4 Common Mistakes When Investing With ETFs

Investing with ETFs has become commonplace over the last 5-10 years, and with good reason, investing with ETFs can provide an easy, low-cost, highly diversified way to create an investment portfolio. But with all the attention ETFs have been getting, it’s understandable that mistakes are being made when self-directed investors are implementing their ETF portfolios.

As an advice-only financial planner, we work with a lot of self-directed investors who want to create a more detailed financial plan. We see a lot of investment portfolios, some of which are excellent, and some with opportunities to improve.

ETF investing has become popular thanks to personal finance bloggers like Canadian Couch Potato. By copying a simple 3-4 fund Canadian Couch Potato portfolio, it’s easy to create a simple, low-cost, and highly diversified investment portfolio.

This low-cost index investing approach is typically what people are referring to when they talk about ETF investing. The issue is that this nuance/detail is often not mentioned or glossed over when ETFs are discussed in the media/newspapers/online forums etc.

The result is that there are many self-directed investors who are keen to use ETFs but are making “mistakes” that could increase their investment fees, decrease their level of diversification, increase their level of risk, or decrease their long-term returns.

Mistakes is in quotations because these are only mistakes when compared to a simple 3-4 fund portfolio (or an even simpler all-in-one portfolio). Some investors may not think these are mistakes at all, but I would challenge any self-directed investor to watch out for the mistakes below, and carefully consider if they may be making some or perhaps all these mistakes when creating an investment portfolio.

ETF Investing Mistake #1: Holding Five Or More ETFs

One common mistake when investing with ETFs is holding a handful of ETFs. To create a well-diversified ETF portfolio requires 3-4 ETFs at most. When a portfolio consists of 6, 8, 10, 12+ ETFs that is a good indication that there is room for improvement.

A simple investment portfolio is easier to manage. A simple investment portfolio also reduces the chance for behavioral investment mistakes. Holding too many ETFs makes the portfolio harder to manage.

The more complex a portfolio the easier it is to make emotional investment decisions and get off track.

When creating low-cost index ETF portfolio, 3-4 ETFs should be enough, or even better, consider using an “all-in-one” ETF to make things even easier.

ETF Investing Mistake #2: Using Sector Specific ETFs

Using sector specific ETFs is another common mistake when investing with ETFs. For the average investor there isn’t much need for a sector specific ETF.

Investing specifically in one sector isn’t in line with a low-cost indexing approach. Sector specific ETFs are typically higher fee and less diversified. Investing in a sector specific ETFs is more speculative than investing in a broad-based index ETFs.

If you’re portfolio contains sector specific ETFs, it’s important to recognize that these ETFs are more speculative in nature. As a best practice we recommend keeping speculative investments to less than 5% of the overall portfolio.

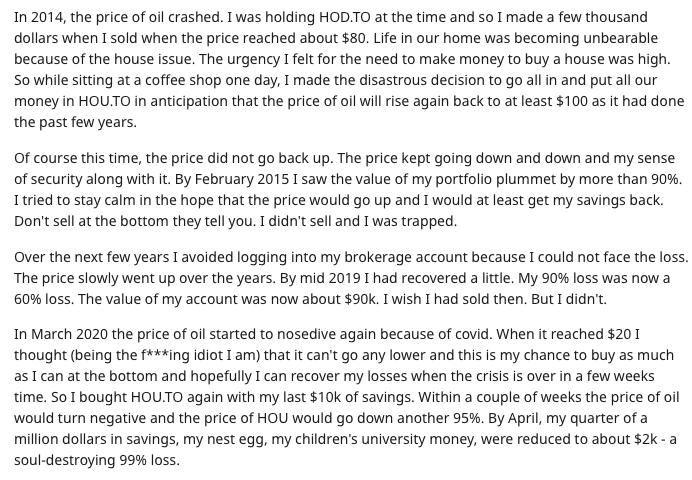

ETF Investing Mistake #3: Using Leveraged ETFs

Leveraged ETFs are NOT for the average investor. Leveraged ETFs amplify the gains and losses of the underlying investments they track. For example, a triple leveraged ETF will turn a 10% loss on the underlying investment into a 30% loss on the leveraged ETF.

Investors holding leveraged ETFs should have an extremely good reason for holding these investments and should strongly consider the additional risk involved.

This Reddit post provides a cautionary tale of the damage leveraged ETFs can have on a portfolio…

ETF Investing Mistake #4: ETFs With Duplicate Holdings

When holding more than 3-4 ETFs, or when holding sector specific ETFs, there is a large risk of duplication. This duplication of the underlying investments may be on purpose, or may be accidental, but it’s often a mistake to duplicate investments using multiple ETFs.

Holding ETFs with similar or the same underlying investments will amplify gains and losses within these investments. For example, holding both a Canadian ETF and an ETF focused on the Canadian banking sector will lead to a lot of duplication.

As another example, holding two Canadian ETFs, one Canadian index ETF, and one Canadian dividend ETF, will again lead to a lot of duplication.

This duplication adds extra complication, higher investment concentration, less diversification and higher risk.

Common Mistakes When Investing With ETFs

Investing with ETFs can provide an easy, low-cost, highly diversified way to create an investment portfolio. But with so many ETFs available it’s understandable that mistakes are being made when investors are implementing their ETF portfolios.

By using a simple 3-4 fund ETF portfolio, it’s easy to create a simple, low-cost, but highly diversified investment portfolio.

This low-cost index investing approach is ideal, but many investors are making “mistakes” which could increase their investment fees, decrease their level of diversification, increase their level of risk, or decrease their long-term returns.

The good news is that in an RRSP or a TFSA, getting back on track is easy. Investments can be sold and reallocated without concern for capital gains tax. This means that an investor can get back on track with their investment plan quickly (don’t have an investment plan, here’s the key components). But for investors using non-registered accounts, there are additional tax considerations that may impact when investments are sold and reallocated.

Either way, if you’re making any of the common mistakes above, it’s a good idea to get back on track as soon as possible.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments