The New TFSA Contribution Limit!

How Big Could Your TFSA Get If You Contribute The Max Each Year?

The TFSA is an amazing account and it just got a little bit better. The contribution limit for 2024 is an additional $7,000. This means that as of January 1st 2024, anyone over the age of 18 in 2009 will have $95,000 of TFSA contribution room if they’ve never contributed before!

What makes the TFSA so amazing is the tax free compounding and when this compounding starts to take hold the results are incredible (just take a look at some of the projections below).

It’s reasonable to expect that many of us with TFSAs will see them reach $1,000,000+ at some point in the future. It’s just a matter of time. We’ll share some projections below but its pretty reasonable to expect that TFSAs could reach $5M, $7M or even $10M+ (in future dollars).

In fact, having TFSAs that reach $1,000,000+ is pretty common in many retirement projections that we do at PlanEasy.

Often, from an income tax and estate planning perspective, we want to draw down TFSAs last in retirement (or sometimes they’re also draw down strategically to avoid higher marginal tax brackets). We’re also strategically shifting assets from RRSPs/RRIFs into TFSAs over time. This leads to some very large TFSA balances and very little tax on the estate (depending on future investment returns of course).

TFSAs: Why You Should Have One

If you have read any other PlanEasy posts, you will know by now that we think TFSAs are amazing, and that you should open one if you haven’t already.

Anyone who is 18 years old with a valid SIN can open a TFSA account. The basic idea is that it’s a “savings account” (which is poorly named because it can hold way more than just savings) that allows you to grow your money completely tax free.

How Do TFSAs Work?

Money placed inside a TFSA will grow completely tax-free. (It’s helpful to think of a TFSA as a box and there’s no income tax on things placed inside or taken out of the box).

Many different types of investments can be placed inside a TFSA (GICs, stocks, bonds etc.) and while they’re inside the TFSA they will not be taxed.

Withdrawals can be made at any time and in any amount. You can choose to withdraw whenever you like, all your savings or just part, and unlike an RRSP, you won’t be taxed on withdrawal.

Contribution room also comes back the next year. Any withdrawals get added to your new contribution room next January 1st

The TFSA Contribution Limit Keeps Getting Bigger

This amazing tool started in 2009. Every year, you can contribute a certain amount, which is the same for everyone. So, if you opened a TFSA this year, you could contribute $7,000, right?!

Well, you could, but since TFSAs started in 2009, you are allowed to contribute as much as the contribution limits for every year for the past 16 years if you turned 18 or older that year. For example, if you turned 18 in 2012 you would have TFSA contribution room accumulating as since 2012.

Here are the past TFSA contribution limits for each year:

2009 – $5,000

2010 – $5,000

2011 – $5,000

2012 – $5,000

2013 – $5,500

2014 – $5,500

2015 – $10,000

2016 – $5,500

2017 – $5,500

2018 – $5,500

2019 – $6,000

2020 – $6,000

2021 – $6,000

2022 – $6,000

2023 – $6,500

2024 – $7,000 – NEW!

This leaves us with a grand total of $95,000 as of January 1st 2024 if you were 18 or older in 2009. You could hypothetically contribute the entire amount to a TFSA if you have never opened one before.

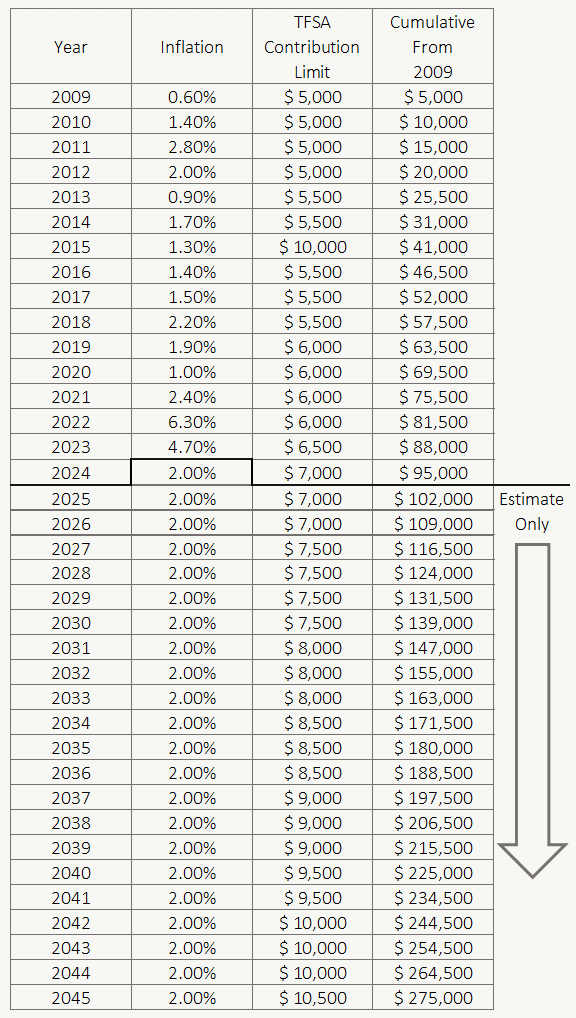

This annual TFSA contribution limit increases with inflation each year so we can try to predict future TFSA contribution limit increases. If we expect 2% inflation each year, this is how the annual TFSA contribution limit may evolve in the future (Disclaimer: This is just a guess, pure estimates, do not use this for financial decisions).

Here is an estimate of possible future TFSA contribution limits for each year:

2025 – $7,000

2026 – $7,000

2027 – $7,500

2028 – $7,500

2029 – $7,500

2030 – $7,500

2031 – $8,000

2032 – $8,000

2033 – $8,000

2034 – $8,500

2035 – $8,500

2036 – $8,500

2037 – $9,000

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

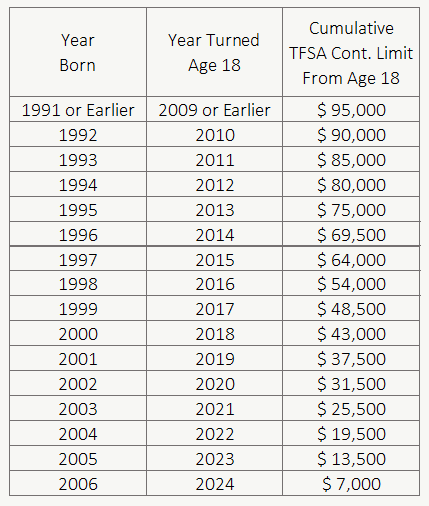

Cumulative TFSA Contribution Room By Age

Because you only start to accumulate TFSA contribution room when you turn age 18 its important to understand what your specific cumulative TFSA contribution room is. This amount will vary by age. The table below assumes no contributions and no withdrawals.

Someone born in 1991 or earlier, who turned 18 in 2009 or earlier, will have the highest cumulative TFSA contribution room at $95,000 in 2024.

But someone born in 1995, who turned 18 in 2013, will have missed the prior 4-years of TFSA contribution room between 2009 and 2012, so their cumulative TFSA contribution room will only be $75,000 in 2024. And someone born in 2001, who turned 18 in 2019, will have missed the prior 10-years of TFSA contribution room between 2009 and 2018, so their cumulative TFSA contribution room will only be $37,500 in 2024.

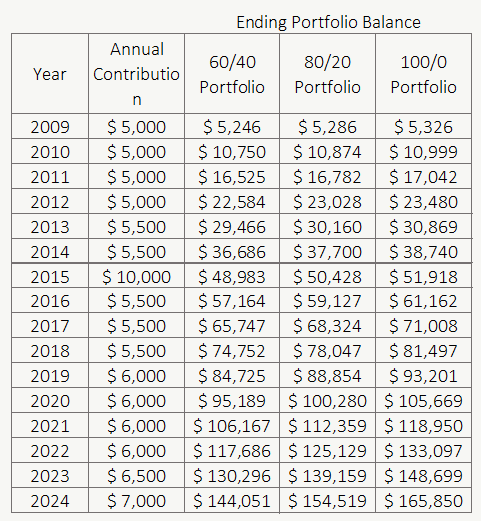

TFSA Growth Over Time

If you’ve been diligently maximizing your TFSA since it was introduced then it will be worth significantly more than the $95,000 in contributions made. In the table below we benchmark TFSA growth based on asset allocation. The investment growth is based on long-term growth assumptions and provides a good benchmark to understand how your TFSA is doing.

For example, if you had been maximizing the TFSA since 2009 in an 80/20 portfolio of equities/bonds then you could expect to have around $154,519 by the end of 2024. This assumes a low-cost index portfolio with fees of 0.25% or lower. This of course may be higher or lower depending on your actual investment fees and investment growth but it provides a good benchmark.

Be Careful About Over-Contributing

TFSAs are great, but because they have unique rules they can be a bit confusing. Sometimes it can be hard to keep track of how much you have contributed each year. The most common way that people over-contribute is when they use it as the name suggests, as a savings account, and withdraw and deposit from it multiple times in a year… don’t do this!

For example, if you contribute $1,000 in January, and then withdraw that $1,000 in May, if you choose to re-contribute it again later in November, you will have technically contributed $2,000 into your TFSA that year, even though this is the exact same money.

Essentially, once you deposit money into your TFSA, even if you later withdraw it, it will still count towards the contribution limit.

Also be sure to remember the 18 year old age rule. A 21 year old opening up a TFSA for the first time today does not have the same contribution room of $95,000 that a 45 year old person would have as of Jan 1st 2024. The 45 year old person turned 18 prior to 2009, meaning that every year since TFSAs started, they were entitled to TFSA contribution room, but not the 21 year old.

The consequence for over-contributing is paying 1% on the amount which has gone over the contribution limit, every month until you withdraw the excess. For example, if you over-contribute $1,000 and do not withdraw it for 6 months, you will have to pay $60. If the CRA believes you purposely are over-contributing to your TFSA, you will have to pay 100% tax on anything that went over the limit.

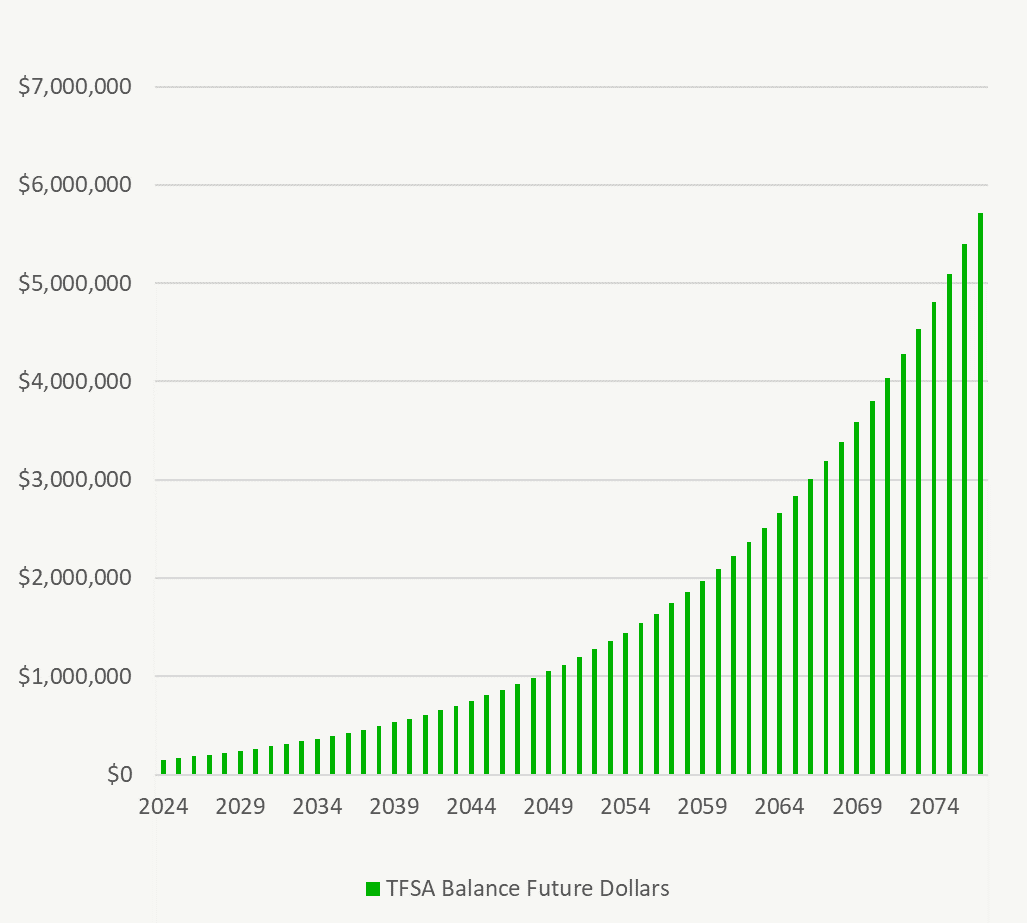

How Large Could Your TFSA Get In The Future?

The TFSA is great, it allows your savings and investments to compound tax free. Let’s fantasize for a moment about how large your TFSA could get in the future if you make max contributions and let compounding run wild.

This is a popular topic and something we’ve written about before. My wife and I have a personal goal is to have our TFSAs reach a combined $1M in less than 20-years. This is actually a fairly realistic goal (we hope anyway) and it’s likely we will see our TFSA grow even more in the future.

For someone who’s contributed to the maximum amount since 2009 when the TFSA started it’s not unreasonable to expect they would currently have a balance over $100k+ if they’ve been investing for the last 10+ years.

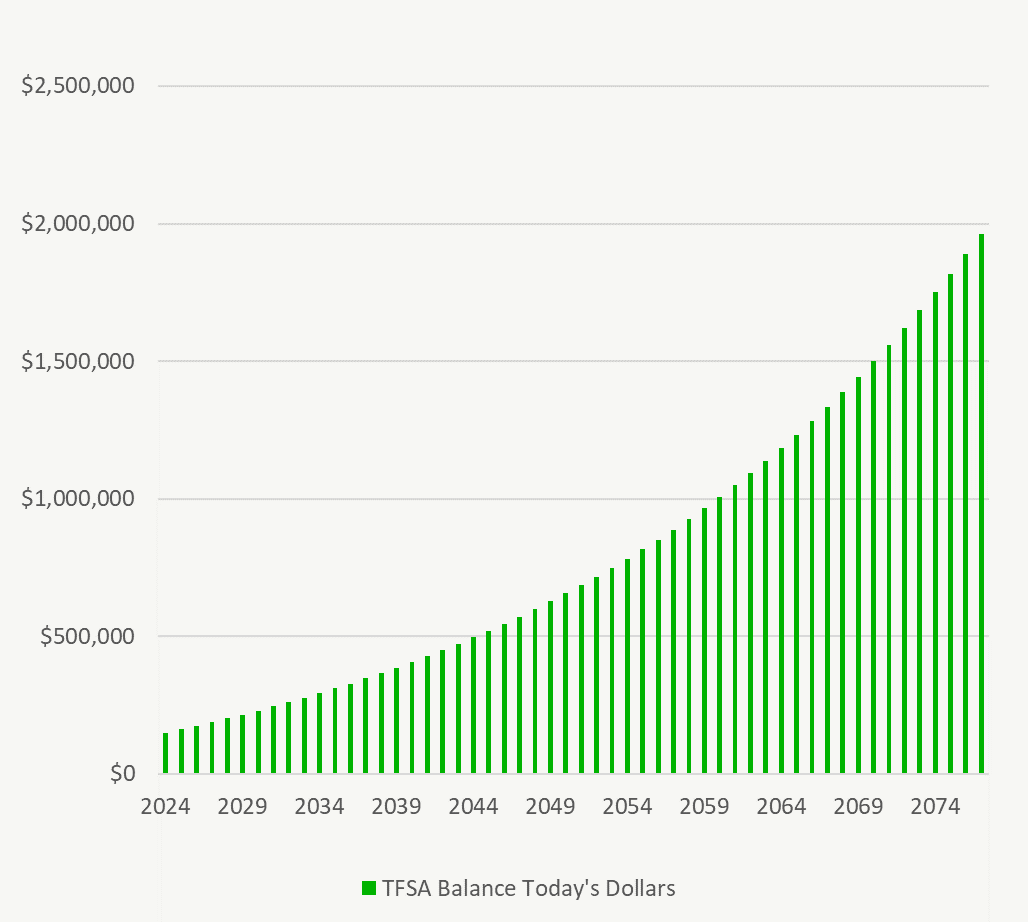

Let’s assume their TFSA currently sits at $137,249 including investment growth and we can see how it may evolve in the future if they continue to max it out each year.

Max TFSA Contributions

Future Dollars

5.55% Return

Max TFSA Contributions

Today’s Dollars

5.55% Return – 2.0% Inflation

Amazing isn’t it? Having over $2M tax free in the future is a pretty good reason to max your TFSA contribution limit each year.

Estimate Of Future TFSA Contribution Room

Assumes 2.0% Inflation

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

My question is my wife died three years ago and willed me her tax free savings of 41,000 I have never touched it and I have never personally opened a tax-free account in my name I don’t know whether I can or how high should handle this I have no idea whether I’m eligible for a my own personal full amount or if I’m required to take over hers account I need some answers this is my query the bank isn’t able to give me an answer to make it my decision going forward can you help me

Hi Jack, I’m very sorry for your loss. The answer is going to depend on how you received the account, as a beneficiary or as a successor holder…

https://www.planeasy.ca/tfsa-beneficiary-vs-successor-holder-the-difference-is-huge/

If you were a successor holder then you would receive the $41,000 and it wouldn’t have affected your contribution room. If you were a beneficiary, and the money went into your TFSA, then it would affect your contribution room. You can log into your myCRA account to view your TFSA contribution room (but keep in mind this value is often up to 12-months out of date and may not reflect recent contributions to your TFSA).

Hello – I’ll be maxing out my TFSA next month and wondering what the conventional approach is come January and the new 6000 available – Invest that asap, or 500/m for the year? I typically invest every month for DCA.

Hey Jen, interesting question, if you have enough savings/investments to maximize the TFSA at the beginning of the year then that’s the best strategy and it allows for the most tax free growth (versus monthly contributions over 12-months).

Now, this might be a bit complex, but if you’re saving up to that $6,000 TFSA contribution over 12-months by setting aside $500 per month then one interesting strategy which would allow you to continue Dollar Cost Averaging (DCA) is to invest it in a non-registered account each month and then shift those investments into the TFSA on Jan 1st as soon as you have new contribution room. This shift can be done in-kind through your broker if that $6,000 has gained in value (but it will trigger a capital gain), or this shift can be done by selling the non-registered investment and contributing cash to the TFSA if that $6,00 has declined in value (and it will trigger a capital loss).

This strategy lets you still invest on a monthly basis in the non-registered account rather than waiting up to 12-months for more TFSA room.

One important point. The reason we have to sell the non-registered investment if it’s declined in value is because we have to “crystalize” the loss. If an asset that has declined in value is transferred in-kind into the TFSA then the capital loss is denied and you won’t be able to use it in the future to offset future capital gains.

This is what we personally do each year. We have a small non-registered account and will shift over investments in-kind on January 1st (or the next business day). It may require a call to your broker or some brokers allow this to be done online.

The CRA says my TFSA limit is more than $81,500. How is this possible?

Hi Charles! First thing to keep in mind is that the TFSA limit in your CRA account should come with a large disclaimer, it can sometimes be inaccurate or out of date, so its always best to do your own calculations on the side before making a contribution.

The second thing to keep in mind is that if you’ve ever used your TFSA in the past, had some growth inside the TFSA, but then withdrawn those funds, that withdrawal gets added to your TFSA contribution room the next January. So if you add $5,000 to your TFSA, it grows to $10,000, and then you withdraw it, that $10,000 gets added to your TFSA contribution room the following January. This is one way that your TFSA contribution room could be higher than expected. This is also why investing in a TFSA early is important.

Does that help?

Hi,

I’ve pulled money out if my house as a mtg,

Am I able to claim the interest if I deposit into a TFSA ?

Or rrsp ,

I was going to leave the room in my rrsp for a rental house sale?

On my assumption it would lower capital gains?

Two questions, sorry

Tony

Hi Tony, unfortunately when you borrow money to contribute to a TFSA or RRSP the interest is not tax deductible.

I wonder how long before TFSA withdrawals will count against GIS. It could be a huge problem for abusers in the future.

How do you calculate the forecasted TFSA limits? Do you change them when the cumulative CPI’s reach the next 500 then reset to the nearest 500 or no reset? Is there an excel function that does this?