Do You Have An Emergency Budget?

You may have heard of an emergency fund, but have you ever heard of an emergency budget?

The fear of the unknown is very real. When it comes to personal finances, a little unexpected expense can cause a major issue. One small expense can lead to a snowball of high interest debt. An emergency fund can help avoid those issues. An emergency fund will help cover the cost of an unexpected expense. An emergency fund will help you worry less about the unknown and will provide a lot of peace of mind.

An emergency fund isn’t the only thing that can provide peace of mind though.

There are many things that you can do to help you worry less about the unknown and avoid financial problems that naturally come up from time to time.

On top of an emergency fund, one thing you can do is have a high savings rate. Having a high (+20%) savings rate will give you room breathe when something unexpected comes up. Another thing you can do is have more than one income stream. Having income from your job, plus investments, plus rentals/AirBnB, plus side gigs will help increase your financial flexibility.

Lastly, having an emergency budget will help you prepare for the unexpected and provide an enormous amount of peace of mind.

Watch The Video!

What Is An Emergency Budget?

An emergency budget is just like it sounds. It’s a second budget that you can use during an emergency. It’s basically your current budget with a 20% to 30% reduction in spending. It’s a “bare bones” type budget, it’s not sustainable in the long term, but it can help get you through emergencies like a job loss or illness, or if your emergency fund gets depleted quickly.

What is the benefit of an emergency budget?

By cutting your spending by 20% to 30%, an emergency budget can help you preserve cash during an emergency. It can also help you replenish your emergency fund faster after the emergency is over.

An emergency budget will also provide peace of mind. It’s nice knowing that if the worst should happen, you can survive on 20% to 30% less and that you already have a plan for how to do it.

Best of all, an emergency budget is something you prepare in advance, so if the worst should happen you don’t even need to think about what to do, you already have an emergency budget ready to go.

All this helps to reduce your financial stress now and if the worst should happen.

“An emergency budget can help you preserve cash during an emergency.”

Our Emergency Budget

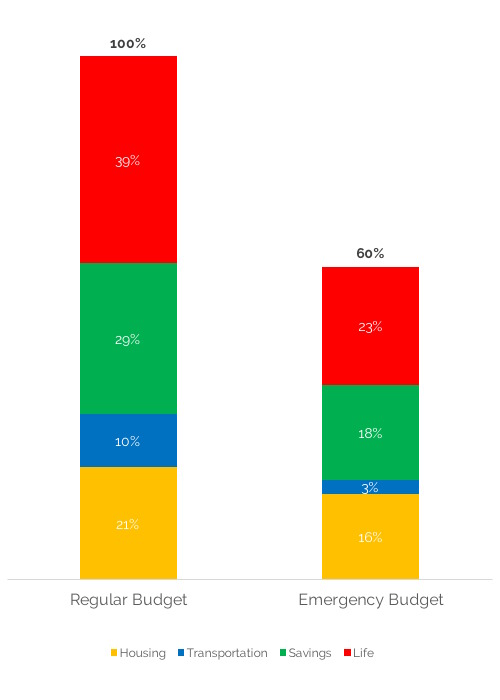

Our emergency budget is pretty simple. We can reduce our outgoing cash outflow by 10% to 40% depending on the severity of the emergency.

First, we stop all non-employer matched savings. We would try and keep employer matched retirement contributions intact to maximize employer matching because it’s essentially free money. Stopping all non-matched savings will help reduce our outgoing cash flow by about 10%. This includes savings for our children’s education. We wouldn’t cut these long term, but during an emergency we could reduce this outgoing cash flow and catch-up later when things are better.

Second, we would reduce our entertainment and travel money and look for no-spend alternatives. Depending on how large a reduction we wanted to make, this could reduce our cash outflow by another 5% to 10%.

Third, we budget for home repairs each month in our regular budget. If faced with an emergency like a job loss we would choose to delay or forgo most home maintenance projects for a short period of time. This wouldn’t be a sustainable reduction, on average people spend about 1% of their home value on maintenance/upgrades each year, but for a short period of time we could reduce our outgoing cash flow 5% by putting off home improvement projects. We could probably do this for a few years.

Fourth, we would reduce our food budget. We could probably cut our food budget by 10% with a few simple changes. If we were in a really difficult situation, like an extended job loss or sever disability, we would utilize local food banks to help reduce our outgoing cash flow. Remember, that’s what these programs are there for, so make sure to support your local food bank if you can. A 40% reduction in our food budget would let us reduce our outgoing cash flow by about 5%.

Lastly, in a dire emergency, we would look at going car-less. If we were faced with an extended emergency we could sell our car and use public transportation. We already bike and use public transit for many errands so going completely car-less would be doable but difficult. This could reduce our cash outflow by another 5-10% depending on how much we would use public transit.

New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

An Emergency Budget Gives You Options

At the most extreme, our emergency budget could reduce our outgoing cash flow by 40%. This would mean implementing all spending reductions in our emergency budget. This would help our emergency fund last almost twice as long but it would be difficult. This would be a drastic action and would only be something we consider in the most dire circumstances.

A less severe reduction would be in the 30% range. This would be easier to sustain for a period of time.

Just making some quick changes would help us reduce our outgoing cash flow by 10-20%. These are easier changes to make and would be our first step during any financial emergency.

Having these options feels great. These options are ready to go in case of any big emergency.

Going through a financial emergency is stressful enough. Having an emergency budget prepared in advance can help reduce that stress significantly. There are no decisions to be made. Just pull out your emergency budget and put it into action!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments