 3: Not Stress Testing Retirement Drawdown

Investment returns and inflation rates will fluctuate from year-to-year. During the accumulation phase this is less of a concern because ongoing contributions, reinvested dividends, and changes in employment income help mute those fluctuations.

But in retirement it’s an entirely different situation. Retirement withdrawals will amplify the impact of poor investment returns and high inflation rates. This is often referred to as “sequence of returns risk”.

To understand the impact of these fluctuations in retirement it’s possible to run a retirement plan through dozens or even hundreds of scenarios. If too many scenarios run out of money in mid or late retirement, then that’s a problem.

A “bad” financial plan won’t include this stress testing. Instead, there is typically just a straight retirement drawdown with no stress testing for different rates of investment returns or inflation rates. The assumption includes an average rate of return that doesn’t fluctuate from year-to-year (because that’s super realistic /s)

Example of Straight Line Retirement Projection

Even A “Bad” Financial Plan Is A Good Start

If you think you might have a “bad” financial plan, there’s no need to panic, even a “bad” financial plan is a good start. Many people don’t have a financial plan at all. They just “wing it”. So, by having even a “bad” financial plan you’re already further ahead.

But you shouldn’t be satisfied with a “bad” financial plan. If your plan has any of the red flags mentioned above, then perhaps it requires a revisit with your bank planner. Ask them to redo the plan with more specific assumptions and drawdown scenarios.

If they’re unable or unwilling to help, then it might be time to reach out to an advice-only financial planner for a second opinion. An unbiased review of your financial plan combined with a more detailed plan will set you on the right course and provide the peace of mind you deserve.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments