The Cost Of Raising A Child

Children are expensive. That’s something we can all appreciate. But just how expensive are they? What is the cost of raising a child? What is the cost of raising 2, 3, 4+ children?

For new parents, or soon-to-be parents, the cost of raising a child can be a real guessing game. As parents to two young children, my wife and I felt the same uncertainty when we started our family. We had to guess about how much it would cost and what kind of expenses we needed to anticipate.

We anticipated some costs, especially in the first few years, but we never took the time to look at the total cost of raising a child, we just didn’t know where to begin.

As many parents can attest to, raising a child is expensive. There are many costs when raising a child. From diapers to daycare, food to formula, the total cost of raising a child is shockingly large.

The estimated cost of raising a child in Canada is $203,550! Wow!

Plus, this estimate doesn’t even include educations savings like RESP contributions. Add in enough RESP contributions to max out the $7,200 government grant and you’re at a total cost of $239,550 to raise a child in Canada!!!

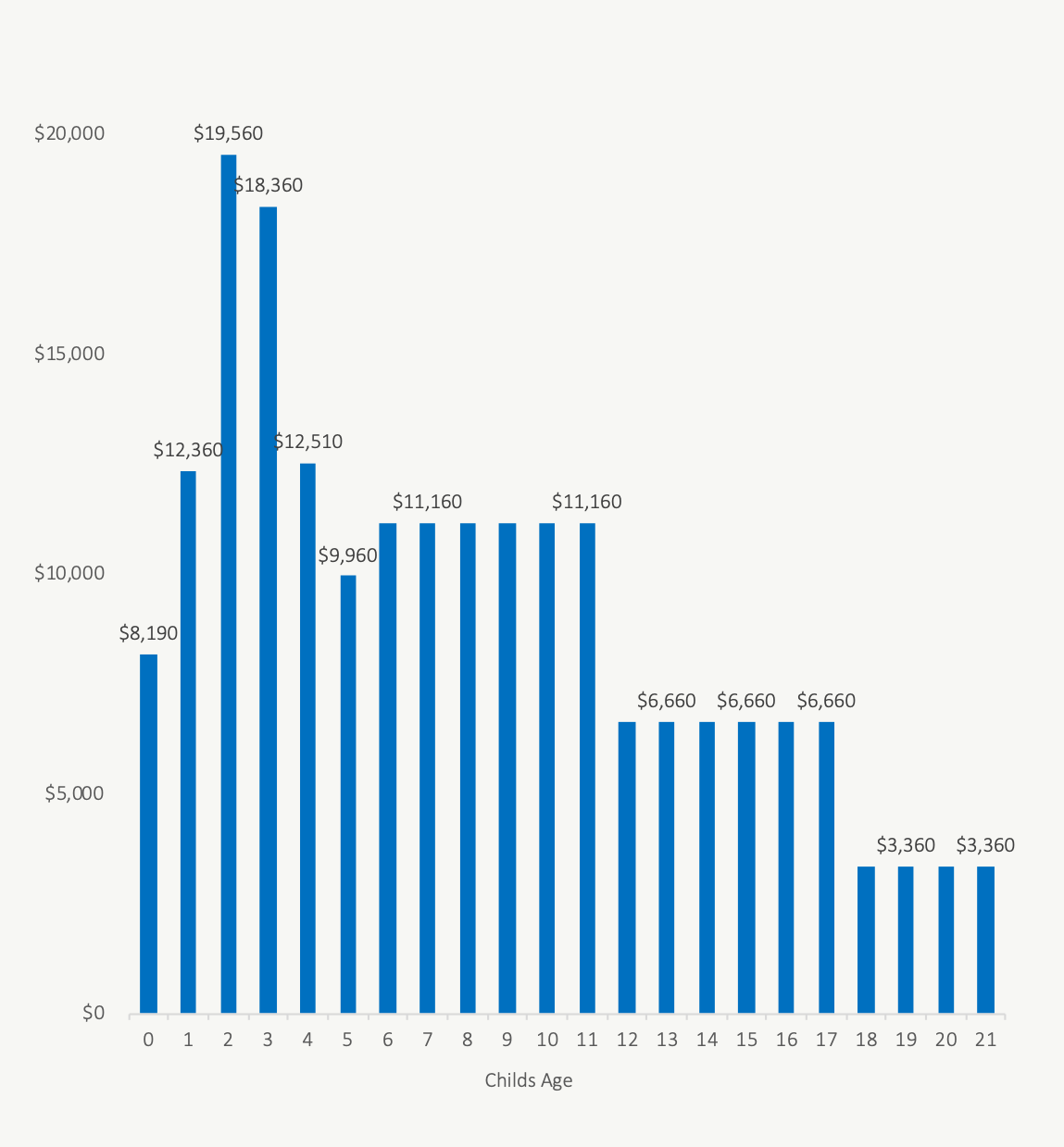

With each child costing nearly a quarter million dollars, anticipating these costs becomes a very important part of a financial plan. It’s also important to realize this this quarter million is very front loaded, with a lot of the cost coming in the early years. For new families this is important.

When building a plan, we want to anticipate these costs on a year-by-year basis, we want to understand when these expenses will occur, and we want to plan for possible cash flow issues down the road.

We also want to help new parents understand that there is a light at the end of the tunnel, because for parents with 1, 2, or 3+ young children, the cost of daycare and diapers can feel pretty overwhelming.

Lastly, we also want to anticipate government benefits and tax credits, both can help offset a large percentage of the cost of raising a child. This is an important part of a family plan and can be worth thousands of dollars per year, so we don’t want to ignore them.

Estimating The Cost Of Raising Children

To help estimate the cost of raising children we just launched a new tool on our financial planning platform. This tool helps new parents and soon-to-be parents anticipate the typical expenses when raising children. From diapers to daycare it can be helpful to have a framework to estimate the typical expenses a new parent may expect. Without this framework it becomes much harder to estimate how much to anticipate.

We break up the cost of raising children into two parts, one-time expenses that typically occur just once for each child. This could be car seats, beds/cribs, mattresses etc.

Then there are ongoing expenses that occur monthly. These monthly expenses may only occur over a certain period of time. For example, a family taking a full 18-month leave may only need to plan for daycare expenses from age 1.5 to age 4.5, when junior kindergarten begins. But other expenses may happen over a longer period of time, like food, clothing and activities.

We’ve created an estimate of these expenses using our financial planning platform to help new parents get a sense of what they could expect. Of course, everyone’s situation is different, a different city or personal situation could dramatically impact these estimates (both higher and lower).

With just a few reasonable estimates we quickly reach a total cost of $203,550 to raise a child in Canada. Here are our estimates by category…

Changing Costs Over Time

The unique thing about the raising children is that child expenses don’t remain consistent over time. Unlike a mortgage or car payment, which is predictable and consistent over time, the cost of raising children will change from year-to-year as the children get older.

This changing cost is important from a financial planning perspective because the cost is usually the highest in the beginning and then decreases as the children get older and enter public school (obviously not the case for those who choose private school).

Without seeing the big picture this high cost in the early years can feel overwhelming for a new parent. We want to plan for lower savings during those early years, but we also want to plan for higher savings as the cost of raising children begins to decline in later years.

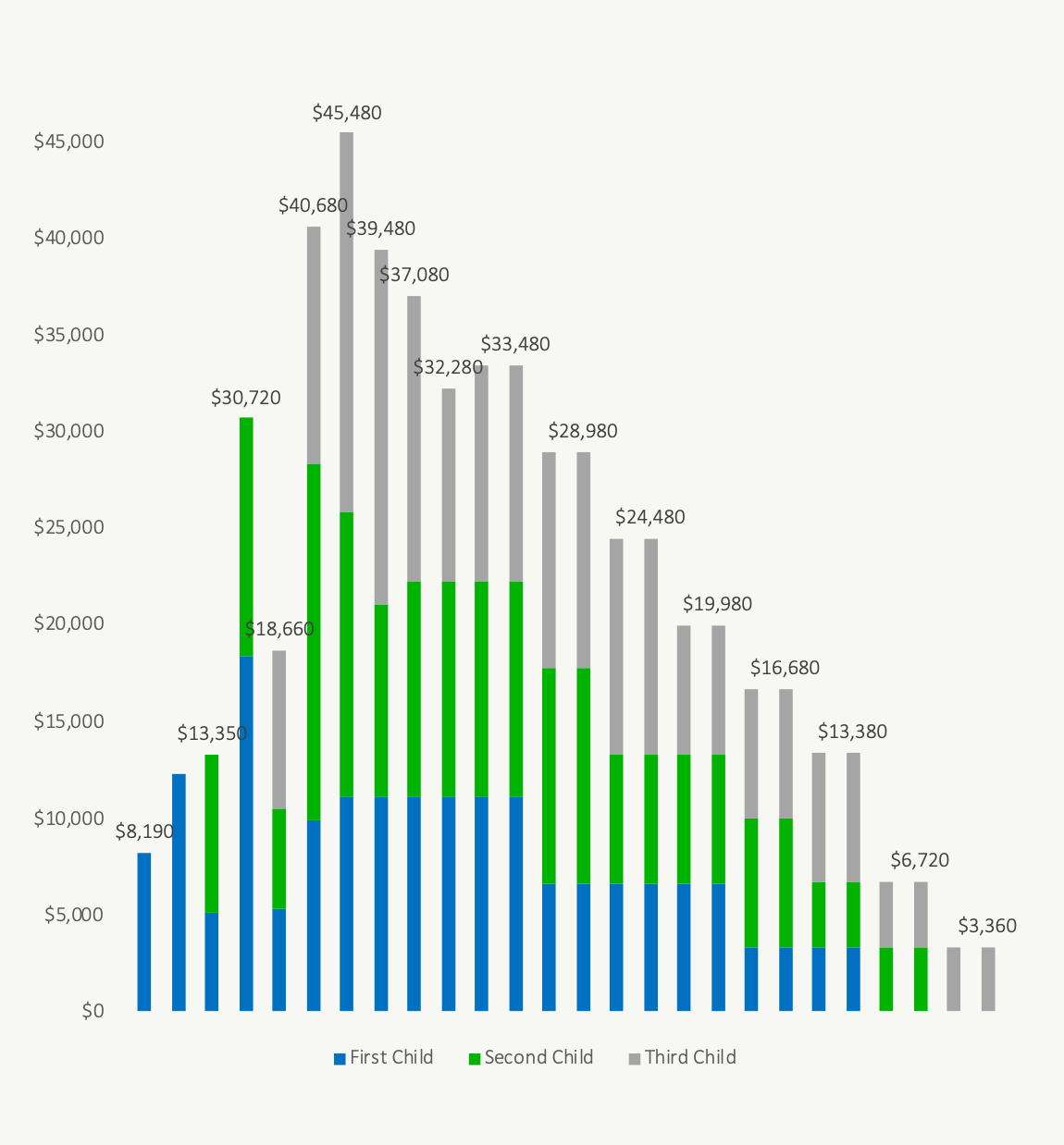

This is also important for families planning for 2,3 4+ children. The chart below reflects how a family with three children may expect the cost to change from year-to-year. We assume in this case that daycare costs are reduced during each parental leave.

Government Benefits and Tax Credits

Although the cost of raising a child can seem daunting, there is also help from government benefits and tax credits.

New parents will begin to receive the Canada Child Benefit once their children are born. This non-taxable benefit is one of the most generous government benefits in Canada. The exact amount is based on a family’s income, but even moderate and higher-income families will receive some benefit.

A family with two children under 6 years old, and a family income of $90,000 per year (around the median in Canada), could expect $7,320 per year in Canada Child Benefits (details on how we calculated that).

On top of the Canada Child Benefit there are also other benefits available. For lower and moderate income families there are GST/HST credits and provincial child benefits too.

There are also tax credits and subsidies available for child care costs. These can help decrease the cost of child care for a family.

Although the cost of raising a child is $203,550, many families will receive benefits and tax credits that will help reduce the net cost of raising a child to something much lower.

The Cost Of Raising A Child

The cost of raising a child can easily reach a quarter million dollars per child. This is a shockingly high amount for new parents to comprehend.

Understanding and planning for these costs is important part of any financial plan for a young family.

Although the cost of raising a child can seem overwhelming, it’s important for new parents to also anticipate government support as well. Most families will be eligible for the Canada Child Benefit as well as tax credits and subsidies for child care. This can dramatically lower the net cost of raising a child.

Life style decisions will also play a big role in how much it costs to raise a child. Many of these estimates will vary wildly from family to family based on their personal preferences and personal situation. Cloth diapers versus disposable, hand-me-downs from family members, buying new versus slightly used equipment, a grandparent who is able to care for young children etc etc.

Just because the typical family spends $203,550 to raise a child doesn’t necessarily mean that you need to spend the same amount. A bit of planning can help reduce this cost significantly.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments