Retirement Income:

Start With RRSP, Non-Reg or TFSA?

When it comes to generating an income in retirement things can get very confusing, very fast. During your working years you probably have one, maybe two, sources of income, typically a paycheck that arrives every 2-weeks, in retirement however you will likely have 5-10 different income sources coming every month.

A typical retiree will have both CPP and OAS payments in retirement (unless you’re extremely high-income and your OAS is entirely clawed back), plus a typical retiree will also have some investments in an RRSP, TFSA and non-registered account to draw from. Add to that pension payments from a defined benefit pension or maybe a defined contribution pension that was converted into a LIRA/LIF, and we’re up to 6 income sources already. Then we have to add additional payments from government benefits like the federal GST/HST credit, Guaranteed Income Supplement (GIS), and provincial benefit programs like the Trillium benefit in Ontario. Some of these arrive monthly, some quarterly, some just once per year.

And if that wasn’t confusing enough, each income source has its own tax and benefit claw back rules that can increase the combined tax/clawback to over 50% even for smaller incomes, especially when we add GIS clawbacks or OAS clawbacks in retirement.

For example, RRSP, CPP, OAS and pension income are all taxed at 100% of your marginal tax rate, but capital gains are taxed at 50% your marginal tax rate, and at some income levels dividend income has a negative tax rate!

Then you have TFSA withdrawals which have no tax at all, and most government benefits are tax-free as well!

All those different income sources naturally create a lot of different strategies to on how to drawdown your retirement assets in the most efficient manner…

Some people believe that drawing down their RRSPs first is the best strategy. Others believe drawing down non-registered assets first makes more sense. There might even be a few people out there who think that drawing down their TFSA first is best.

But the best way to create retirement income and drawdown your retirement assets is actually to mix them all together. Like an expert baker, the key is to mix retirement income sources in just the right proportions to get the best result. The tricky thing is that the exact proportions will depend on your specific situation, how much you have in each account, and how much retirement income you’re trying to create each year.

How much is planning your retirement income worth? How about $100,000 or more in reduced income tax! Even low- and mid-income seniors can benefit from strategic retirement income planning to help them avoid GIS claw backs, which can easily be worth $1,000’s per year.

At the end of this post we’ll show you 7 different withdrawal scenarios’. The difference between the best and the worst is over $328,490 in today’s dollars.

First, a bit of background on why we want to mix retirement income…

Paying Zero Tax In Retirement

Is it possible to pay zero tax in retirement, or at least part of retirement? Absolutely it is.

The key is to mix retirement income in just the right proportions.

Let’s consider an example where we have a couple who has $1,000,000 and wants to retire early at age 50. They each have $200,000 in RRSPs (this could be LIRA too), $200,000 in non-registered assets, and $100,000 in TFSA. When we add up each account they have $500,000 each for a total of $1,000,000. They have no pension but can expect to receive reduced CPP at age 60 and full OAS at age 65.

Our fictional couple is already good at tax planning so they hold Canadian equities in their non-registered account, US equities in their RRSP, and international equities and bonds/fixed-income is spread across their RRSP and TFSA.

Our couple already knows that eligible Canadian dividends have a negative tax rate at low and moderate income ranges. Because our couple lives in Ontario, any dividend income under $47,000 per person has a marginal tax rate of -6.86% (thank you dividend tax credit). That means every $1,000 in eligible Canadian dividends will lower their tax owing by $69. That’s right, the more dividend income they receive, the lower their tax payable.

With enough eligible Canadian dividends, our couple will pay zero tax each year. But we don’t want too many dividends because these are non-refundable tax credits, so unless we have other income to offset, these tax-credits will disappear each year.

Related Posts:

- The Simple Retirement Plan

- Understanding RRSPs: The 6 Benefits (And 7 Drawbacks) of RRSPs

- The Biggest Risk in Retirement is… Sequence of Returns Risk

Best Strategy Is To Mix Retirement Income Sources

As you’ll see in the examples below, drawing down just one type of asset isn’t the best strategy because we might be leaving non-refundable tax credits on the table each year. The best strategy is to mix retirement income sources to use up these non-refundable tax credits every year. To ensure that we maximize the dividend tax-credits we want to plan a mix of different income sources in retirement.

In most cases we can mix income sources proportionately to ensure we pay the minimum amount of tax. This could be pension payments, RRSP/RRIF withdrawals, LIRA/LIF withdrawals, GIC interest, bond interest etc.

In our example, our couple also has a large amount of registered assets in RRSPs. When these assets are withdrawn, they’ll trigger income tax at their marginal rate. Every year our couple can withdraw a certain amount from their RRSP to maximize their non-refundable tax credits and still pay zero tax.

If our couple plans their RRSP withdrawals strategically they will pay zero income tax from age 50 all the way until age 70. Twenty years of zero tax even though they’re spending $50,000/year in today’s dollars.

Even when CPP starts at age 60, and OAS starts at age 65, the tax credits are enough that our couple still pays zero income tax. Only when non-registered assets are fully depleted at age 70 do they start to pay a small amount of income tax each year.

Of course, every situation is different. Dividends aren’t the same each year, the proportion of assets in each account won’t be the same, CPP and OAS will be higher/lower etc. etc. They key thing to keep in mind is that drawing down one type of asset before another is rarely the best strategy. Often the best strategy is to mix income sources in retirement to minimize taxes and maximize government benefits.

Seven Different Retirement Income Strategies To Generate $50,000/Yr:

Disclaimer: The scenario’s below are examples only and should not be used for planning purposes. Even small changes in timing, asset values, mix of assets, rate of return, government benefits etc can have a large impact on income tax and government benefit strategy. If you’re unsure about the best way to generate retirement income given your unique situation then we recommend you speak with an advice-only financial planner.

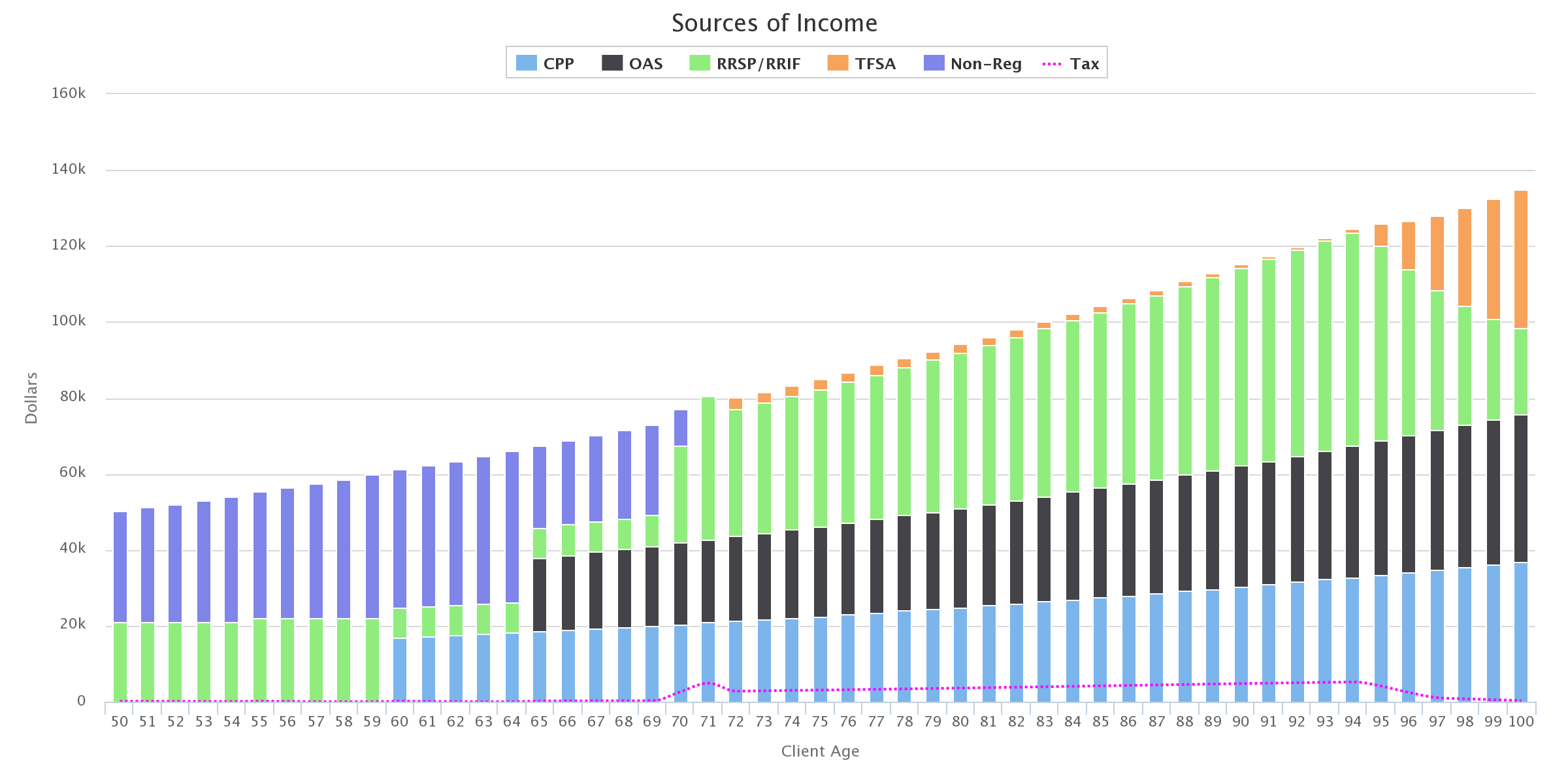

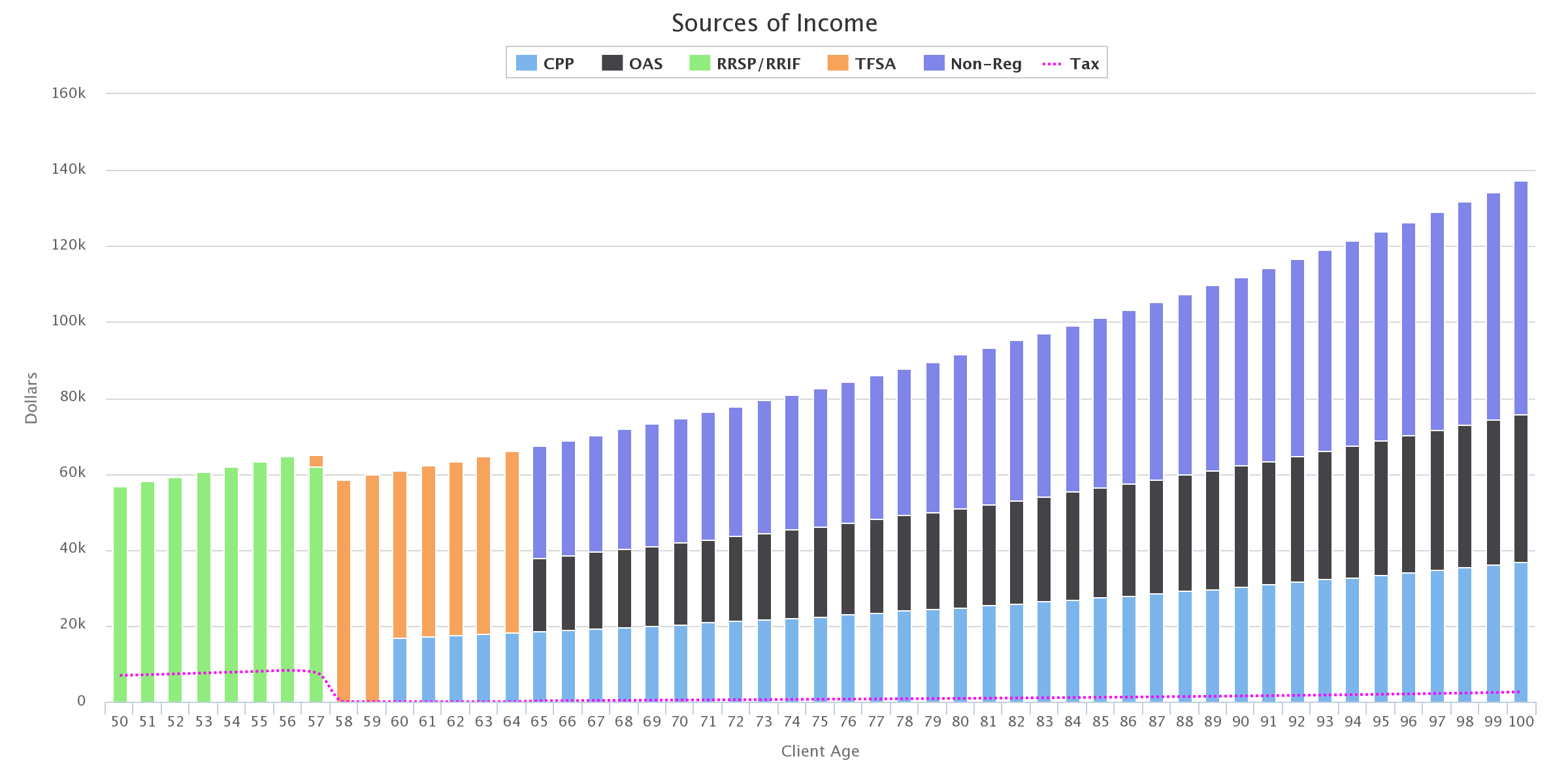

Best Scenario: Hybrid Withdrawals from Non-Reg, RRSP and TFSA to Maximize Non-Refundable Tax Credits

- Total After-Tax Income From Age 50 to 100: $2,550,000

- Total Income Tax Paid: $56,858

- Estate Value After Tax: $1,794,571

*Totals above are in today’s dollars, values in graph are in future dollars.

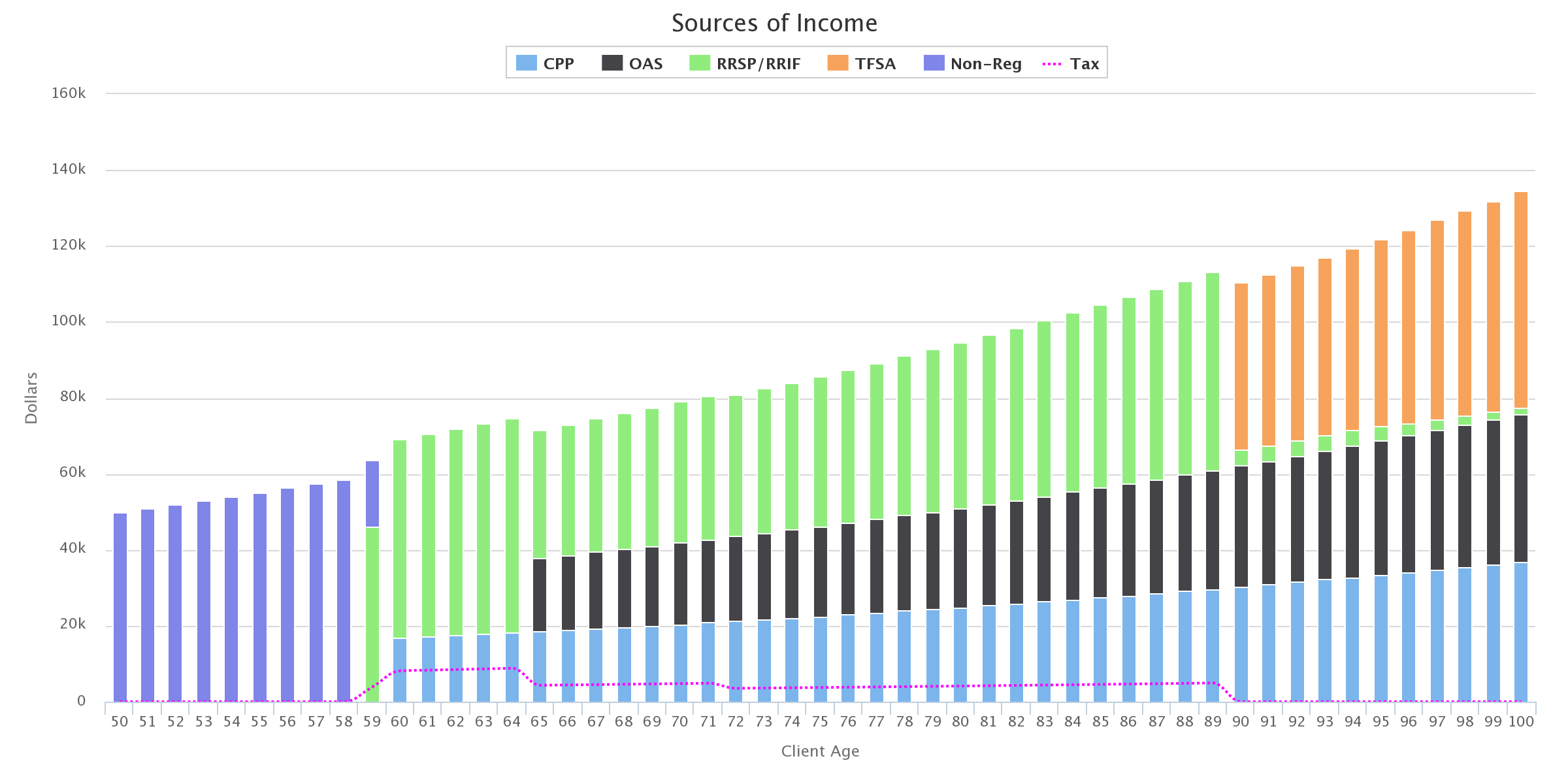

Sub-Optimal: Non-Reg, then RRSP, then TFSA

- Total After-Tax Income From Age 50 to 100: $2,550,000

- Total Income Tax Paid: $100,039

- Estate Value After Tax: $1,591,310

*Totals above are in today’s dollars, values in graph are in future dollars.

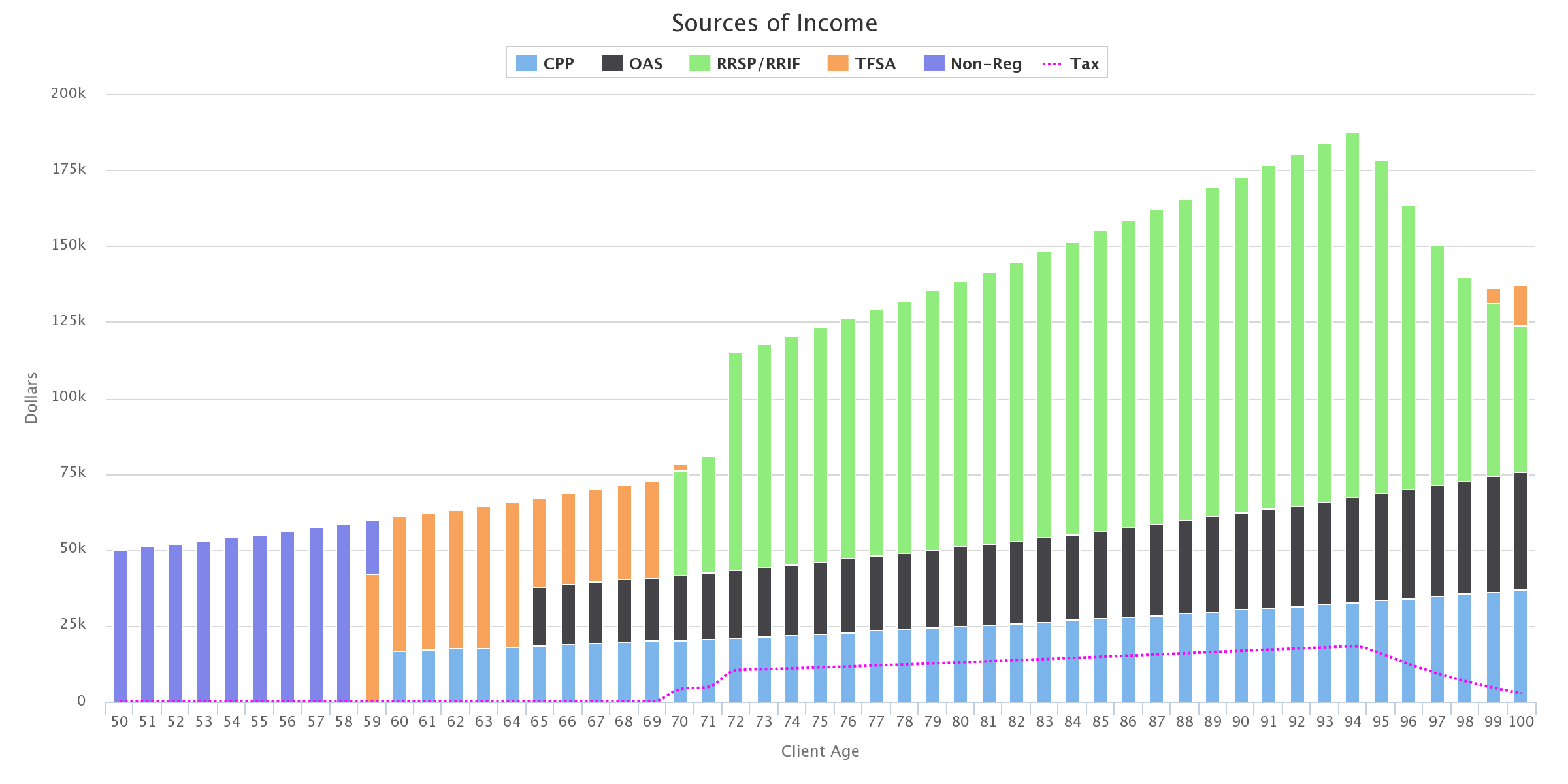

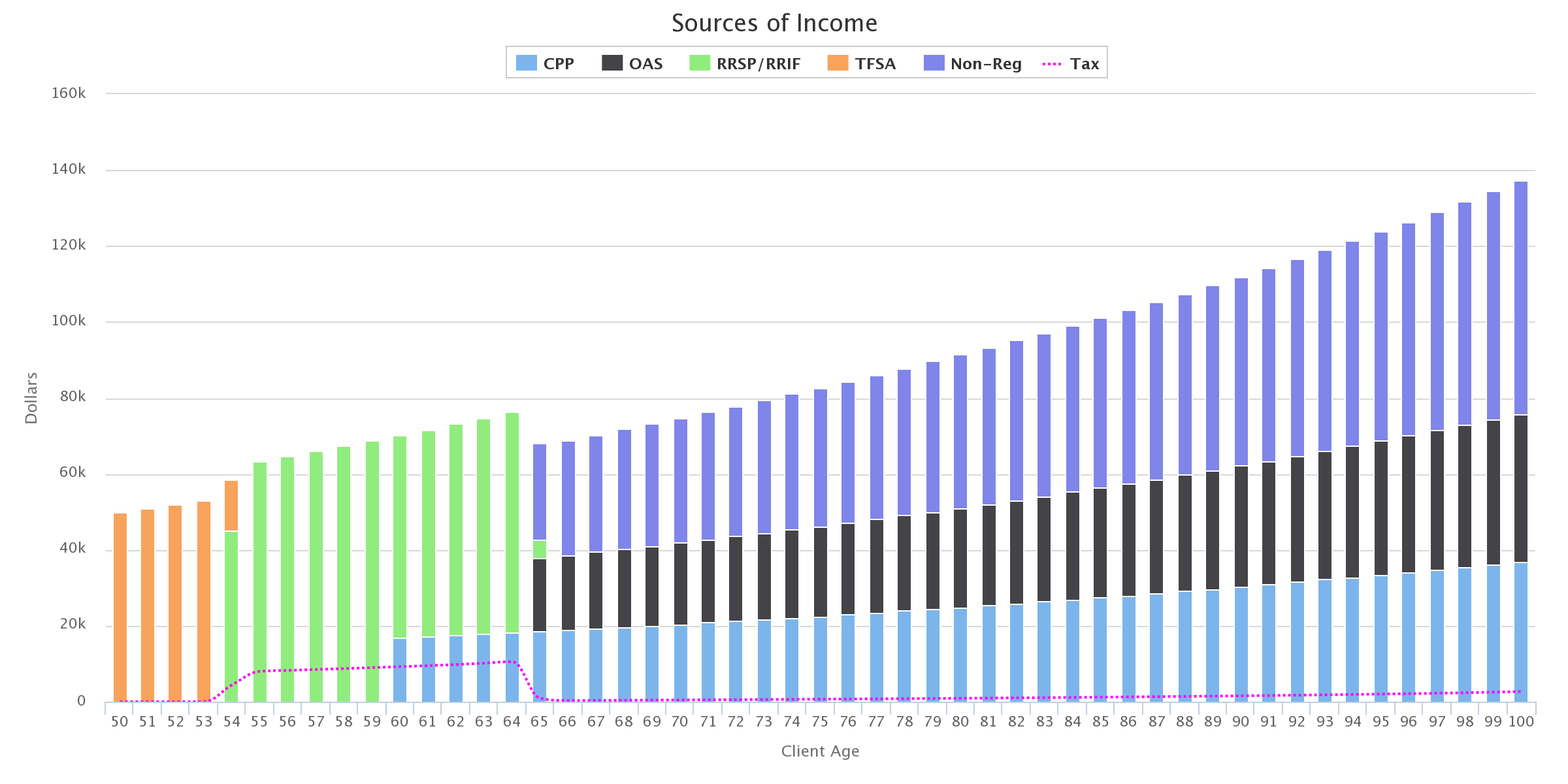

Sub-Optimal: Non-Reg, then TFSA, then RRSP

- Total After-Tax Income From Age 50 to 100: $2,550,000

- Total Income Tax Paid: $193,437

- Estate Value After Tax: $1,466,565

*Totals above are in today’s dollars, values in graph are in future dollars.

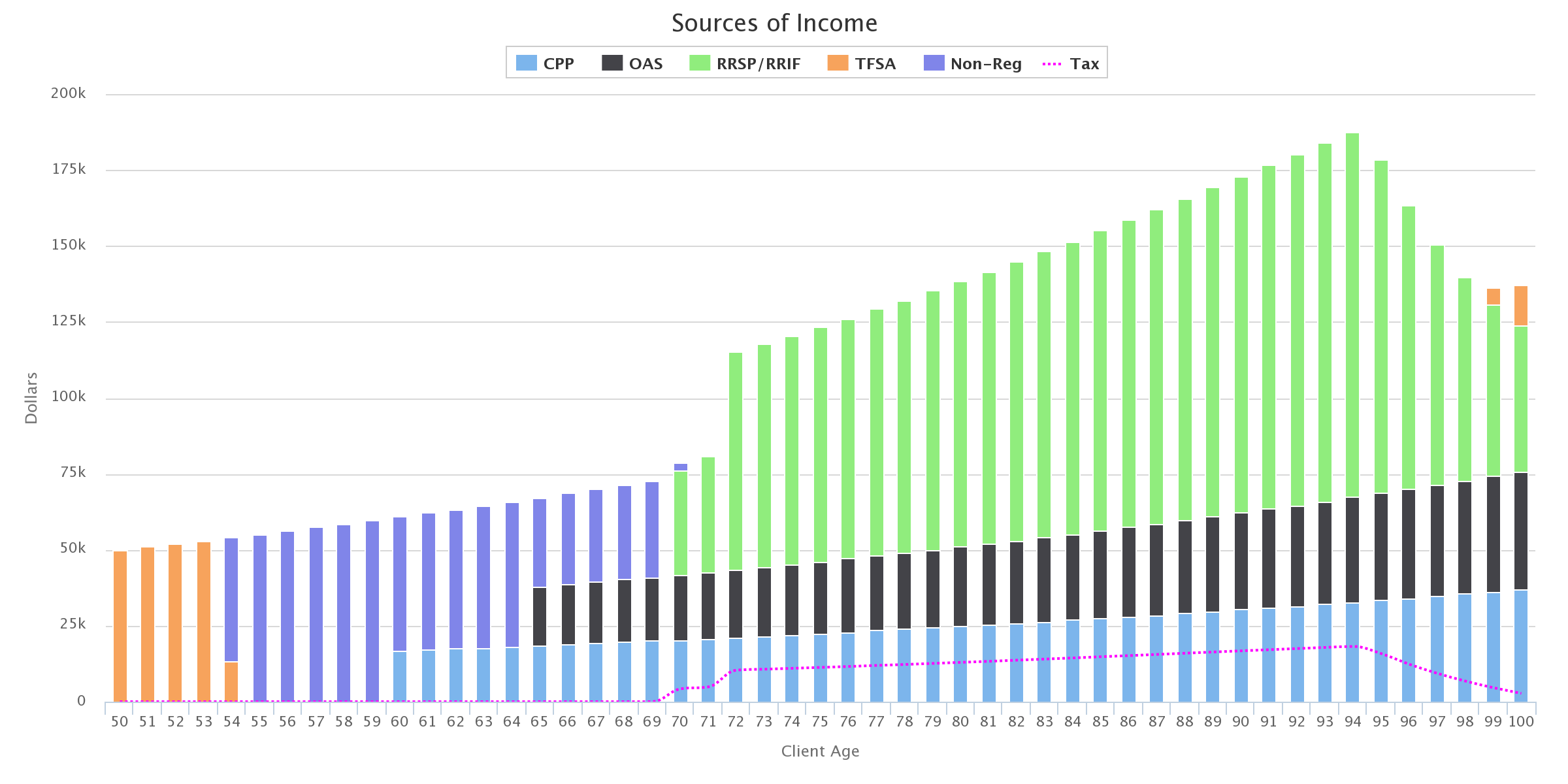

Sub-Optimal: RRSP, then Non-Reg, then TFSA

- Total After-Tax Income From Age 50 to 100: $2,550,000

- Total Income Tax Paid: $56,530

- Estate Value After Tax: $1,583,061

*Totals above are in today’s dollars, values in graph are in future dollars.

Sub-Optimal: RRSP, then TFSA, then Non-Reg

- Total After-Tax Income From Age 50 to 100: $2,550,000

- Total Income Tax Paid: $76,040

- Estate Value After Tax: $1,516,971

*Totals above are in today’s dollars, values in graph are in future dollars.

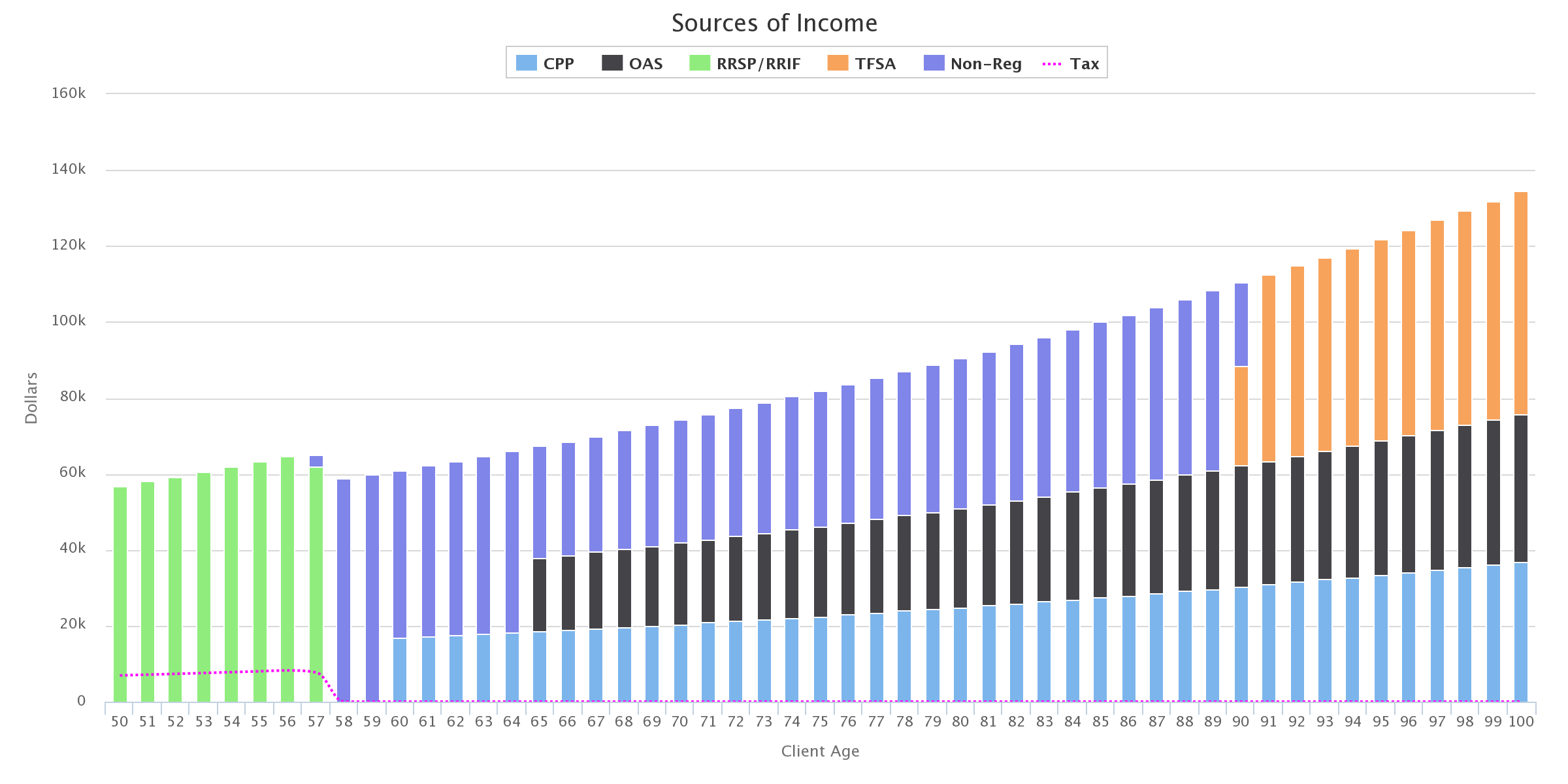

Sub-Optimal: TFSA, then Non-Reg, then RRSP

- Total After-Tax Income From Age 50 to 100: $2,550,000

- Total Income Tax Paid: $193,460

- Estate Value After Tax: $1,466,480

*Totals above are in today’s dollars, values in graph are in future dollars.

Sub-Optimal: TFSA, then RRSP, then Non-Reg

- Total After-Tax Income From Age 50 to 100: $2,550,000

- Total Income Tax Paid: $100,274

- Estate Value After Tax: $1,466,081

*Totals above are in today’s dollars, values in graph are in future dollars.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

You reference the “negative tax rate on eligible Canadian dividends”… It is a myth or at least an illusion. See this article for a very good and detailed explanation.

https://www.advisor.ca/tax/tax-news/tax-efficient-investing-and-dividends/

Cheers

Thanks for your comment Garth! You’re of course referring to the fact that dividends are already taxed at the corporate level and the integrated tax rate between corporations plus individuals is not negative. While this is true, from a personal financial planning perspective its important to recognize that different types of income are taxed differently, and at some income levels this tax rate can actually be negative for an individual. By taking this into account we can actually make things easier for clients and plan to pay less tax (often the largest expense for a retiree).

I just think that too many people prefer dividend income over interest income or cap gain income because they think there is a tax advantage. Corporate tax is paid on behalf of the shareholder and should be considered equivalent to individual income tax. It is as if you paid the tax yourself.

I agree Garth! Great point. Investors definitely shouldn’t chase dividends just for the sake of the dividend tax credit.

Owen, great post, especially the charts. It really gets the message across.

From your experience or perhaps running a few scenarios, in the above couples situation, would the optimal strategy change if they started their CPP at 65, or perhaps even delayed starting CPP and OAS until age 70?

Hi Bob, thanks for the comment! The strategy would definitely change slightly. Delaying CPP and OAS would mean less taxable income in early and late 60’s. We’d want to make larger registered withdrawals to trigger enough taxable income to take advantage of non-refundable tax credits.

We also want to be careful about having too much taxable income after age 70. Delaying CPP and OAS to age 70 would increase taxable income, when we add mandatory RRIF withdrawals that might push us into a higher tax bracket and/or into OAS clawbacks for higher incomes. We’d probably want to draw down some registered assets prior to CPP and OAS starting at age 70 to decrease our average lifetime tax rate.

I am think my situation may be similar to your ficticious couple. I would be interested to know what happened to the rest of their non reg accts. If they were drawing down only the dividends what happened to the capital. Or did they draw it all down, harvesting dividends and selling shares at the same time?

Hi Amy, great question, in the optimal example the non-registered account is also being drawn down. We’re only drawing enough from the registered accounts to take advantage of tax credits and then in early retirement the remaining income comes from a mixture of investment growth in the non-registered account and capital draw down.

Great post. My situation is very close to your scenario. I retired a few years ago in my mid 40’s and have a similar draw down strategy. My rrsp and TSFA are maxed at $600k and $100k respectively. I also have a healthy non-reg account.

Starting last year I converted my RRSP into a RRFI and plan to draw down $30k to $40k each year to deplete it by my mid-seventies. It will depend on how the markets do. This will ensure that I don’t get hit with a massive tax bill if I wait until 71.

I will also cash in come capital gains from my non-reg each year so it doesn’t build up too much as well, while trying to pay minimum overall taxes.

I plan to max my TSFA every year until death and never touch it.

It’s nice to see someone backup my strategy as I have yet to see this elsewhere for early retirees. Most investment blogs focus on the accumulation stage. Very little is talked about the decumulation stage. Thank you!

Hi Ken, thanks for your comment! Drawdown strategy is an interesting opportunity for retirees that doesn’t get the attention it deserves.

Keeping the TFSA to last is definitely the way to go in most cases but I’ve also seen scenarios where we could use strategic TFSA withdrawals in certain years to avoid higher marginal tax rates. As with everything personal finance, the optimal drawdown strategy really depends on each person’s specific situation.

Thanks again for your comment Ken!

How do you avoid higher marginal tax rates by drawing down tfsa? What software can I use to figure out the best strategy. I read Fred Vettesse’s book on deaccumulatiin. I have tried the Perc calculator on Morneau Shepell but don’t trust it much. What are you thoughts on a 20% life annuity Fred suggests? Thanks

Hi Jane, TFSA withdrawals can help avoid higher marginal tax rates if you’re right on the edge of the next tax bracket. Rather than drawing more from an RRSP/RRIF you can draw strategically from a TFSA to fund that last little bit of retirement income. This helps avoid a higher marginal tax rate and/or OAS clawbacks.

A small annuity can be a great tool in certain circumstances but it depends on other sources of retirement income, tax rates, government benefit clawbacks, age, health/longevity etc. etc. In certain circumstances a small annuity can make a very positive difference in a retirement plan.

I’m biased but the best way to figure out the best strategy is to work with an advice-only financial planner like PlanEasy. We work with a specific type of client so take a look at our Services to see if we’d be a good fit…

https://www.planeasy.ca/services/

Hi Owen, thank you for this informative article.

Your comparisons for different scenarios are very interesting. Depending on the type of investment you have among other considerations, we can develop a personalized optimal strategy.

I was also wondering why many people say the general recommendation for a retired couple is:

first, non registered account of higher income,

then, non registered account of lower income,

then, registered account of lower income,

finally, registered account of higher income

Thank you.

Hi June! In general, that advice can make sense, but every person’s financial situation is unique and there are often opportunities to improve on the general advice when doing a comprehensive financial plan. For example, this general advice would fail if delaying registered withdrawals leads to large OAS clawbacks in the future. The general advice might reduce tax now but will increase tax and clawbacks in the future. Similarly, as we saw above, if delaying registered withdrawals means that tax credits are not fully used up each year then there is a missed opportunity by delaying registered withdrawals.

Every situation is unique, so the general advice only goes so far. Thanks for the comment!

Thank you so much for your answer Owen!

“…The general advice might reduce tax now but will increase tax and clawbacks in the future.”- that’s exactly what I was wondering, and it may make more sense to go hybrid, as you showed here. Thank you again!

Another excellent post.

You could also add to the list of retirement income sources, foreign personal pensions (perhaps with several different companies), foreign work pension schemes, and foreign government pensions. In our case, after a year of consolidating some of those sources, that’s an additional four income sources we have to deal with today. Now throw in currency fluctuations, currency conversions (which in itself can lead to taxable gains or losses), foreign tax deductions and refunds, and even a fiscal year that’s different from Canada. Oh, the fun of it.

Thanks Bob, yes, foreign income sources add a whole additional layer of complexity, especially when some are indexed and some are not. And of course if they are indexed to inflation its a different inflation than what we experience in Canada.

I’d forgotten about the indexing. The UK state pension is indexed to a minimum of 2.5% p.a. before the state retirement age, then it increases by 5.8% pa if you don’t start drawing the pension, but when you do, if you live in Canada it’s frozen at your starting level, but if you live in the US it’s indexed. Apparently, if a Canadian resident visits the UK while receiving their state pension, for the duration of their stay they can request it be brought up to the current pension level.

Hi Owen

I found your article on Retirement Income very interesting. Is the calculator available to allow someone to put in their specifics like age of retirement, delaying CPP and OAS etc.

Hi Craig, thanks for the comment! We’ve developed a whole platform to help with decumulation planning in retirement. The platform will help plan accumulation as well as decumulation from various accounts. It will also help estimate future CPP and OAS benefits and integrate them into the drawdown plan. For more details visit our case studies, at the bottom of each case study is a link to a public dashboard with more details…

https://www.planeasy.ca/advice-only-financial-planning-case-studies-case-study/

Hi Owen,

Great Article! I love the suggestion of Hybrid Withdrawals. I ran my excel projection with Non-registered withdrawals first then RRSP which came out with the highest Estate Value. Then I ran the projection with RRSP withdrawals first followed by Non-registered withdrawals that came in lower than the first Estate Value. When I ran the projection with asset totals proportional weighted withdrawals (ATPWW) the Estate value was the highest so far. What I mean by ATPWW is say for example I need $50k total withdrawals and my wife’s RRSP 40% of the total of all RRSP and Non-registered accounts then I withdraw $40% of the $50k ($20k) for her RRSP. It worked out better but was just an attempt to see if your logic works and it did. Not sure exactly why but it did.

Do you have any other articles on how to determine the best breakdown of the split of withdrawals? Is this something that is approximated for the plan and then adjusted on the fly each year based on income types (div, interest, cap gains, etc.) and amounts? If so , how do you adjust on the fly?

Hi Ed! Thanks for your comment, glad you came to the same conclusion. Unfortunately there are no hard and fast rules about withdrawal order or decumulation planning. It depends on many factors like CPP income, OAS income, other taxable income (ie. from a pension), it can depend on income splitting ability, it can depend on the types of income being generated in the non-registered account vs the registered accounts, it can also depend on the size of the accounts and how close you are to marginal tax rate thresholds. This is where retirement planning becomes as much of an art as it is a science. It becomes much easier to do this type of planning once you have a good “feel” for the various factors/rules.

Thanks Owen. I can see that by looking at my data. Depends on when the plan ends. In the first 10 years RRSP first wins out, the second 10 years the Non-registered first option wins out, and if the plan runs to the end the Hybrid options works best for the last 10 years. With potential for tax changes on RRIF withdrawals and numerous other factors I think the hybrid covers all bases. Pretty hard as you say to optimize this perfectly.