When To Have Multiple Beneficiaries On A TFSA

A TFSA is often the last account that we want to draw on in retirement. There are some great tax advantages to the TFSA because it allows contributions to keep growing tax free even in late retirement. New contribution room is accumulated each year and the account also regains the contribution room the following year after withdrawals have been made.

Because the TFSA is often the last to get drawn down in retirement this means that the TFSA will most likely make up a large portion of any future estate.

How large can a TFSA get? It’s reasonable to expect that with new contributions and investment growth we’ll see many TFSAs in the $1M to $2M range in the future!

The potential size of TFSAs in the future makes it important to understand how TFSAs can be passed on after death. There are a few options to consider and one option is to have multiple beneficiaries on a TFSA.

But is having multiple beneficiaries on a TFSA the right option for your estate plan? In this post we’ll look at why you may want to name multiple beneficiaries on your TFSA and some of the other options you may want to consider.

Passing On A TFSA After Death

There are a few different ways to pass on a TFSA after death.

One of the best ways to pass on a TFSA is only available to spouses. A spouse can be designated a ‘successor holder’ on a TFSA. A successor holder is a special designation whereby the spouse receives the tax sheltered TFSA and doesn’t lose any contribution room (read more about successor holders here). If your spouse isn’t listed as a successor holder on your TFSA then this is an option you will definitely want to consider.

Another option is to designate a beneficiary on your TFSA. A beneficiary is different than a successor holder because they don’t get the tax sheltered TFSA, only the money inside it. So after death the TFSA is closed and the value is given to the beneficiary. The beneficiary can contribute the money to their TFSA, but only if they have available contribution room.

The other option is to pass on the TFSA as part of the estate. When the TFSA is part of the estate the value of the TFSA gets distributed according to the will. This is beneficial when it’s important to equalize estate value among many parties. The downside of including the TFSA as part of the estate is that it’s now subject to probate fees. Plus, wills and estates are public, so the value of the TFSA will be known to anyone who cares to look. The public nature of wills and estates may not be ideal when the TFSA is quite large.

How Large Can A TFSA Get?

Understanding the options for passing on a TFSA after death is important because of how large a TFSA can get in the future. There are many pros and cons to the TFSA, but one major ‘pro’ is that they can continue to exist for an entire lifetime, this means they can get quite large in the future.

Unlike an RRSP/RRIF/LIRA/LIF, there are no mandatory minimum withdrawals from a TFSA. This means a TFSA can continue to grow every year and can potentially get quite large by late retirement.

Also, unlike an RRSP/RRIF/LIRA/LIF, the TFSA gains new contribution room every year on January 1st. This means that assets from a non-registered account, registered account, or capital asset sale (like the sale of a home or cottage) can be shifted into the TFSA each year as new contribution room becomes available. This causes it to grow even larger.

How large can a TFSA get? It’s not unreasonable to expect TFSAs in the $1M to $2M range in the next 10-30 years (in fact our goal is to grow our combined TFSAs to $1M by age 55).

The potential size of TFSAs in the future makes it extremely important to understand how TFSAs get passed on after death.

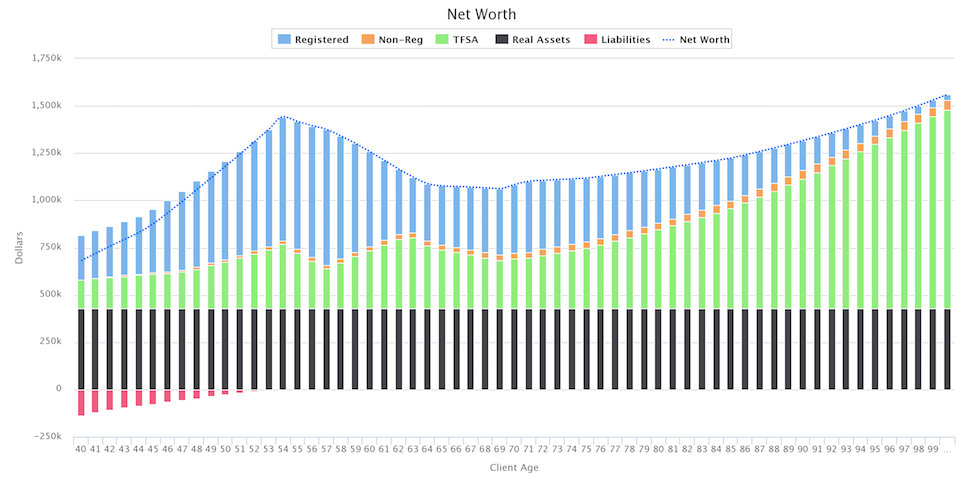

Example Of How A TFSA Grows In Retirement

(Notice how the RRSP/RRIF shrinks as the mandatory minimum withdrawal increases over time? This doesn’t happen with a TFSA)

Listing Multiple Beneficiaries On A TFSA

One interesting option when passing on a TFSA is to list multiple beneficiaries. This could be children, siblings, cousins, friends, charities etc Or it could be a combination of those options.

There is no limit to the number of beneficiaries that can be listed on a TFSA (although once it’s above a certain number it may require a special call to your financial institution to accommodate the extra beneficiaries).

There are a few benefits of listing multiple beneficiaries…

- TFSA assets are passed on more quickly after death, these assets do not need to go through the estate process (which can be lengthy).

- TFSA assets are not listed as part of the estate and therefore the size of the TFSA is not public, this provides a greater level of privacy.

- TFSA assets are not part of the estate and therefore are not subject to probate tax.

Of course there are downsides to listing beneficiaries on a TFSA, one major downside is that it’s harder to equalize the value of the estate.

Depending on estate goals and other assets, listing multiple beneficiaries on a TFSA could make it very difficult to be “fair” with how assets are passed on.

This can be especially challenging when the value of investment assets inside the TFSA fluctuate differently than other estate assets like real estate. When some assets are inside the estate (like a family home or cottage) and other assets are passed on directly to beneficiaries (like a TFSA) this can make it more challenging to be completely fair with the final value being passed on.

Having Multiple Beneficiaries On A TFSA

Due to the importance of the TFSA in a financial plan it’s also important to think about how a TFSA gets passed on in the future. There are many options when deciding how to pass on a TFSA and one of those options is to list multiple beneficiaries.

There are certain advantages to listing multiple beneficiaries on a TFSA but also certain downsides.

With the potential size of a TFSA being in the millions in the future it’s important to consider how these assets will eventually be passed on.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Owen, the ‘successor holder’ seems like the best option, so if the estate is fairly simple, do you see any problems with splitting a very large TFSA into several identical accounts, and listing each child as the successor holder on each of “their” portions of the total TFSA?

Hi Bob, ‘successor holder’ is definitely an attractive option but unfortunately its limited to spouses/partners. Its similar to the tax free spousal rollover of RRSP/RRIF assets. The money isn’t taxed and the contribution room isn’t lost when transferring to a surviving spouse.

For children the next option would be to list multiple beneficiaries. No need to split into multiple accounts since many beneficiaries can be listed on one TFSA. This can be a great option for simple estates but can get complicated when there a special estate goals. For example, if one of three children will inherit a family home/cottage/farm it can get challenging to equalize the value when some assets pass through the estate and some go directly to the beneficiary.

Thank you for clarifying. Much appreciated.

Can one of your multiple beneficiaries on a TRSA be your Estate, i.e. adult child#1 30%, adult child #2 30% and Estate 40%?

Thank you

Hi Bob, you can definitely have multiple beneficiaries on your TFSA… here are some more details…

https://www.planeasy.ca/when-to-have-multiple-beneficiaries-on-a-tfsa/

I would highly recommend speaking with an estate lawyer about your will, power of attorney, and general estate goals. You want to make sure the way you’ve structured your estate is aligned with your goals.

I would like to help a relative who suffered an accident and cannot work. He has no tfsA now and the income earned from a tfsa each year would assist in his current situation. I realize that my income would be reduced and thereby there would be less tax paid to the cra but are there other implications apart from his choosing to spend the principal immediately since he is free to choose. As far as my tfsa is concerned I have no additional space for more contribution.

Unlike the US there is no gift tax in Canada, so providing a gift such as this is easier here. That being said there are still considerations like is this a gift or a loan? Do you expect or need that principal back in the future? These are large considerations so it’s best to seek professional advice from a lawyer and/or tax professional before making large gifts.