Why We Don’t Care About Investment Returns

This is the time of year when everyone starts talking about investment returns. It’s been a wild ride and just months ago it would have been difficult to imagine reaching positive investment growth year over year. With the incredible ups and downs of this year, investment returns are bound to be in the headlines over the next few months.

For some people, investment growth is an important metric. They care about time weighted returns, money weighted returns, and breaking down their year over year growth by geography, sector, and even individual investments.

We, however, don’t care about investment returns.

In fact, I couldn’t tell you what our year over year returns have been this year or in past years. The only way we’d know is because our discount broker likely tracks that for us. Otherwise it’s just not a personal finance metric we put much value in.

Of course, we do care about long-term returns, but we don’t care about year over year returns, and here’s why you shouldn’t either…

#1 Investment Returns Are Not In Our Control

Year over year returns are completely out of our control. We follow a low-cost passive indexing strategy. We want to match the market returns at the lowest cost possible.

We have a highly diversified, low-cost ETF portfolio that gives us exposure to Canada, US and Global equities plus a healthy mix of bonds and fixed income as well.

We rebalance regularly, on a set schedule, and only three times per year.

There simply isn’t much we can do about our year over year investment returns. Our portfolio will match the growth of the market with minimal drag from investment fees. Simple, effective, and boring.

Tracking year over year investment returns wouldn’t add much value because that information wouldn’t result in us doing anything differently.

#2 It Puts Too Much Focus On Year Over Year Returns

The second reason we don’t care about investment returns is because it puts too much focus on year over year returns. It’s an arbitrary point in time. It doesn’t matter what your investments did from Dec 31st to Dec 31st. Why not June 27th to June 27th? Or October 3rd to October 3rd?

Tracking year over year returns does one thing, it creates a short-term mind set, and that can be dangerous.

Short term thinking can lead to the wrong asset allocation, trying to time the market, taking on too much risk, a lack of diversification etc. etc.

The individual investor shouldn’t be chasing investment returns from year to year. It can lead to some big behavioral pitfalls that can negatively impact returns. The best investment strategy is one that requires the least amount of maintenance.

#3 Investment Returns Are Minor When Compared To Spending Decisions

For most families, rate of return isn’t even that important, not relative to other personal finance decisions. Decisions around day-to-day spending will greatly outweigh investment returns and these decisions are entirely within our control (the exception of course is if you already have a very high savings rate).

It’s important not to focus entirely on investment returns and lose sight of day-to-day spending decisions because they can make a world of difference in a long-term plan.

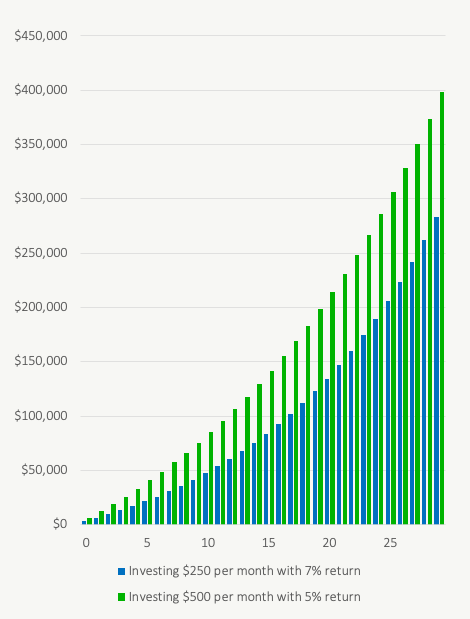

Saving $250 per month and getting a 7% rate of return will result in $283,382 after 30-years.

But saving $500 per month and getting a 5% rate of return will result in $398,633 after 30-years. About 40% more! Trying to make up for a poor savings rate with an above average investment returns isn’t a winning strategy.

We prefer not to focus on investment returns but instead focus on the things we can control, like day-to-day spending decisions. As a family, we manage our spending using a simple digital envelope method. It helps us keep our spending under control and ensure we’re saving the right amount to reach our goals.

Less spending and more savings will make up for a big difference in investment returns (and because risk = return, this difference can only be made up through more investment risk, something we’re not interested in doing).

But Investment Returns Are Important, Right?

Are investment returns important? Absolutely! But it’s important to focus on the things we can control versus the things we cannot control.

Short-term investment returns are not in our control.

With a highly diversified and low-cost investment portfolio, year to year returns are out of the individual investors control. They’re the result of broad investment and economic trends, not something you or I could predict (or senior economists for that matter).

With a high level of geographic diversification, a high level of specific company/bond diversification, low-investment fees, and a solid rebalancing plan, the individual investor has very little control over investment returns. They’ve already done everything they can do to ensure the risk/return of their portfolio has been optimized.

Investment returns are important because they help us achieve financial goals through the “magic” of compounding, but the year over year returns of our investment portfolio is not something we should care deeply about.

It’s nice to know, but if investments are up/down in a given year that should have little to no impact on a financial plan. Only during a prolonged period of low or negative investment returns would we even begin to make changes to our plans. Other than those extreme periods of time, we simply shouldn’t care too much about investment returns year over year.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments