Eight Ways To Build An Emergency Fund Fast

Emergency funds are great. There are lots of reasons why you should have an emergency fund. Financial emergencies happen all the time. It could be an unexpected car repair, the deductible on your home insurance, or something really terrible, like dropping your iPhone and it shattering into a million pieces.

The common recommendation is to have between 3 and 6 months of living expenses in your e-fund (more if you have variable income or work in an industry known for layoffs).

But saving 3 to 6 months of expenses can seem daunting. Even saving up just one month of expenses in your emergency fund can take a very long time if you’re just making ends meet.

Don’t get discouraged, emergency funds are great, even small ones. Having just $100 in a savings account can make a huge difference.

If it seems like it’s taking forever to reach your e-fund goal, and you want to build your emergency fund faster, then try one, two, or all eight of these ideas to help boost your e-fund quickly.

1. Cut Expenses For A Few Months

Temporarily cutting expenses for a few months will help you save more money and boost your emergency fund. Look at your monthly spending and see what you can do without for a few months. Saving money on expenses can give your emergency fund a nice little boost.

If you’re not already doing so, start budgeting and tracking your spending. You’d be surprised by how much money you can save just by being more aware of your daily spending.

If you can cut your low value spending you might be able to reduce your spending and not even notice. When I first started budgeting I was amazed that I wasted $500+ per year on coffee (not even for social reasons, it was just me being lazy). Just by being more mindful of my spending I was able to cut $500 per year without feeling a thing.

2. Get A Second Job Or A Side Hustle

Having a second job can be exhausting but it can also be a great way to build an emergency fund quickly. Put all this extra income towards your emergency fund and it will grow much faster. Even a few months of part time work, or some other way to make money, can have a big impact on your emergency fund.

After 3-6 months you could be well on your way to a large emergency fund.

Watch The Video!

3. Sell Extra Stuff

Selling stuff is a quick way to raise some extra cash for your emergency fund. Take stock of all your stuff and look at what you don’t need anymore. Not only is this a good practice to help you pare down your extra possessions but you can raise a bunch of extra cash too.

We do a “clean-up” once per year and make between $100 and $1,000+ from Craigslist/Kijiji sales.

4. Move In With Family

This is a great option if you’ve just graduated. Moving back home might be the last thing on your mind, but it can be a great way to build an emergency fund quickly. Combining full time employment with living at home can help you boost your emergency fund fast!

Make sure to make a budget and track your expenses. Lifestyle inflation is real and it can be very tempting to spend that enormous paycheck when you’re living at home.

5. Rent Out A Room

You don’t need a rental suite to become a landlord, even a spare bedroom can create additional rental income. Renting a room is a great way to boost your emergency fund.

Having a roommate may not be ideal but it can provide extra income that can help boost an emergency fund quickly. There are lots of options for renting a room, from a traditional long-term rental, to a medium-term rental to an international student, or even a short-term rental on Airbnb.

If you want to go to the extreme, you can look at house hacking your way to zero housing expenses. House hackers find innovative ways to cut their housing costs to nearly zero (or sometimes even make money!).

Blog post continues below...

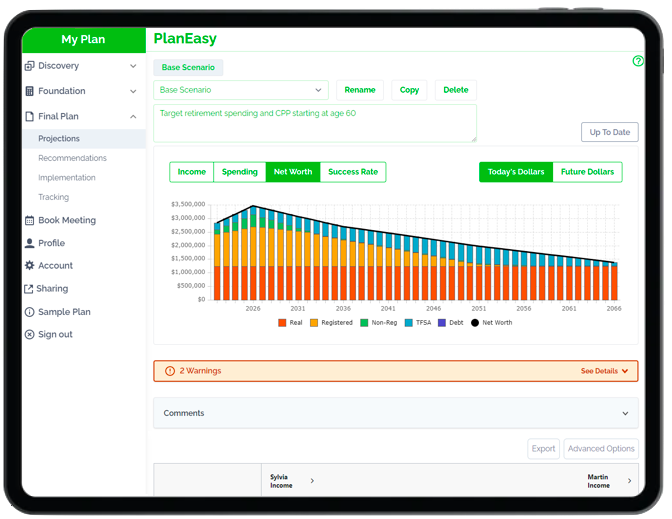

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

6. Use Your Tax Refund Or Bonus

Tax refunds are wonderful (owing money for taxes is not so wonderful). Put that tax refund to good use by putting 100% of it towards your emergency fund. Don’t give yourself a chance to spend it, put it directly into your emergency fund.

Do the same thing with your bonuses. Put them directly into your emergency fund. Out of sight, out of mind.

7. Press Pause On Extra Retirement Contributions

Building an emergency fund should be a priority. You may need your emergency fund tomorrow, next week, or next month, you just don’t know

Building up your emergency fund quickly will help you avoid unnecessary stress. If you’re making extra retirement contributions you should put these on hold and use that money to boost your emergency fund first.

The only exception is when you get an employer match on your retirement contributions. This is free money so take advantage of your employer match first and then put any extra money towards your e-fund.

8. Permanently Reduce Expenses

Experts recommend having between 3 and 6 months of savings in an emergency fund. So, if you can permanently lower your monthly expenses then you need less money in your emergency fund!

By decreasing how much you spend reach month you can reach your emergency fund goal faster.

If your goal was to have $9,000 in your e-fund ($3,000/month x 3 months) and you were able to permanently reduce your expenses by $500 per month then your new e-fund goal is now $7,500 ($2,500/month x 3 months) and that means you’re $1,500 closer to your e-fund goal!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments