High Investment Fees Could Cost You $1,000,000+

Imagine paying $1,000,000 in investment fees? It seems crazy, doesn’t it? There aren’t many things I could imagine spending that much money on, and investment fees would certainly be at the bottom of the list. And yet, there are millions of Canadians who could end up paying this much, or possibly more, in investment fees over the course of their life.

If given an extra $1,000,000, what would you spend that money on? Probably not investment fees. I would probably spend that money on a vacation, a cottage, a reno, or a hundred other things before choosing to spend extra money on investment fees.

But for a mutual fund investor in Canada, over time, high investment fees could easily add up to $1,000,000+.

If you don’t believe me, or just want to see the details, lets take a look at the numbers together…

Watch The Video!

High Investment Are A Drag

Unfortunately, high investment fees create a drag on investment returns. They act as an anchor, slowing down investment growth. Let’s look at a simple example where the underlying investments retuned 7.5%. In a high fee investment portfolio, after fees of 2.5%, the investor only sees a return of 5.0%.

The investment fees of 2.5% are deducted automatically, the investor never sees this, they only see that their investments went up 5.0%.

This is still good, but much less than the underlying investments. In this example the investor gives a third of the investment growth to the investment manager (that’s probably higher than most people’s average income tax rate, and you thought taxes were bad!)

Annual Fees Add Up Over Time

Over time these high annual investment fees really add up. Given enough time these fees could easily add up to $1,000,000 or more. Imagine paying $1,000,000 for anything?

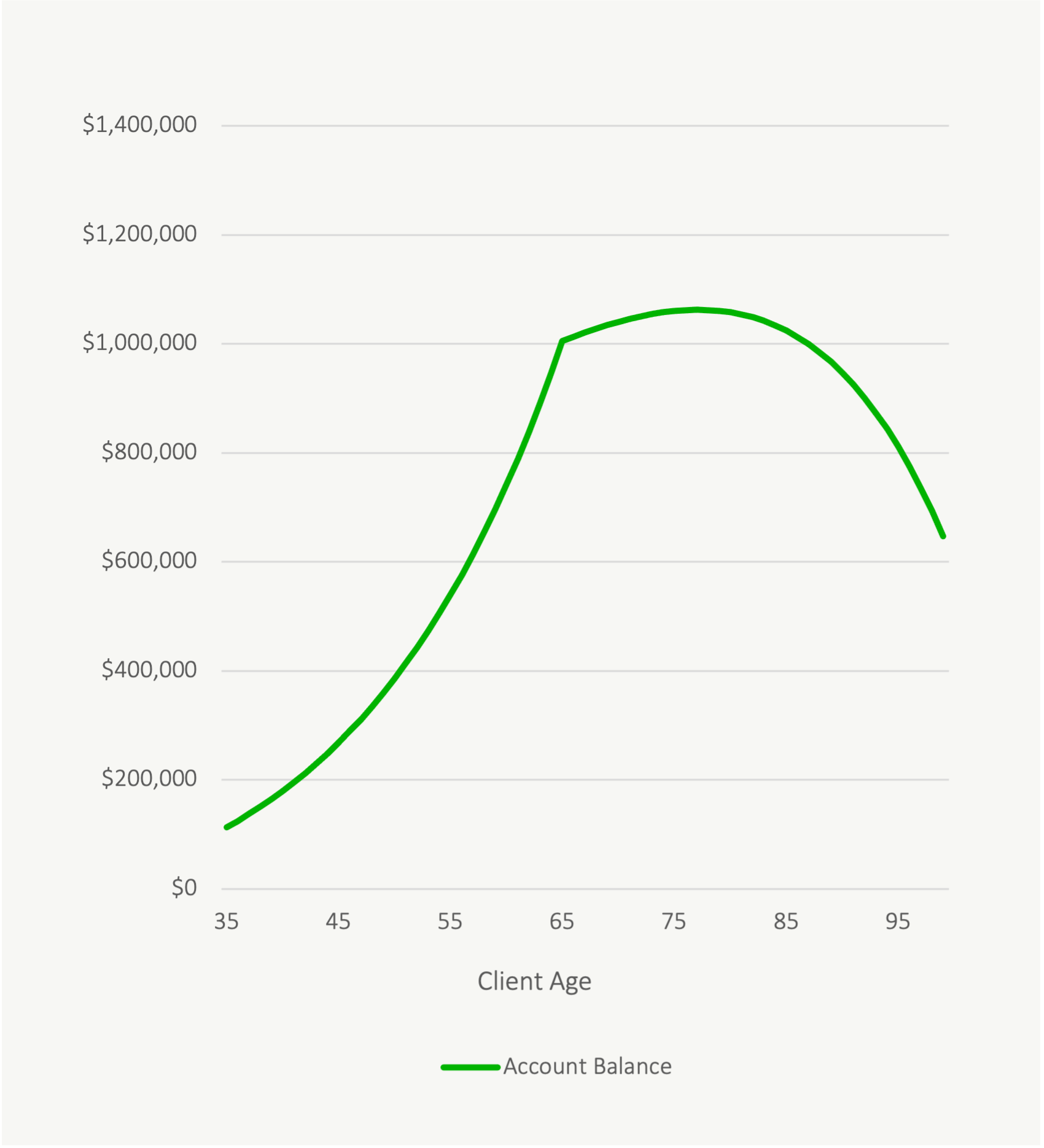

To illustrate this, let’s use a client example. This client is 35-years old and has $113,206 in their TFSA. They’ve done well. They’ve been diligently maximizing their TFSA each year since the beginning and expect to continue maximizing it until age 65 when they plan to retire.

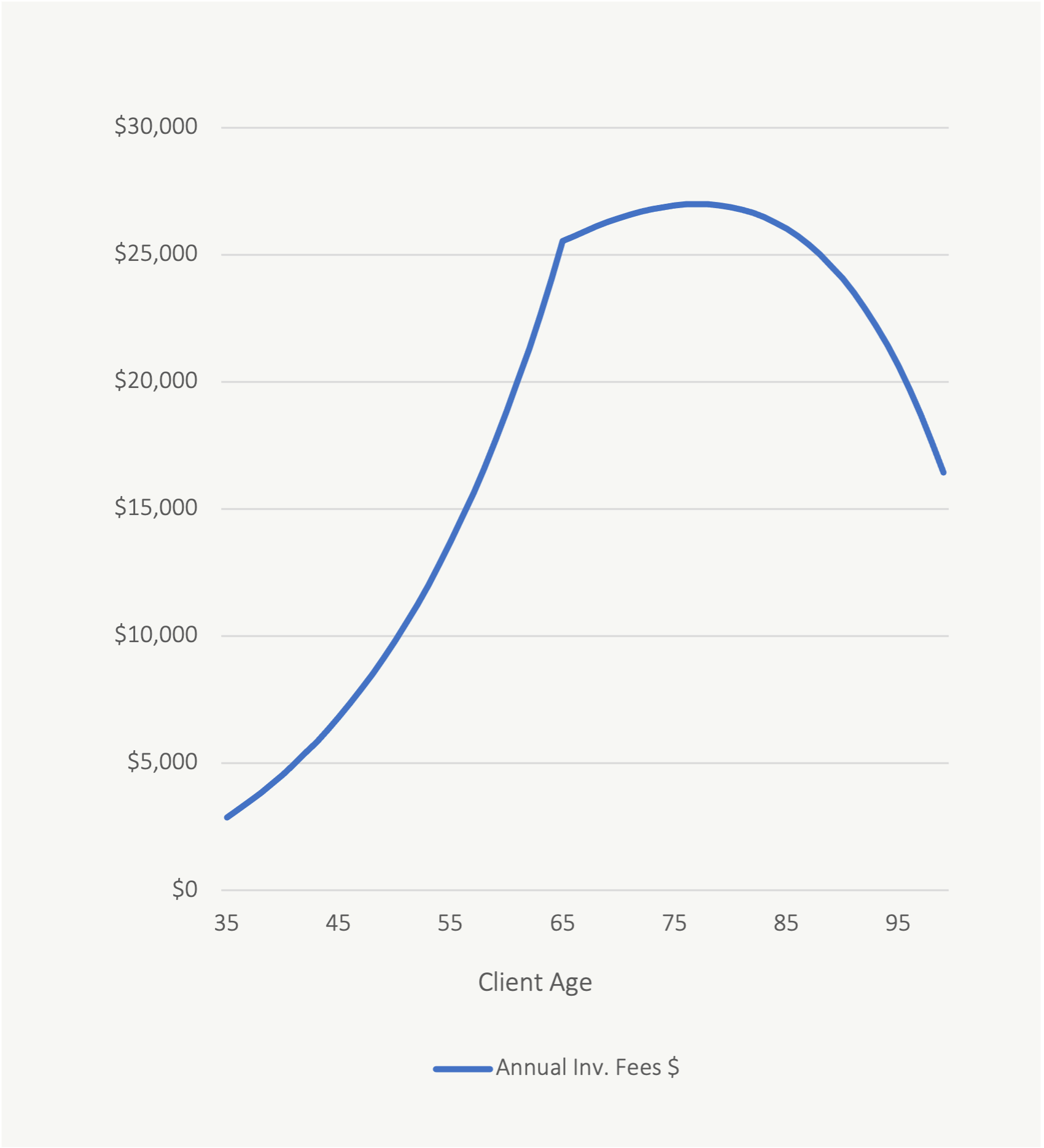

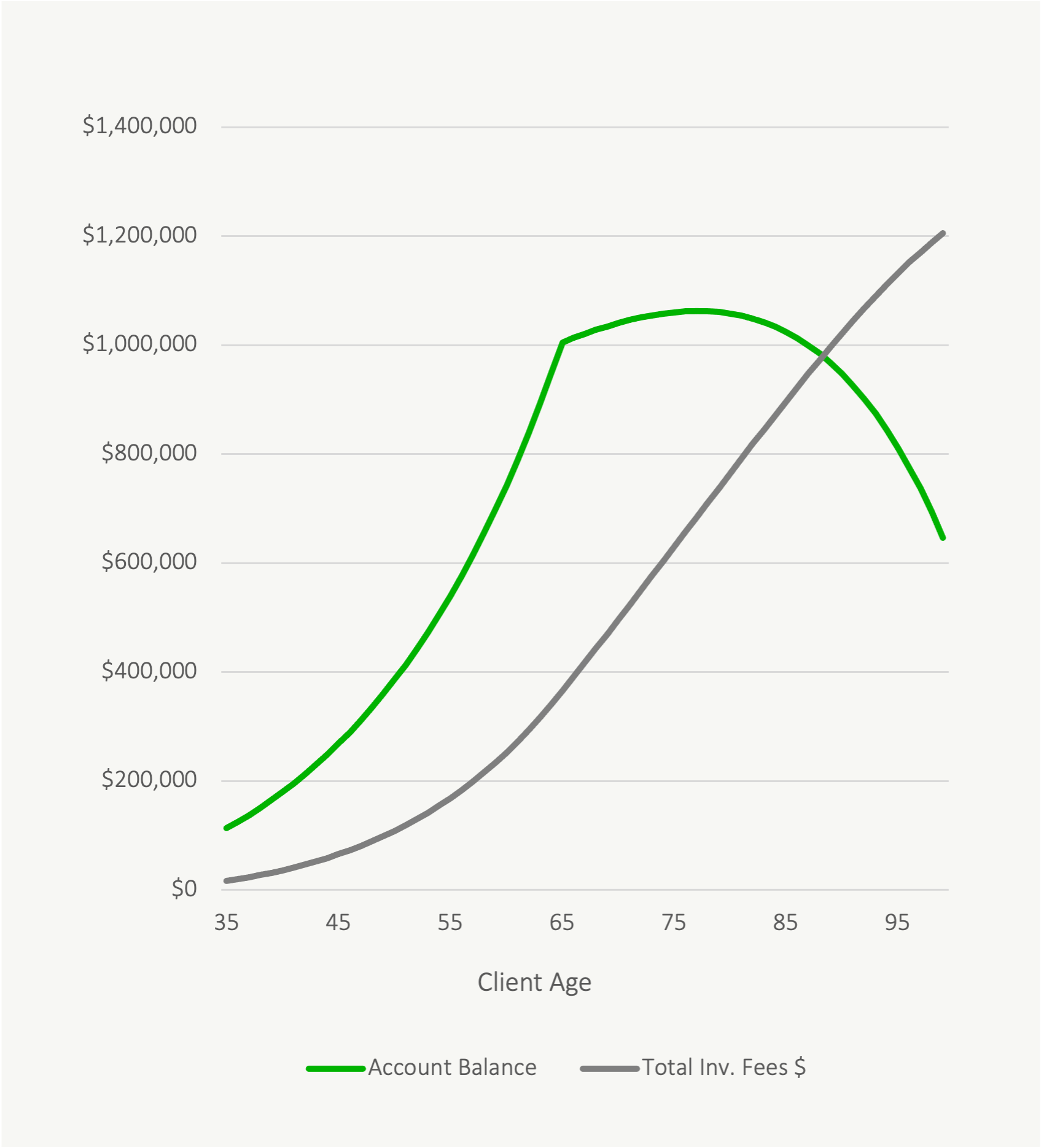

Their investment portfolio consists of a handful of high MER (management expense ratio) investments. The average MER on the entire portfolio is 2.54%. They’ve already paid $14,210 in fees to date and this year investment fees will be another $2,875.

As the portfolio grows with new contributions and investment growth this only gets worse and worse.

Here are a couple of interesting stats about this portfolio over time…

The account balance will peak at just over $1M.

This year they’ll pay $2,875 in investment fees but as the account continues to grow annual investment fees will also grow with the account balance. At the peak, investment fees will be $26,992 per year.

Adding up investment fees each year shows that the total investment fees from now until late retirement will be $1,204,923, AND, over 2/3rds of their investment fees will be paid after they retire. (Another great reason to make sure you have low investment fees before you enter retirement!)

What Are YOUR Investment Fees?

Ok, so you might be wondering, what are YOUR investment fees? One annoying thing about investment fees is that they’re hard to find. A cynic might say that is on purpose (and I might have to agree with that cynic).

Often, investment fees not shown on the investment statement, or they’re split up into separate fees like advisor fees (which are often shown) vs MERs (which are often not shown). And although there are proposed changes in legislation that would make fee disclosure more transparent, it’s slow progress.

To find your investment fees will require a bit of research, thankfully with a couple of online tools it can be relatively easy.

Step 1: Find your fund name and/or fund code on your statement

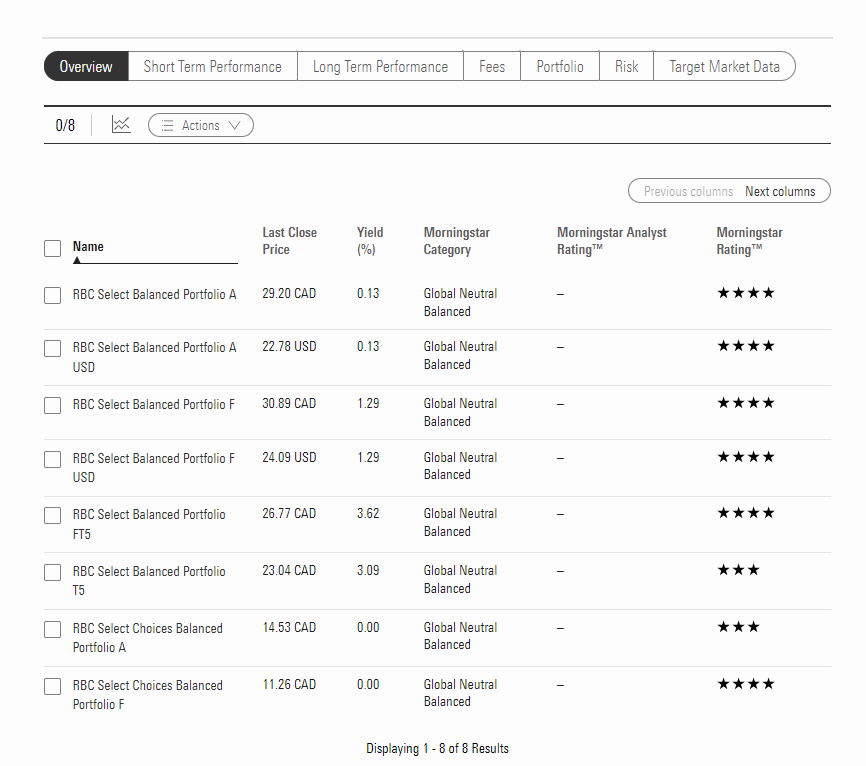

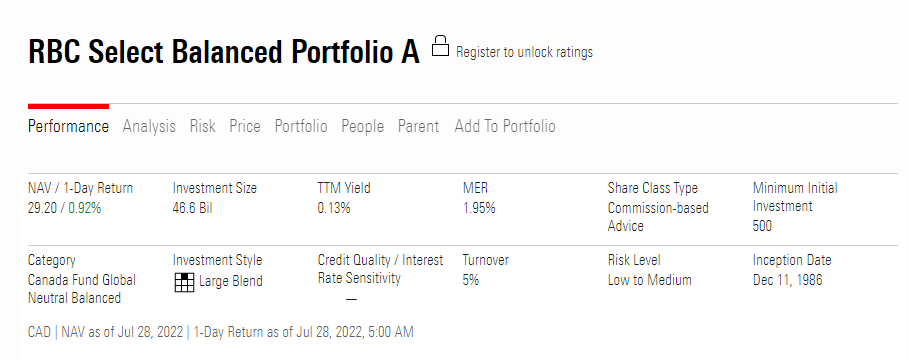

Step 2: Go to Morningstar.ca and enter the fund name and/or code.

Step 3: If there are multiple funds with the same or similar name, look at the price of the fund and find one that has a similar price (see image below)

Step 4: Grab the MER % (see image below)

Step 5: Multiply the MER % by your balance in that fund, this is your annual investment fee in $’s

If you think you might be paying too much in fees, but aren’t sure where to begin, speak with an advice-only financial planner today. An advice-only financial planner has no vested interest in the products you use. They work for you and only you. They’ll be able to provide an unbiased second opinion and possibly save you $10,000, $100,000 or $1,000,000+ in investment fees.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Great insights, despite the spelling and grammatical errors.

Ahh, thank you Warren! This is why I shouldn’t quickly write a post on a long-weekend! Made a couple of fixes, let me know if you notice any other issues.