What Is Financial Independence/ Retire Early?

(aka FIRE)

You may have noticed a new term starting to creep into the mainstream financial media, that term is FIRE, and you might be wondering, “What the heck is FIRE? And how is it related to personal finances?”.

FIRE is an acronym that stands for Financial Independence/Retire Early. The basic idea is that if you pursue FIRE you can eventually stop working for money. You can be financially independent. You can do anything, retire early, keep working, volunteer, basically you can have more freedom.

The idea is that with enough savings/investments you’ll eventually reach the point where you can live off your investment income indefinitely. Once you reach this point you’re considered financially independent, you no longer NEED to work for an income, and can retire to a life of leisure (although you may choose to continue to work, change roles/professions, start a business, or volunteer).

While the concept of early retirement sounds amazing, it does take quite a bit of focus and determination to get there. To reach FIRE it requires a high savings rate, very high.

The typical financial advice given to the public is to save and investment approximately 20% of your net income (part of the simple 50/30/20 budget).

But to reach financial independence retire early you need to save more, much more. To reach FIRE you need to have a savings rate somewhere in the 30%-70%+ range. The higher your savings rate the faster you can stop working for money.

Because it’s easier to reach financial independence/retire early with a high savings rate, the path to FIRE is made easier with an above average income. With an above average income, basic expenses are easily covered, and it becomes more about managing lifestyle inflation. People who pursue FIRE try to limit their lifestyle inflation to maintain a high savings rate.

FIRE is also possible with a below average income, but requires a lot of creativity to reduce basic expenses. This may include house hacking, avoiding car ownership, and more extreme lifestyles. To reach financial independence/retire early with a low-income you need to live an alternative lifestyle.

Reaching FIRE is one of those extreme personal finance goals, it’s a goal that isn’t for everyone.

Even though the end goal sounds appealing, it requires a lot of hard work and dedication along the way. Reaching financial independence retire early means living way below your means for the rest of your life. It’s a lifestyle more than it is an end goal. It’s a lifestyle with a lot of freedom, but it’s also a lifestyle that requires a lot of control.

If you’re able to control your spending, and save a large % of your income, then reaching financial independence might only be a few years away.

To find out how far away you are from financial independence you can make a copy of our FIRE calculator and quickly calculate how many years it will take to reach FIRE in your situation. It will help you estimate how many years from FIRE you are based on your net-income, current expenses, and existing savings.

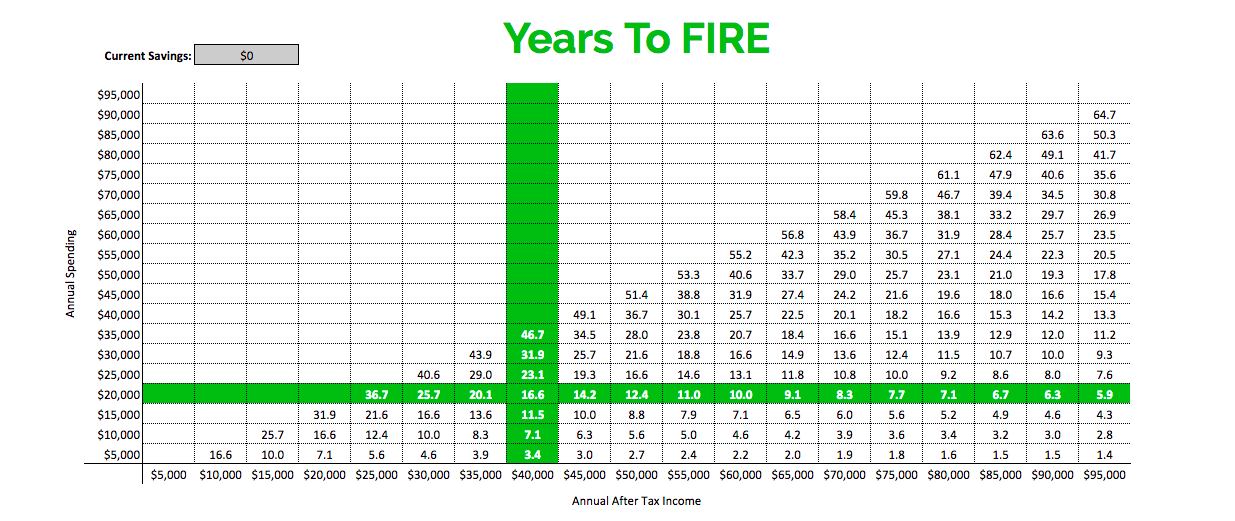

We’ve used our FIRE calculator to create four examples of how to reach FIRE.

Low-Income/Low-Spending

In this scenario, we’re going to assume a household net-income of just $40,000 per year with low annual spending. This level of spending would need to be maintained after reaching financial independence so this is a tough scenario. It will require a lot of creativity to maintain this low level of spending over the long-term but if possible it will let this household reach FIRE in just 16.6 years. They could start from zero at age 33 and be retired early at age 50.

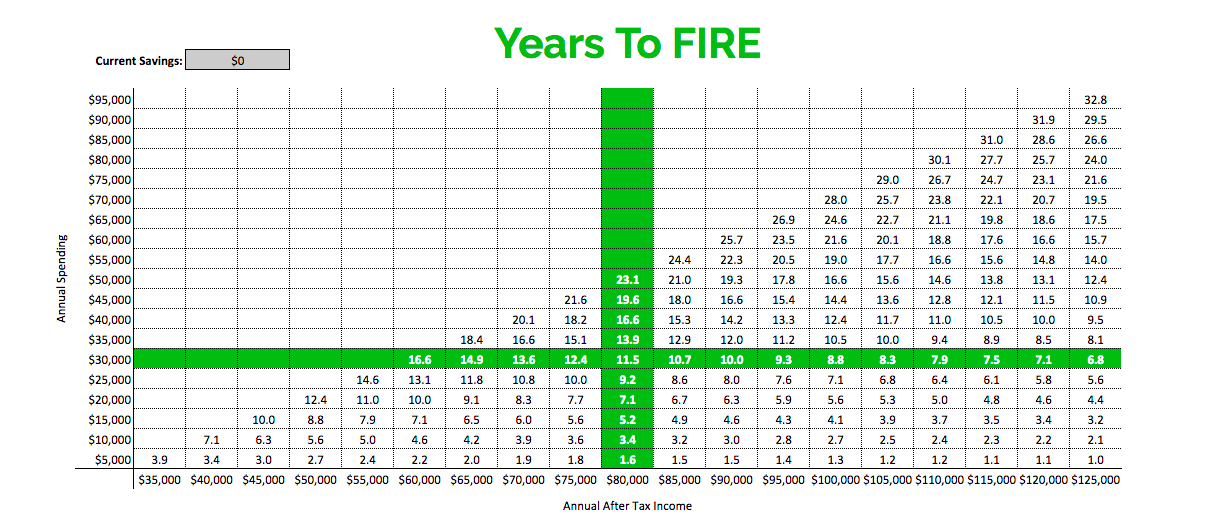

Moderate-Income/Low-Spending

In this scenario, we’re going to assume a household net-income of $80,000 per year with low annual spending. This family is already doing really well and can decrease their FIRE journey even further by increasing income or decreasing expenses.

Increasing their income by $5,000 will shave 0.8 years off their FIRE journey. Similarly, decreasing expenses by $5,000 will shave 1.3 years off their FIRE journey. (Notice how reducing expenses is worth almost twice as much as increasing income? This is how a penny saved can be worth two pennies earned)

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

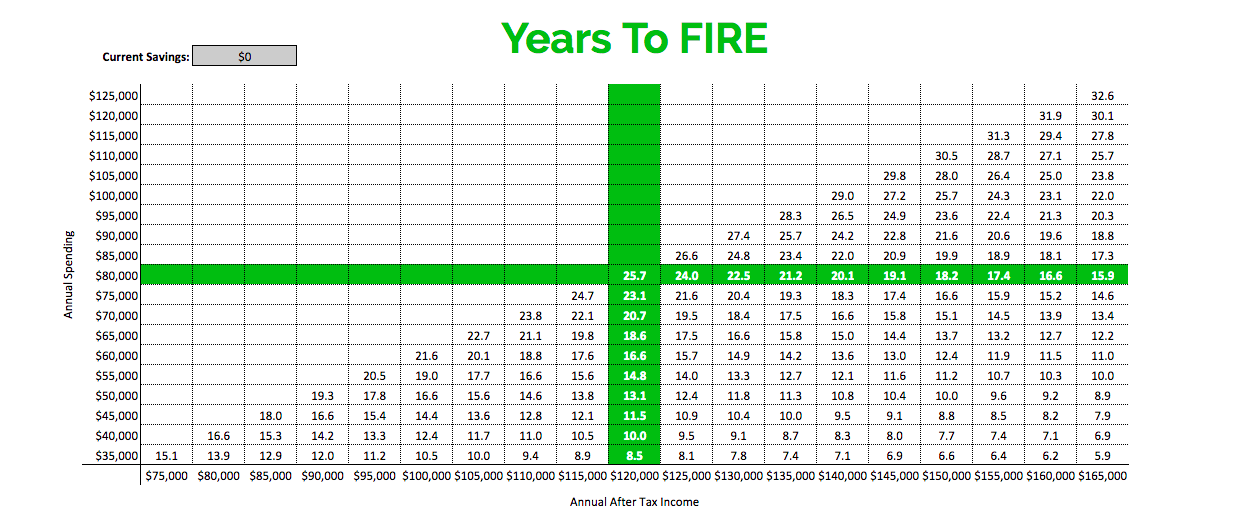

High-Income/Moderate-Spending

In this scenario, we’re going to assume a household net-income of $120,000 per year with moderate annual spending. This family is already at the recommended savings rate but can drastically decrease the years to FIRE by either decreasing their spending or increasing their income.

Increasing their income by $5,000 will shave 1.7 years off their FIRE journey. Similarly, decreasing expenses by $5,000 will shave 2.6 years off their FIRE journey.

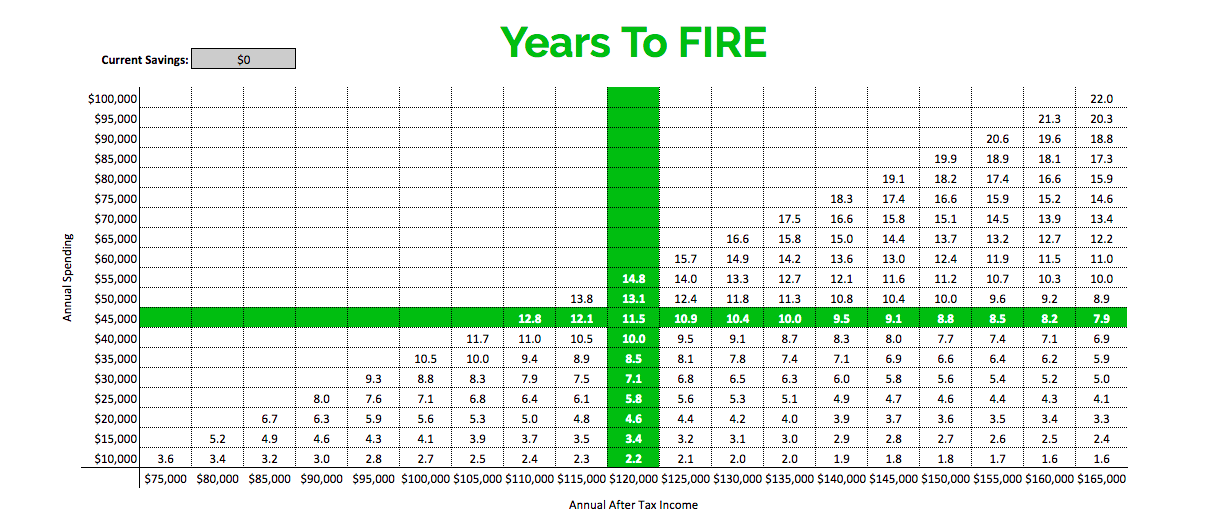

High-Income/Low-Spending

In this scenario we’re going to assume a household net-income of $120,000 per year. This is well above the average income in Canada and this makes it much easier to achieve FIRE.

With a high-income, and living well below your means, it becomes possible to reach financial independence/retire early in just a few years.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

The formulas are a good match for my experience. I made a mid to high five figure salary for most of my working years. At 30, I started socking away 25% of my gross salary whenever possible, and took maximum advantage of any company RRSP match, etc that came my way. In spite of getting laid off at 45 and having to climb the ladder at a new organization, I was able to knock off at 57. Not exactly FIRE, but I haven’t had to pare back my lifestyle, and it feels great not to have to face re-orgs and performance reviews any more. So it can be done – just work out a realistic plan and stick with it.

Congratulations Marc, that sounds like a solid path.