What If You Maximize Your TFSA and RRSP Each? Year How Much Money Would You Have?

What if you maximize your TFSA and RRSP each year, how much money would you have in the future? If you just had one singular focus, how much could you accumulate? And would it be enough for retirement?

The TFSA and RRSP are two amazing tax advantaged accounts. They allow investments to grow tax free or tax deferred. They can be used to save and invest for retirement. Over time these contributions grow considerably with dividend income, interest income, and capital gains.

For the RRSP, new contribution room is based on 18% of the previous year’s employment income.

For the TFSA, new contribution is a set amount that grows with inflation in $500 increments.

Depending on your income level, maximizing both your RRSP and TFSA could mean a savings rate of 20%, or 25%, or 30% or even 35%+ at lower income levels.

That’s a high savings rate!

So, we can already anticipate that by maximizing the RRSP and TFSA every year we will probably end up with a sizable amount of financial assets, but how much exactly?

Is it $1 million?

Is it $2 million?

Is it $3 million or more?

In this blog post we’re going to have a little fun; we’re going to take a look at how much money you could accumulate if you just maximized new RRSP and TFSA contribution room each year.

Watch The Video!

The Example

Let’s start our example with a few assumptions.

First, to make things easier we’re not going to assume a home purchase, so no debt, no HBP/FHSA etc. just a monthly rental expense in a rent-controlled apartment that increases with inflation.

Second, we’re going to assume income starts at $60,000 per year at age 25 but grows to $77,000 per year in today’s dollars by age 35, so a bit of career progression.

Third, because we’re only maximizing RRSP and TFSA, this means a bit of lifestyle inflation over those 10-years as well. Only a small portion of the salary increase with go towards extra RRSP contributions and the rest will be spent, this increases room for rental expenses, vacations, discretionary spending over time.

We’re going to take this example and look at three scenarios, one where RRSP and TFSA contributions only start at age 45, and second where they start at age 35, and a third where they start at age 25.

Do you have any predictions for how large these accounts will get by age 65 or by the end of retirement?

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

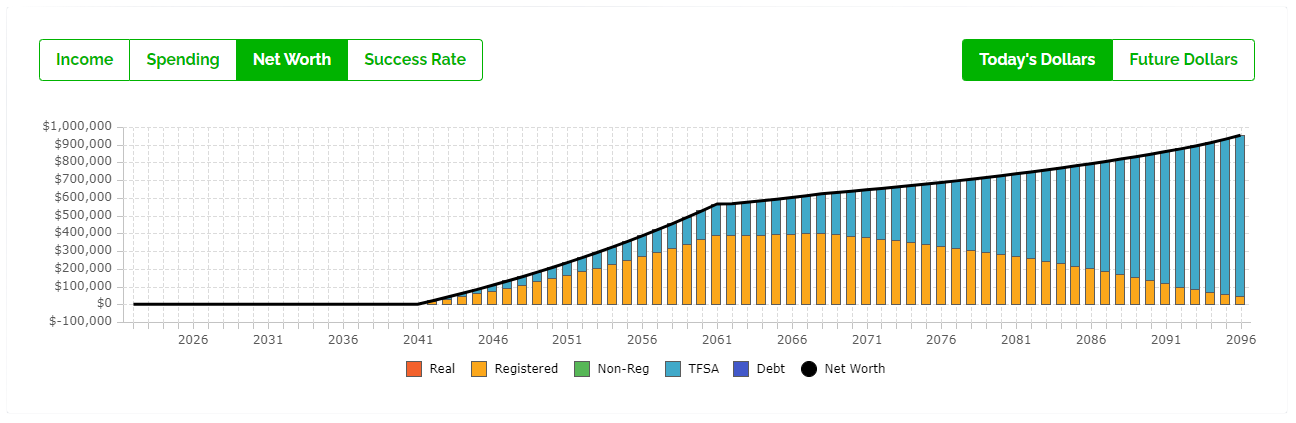

Maximize RRSP And TFSA Starting At Age 45

By maximizing the RRSP and TFSA each year starting at age 45…

- Net worth at retirement reaches $565,601 in today’s dollars and $1,272,080 in future dollars

- Net worth at the end of retirement reaches $953,154 in today’s dollars and $4,436,780 in future dollars

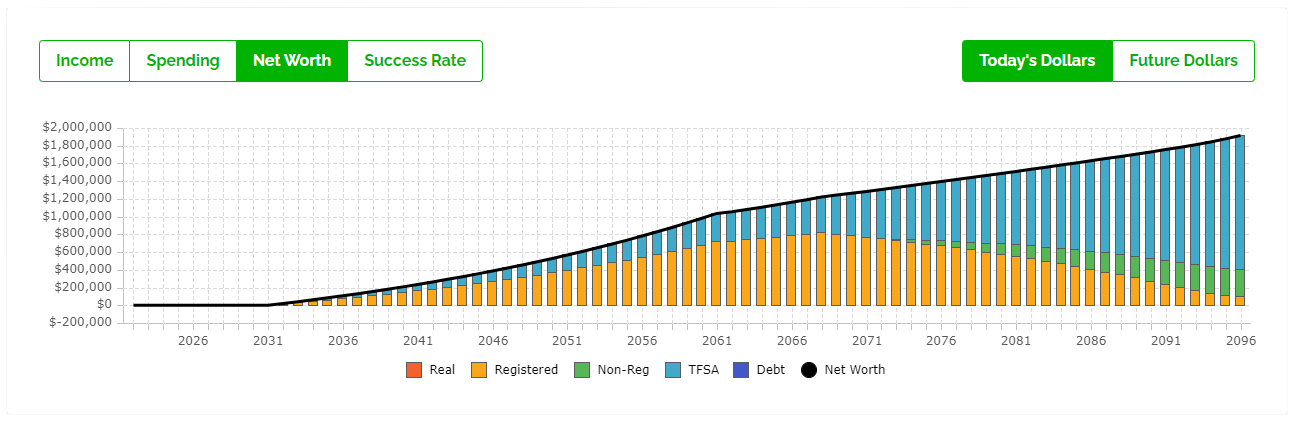

Maximize RRSP And TFSA Starting At Age 35

By maximizing the RRSP and TFSA each year starting at age 35…

- Net worth at retirement reaches $1,036,123 in today’s dollars and $2,330,319 in future dollars

- Net worth at the end of retirement reaches $1,915,444 in today’s dollars and $8,916,089 in future dollars

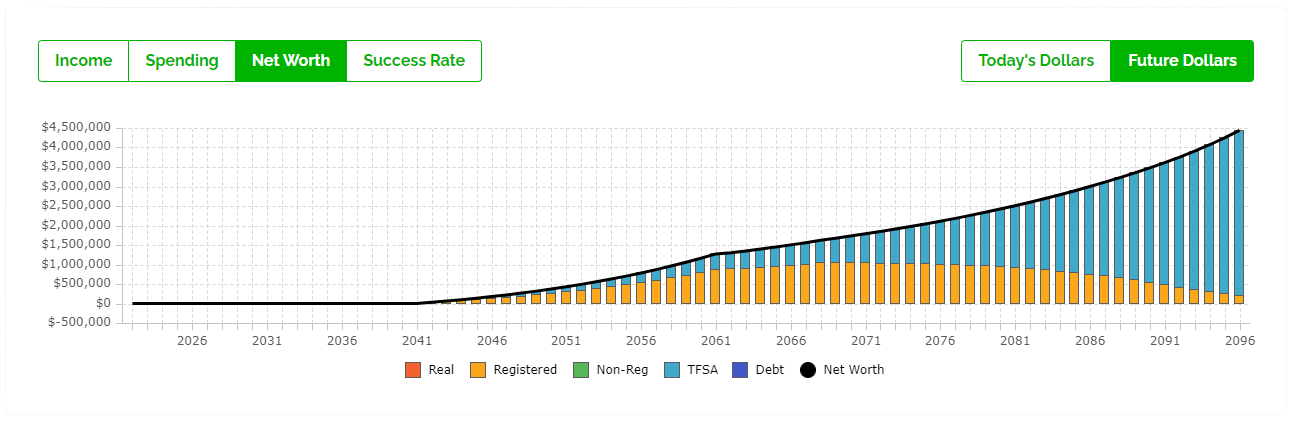

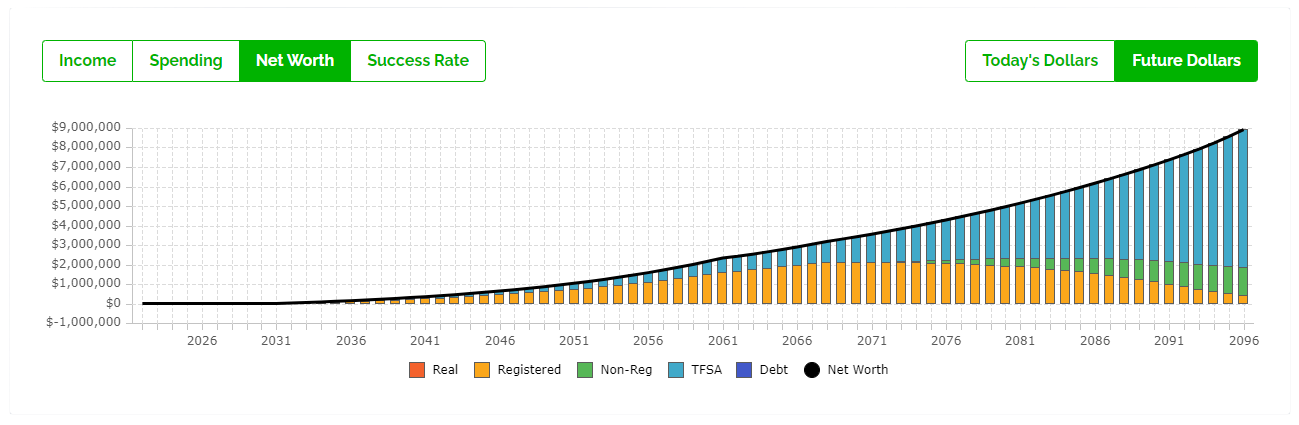

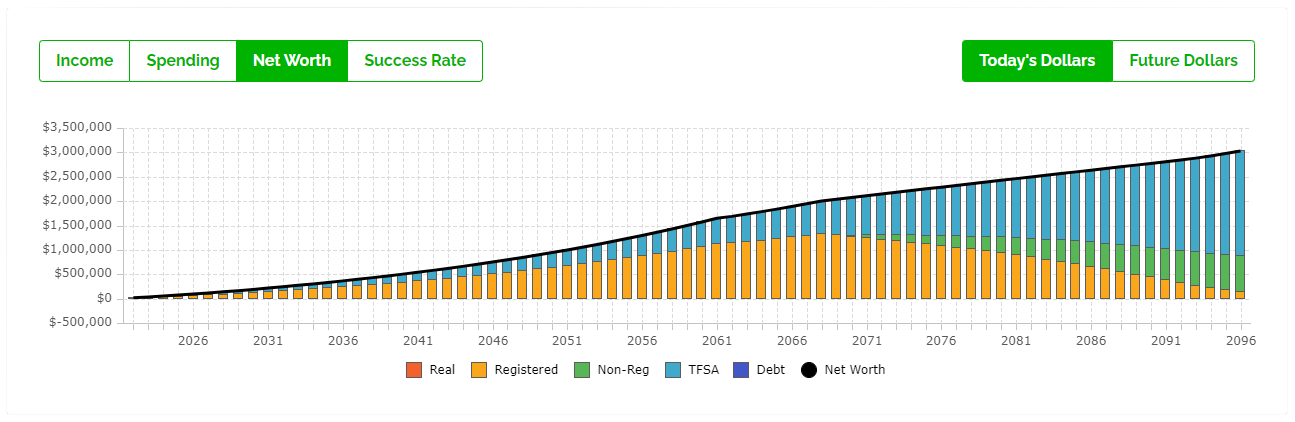

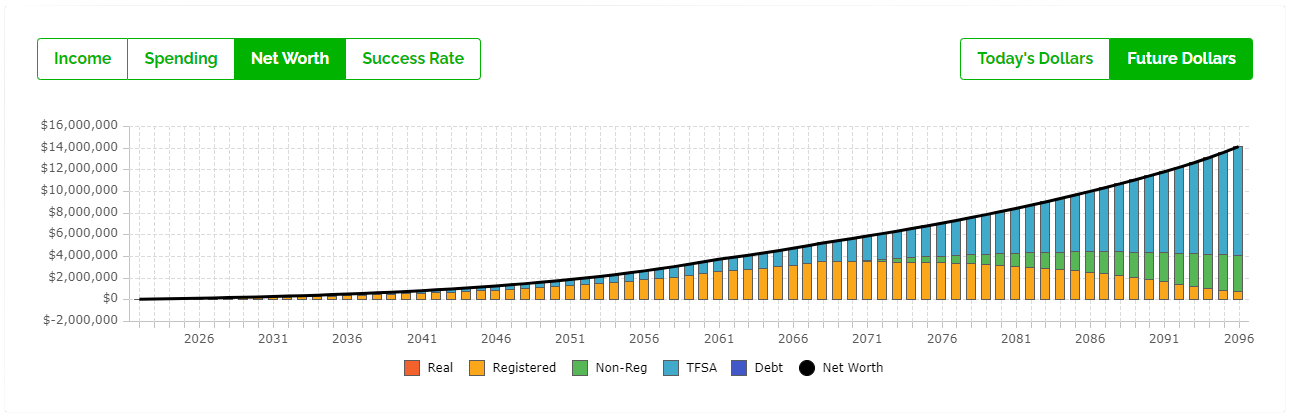

Maximize RRSP And TFSA Starting At Age 25

By maximizing the RRSP and TFSA each year starting at age 25…

- Net worth at retirement reaches $1,647,506 in today’s dollars and $3,705,365 in future dollars

- Net worth at the end of retirement reaches $3,030,235 in today’s dollars and $14,105,264 in future dollars

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments