Best Time To Plan For Retirement? Age 70? 65? 60? 55? 50? 45?

There is never a bad time to start saving for retirement, but when is the BEST time to start planning? We’ve been told to start saving & investing for retirement from a very young age, the earlier the better, but when do you actually start planning for retirement itself? When do you start to think about income, expenses, taxes and government benefits during your retirement years?

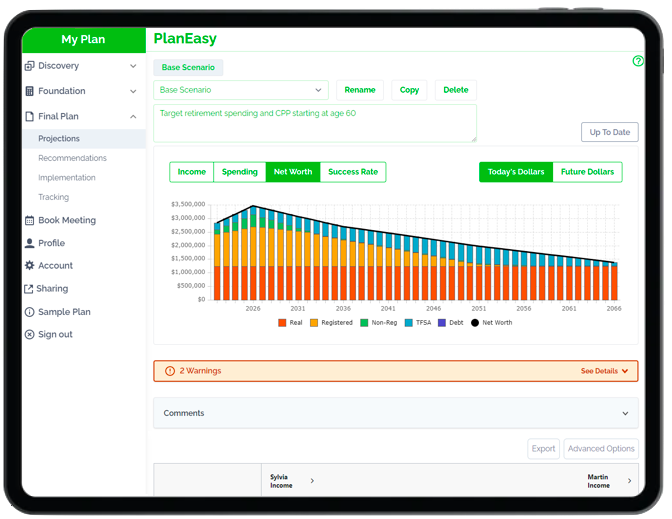

Retirement can be very complex. When you reach retirement it’s pretty easy to have 6-10 different income sources, all with different tax treatments and claw back rules. One income source can be tax free while the other is fully taxed. Some retirement income is counted when calculating government benefit claw backs while others aren’t. These rules can make it difficult to estimate how much you can expect in retirement.

Retirees usually have their own source of retirement income from TFSAs, RRSPs, LIRAs, RRIFs, and non-registered accounts. Plus, they have government retirement programs like CPP, OAS and GIS. Then there are government benefits like the GST/HST credit and other senior’s benefits. And on top of that there are defined benefit pensions and annuities too.

With all these different income sources, it can get a little confusing. It can be difficult to know exactly how much can you expect in retirement income, how much will be lost to taxes, and how that matches up with retirement expenses.

As you get closer to retirement it can be extremely helpful to have a retirement plan in place. A plan that integrates all these different sources of income, calculates taxes and government benefits, and ensures you can reach your retirement spending goals. But can you reach a point where it’s too late to plan for retirement?

When is the best time to plan for retirement?

Retirement Planning At Age 70

Age 70 is almost too late to start planning for retirement. This is because at age 71 you’re required to convert RRSPs into RRIFs and LIRAs into LIFs. After this conversion takes place you’re stuck with mandated minimum withdrawals (and in the case of LIFs there are maximum withdrawal limits too).

This conversion takes away a lot of flexibility in your retirement plan. It’s still possible to plan for retirement at age 70, but your options are more limited, so it’s better to start earlier.

Retirement Planning At Age 65

Age 65 is getting too late to start planning, at age 65 you’re eligible for OAS and GIS benefits from the government. These senior’s benefits are very generous but also come with very high claw back rates if your income falls within the claw back zone. This means every $1 you earn from certain income sources will see your benefits get clawed back. Waiting until age 65 to plan for retirement means you may incur unnecessary claw backs on your government benefits.

These claw back are stiff too. For people in the OAS claw back zone they will see their OAS benefits decrease by 15% of every extra dollar they earn from certain sources. For people in the GIS claw back zone it’s even worse, they will see their GIS benefits decrease by 50-75% for every extra dollar they earn.

Because different types of income are treated differently for OAS and GIS calculations it can be helpful to structure your finances well before retirement with these claw backs in mind.

Watch The Video!

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Retirement Planning At Age 60

Age 60 is better, but at age 60 you’re eligible for CPP benefits. CPP is the Canadian Pension Plan and CPP benefits are based on earnings & contributions throughout your working years. Once started, CPP benefits will continue for the rest of your life.

When planning for retirement in can sometimes make sense to start CPP benefits early, even when still employed, or in other circumstances it can make sense to draw down other sources of retirement income first and delay taking CPP until age 65 or even age 70.

Planning when to take CPP is best done in advance. Waiting to age 60 might be too late. Calculating your CPP entitlement before age 60 will help you decide when to start taking CPP.

Retirement Planning Between Age 45 and 55

Between ages 45 and 55 is the best possible time to plan for retirement. It can be helpful to plan for retirement before age 45 too, but the best time to plan for retirement is 5-15 years before your expected retirement date.

Between age 45 and 55 you’ll have a better idea of what your retirement will look like. You can estimate retirement spending. You can calculate expected CPP, OAS and GIS benefits. Your personal savings have hopefully been growing for a while now and compound interest is probably doing a lot of the work.

Age 45+ is also the time that many households find themselves transitioning into a new financial phase, a phase that will look more like their retirement years. Your mortgage is hopefully close to being paid off. Your kids are probably getting ready to leave the house. You’re probably reaching your peak earning years. These changes usually mean additional cash flow becomes available, cash flow that can be put toward your retirement goal.

With extra cash flow becoming available between age 45 and 55 this is a good time to make sure you’re saving enough for retirement (or saving too much!). You can calculate expected benefits from CPP, OAS and GIS and make sure you have enough savings to close the gap.

Between age 45 and 55 retirement spending becomes easier to predict. Your spending habits are more predictable and you’ll have a much better idea of your desired lifestyle in retirement.

Most importantly, when you’re 5-15 years from retirement you still have time to make changes if your plan isn’t exactly what you expected. You can make changes to reduce taxes, increase government benefits, or save more towards retirement.

The best time to plan for retirement is between ages 45-55. Start planning at least 5-15 years before you plan to retire. This is the best time to make your retirement exactly what you want it to be.

Note: For anyone who wants to retire early, the 5-15 year rule still applies. For example, if you want to retire at age 50 rather than age 65, then the best time to plan for retirement is between age 35 and 45.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments