Great Low Risk Investments And Where They Fit Into Your Plan

Low risk investments are an important part of every financial plan. There are certain reasons we want to use low risk investments in a plan and there are different types of low risk investments that we may want to consider.

Often we can become too focused on increasing investment return to appreciate the usefulness of a low risk investment. When used appropriately, a low risk investment provides an important source of funds in an emergency, or provides less volatility in our investment portfolio, or provides a psychological advantage that may help us avoid making a behavioural mistake during a downturn.

There are a few places that low risk investments will show up in a typical financial plan. If you haven’t considered these uses for low risk investments then it might be time to get a second opinion on your financial plan…

- Emergency fund

- Saving for infrequent expenses

- Saving for a down payment (Or other short term financial goal)

- Fixed income portion of an investment portfolio

These are some of the typical uses for low risk investments but what are some good low risk investments to use and which of these uses would they be appropriate for?

High-Interest Savings Account

A high interest savings account is your typical low risk investment option. The interest rate on a high-interest savings account is usually equal or higher than inflation. Your average savings account at your bank won’t meet this goal. There are high-interest savings accounts available from financial institutions that have interest rates above inflation.

One of the major benefits of a high-interest savings account is that they’re often CDIC insured. This protects the principal in your account up to $100,000. This is an important benefit of a high-interest savings account and one of the reasons why it’s a great low-risk investment.

The other benefit of a high-interest savings account is that your savings are extremely liquid. Unlike other low-risk investments, a high-interest savings account isn’t locked-in and you have immediate access to your money if needed.

Typical uses for a high-interest savings account in your financial plan would include holding your emergency fund, to save up for a down payment, or to hold savings for infrequent expenses like home repairs, vehicle repairs, vehicle upgrades etc.

(Read more about the best way to save money for a house)

Guaranteed Investment Certificates (GICs)

With lower interest rates GICs have lost their appeal as an investment vehicle, but GICs are still a great low-risk investment that can play an important role in your financial plan.

A guaranteed investment certificate typically locks in your savings for a period of time. This period could be 90-days, 180-days, 270-days, 1-year, 2-years, 3-years, 4-years or 5-years.

This locked in period means that GICs are not quite as liquid as a high-interest savings account and it can be harder to access your savings quickly. But this locked in period does mean that GICs often provide a higher yield than a high-interest savings account, this is to compensate you for losing access to your money for a period of time.

GICs that are under 5-years in length are eligible for CDIC insurance, so there is essentially no risk when investing in a GIC.

GICs are typically used for longer term savings goals. The interest rates on GICs can be higher than a high-interest savings account, so this provides an incentive to lock in savings for a period of time.

One use for a GIC could be when saving for a down payment. If you know that you won’t be purchasing a home for the next few years then a GIC is one low risk option to help your savings grow in the short term.

Another use for a GIC is to make up part of the fixed income allocation in your investment portfolio. Depending on your risk profile you may want to have 10%, 25% or 40% of your investment portfolio in fixed income investments. GICs, specifically a GIC ladder, can make up part of your fixed income investments.

Setting up a GIC ladder means purchasing GICs with various maturities like 1-year, 2-year, 3-year, 4-year and 5-year. As the GICs mature you roll them back into a new 5-year GIC which would become the top of the ladder. Typically we wouldn’t want GICs to represent ALL of our fixed income investments, this is because GICs are not as liquid as other fixed income options and so they aren’t as useful when rebalancing a portfolio during a downturn.

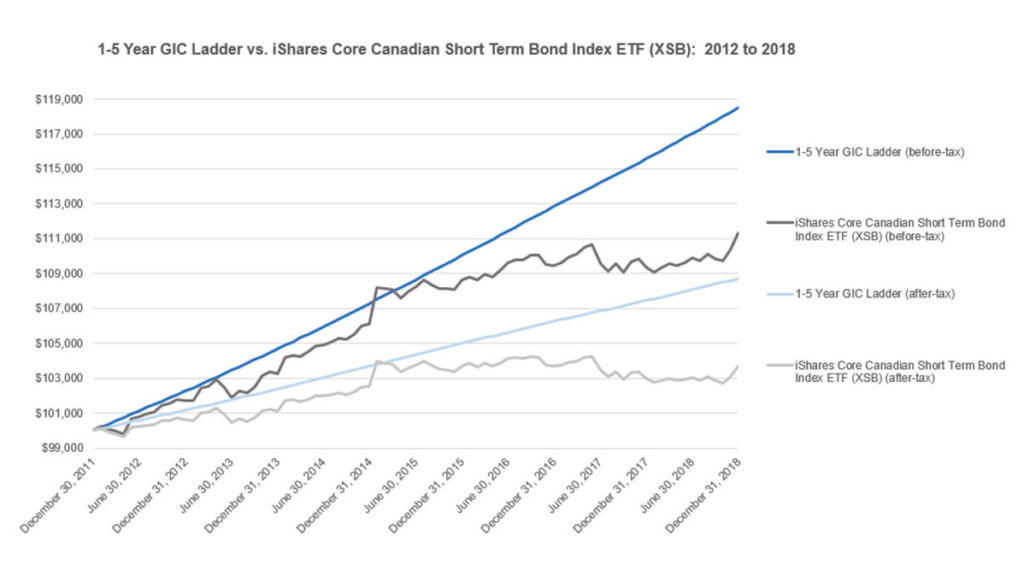

Still, GICs can be an attractive part of a fixed income portfolio. Justin Bender from PWL Capital has a great example of how GIC ladders have outperformed your typical bond fund in the past. Depending on the interest rate environment at the time this can make a GIC ladder an interesting part of your fixed income allocation.

GIC Ladder vs Bond Fund

(This is one example. Past performance is no guarantee of future results!)

Bond Funds

The last low-risk investment option is a bond fund. Calling a bond fund low-risk is a bit of a stretch. Bond funds are lower-risk than an equity fund but they’re still risky.

Bonds and bond funds are susceptible to changes in interest rates and this can make them a bit risky. An increase in interest rates means that your bond fund could lose value in the short-term. A decrease in interest rates means that your bond fund could gain value in the short-term. These fluctuations create risk, especially if you need access to your principal in the short-term (say for a home down payment).

But on the other hand these fluctuations can sometimes be an advantage. During a recession, if interest rates decrease, this will help a bond fund maintain or possibly increase its value. This helps decrease the volatility in your investment portfolio plus it lets you rebalance from bonds into stocks during a downtown. Rebalancing your investment portfolio on a regular basis is an important routine for every investor to have. (Read more about rebalancing your investment portfolio)

This opportunity to “rebalance” during a recession is an important reason to include this lower-risk investment in your investment portfolio. When we rebalance during a recession we’re selling bonds and purchasing equities. This act of rebalancing is a powerful psychological advantage during a downturn because it “forces” an investor to buy equities in a down market and helps them avoid panic selling as equity prices drop in value.

Where Low-Risk Investments Fit Into Your Plan

Low risk investments will fit into a financial plan in a few different places. From an emergency fund, to saving for a short-term goal, to reducing volatility in our investment portfolio… low-risk investments are an important tool for any financial plan.

There are different low-risk investment options to consider, like a high-interest savings account, GICs, and bond funds. These are important tools that every investor should be using as part of their long-term plan.

Don’t make the mistake of chasing returns at all costs, make sure these low-risk investments are integrated in your financial plan. They may not provide the highest return but they fill an important role in your plan and they provide a large amount of peace of mind.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments