The Larger Your Portfolio, The Less Often You Should Check It

When it comes to financial planning we often focus on the numbers, net worth, debt, rate of return etc. But half of financial planning has nothing to do with the numbers. Half of financial planning is about behavior. It’s about managing our behavior, our expectations, our emotions etc.

When it comes to personal finance, and specifically investing, we are often our own worst enemy. We make financial decisions based purely on emotion, often costing us more money down the road.

One of the most common mistakes we make is checking our investment portfolio too often. Investment portfolios are not something that should be checked daily or weekly (unless you’re day trading, which is a whole other conversation)

Checking our investment portfolios has become even easier with online brokerage accounts and financial aggregator apps like Mint.

But… just because it’s possible doesn’t mean you should.

The problem with checking your portfolio too often is that we don’t feel gains the same way we feel losses, even if they’re worth the exact same amount.

The emotional impact of a $10,000 loss is more than the emotional benefit from a $10,000 gain. It’s completely illogical, but that’s how we feel. We experience the emotional impact of losses more than gains. We remember losses more vividly, and for a longer period of time than we do for gains.

This is a problem when it comes to investing. Even though a well-diversified portfolio should gain over the long-term, it will likely experience some big swings in the short and medium-term. By checking our portfolios too often we experienced all those gains and losses, and because we feel losses more than gains, the net effect is that we can feel a bit sad.

What we need to do is check our portfolio less often, especially for medium and large portfolios. Let me explain why…

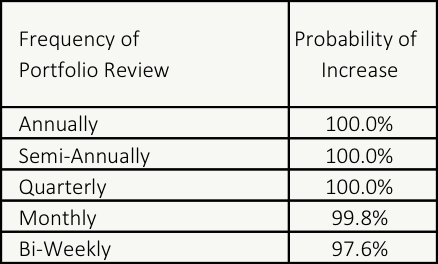

Smaller Portfolios: Check Bi-Weekly or Monthly

For smaller portfolios, bi-weekly or monthly contributions can greatly outweigh fluctuations in the stock market. This means that there is a very small chance that you’ll see your portfolio drop over 2-weeks or 1-month. Even a large loss in the stock market will be offset by regular contributions, the net effect is that your portfolio still gains, even in the short-term.

Imagine we had a portfolio of $10,000 and we were contributing $500 bi-weekly. That contribution means that every 2-weeks the portfolio gains by 5% just from contributions! Because of those large contributions we pretty much have a 100% chance of seeing the portfolio gain over a 1-month period. The only exception would be if we’re checking on a bi-weekly basis, but even then, we have a 98% chance of seeing the portfolio gain over 2-weeks.

So, if you’re just starting to invest, and you’re motivated by seeing your investment portfolio gain, then by all means check as often as you like, there is very little chance of seeing your portfolio decline.

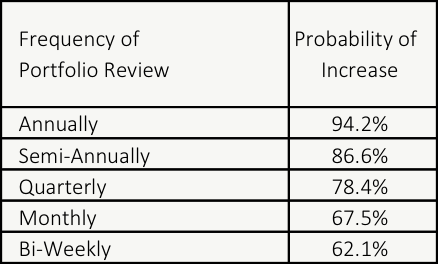

Mid-Size Portfolios: Check Quarterly or Semi-Annually

When it comes to mid- size portfolios, contributions are much less impactful. More and more of the annual gain comes from the portfolio itself. This also means that fluctuations from day to day and week to week are becoming very large.

A $500 bi-weekly contribution is only 0.5% of a $100,000 portfolio. Even a small 1% decline in the stock market can wipe out a bi-weekly contribution!

That’s why with mid-size portfolios, it’s better to check less often. Checking once per quarter or once every 6-months will help an investor avoid a lot of those small fluctuations. By checking quarterly or semi-annually an investor will have a much higher chance of seeing their portfolio gain (and a much higher chance of avoiding all those negative investor behaviors).

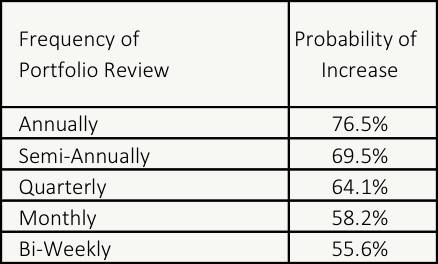

Large Portfolios: Check Annually

Large portfolios experience huge swings week to week. It’s possible for a large portfolio to increase or decrease more than an investors annual salary. Investment contributions are just a small fraction of portfolio value.

When you have a large portfolio, checking too often means that you’re very likely to see your portfolio decline. Checking on a bi-weekly basis means you may only see your portfolio gain about 55.6% of the time, the other 44.4% of the time you could see your portfolio decrease, sometimes by a large amount! That doesn’t feel very good!

When your portfolio is large, you want to check it just once per year. With a well-diversified portfolio, checking annually to rebalance your portfolio is more than enough. Ideally that annual review should happen at the same time each year. By checking annually it’s more likely that you’ll see your portfolio gain, although 1 out of 4 times you still might see a loss.

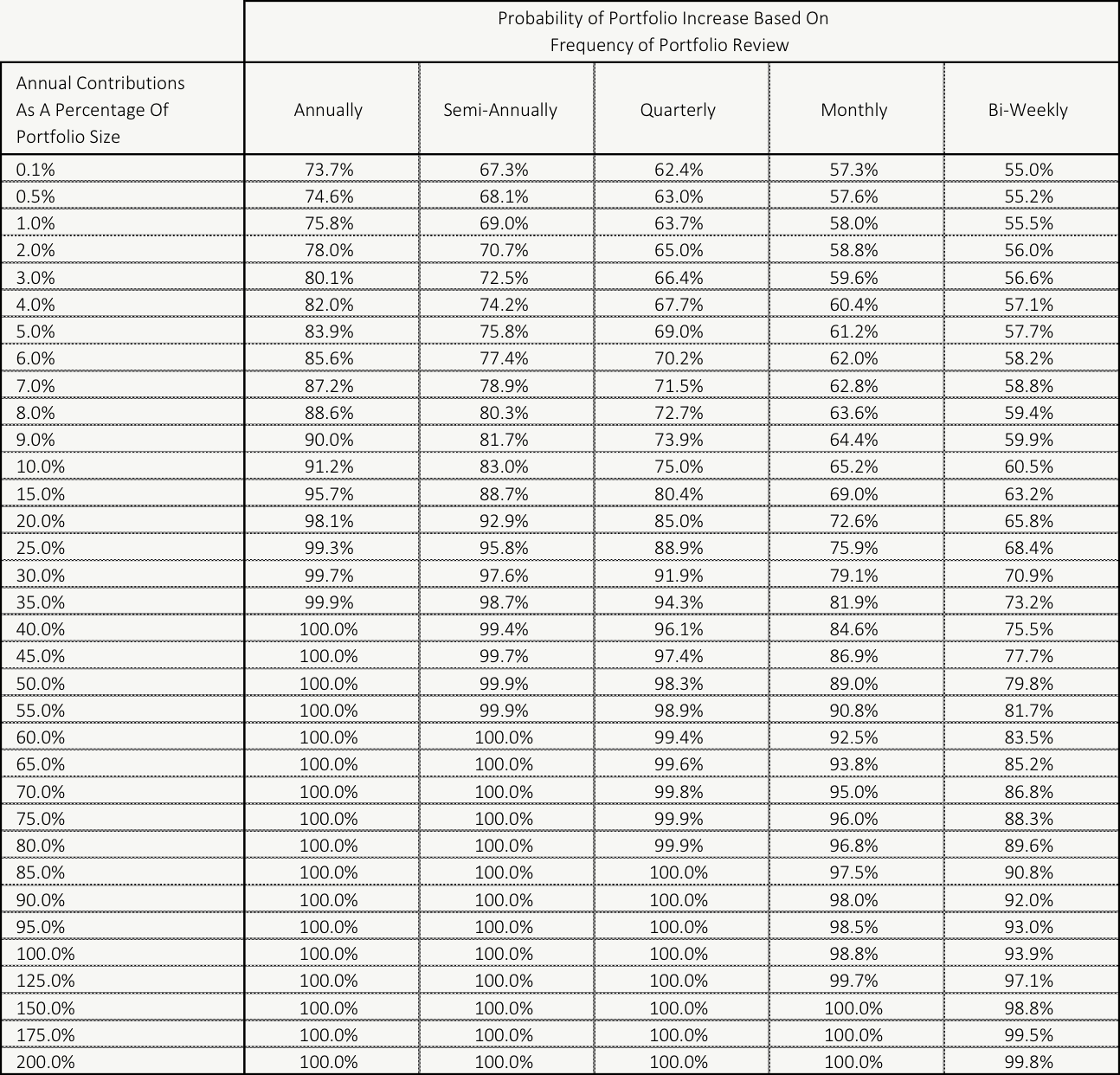

What Really Matters Are Annual Contributions Relative To Portfolio Size

Although we’ve been talking about portfolio size, what really matters is the relative size of your annual contribution’s vs your portfolio size.

If your annual contributions are $100 vs a portfolio of $10,000 then you’re going to see the same fluctuations as someone who has annual contributions of $10,000 vs a portfolio of $1,000,000. In both cases the relative size of annual contributions vs the portfolio is 1%.

We can calculate the probability of seeing a portfolio gain for lots of different relative portfolio sizes. In each case, we’re looking at the relative size of annual contributions vs the portfolio. The probability is the chance that we’ll see the portfolio gain over that time period.

As an example, if your annual contributions represent approximately 5% of your portfolio value and you check your portfolio quarterly you could expect to see your portfolio gain about 69% of the time.

Disclaimer: This analysis is an example only and shouldn’t be used to make investment decisions for your specific portfolio. It’s based on a highly diversified, low cost, CCP style portfolio with an allocation of 90% stocks and 10% bonds. Average return and standard deviation were calculated annually. Different portfolios will have different levels of return and standard deviation (a measure of risk).

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

How do you avoid looking at your portfolio if you are making regular contributions? I usually contribute every one or two months, and I’m not sure how purchase more ETF shares *without* seeing my overall balance since it is so prominent on the website.

Hi David! Thanks for the comment! This is one area where robo-advisors and low-cost mutual funds (like the e-series) have an advantage. Its extremely easy to set up a preauthorized purchase plan (PPP) or systematic investment plan (SIP). By automating a well diversified portfolio there is no need to sign in on a regular basis.

But if you want to go with a low-cost ETF portfolio there is still one option available.

Some ETFs allow pre-authorized cash contributions (PACCs) to be set up. This takes a specific amount from your checking account each month/quarter/year and invests it in the ETF you specify. Because you can only buy full ETF units this may leave a small remainder of cash, but between an EFT DRIP and ETF PACC this will automate of the majority of purchases. Then you can log in every 6-12 months to invest the remainder and rebalance your portfolio if necessary.