Does The 4% Rule Make A Good Retirement Plan?

Does the 4% rule make a good retirement plan? Before we answer that question let’s first explore what the 4% rule is and some of its pros and cons.

The 4% rule is a great personal finance rule of thumb.

Like many rules of thumb, it provides good direction for financial goals, it’s simple, it’s easy to understand, and it’s relatively accurate.

Unlike other personal finance rules of thumb, the 4% rule is also backed up by quite a bit of academic research, so if there was any personal finance rule of thumb to use, it would certainly be the 4% rule.

Let’s review what the 4% rule is in more detail, the pros and cons, and why you may or may not want to use the 4% rule for your retirement plan.

Watch The Video!

The 4% Rule

The 4% rule suggests that a retiree can draw 4% from their portfolio each year, adjusted for inflation, and have a reasonably high chance of success. In the original research “success” was when a retiree reached the end of a 30-year retirement period with money left over, even if it’s just $1.

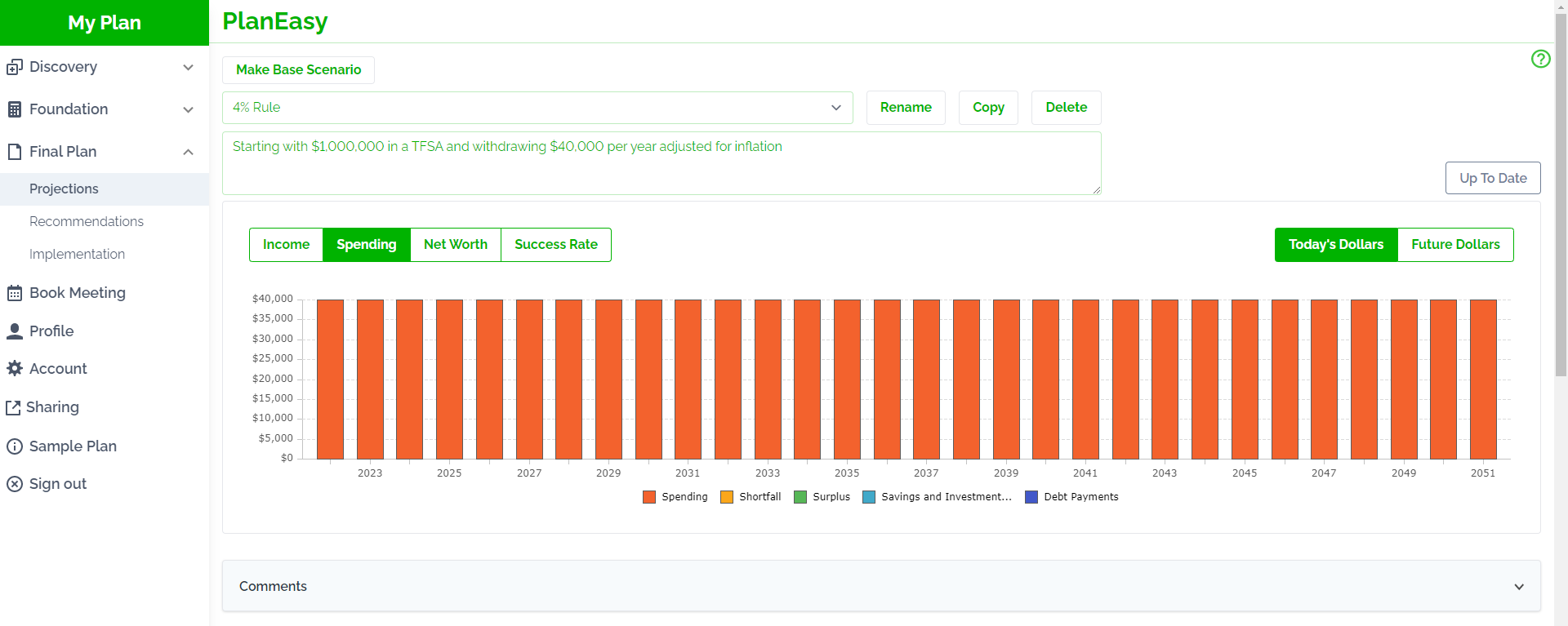

For example, if you retire with $1,000,000 in a TFSA (letting us ignore income tax) then you could spend $40,000 per year, adjusted for inflation, for 30-years and have a good chance of having money left over.

In the first three years of retirement, if inflation was 2%, then 4%, then 4.5%, then withdrawals would increase to $40,800 in year 2, $42,432 in year 3, $44,341 in year 4. This keeps the purchasing power at the original $40,000.

Benefits Of Using The 4% Rule

- It’s simple.

- It’s easy to understand.

- It provides a good rough goal.

- It’s backed up by lots of academic research.

To create a goal using the 4% rule, just take your retirement spending goal, divide by 4% (or multiply by 25), and that’s your goal for your investment portfolio at retirement in today’s dollars.

For example, if you want to spend $60,000 per year in retirement that would require $60,000 x 25 = $1,500,000 in today’s dollars.

Problems With Using The 4% Rule

Problem #1: The original research only looked at 30-year periods.

Looking at 30-year periods made sense in the past, but with longevity increasing, many people who retire in their 50’s and early 60’s can easily have retirement periods of 40+ years.

Problem #2: The 4% rule does not include investment fees.

Adding investment fees will drag down the 4% rule. The higher the investment fees the lower the safe withdrawal rate. The 4% rule becomes the 3% rule or the 2% rule if we add investment fees of 1% or 2% respectively. This is just one reason why decreasing investment fees prior to retirement is important.

Problem #3: The original research only looked at US returns, not global returns.

The US had a good run for the last 100-years, and while there is no reason to believe this won’t continue, we also cannot use past returns to predict future results

Problem #4: The 4% rule is actually very pessimistic.

The goal of the 4% rule was to avoid running out of money in the future. It was built using historical rates of return. It’s built using the very the worst historical periods of investment returns and inflation rates. The 4% rule is a “glass half empty” type of personal finance rule. Chances are those who use the 4% rule will have money left over after 30-years, sometimes a lot of money. This means that there is an opportunity cost to using the 4% rule because in many historical periods there is likely money left over.

Problem #5: Doesn’t adapt for changes in retirement income like CPP, OAS, GIS etc.

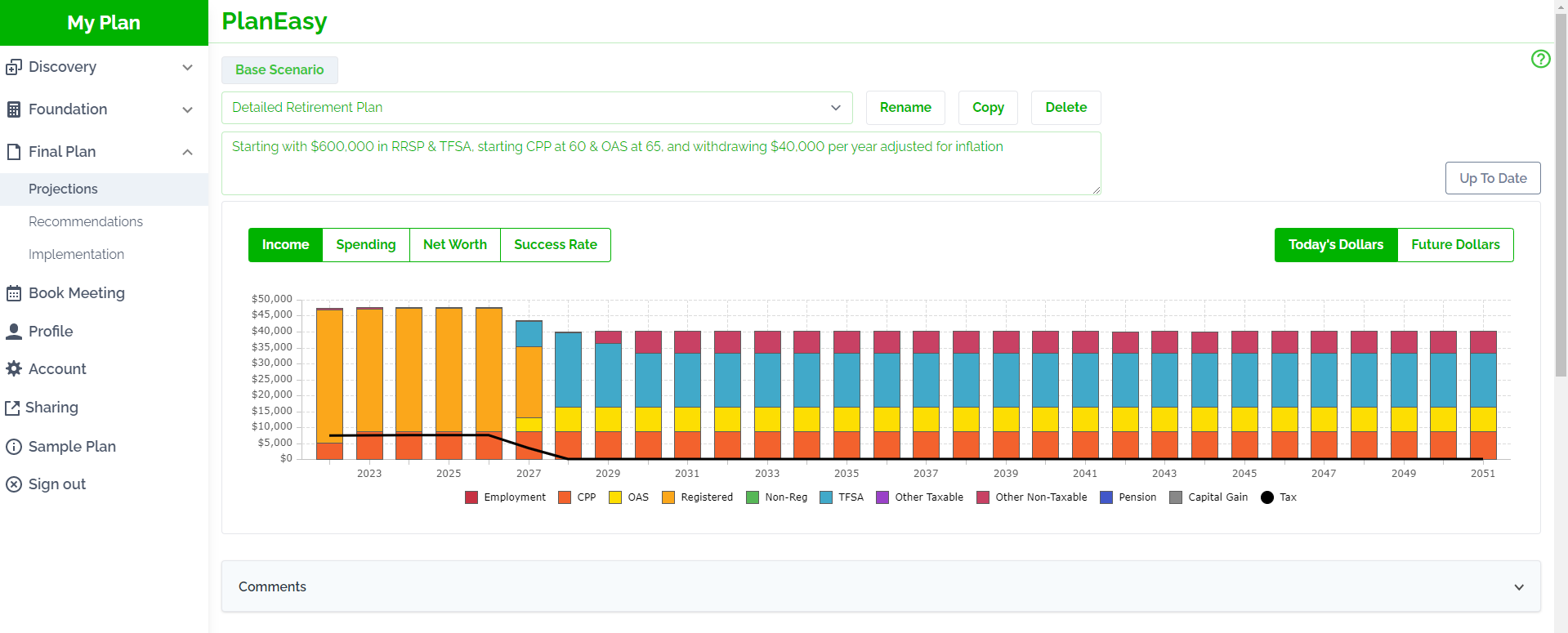

The 4% rule doesn’t account for retirement income that phases in like Canada Pension Plan, Old Age Security, Guaranteed Income Supplement, defined benefit pensions, bridge benefits. For someone retiring in their 50’s, they may spend 5%+ of their portfolio each year in early retirement and then when CPP and OAS begin this might drop to 3% or less. The 4% rule doesn’t easily adapt to these changes in retirement income.

Problem #6: Doesn’t adapt for changes in retirement spending.

The 4% rule also doesn’t adapt for changes in retirement spending. Early retirement spending might be higher when spending on travel and hobbies are at their peak. Mid/late retirement spending may be lower when these discretionary expenses begin to decline. The 4% rule doesn’t adapt well to these changes in planned retirement spending.

Does The 4% Rule Make A Good Retirement Plan?

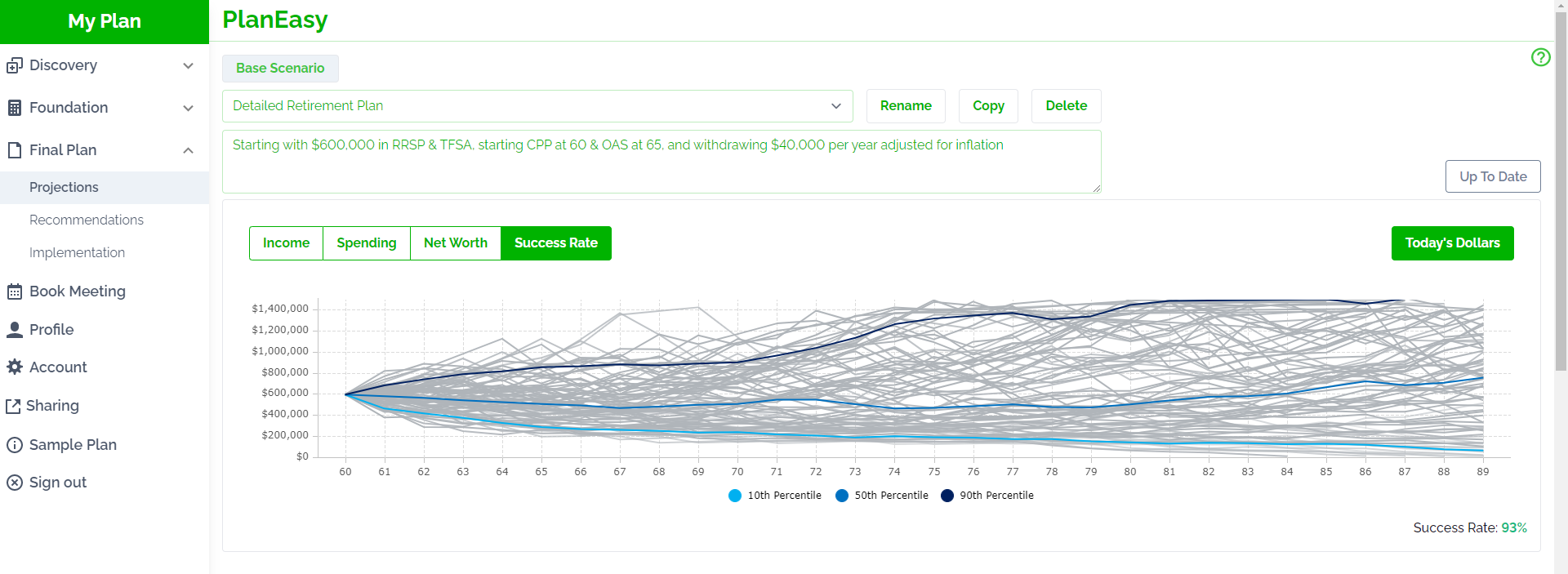

Does the 4% rule make a good retirement plan? Not really. It provides good goal to work towards but in terms of a retirement plan the 4% rule is too high level. A more detailed accumulation and decumulation plan is necessary to fine tune retirement income, spending, taxes etc. This detailed plan can be tested over historical periods of stock returns, bond returns, and inflation rates to find the overall success rate.

Instead of using the 4% rule it’s better to look at a retirement plans success rate. Using year by year assumptions for income, spending, tax etc it’s possible to determine how many historical periods would result in money being left over at the end. Each period with money left over at the end would be considered a success. As long as 80-90%+ of historical periods result in money left over at the end then the plan can be considered successful.

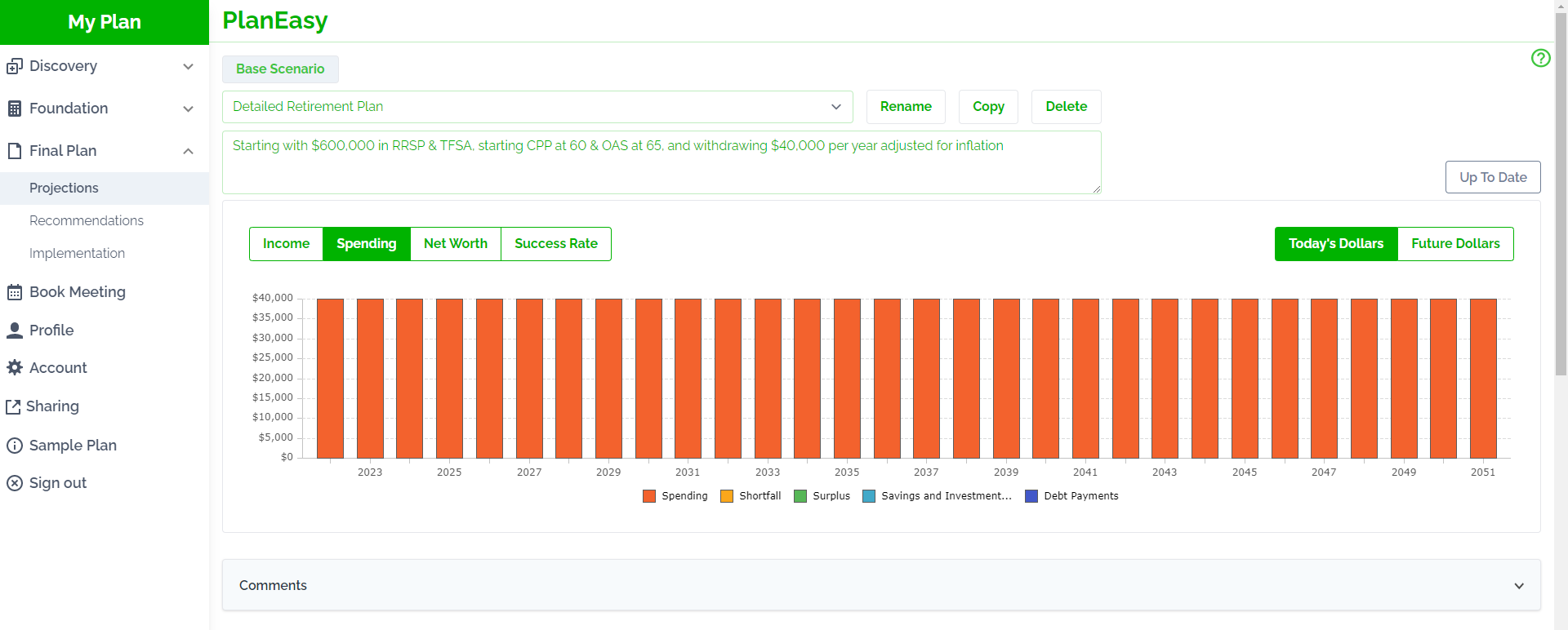

Here is an example of a detailed retirement plan with $40,000 per year in spending and a very high success rate. This retirement plan starts with financial assets of $600,000 split between RRSP and TFSA, nowhere near the $1,000,000 required by the 4% rule.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

The 4% rule problem #7

RRSP ‘s which most people have and will rely on eventually will become a RRIF.

Which will require over time a ever increasing withdrawal rate. So the 4% rule only works from 60 – 71 ,if you are using your RRSP for income. A non registered account would work fine with the 4% rule.

Fantastic point Andrew! How are you planning to deal with this problem? Will you take more than the minimum out of the RRIF early in retirement? Or just wait for RRIF minimums to go up but invest the excess withdrawal in a non-registered account?