How Much Money Will Flow Through Our Hands Over A Lifetime?

One amazing thing to consider about personal finances is the sheer amount of money that will flow through our hands over a lifetime.

Knowing how much money we’ll touch over a lifetime provides a very good incentive to get better at managing income and spending, to learn more about investing, to understand how income tax works etc. etc.

Given the amount of money we’ll handle over a lifetime, learning more about personal finances will pay dividends over many years. If you’re able to manage money well, then you’ll have a life that is free from financial stress (for the most part, it’s never possible to completely avoid financial stress).

Because of the sheer amount of money that will flow through our hands over a lifetime even a small positive change can have a significant effect.

So how much money will we “touch” over a lifetime… is it $500,000? $1,000,000? $2,000,000? $5,000,000? You might be surprised…

How Much Money Will We “Touch” Over A Lifetime?

The sheer amount of money we’ll “touch” over a lifetime is amazing to consider. On a weekly, bi-weekly, or monthly basis it can feel like a modest amount of money, but when we add it up over a lifetime the numbers become very large.

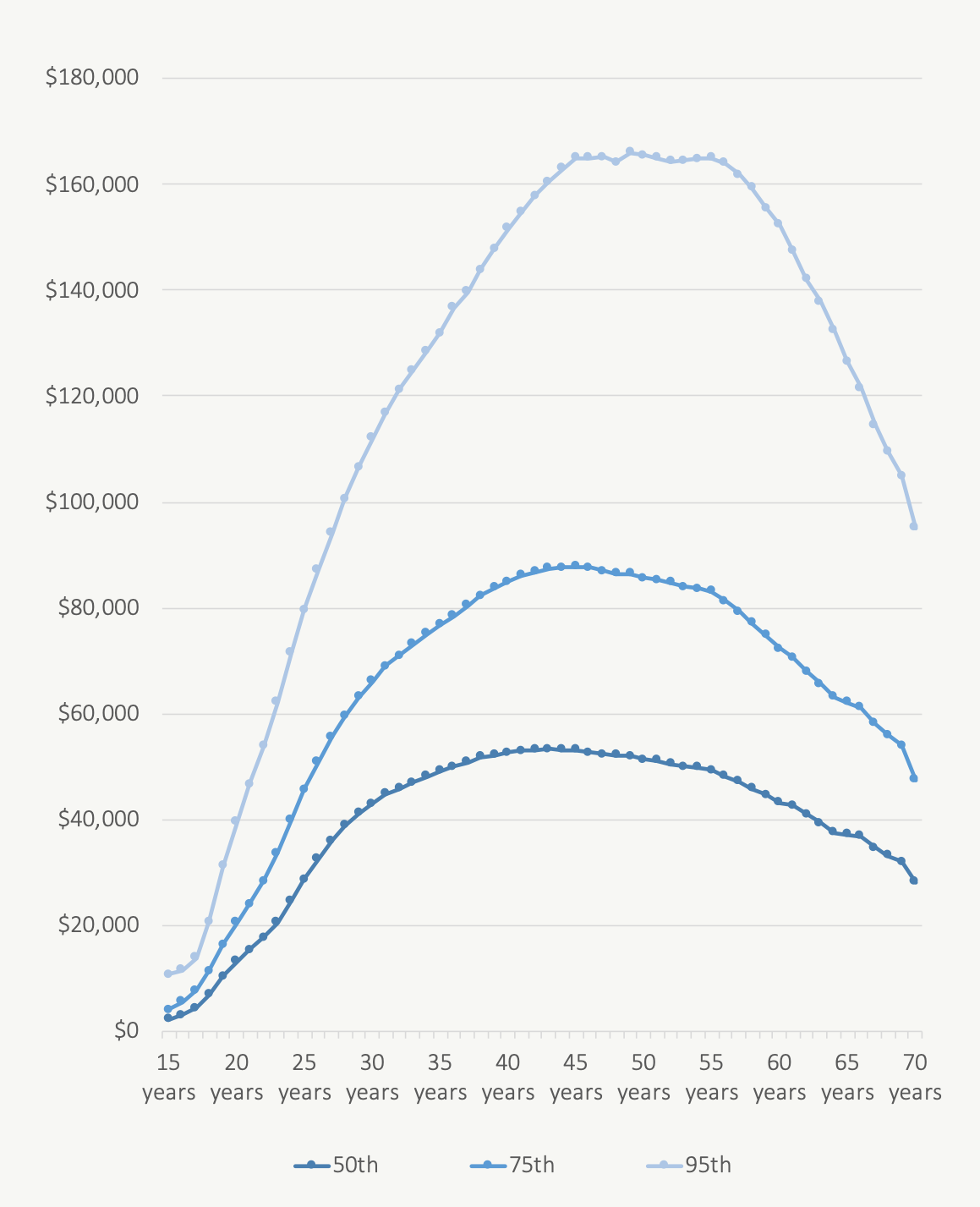

To help get a sense of how much money we’ll “touch” over a lifetime we’ll use the data from the 2016 census, adjusted for inflation. The chart below shows the 50th, 75th, and 95th percentiles for individual income. It shows how income changes as we age.

You’ll notice that income generally starts low but then quickly increases in our 20’s and 30’s, by age 40-45 income growth starts to slow, and by age 55 income begins to decline again. At the peak, someone in the 50th percentile will earn $53,299 per year, someone in the 75th percentile will earn $87,797 per year, and someone in the 95th percentile will earn $166,070 per year.

Over a lifetime these amounts begin to add up quickly. From the age of 15 to 70, an individual in the 50th percentile is expected to have a total income of $2,197,305, an individual in the 75th percentile is expected to have a total income of $3,586,683, and an individual in the 95th percentile is expected to have a total income of $6,761,582!

Creating A System To Manage Income And Spending

Based on the sheer amount of money we’ll “touch” over a lifetime it pays to have a good system to manage income and spending. Creating a strong routine can be quite helpful when managing $2 million to $6 million in income.

Managing income and spending using a system like the envelope digital method can make it easy to manage this large amount of money.

Setting up automated contributions to investment accounts can help create a strong investing habit and can help take advantage of dollar cost averaging.

Setting up regular checkpoints can help ensure that your finances remain on track (especially for couples).

Setting up just a few of these best practices can make it much easier to manage the millions of dollars that will flow through our hands over a lifetime.

Read more…

Keep Things Simple: Create A Routine For Your Finances

Managing Cash Flow Using The Digital Envelope Budget System

Couple Money: Managing Shared Finances In A Relationship

How To Manage Money… Made Easy

Small Changes Make A Big Difference

The benefit of having a strong system is that saving and investing even a small portion of earned income on a regular basis can dramatically improve your financial future.

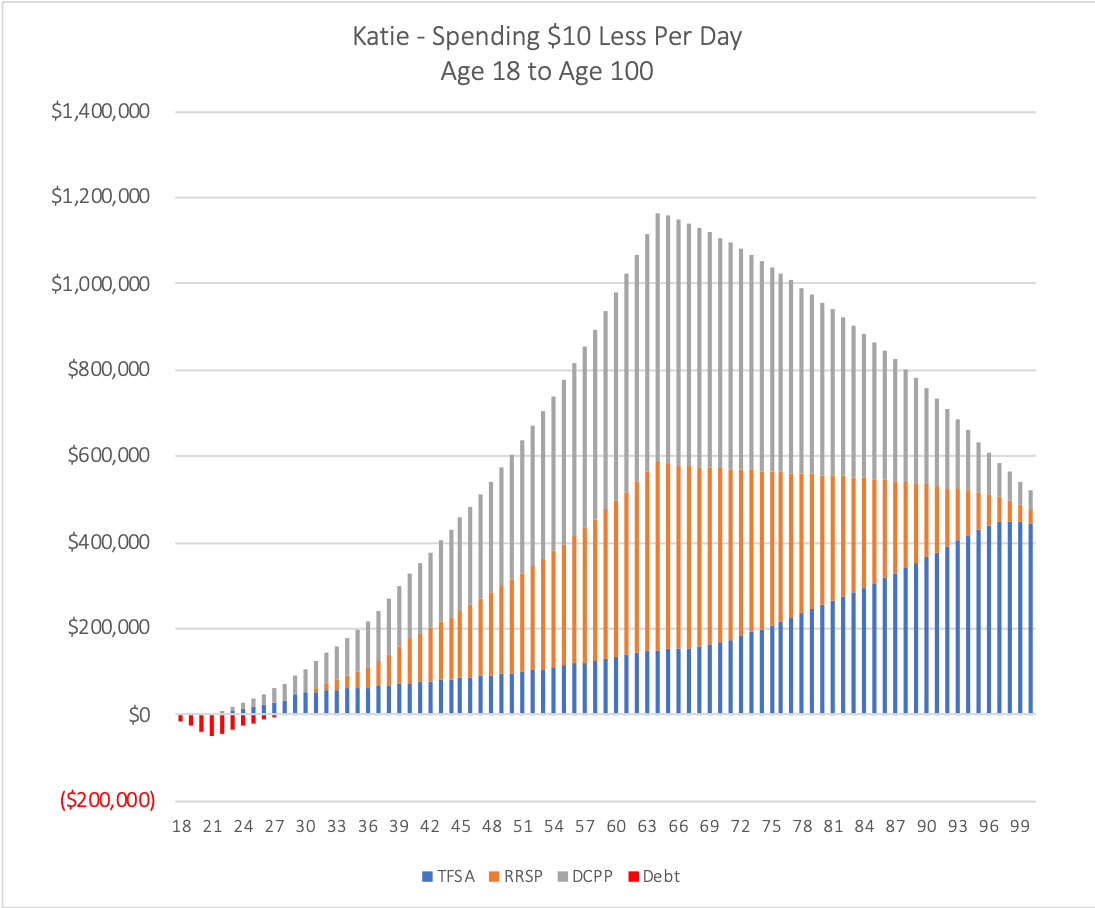

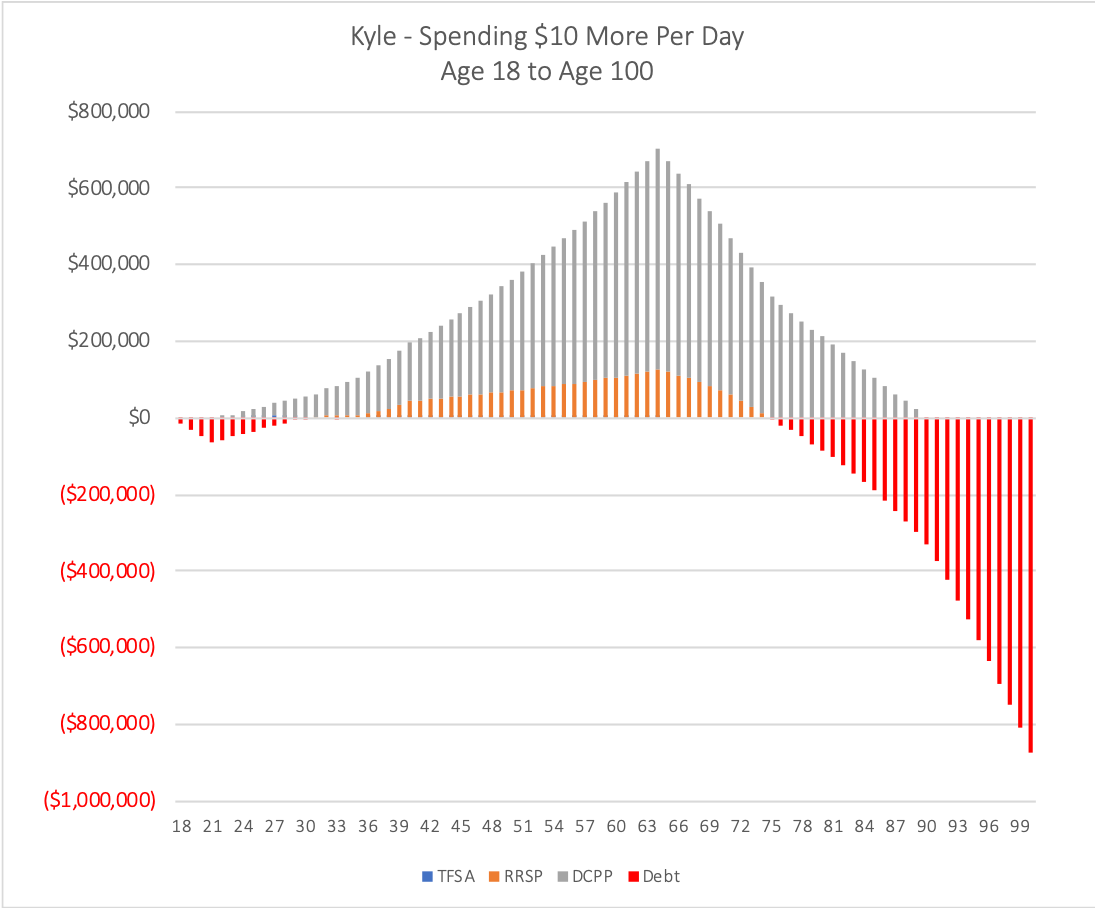

The difference that $10/day makes is staggering. Saving and investing just $10 extra per day can mean the difference between financial success and financial failure.

In a previous post we looked at two hypothetical friends, Katie, and Kyle, who’s only difference is that Katie saves an extra $10 per day over her lifetime. As you can imagine, Katie’s financial future looks great, while Kyle’s spending habit leads to trouble in the future.

Katie’s future…

Kyle’s future…

Based on how much money we touch over a lifetime this is understandable. It might seem like a small amount day-to-day, after all it’s quite easy to spend an extra $10, isn’t it? But that small amount adds up over time.

Given that the average person will touch over $2.2 million dollars over their lifetime, and a high-income earner will touch over $6.7 million, it pays to spend a bit of time creating a solid system to manage income and spending.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments