Have We Reached Peak Housing Demand?

How To Manage Real Estate Risk

Demographic trends can be extremely interesting. Demographic trends can influence a lot of things, they can impact voting and public policy, they can impact consumer trends, they can impact the consumption of goods and services.

The interesting thing about demographic trends is that they’re (somewhat) predictable. The way our population looks today will directly translate to how it looks in the future. Factors like immigration and advances in health care can change these trends slightly, but in general, the way people age is fairly predictable.

What is interesting about demographics is that as people age they do things differently, their behavior changes, their lifestyle changes, they consume different things.

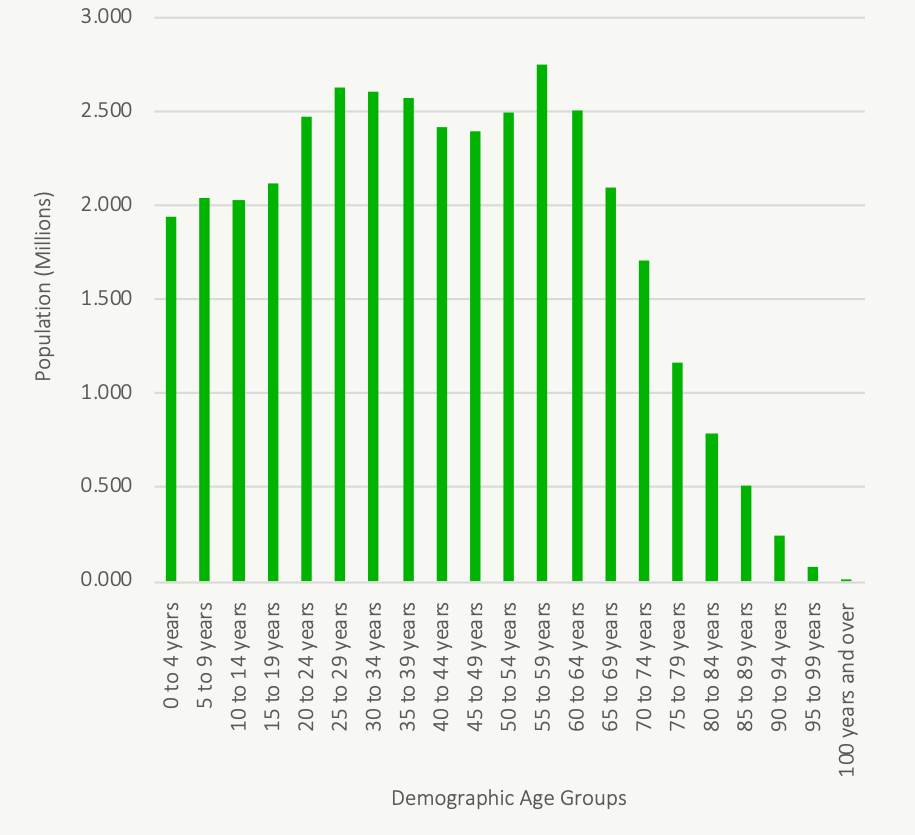

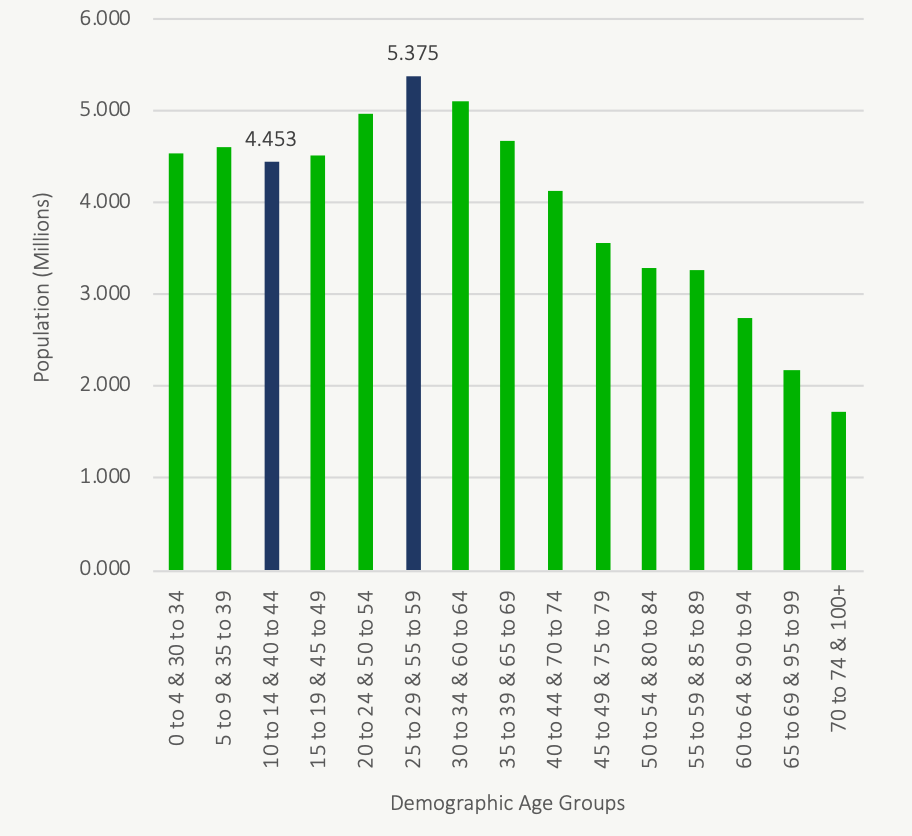

Over the last 60+ years there have been two huge demographic waves, the first was the “baby boomers” and the second was their “echo”. These two groups are very noticeable when looking at population by age group. Demographic charts clearly show two huge population waves with troughs in-between.

Now, I’d like to preface this post with the fact that I hate predictions and forecasts. In my opinion, a good financial plan shouldn’t rely on predictions or forecasts to be successful. A good financial plan will prepare for various future events and still have a high chance of success. It’s important to anticipate possible risks and how they may impact a financial plan.

Typically, when we talk about risk we talk about investment risk and inflation rate risk. A good plan will still be successful even with changing investment returns and changing inflation rates. But what about real estate values? What about housing?

For two groups of people, the variability in real estate values should be a big concern when doing a financial plan. One group is real estate investors, people with rental properties that make up a large % of their assets. The second group is future downsizers, people who have made downsizing to a smaller home a key part of their future financial plan.

For these two groups of people it’s important to understand that real estate growth rates can vary and this creates risk. Simply assuming inflation, or inflation + xx%, is not a great strategy.

In this post we’ll look at how demographics may impact future housing demand and why a good financial plan should be prepared for different rates of real estate appreciation.

Demographic Waves: The Boom and Echo

Demographics over the last 60+ years have been dominated by the boom and echo waves. These “waves” are clear peaks in the demographic charts (see below). They represent large increases in population that slowly permeate through time as people age.

The boom and echo are separated by a period of time. For simplicity we’re going to use 30-years from peak to peak but the reality is that the echo is more spread out. Still, from the chart below you can see the highest bars, the peak to peak, is about 30-years apart.

Between these two peaks we have a trough. The total population in this trough is quite a bit lower. At the lowest point the population for a given age range is about 12% below the peak. This isn’t a massive difference, especially when compared to the gyrations in the stock market, but when we’re talking about population it can be quite impactful.

The Impact of Demographics

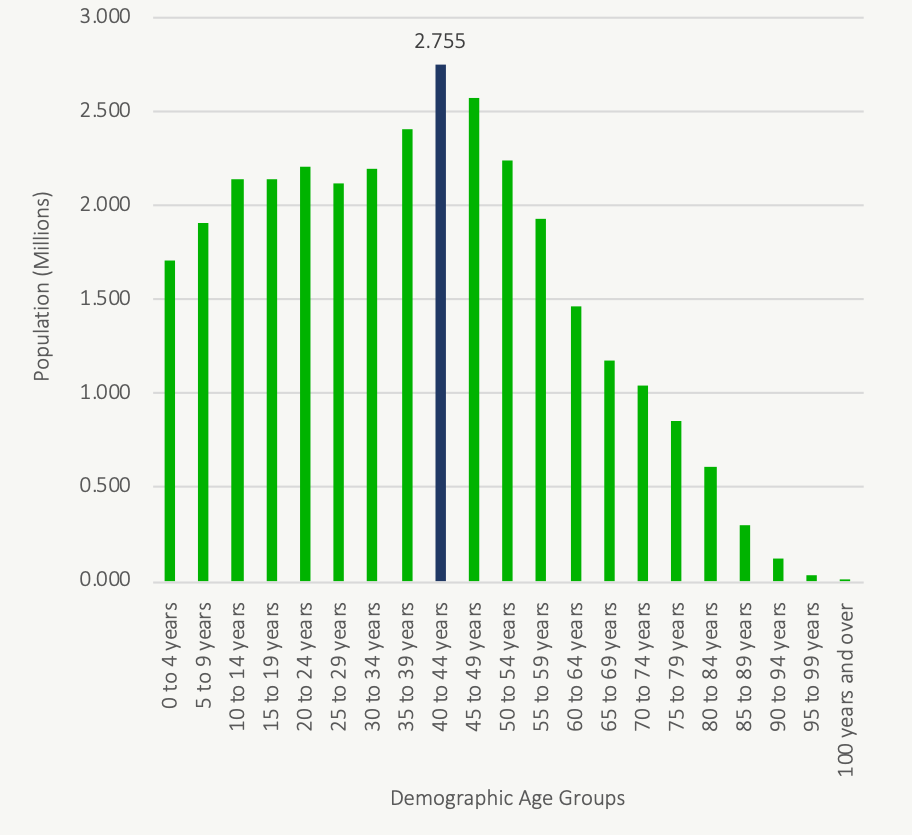

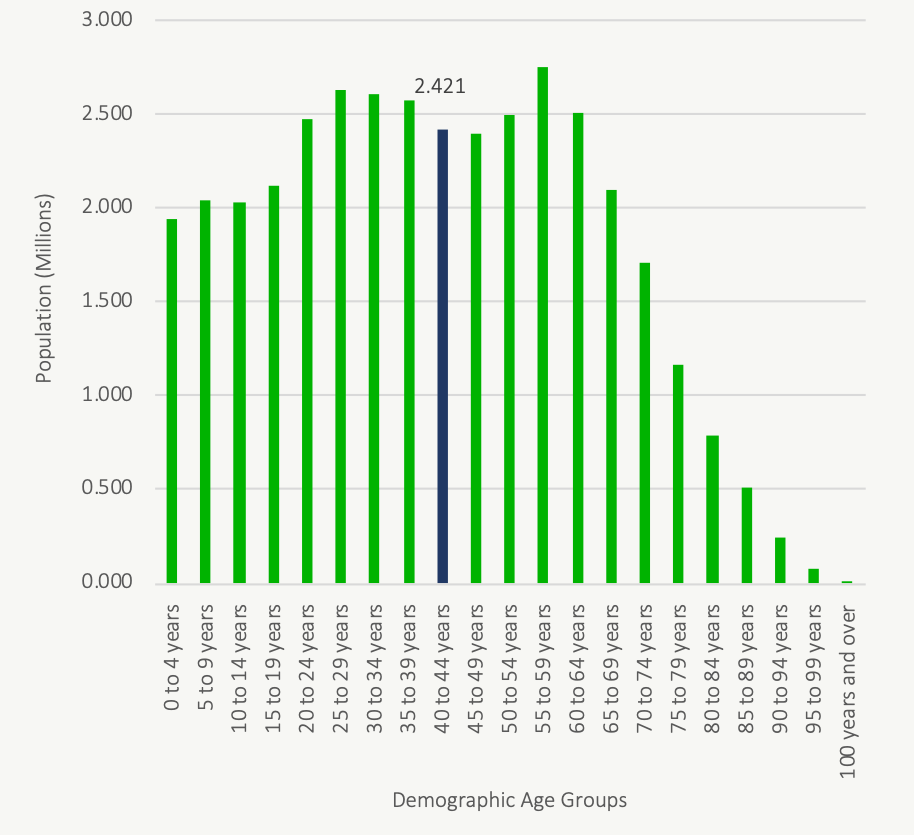

How impactful is this shift in demographics? Imagine we had a product that was only purchased by a certain age group and no one else, imagine that age group was the 40-45 age group.

If you were selling this product 15-years ago you would be thrilled. Your market segment would have been 2.755 million people. You would have just experienced a wave of growth as the “boom” entered your market niche. You’re selling your product like crazy and trying to keep up with demand.

But… if you look forward 15-years to today the trend looks pretty discouraging. The “boom” has moved on as they got older. Even with general population growth plus new immigration, your market segment, the 40-45 age group, has declined in population to 2.421 million. The market got about 12% smaller!

The compound annual growth rate over 15-years is -0.86% per year over that time. While other businesses were growing your business would be declining simply due to demographics!

Of course, in real life it’s not so simple. Products and services rarely typically target such a specific age group. Yet, the impact of demographics can still be very large.

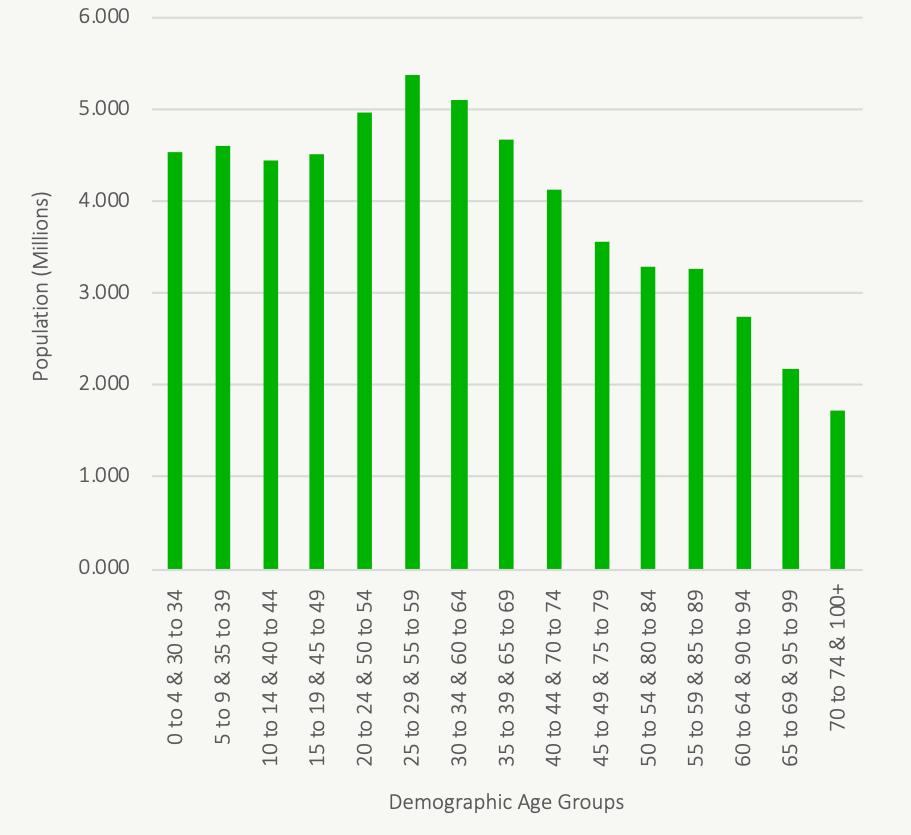

Combining The Boom And Echo

One interesting thing that’s happening right now is that we have two large groups of population who want to own a particular product at the same time, real estate. The “boom” isn’t ready to give up their real estate yet (and may even want to purchase more in the form of larger homes, cottages, and/or vacation homes) plus the “echo” wants to get into the market for the first time by purchasing family homes, starter homes, and condos. This duel effect creates a massive wave of real estate demand.

To keep things simple, we’ll assume a 30-year gap between boom and echo. We’ll combine these two age groups into one population. This will give us a better sense of how their combined behavior could impact markets in the future.

As we can see, the combined peak is in the 25-30 age range plus the 55-60 age range. The 25-30 age range is the time when a home purchase starts to become a priority with approximately half of people purchasing a home before age 30 and half after.

Have We Reached Peak Housing Demand?

This brings us back to the point of this post. Based on the chart, have we reached peak housing demand?

Like the simple example above, if we look at the next 15-years what is going to happen? The 25-30 & 55-60 age group is going to get a lot smaller.

If we use the current 10-15 & 40-45 age group as a proxy* for future population, then it looks like there could be a big decline in population as they get older and enter into the 25-30 & 55-60 age group.

Between peak and trough there are 922,000 less people. The decline in population is approximately 17% over 15-years. This is a compound annual growth rate of -1.25%.

When the “boom” and “echo” want to sell their real estate in the future, either to downsize, to free up capital from rental properties, or to sell their starter home/condo and move up into a larger home, there will seemingly be a lot less people who are willing to purchase those real estate assets (approximately 17% less!).

*This isn’t a perfect assumption because it ignores other factors like immigration and advances in health care.

Managing Real Estate Risk

For most people these demographic trends don’t matter much. For people who own a home, and their home is their only real estate asset, this 10-15 year trend isn’t as consequential. A home isn’t an investment and therefore the risk is smaller or non-existant.

However, for real estate investors and future downsizers, it’s important to manage real estate risk. For these two groups real estate is an important factor in their long-term financial plan.

Some of the clients we work with have rental properties as part of their long-term plan. Many of these rental properties are unfortunately cash flow negative or barely cash flow positive. These properties have done well over the last 5-15 years thanks to real estate appreciation but the current cap rate and cash-on-cash return for these rental properties is typically quite low. The return only improves if we consider future appreciation (and appreciation is a BIG factor due to the leverage on rental properties). But as we saw above, there are factors that can influence appreciation over time, and demographics are one of those factors.

If appreciation is the main source of real estate return, then we need to understand how a lower appreciation rate can impact a financial plan in the future. Even a 1% decrease in the appreciation rate can have a significant impact over time. For rental property owners or future downsizers, this is an important risk to understand and to manage.

Have We Reached Peak Housing Demand?

Have we reached peak housing demand? Who knows, I’m loathe to make predictions. But demographic trends could certainly soften the demand for real estate without changes to other factors like immigration, health care, or home ownership rates.

Because we have no idea what will happen in the future, real estate investors and future downsizers should be prepared for lower appreciation rates in their financial plan. Plan for the best but prepare for the worst.

Real estate investors and future downsizers should be asking how their plan looks with a lower growth rate? What happens if real estate appreciation is lower than inflation over the next 15-20 years? What happens if appreciation is zero and cash flow is low/negative?

Stress testing a financial plan is the only way to feel secure. Although demographics are easier to predict, there are still many other factors that could impact asset values in the future. If real estate assets are an important part of your plan, then it makes sense to stress test these growth rates to see how different scenarios perform and what risk level you’re truly comfortable with.

Our custom financial plans include up to three scenarios. If you’re a real estate investor or a future downsizer, this is a great way to test different factors and how they impact your financial plan. If you haven’t yet stress tested your financial plan then now might be a great time to make sure your plan is successful even with lower rates of return.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments