Six Retirement Risks To Plan For

Preparing for retirement can be exciting but also a bit stressful. Retirement is full of opportunity but also full of risk, and there are six key retirement risks to plan for.

Planning ahead to avoid or reduce these risks will make retirement more enjoyable. It will make a retirement plan more robust, more stable, and more secure.

These risks are very common in retirement, but everyone experiences these risks differently depending on their situation and goals. Depending on your situation, these risks may already be reduced, but if not, then you may need to take extra steps to reduce these risks in retirement.

Investment Risk

Investment risk is the most common risk in retirement. This is the risk of a large decrease in portfolio value disrupting a retirement plan. Imagine your retirement portfolio drops from $1,000,000 to $700,000 over the course of 12-months, this is investment risk.

When the value of a portfolio drops too far in retirement it can increase the chance of running out of money in the future (especially if there is no room to decrease spending). (Read more about Sequence of Returns Risk)

However, a large decrease in portfolio value should be expected at least 3-5 times in retirement. The economy moves in cycles, so every 5-10 years we should expect to experience a correction, recession, or depression. Over a 30 to 40 year retirement period this means at least 3-5 major drops in portfolio value.

By planning ahead this type of risk can be reduced, but never completely eliminated. Having a diversified portfolio can help reduce investment risk in retirement. Also, having the right asset allocation will help ensure your investment portfolio is in line with your personal risk profile.

Investment risk can also be reduced by delaying CPP & OAS. Retirement assets are spent down while waiting for CPP & OAS to begin. This turns risky investment assets into a guaranteed government pension

Purchasing an annuity is another way to reduce investment risk in retirement. An annuity provides a guaranteed income for life.

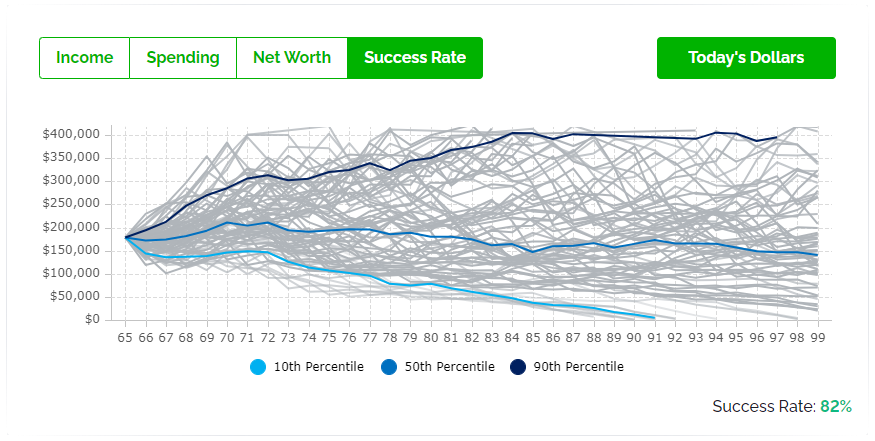

Finally, it’s important to test a retirement plan over various periods of historical investment returns to ensure the chance of running out of money is low. By testing withdrawals over many periods of investment returns and inflation rates we can identify a “safe” level of retirement spending that helps ensure the portfolio can survive even the worst-case scenario.

Every line in this chart is one “path” a retirement plan could take based on investment returns and inflation rates. Every path has the same level of retirement spending, but different historical investment returns and inflation rates. This retirement plan is too risky, and spending is too far above the “safe” level, leading to a very low success rate.

But this retirement plan on the other hand is very solid, this level of spending is “safe” even in the worst-case historical returns.

Inflation Rate Risk

Inflation rate risk is another common risk in retirement. An extended period of high inflation is less common than a large drop in portfolio values, so sometimes we can forget or even ignore inflation rate risk.

But if you ask someone who lived through the high inflation of the 1970’s they will certainly tell you about the high level of uncertainty that comes with high inflation.

Even modest inflation can have a big impact on a long-term plan. Even just going from 2% inflation to 3% inflation will add an extra 21% to your average expenses after 20-years.

Fixed-income investments like bonds and GICs tend to perform poorly during periods of high inflation so it’s important to avoid being too conservative in retirement. The correct asset allocation for your personal risk profile will help ensure a reasonable amount of the portfolio is allocated to equities which are less impacted by high inflation. (See the impact of being too conservative in retirement)

Delaying CPP & OAS can also help decrease the impact of high inflation because these benefits are both indexed to inflation. By delaying CPP & OAS these benefits will be larger in the future and will represent a large percentage of retirement spending.

A defined benefit pension, if indexed to inflation, is a great way to reduce the impact of high inflation.

Watch The Video!

Longevity Risk

Longevity risk is basically the risk of living a long and healthy life. A long and healthy life is something we all hope for, but it does mean there is a higher chance that we outlive our money.

Longevity risk is particularly high for retirees that rely on their own investment assets for most of their retirement income.

It’s important to have a withdrawal rate that is sustainable over the long-term. Drawing too much from the portfolio will eventually lead to the portfolio running out of money in the future. Over a 30-40 year retirement period even a modest amount of over spending can quickly deplete the portfolio.

Delaying CPP & OAS will decrease longevity risk because both of these benefits increase the longer they are delayed and will continue for the rest of your life. (Read about using CPP strategically in retirement)

An annuity is another important tool to help reduce longevity risk. “Annuitizing” a portion of the portfolio can help provide a higher base level of retirement income that will continue for the rest of your life.

A defined benefit pension is another large advantage when trying to reduce longevity risk.

Finally, having the right level of retirement spending will ensure you don’t overspend and deplete the portfolio too early.

Spending Risk

Even a short period of higher spending can have a very detrimental effect on retirement assets. It’s important to identify your “safe” level of retirement spending, a level of spending that is supported throughout retirement and even during the worst-case investment periods.

Spending even slightly above this “safe” level of retirement spending can quickly increase the risk of running out of money in the future. (Read about how to estimate retirement spending)

An increase in spending could be caused by…

- Not creating a retirement budget

- Unrealistic retirement budget with missing amounts or missing categories

- Not checking actual spending versus retirement budget on a regular basis

- Missing “infrequent expenses” like home repairs, vehicle repairs, and vehicle upgrades

- Not planning for out-of-pocket health care spending like dental care etc.

- Unexpected health care emergency

- Emergency expenses

Creating a solid retirement budget and testing that target level of spending over 30-40 years and over multiple recessions/depressions is the only way to have confidence that you have a “safe” level of retirement spending.

Blog post continues below...

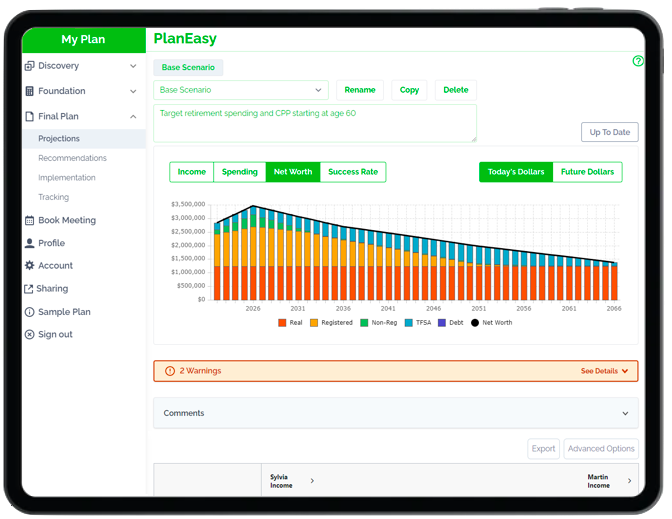

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Health Risk

Having an unexpected health care emergency can have a big impact on a retirement plan. This may cause a disruption to part-time income in retirement and/or it could cause increased spending on things you would normally do on your own, like cleaning, cooking etc.

A health emergency in retirement may require extra spending on making the home more accessible. It may also lead to specialized treatment that isn’t covered by provincial and/or private health plans.

Health risk can be mitigated by having a healthy emergency fund in retirement. Having 3 to 6 months of retirement spending in cash can help buffer against these unexpected emergencies. (You can also consider creating and emergency budget for retirement)

A health risk can also be reduced by purchasing “catastrophic” health coverage from an insurance provider.

Having a fully funded TFSA is another way to reduce the impact of a health care emergency. Unlike registered assets inside a RRIF/LIF, a large TFSA will not cause any additional income tax or government benefit clawbacks. And when making a TFSA withdrawal this amount is added back to your contribution room in the future.

Lastly, having some spending flexibility can go a long way to reduce the impact of a health care emergency. When a retirement budget includes a decent amount of discretionary spending, for example on travel, hobbies, entertainment, this discretionary spending can be reprioritized during a health care emergency. The “tighter” the retirement budget, the more risk there is.

Survivor Risk

Survivor risk is the risk of one person in a couple passing away unexpectedly in retirement. Many people may not realize but benefits like CPP and OAS have little to no survivor benefits.

For couples this can be a big risk in retirement if these benefits make up a large portion of retirement income. (See how CPP and OAS survivor benefits work)

Couples with defined benefit pensions have an even larger risk unless the elected to take a 100% survivor benefit (which typically means a small reduction in monthly pension income). The normal survivor benefit of 60% would mean an additional reduction in retirement income for couples with defined benefit pensions.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments