Breaking Up With An Investment Advisor Is Hard To Do

Over the last few years the number of low-cost investment options has exploded in Canada. There are new and easy ways to create a low-cost, diversified portfolio, that isn’t dragged down by high investment fees.

There were always low-cost, do it yourself options, but they required a fair amount of manual work to make contributions, invest those contributions, and rebalance periodically (and let’s not forget, the stress of keeping yourself on course during a correction or recession).

But now there are new options available. In addition to a low-cost ETF portfolio or a low-cost mutual fund portfolio, there are options like low-cost “all-in-one” ETFs and low-cost robo-advisors.

These new options provide investors with new ways to invest in a low-cost portfolio without necessarily doing all the work themselves.

This has understandably put a lot of pressure on investment advisors who have historically charged extremely high fees on the investment products they sell.

The average investment fee on a mutual fund portfolio in Canada is around 2.3%. This can cause an enormous amount of drag on an investment portfolio. A $1,000,000 investment portfolio would experience a $23,000 annual drag from investment fees! That has a direct impact on how much retirement income you can create from your investment portfolio.

But switching from a high-priced mutual fund portfolio can be hard to do.

Even with the high fees, traditional investment options continue to dominate the investing landscape in Canada, but things are starting to change. ETFs are now outselling mutual funds. More money is now flowing into ETFs than into mutual funds (bear in mind that you can also have high-priced ETFs, and low cost mutual funds, so this isn’t necessarily the best indicator).

But… if these low-cost investment options have been around for a while, why the slow change? Why aren’t more people switching?

There are three main risks people face when making a change of this kind, financial risk, emotional risk, and social risk. These risks can be difficult to overcome. Let’s understand each one and why they make breaking up with an investment advisor hard to do…

Emotional Risks

Emotional risk is the fear of the unknown. Many people have been investing with mutual funds for 20-30+ years. There is a lot of familiarity with mutual funds, how they work, what to expect, and the level of returns they provide.

High-priced mutual funds also benefit from momentum. They’ve been the investment choice for decades. Accounts are set up, investment contributions happen automatically, rebalancing is done for you in many cases. They produce ok returns, so why “rock the boat” and make a change?

This emotional risk can be difficult to overcome. Low-cost investment options typically don’t involve an advisor, so it’s up to the individual investor to make themselves aware of the benefits and downsides of these new options. This creates a lot of fear and can keep many people from switching.

One way to overcome this risk is to try a new investment option along side your existing portfolio. Rather than switching your portfolio over all at once, you can start by making new contributions to a new investment account with a new investment option. This allows you to get comfortable with a new investment option before making a full change. This type of “hybrid” approach is a great option for those with larger portfolios.

Social Risks

Social risk comes from the fact that we often share a close relationship with our investment advisors, they could be friends, or part of the same social circles, or have a long history of advice and support.

Breaking up with an investment advisor can create a lot of stress. It can be incredibly difficult to separate the business side of investing with the social side. This mixed relationship creates a very difficult conversation, a conversation that many people wish to avoid.

The result of this social risk is that many investors choose to delay or avoid this conversation and continue to pay higher investment fees as a result.

One way to reduce this risk is to speak with the fund company directly. Call the customer service center and ask if there are any Deferred Sales Charges (DSCs) or other fees before making a change. The other benefit of switching to a new investment option is that this move is often initiated by the new financial institution. The new financial institution will help manage the transfer of funds. This can help avoid a direct conversation with an old investment advisor.

Financial Risks

Switching to a low-cost investment option can also have financial risks. For example, non-registered assets could have sizable capital gains. Moving these to a low-cost investment option would mean triggering these capital gains and potentially a large tax liability.

Without understanding the implication of these decisions there could be a large risk of triggering capital gains at the wrong time, incurring additional taxes and/or triggering government benefit clawbacks.

On the positive side, switching to a low-cost investment option is much easier in a tax advantaged account like a TFSA or RRSP. Inside these accounts there is no concern about triggering capital gains.

One way to overcome this risk is to start by moving TFSAs and RRSPs to a lower cost investment option and then moving over non-registered accounts in a strategic way. This could be done over a few years to spread out capital gains, or this could be done during a “dip” in investment values when the capital gain has temporarily been reduced. But be aware that a switch to a new investment account can often take 4-8 weeks, so there is a timing risk if investments are sold and transferred in cash.

Financial Benefits

Offsetting all these risks is one large benefit. The benefit of a low-cost investment portfolio is that investments are able to grow faster without the annual drag of high investment fees.

As we already mentioned above, a retirement portfolio with $1,000,000 in investment assets would experience an annual drag of $23,000 if invested in a typical mutual fund portfolio.

But what I find more important is what this means in retirement. A high-priced investment portfolio has a much higher chance of running out of money in the future. The real risk of a high-priced investment portfolio is that you may need to spend less in retirement and/or risk running out of money.

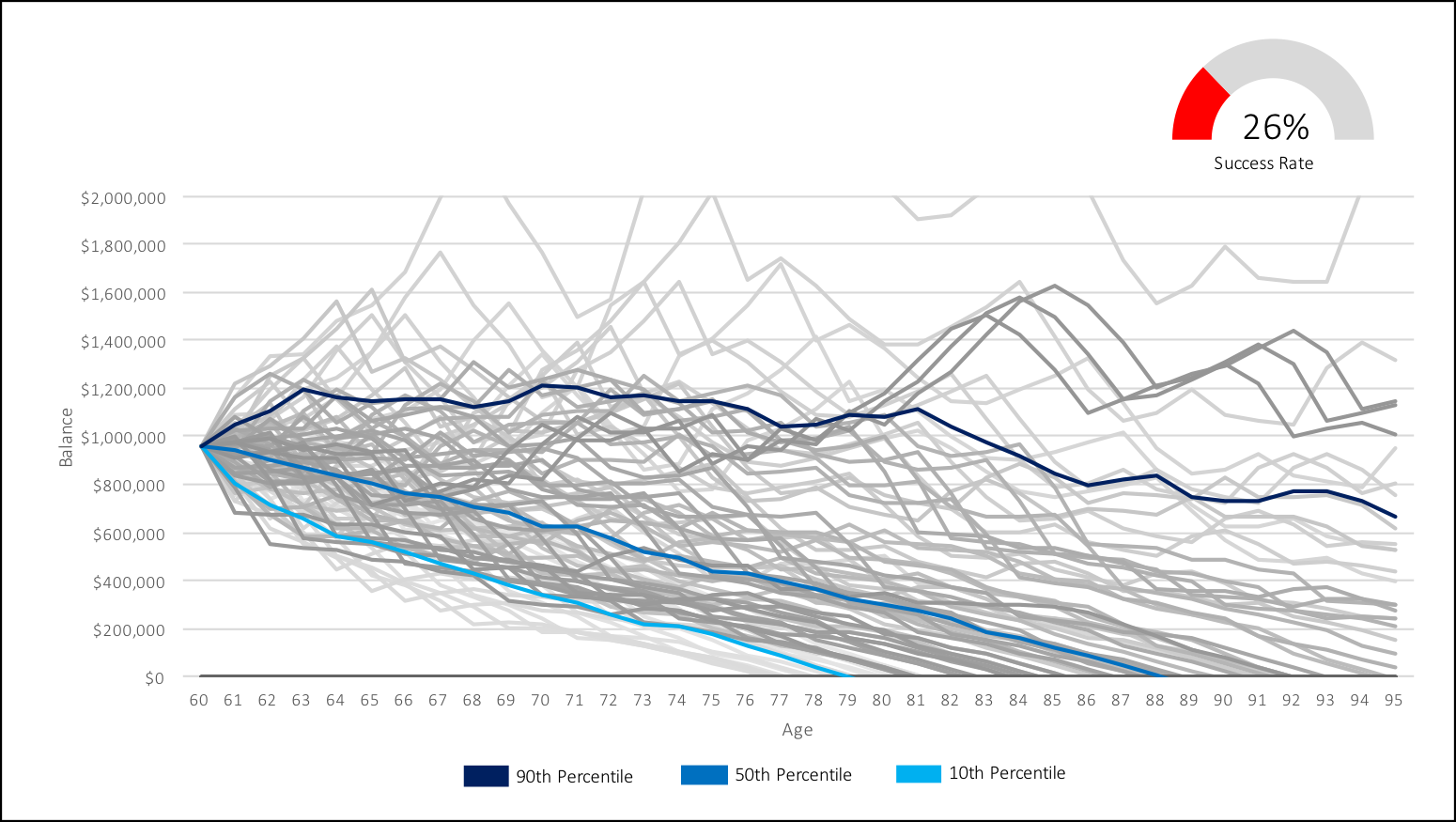

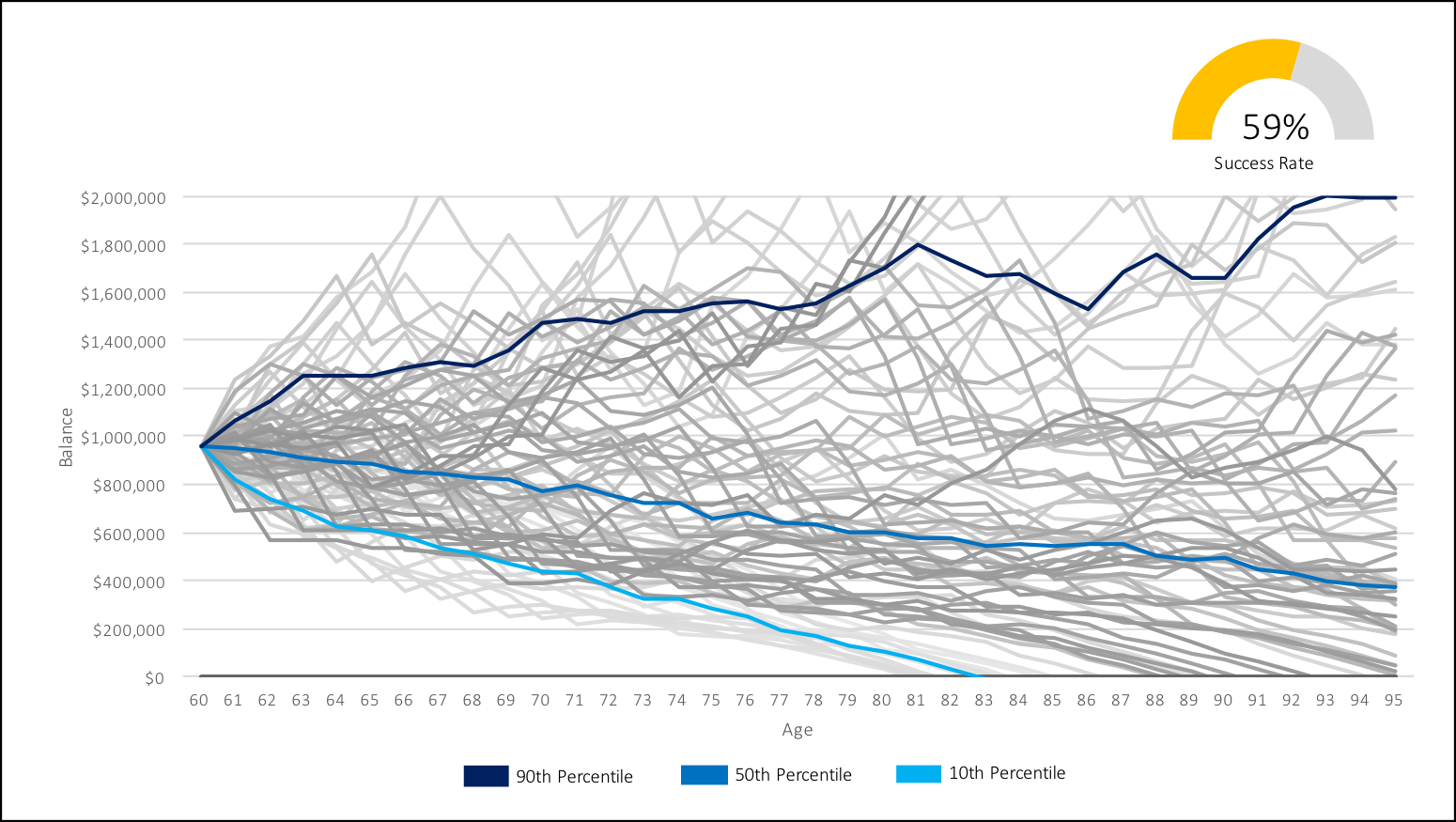

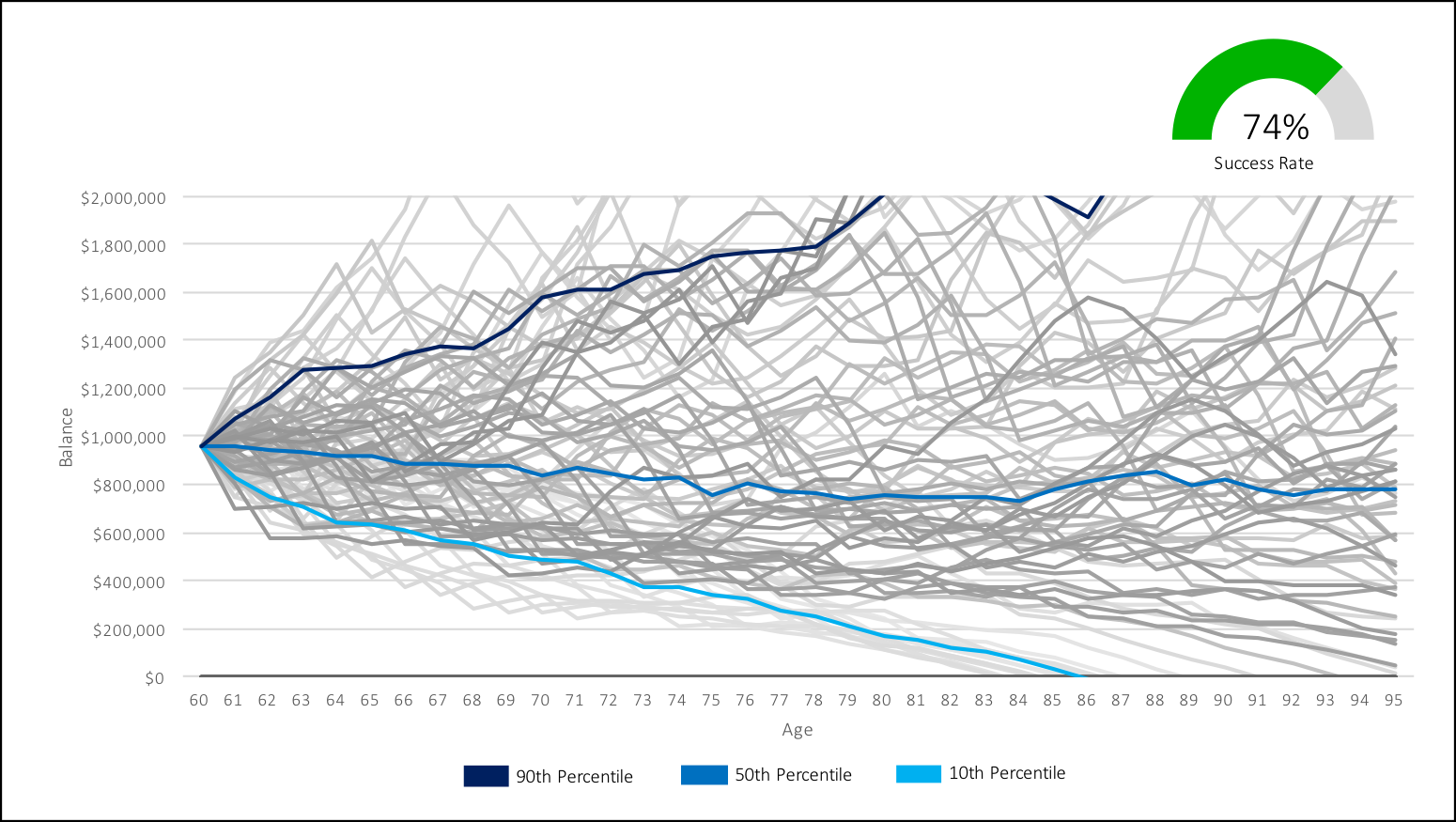

Below we’ve modeled out how investment fees increase the risk of running out of money. In each case, we start with a $1,000,000 retirement portfolio and this portfolio is invested with a balanced risk profile. We draw $40,000 per year for retirement spending. The only difference is the drag from the annual investment fees.

In the first case, we have a typical high-priced investment portfolio at 2.3% annual fee.

In the second case, we have a typical robo-advisor portfolio at 0.76% annual fee.

In the third case, we have a typical low-cost ETF portfolio at 0.16% annual fee.

Each line in the chart below shows how our investment portfolio would fare during one historical period. It’s like we took our investment portfolio back in time to 1900, 1901, 1902… 1929, 1930… 1950, 1951 etc etc.

What amazes me is how likely it is that that the high-priced investment portfolio will run out of money before age 100, nearly three quarters of the time these retirees would end up with an investment balance of $0 before age 100.

That’s the real risk of a high-priced investment portfolio. And that’s why everyone with an investment advisor should understand the fees they’re being charged relative to the value they’re receiving.

Breaking up with an investment advisor may be hard to do, there may be emotional, social and financial risks, but paying fees of 2.3% per year also comes with risks, like the risk of running out of money in retirement. If you’re currently in a high-priced mutual fund portfolio, read about some of the different investment options that you may want to consider.

Success Rate Analysis

High-priced investment portfolio with 2.3% annual fee.

Success Rate Analysis

Robo-advisor portfolio with 0.76% annual fee.

Success Rate Analysis

Low-cost ETF portfolio with 0.16% annual fee.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments