Setting The Right Asset Allocation For RESP Investments

Updated for 2021.

One of the hardest things about RESPs is choosing the right investment and managing the allocation between stocks and bonds. There are so many RESP investment options and it becomes especially challenging when families have more than one child. When families have a few children, who are perhaps a few years apart in age, it becomes very challenging to set the right asset allocation for the investments inside the family RESP.

Why is it important to set the right asset allocation?

Asset allocation is a large driver of risk. The more equity assets in a portfolio, and the less fixed income assets, the more risk. There is always risk when investing, whether that be in stocks or bonds, but stocks have always had a “risk premium”. That means they have a higher risk but also a higher return.

When managing asset allocation in an RESP we need to be very careful because we’re typically investing over a few different time horizons.

A 16-year old high school student is going to have a very different asset allocation in their RESP than a 4-year old pre-schooler. We want to make sure the 16-year old has money for post-secondary in two years and isn’t going to lose half of their education fund during a downturn. On the other hand, our pre-schooler has loads of time, so we can take on a bit more risk and hopefully grow their education savings over the next 14+ years.

It’s these different investment horizons that make investing inside an RESP especially challenging (even more so for self-directed RESPs where the individual investor is making all the decisions).

Related Posts:

- Catch-Up On Your RESP Contributions and Free Government Grants

- Canada Child Benefit: The Hidden Tax Rate

- Family Financial Planning: Tax Strategies for Families with Children

Typical Investment Horizons for RESPs

RESPs typically go through three different investment horizons, and they do that over a relatively short period of time. This is unlike retirement savings which remains a long-term investment for a very long time, sometimes decades. RESPs start out as a long-term investment but quickly shift into medium-term and then short-term.

Here are the three investment horizons for RESPs based on the age of the child:

Age 0-8: Long-Term

Lots of time to make back losses. Can choose a higher risk mix of investments in-line with personal risk profile.

Age 8-13: Medium-Term

Some time to make back losses but it depends how much. Choose a balanced mix of investments considering personal risk profile.

Age 13-18: Short-Term

No time to make back losses. Choose safe investments regardless of personal risk profile.

Setting A Target Asset Allocation By Year For RESP Investments

We can take this one step further and target a specific asset allocation year by year.

We’ll start at age 0 with an aggressive asset allocation of 90/10 (adjust this based on your personal risk profile) and we’ll end with a very conservative asset allocation of 10/90 at age 17.

Based on those two targets we can extrapolate our target asset allocation year by year. Based on these two targets we want to shift our asset allocation by approximately 4.7% each year.

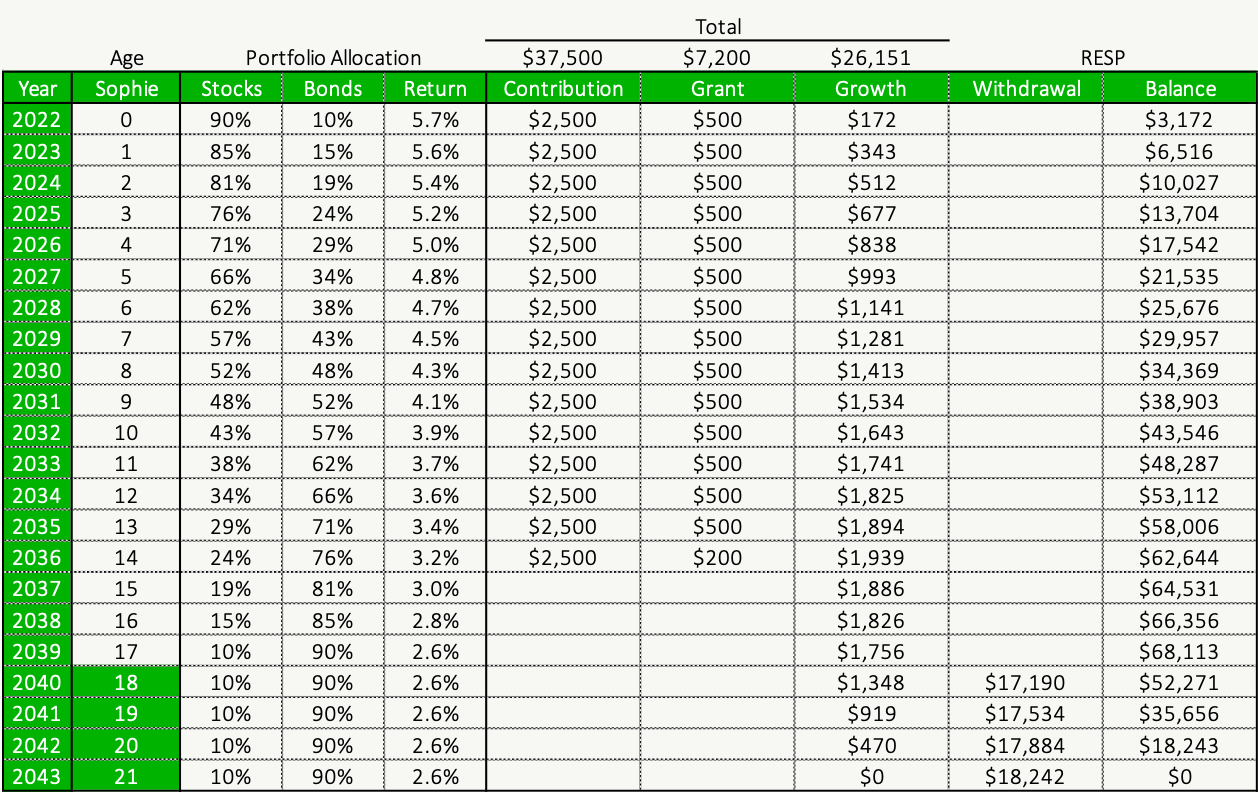

Here is an example RESP plan for a family with one child…

Setting RESP Asset Allocation For Families

This can be done for a family as well but it gets a bit more complicated. We can set the same target asset allocation for each child based on age, but then we want to weight that allocation by each child’s age to make it fair for the older children who technically have more contributions (were not using actual contributions, were taking the value of the account and spreading it across the children based on number of available contribution years).

The idea is that a 6-year old should have twice the contributions as the 3-year old, so we want to weight the allocation more heavily for the 6-year olds target allocation and weight it a little bit less for the 3-year olds target allocation. The result is this nice blended allocation for the entire family.

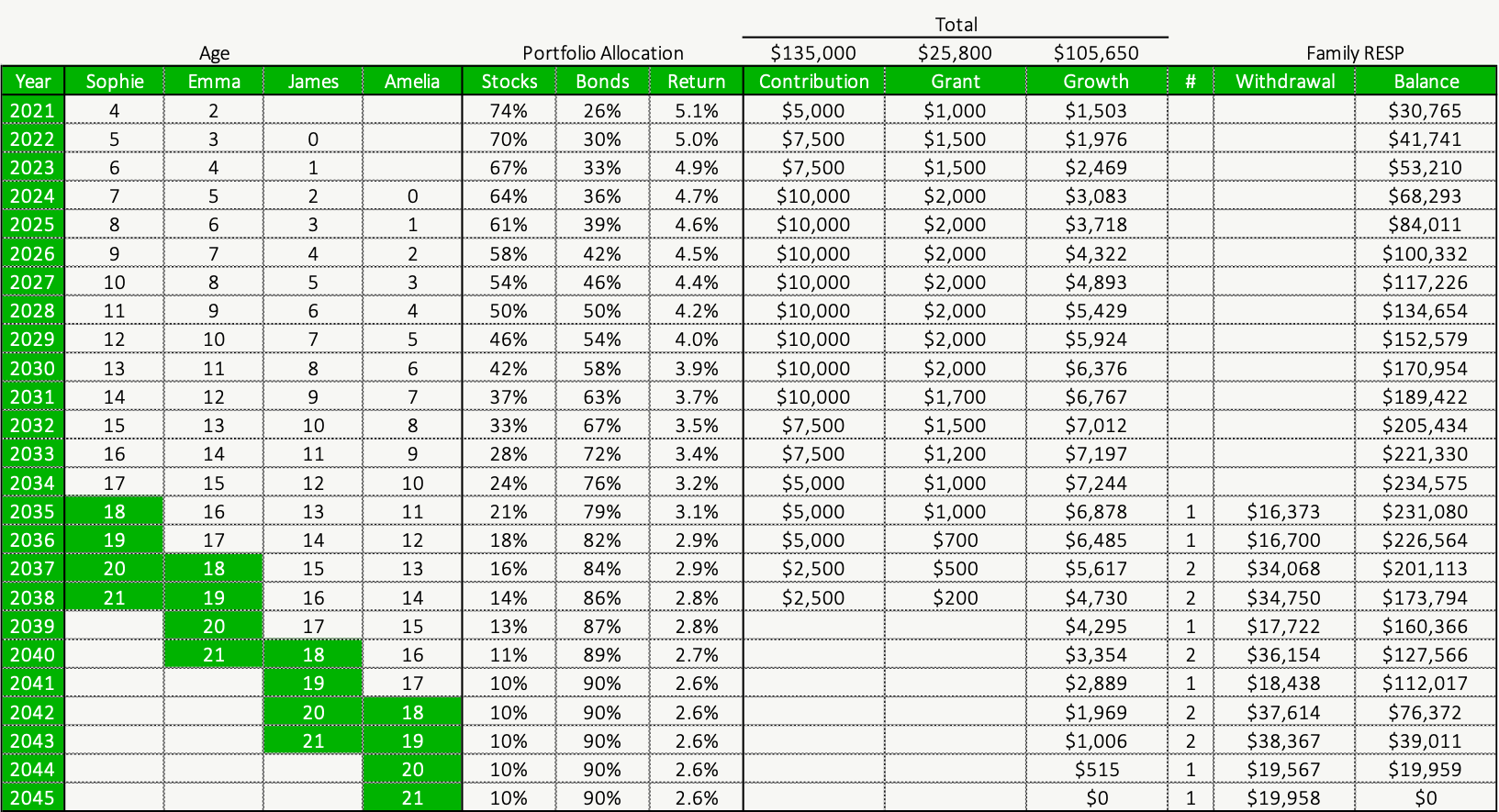

Here is an RESP plan for a family with four children…

If this all seems like too much work, please seek out help from an advice-only financial planner. The last thing you want is to see your child’s education savings lose value just a few years before starting post-secondary. If you don’t feel like you have the right asset allocation then please seek out some unbiased help.

Disclaimer: This is for educational purposes only and should not be considered investment advice. Always speak with your financial planner before making changes to your investment plan.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Related Posts…

9 Comments

Trackbacks/Pingbacks

- Building A DIY Model RESP Portfolio Using ETFs – Wallet Bliss - […] not sure of the right asset allocation for the RESP portfolio? Here’s an handy guide from Owen Winkelmolen, a…

- Weekend Reading – Death by PowerPoint, Bond ETFs, RESPs and more #moneystuff - My Own Advisor - […] Here is a great read from my friend Owen at PlanEasy to help structure your asset mix by the…

Thanks Owen, interesting article. My daughter and I were just discussing this because she is opening a RESP for her child. Question though, when this DIY grandpa tries to follow your example and reduce the equity side year over year by 0.04705 [=ROUNDDOWN(D2-(D2*0.04705),0)] [D2 is 90] it’s fine until year 3 when it differs by .01 and increases each year beyond. How do you calculate the shift in the allocation?

Hi Dean, thanks for the comment. It looks like your formula takes the previous asset allocation and applies 4.705%, this will result in a smaller shift each year as the stock allocation declines. To match the values in the post you’ll want to simply take the prior year stock allocation and subtract 4.705% each year. So 90%, then 90% – 4.705% = 85.295%, 85.295% – 4.705% = 80.59%, 80.59% – 4.705% = 75.885%, 75.885% – 4.705% = 71.18% etc etc. This will shift the stock allocation from 90% at birth to 10% by age 17. Happy investing!

Hi Owen, for parents who have maxed out their TFSA and RRSP, do you recommend front-loading the RESP of the portion that doesn’t qualify for the CESG over taxable investing? Sure you don’t get the CESG, but you get tax deferred and hopefully tax advantaged growth right?

Hi John, for parents who have maximized both TFSA and RRSP, yes, I love the strategy of maximizing the lifetime RESP contribution limit of $50,000 per child. Usually we recommend doing this with an extra contribution of $14,000. As it stands today, $36,000 in contributions are required to maximize the grant so there is an opportunity to add an extra $14,000 on top of the regular contributions to maximize the lifetime contribution limit. Every situation is different, but this allows the additional $14,000 to grow without the drag of income tax. For high income earners, in a high marginal tax bracket, this can be especially helpful.

Hi Owen – thank you for the article. I’m wondering if you would be willing to share the formula you used to appropriately ‘weight’ each child’s age when managing multiple children in a family RESP? Thanks!

Hi Michelle, there are different ways to go about it, but the easiest way is to first set the appropriate asset allocation for each child, then sum up the ages of the children and use their relative age as a weight. So if there were two children age 10 and age 6, the total would be 16 and the oldest would have a weight of 10/16 and the youngest would have a weight of 6/16. Then multiply the weight for each child by the asset allocation for each child to get the overall asset allocation for the RESP. This way the oldest child’s asset allocation carries a bit more “weight” given they’ve had more contributions and are closer to post-secondary.

Another way to do the weight is based on contributions, but for a family RESP that is going to be shared anyway, often weighing by age is easier/better.

Thanks for the response Owen – this makes complete sense and is very helpful!!

I immigrated to Canada in 2021 when my children were 9 and 6 years old and I started their RESP in 2022.

If I overcontribute every year to their RESP, is it possible to still get the complete CESG grant of $7200 for each child by the time they turn 17? Or have I “lost” the CESG for the time prior to them becoming Canadian residents?

Hi Anand, your children would only start to accumulate RESP grant the year they became residents or citizens, not for any years prior, so it will unfortunately not be possible to get the full CESG of $7,200 because it takes 14.4 years to get the maximum grant.