It’s Time To Plan, Not Panic: How To Prepare For A Recession

They say the best time to plant a tree was 20-years ago but the second best time is now.

The same goes for financial planning. The best time to build a plan is before a crisis/recession/depression but the second best time is today. A good financial plan will help ensure that you’re prepared for a recession or financial emergency.

Having a financial plan provides an incredible amount of peace of mind. A good financial plan will already have anticipated a scenario like this and will ensure you’re still successful. It will highlight how to prepare for a recession and what changes you need to make to ensure you are successful over the long-term.

There are a few best practices that can help improve the ‘robustness’ of a financial plan. These are practices you can start using right away, even if they weren’t previously part of your plan.

Some of these best practices focus on behavior. They help manage your financial routine during emotional periods like this. Some focus on flexibility. They ensure that you have room in your plan to absorb the unexpected, whether that be changes in income, changes in expenses, or changes in investment returns.

It doesn’t matter if you’re in retirement, starting a family, or just starting to save and invest, there are a number of ways that you can prepare for a recession that will help you feel better about your finances and your long-term plan.

This post will touch on many of these best practices. These are best practices that we’ve covered in previous posts, so we’ll cover the basics here and link to past posts for more detail.

Create An Emergency Fund

Having an emergency fund provides an enormous amount of peace of mind. Ideally an emergency fund is worth between 3 and 6 months expenses. Emergency funds are important for everyone, whether you’re a student, a parent, or a retiree.

With fewer financial commitments, a 3-month emergency fund is adequate, but once you own a home with a mortgage and/or have dependents that amount should increase to 6-months.

Your emergency fund could be even higher if you’re employed in an industry that is very sensitive to economic growth or if a large part of your income is variable (eg a large percentage of income comes from commissions, freelance, consulting etc)

If you don’t quite have 3-6 months of expenses saved in an emergency fund then this is the perfect time to start saving. Even a smaller emergency fund can still be extremely helpful if the unexpected were to happen.

If you’re building your emergency fund aim for between $1,000 and 1-month of expenses first. After you reach this level then you may want to evaluate adding more to your emergency fund against other financial goals, like paying off high interest debt. Ideally high interest debt above 8%-10% will be paid off before adding more to an emergency fund.

Create A Debt Payoff Plan

Having fewer debt payments increases financial flexibility. Less money going toward debt payments means you have more freedom to adjust your outgoing cash flow if necessary.

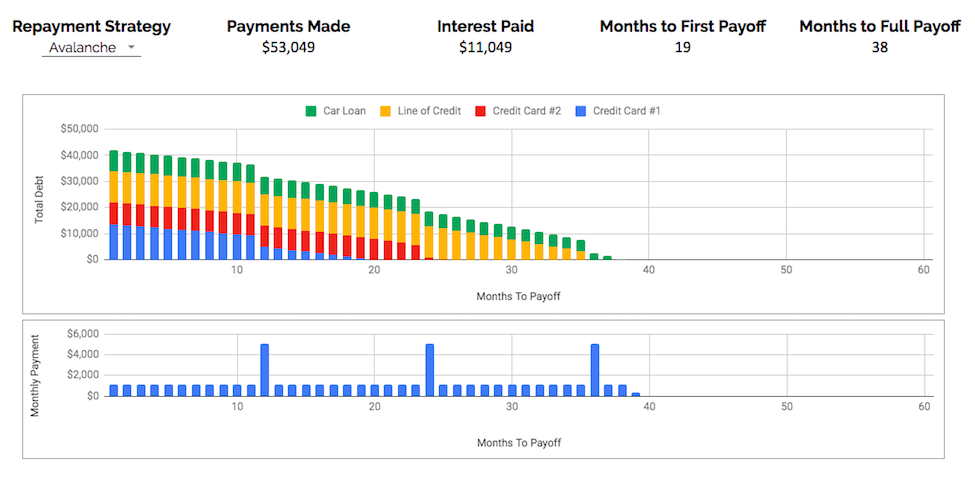

Create a debt payoff plan using our free debt calculator. Download a copy of the Google Sheet template, add your debts, and then start adding extra payments to see how fast you can pay off your debt.

Paying off high interest debt should be a priority. Mathematically this is the best option. This is called the ‘avalanche’ method because you start by putting extra payments against high interest debt first and once that debt is paid off you switch to the next highest, working your way down to the lowest interest debt last.

But, if you want to increase your financial flexibility, which can be helpful during a recession, then the ‘snowball’ method might be best. The snowball method starts by putting extra payments against the smallest debt first, regardless of interest rates. This strategy can be helpful because it ensures you payoff your first debt faster. This is a great psychological boost but it also increases financial flexibility because you have one less payment to worry about each month.

During times of uncertainty there are some debts that should be last on the list for payoff. These would include mortgages and government student loans. Mortgages typically have very low interest rates and if you’re making extra payments it’s hard to get that money back out of the mortgage at the same interest rate (unlike a credit card or revolving line of credit where extra payments could be re-advanced easily if faced with an emergency). Government student loans have extra features that allow for reduced payments based on income. This is valuable if you’re facing a job loss or reduction in income. Having financial flexibility is important during a recession and this means extra payments should be made against other financial goals first.

Refinance And Take Advantage Of Lower Rates

One thing that often happens during times of uncertainty is that interest rates decrease. This is often led by central banks who want to stimulate the economy and increase spending. They lower their benchmark rate and this can lead to lower mortgage rates.

Dropping interest rates could create an opportunity to lower the interest rate on your mortgage and increase financial flexibility. If you’re coming up for renewal that is a perfect time to lock in a lower rate. But even if you just started a new mortgage term it’s still possible to break a mortgage for a fee.

Mortgages that started only a few months ago could have rates 1% above current rates (or perhaps even higher). This creates an opportunity to break a mortgage, refinance at a lower rate, and still come out further ahead by the end of the term. Speak with a mortgage broker about this opportunity because breaking a mortgage has a financial cost that could be in the $1,000’s to $10,000’s depending on the mortgage. However the financial benefit of a lower rate could easily offset this cost if you’re early in your mortgage term.

Refinance And Extend Your Amortization

Refinancing or renewing your mortgage also creates an opportunity to extend your amortization and reduce monthly payments. This financial flexibility is valuable during a recession and the extra cash flow can be used to increase an emergency fund or pay off other debt.

As things stabilize in the future this extra cash flow can always be put against the mortgage again through higher monthly payments or lump-sum payments. This ensures that your mortgage is still paid off with the same speed but also allows for increased flexibility during times of uncertainty.

Spend Tracking and Basic Budgeting: Understand Your Spending

One of the best things we can do in a financial plan is build a basic budget. The goal isn’t to necessarily follow the budget exactly but to understand where spending is currently going and where we would like spending to go in the future.

Everyone’s spending will differ based on their personal values. We all value our spending differently. This means there is no “right answer” when it comes to budgeting.

Tracking spending and creating a budget is an amazing way to evaluate if your spending aligns with your values. You may find that some categories of your monthly spending are higher than you would like and other categories are lower than you would like.

You can use our free budget tracker to do this exercise. It’s based on Google Sheets and Google Forms. You can make a copy in your own Google Drive to set up your spend tracker and track your spending directly from your phone/tablet/laptop.

![]()

If you want to evaluate your spending and start making changes right away you can use your credit card statements and bank statements to enter past purchases. Three months of past spending should give you a good sense of where your money is going.

Emergency Budgets: Know Where To Cut Back On Spending

One of the major benefits of tracking your spending and building a basic budget is that it’s much easier to cut back on spending if necessary. If faced with a job loss or financial emergency, having a good sense of where your money is going will let you reprioritize more easily.

You can take this one step further by setting up an emergency budget BEFORE you even experience an emergency.

As a general goal, an emergency budget should have spending 20%-30% below your current spending. For a retiree that may mean cutting back on travel spending or hobbies during a recession. For families that may mean reducing restaurant meals, making fewer convenience purchases, stopping certain subscriptions, and cutting back on entertainment spending during a recession.

In addition, regular savings and investments would typically be postponed during an emergency. This is another advantage to having a high savings rate prior to a recession. A savings rate of 20%-30%, when combined with a spending reduction of 20%-30%, will mean that outgoing cash flow could be reduced by as much as 50% during an emergency. Having this kind of flexibility is extremely valuable!

Investment Plan: Accumulation Phase

No financial plan is complete without at least a basic investment plan. A basic investment plan should outline a few things…

1. Fees

2. Diversification

3. Target asset allocation (aka personal risk tolerance)

4. Rebalancing frequency

5. Target contributions

Outlining these factors beforehand helps ensure that you will stick to your plan even during the biggest market drops that happen during a recession.

As a best practice investment fees should be kept to 0.75% or lower. Diversification should be high, with no individual stock or bond making up more than 3%-5% of a portfolio. Asset allocation should be based on personal risk tolerance and investment experience. Rebalancing should be done automatically or done manually on a set schedule (ideally set in advance with the same calendar dates each year). Contribution schedule should be clear and shouldn’t be increased/decreased in response to short-term changes in the market.

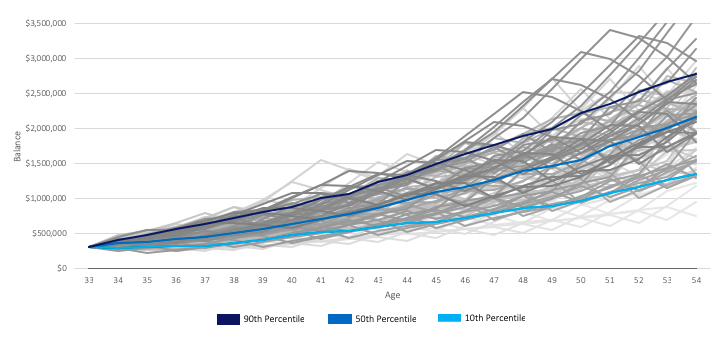

Plus, variability should be expected. Drops of 20% to 30%+ are normal when investing over a long period of time. A good investment plan will outline the market drops an investor could experience given their asset allocation. This might be as simple as showing the largest 12-month decline in the last 20-years (as is done with the Canada Couch Potato model portfolios) or it could be something more specific, like a sequence of returns analysis using historical market results and actual planned contributions.

Below we have an example of this type of sequence of returns analysis during the accumulation phase. This client has 20+ years to retirement and could expect at least 1-3 recessions during that time frame. Even with those market drops their investment plan is relatively stable thanks to their continued contributions (an important reason to stick to your plan!)

Investment Plan: Decumulation Phase

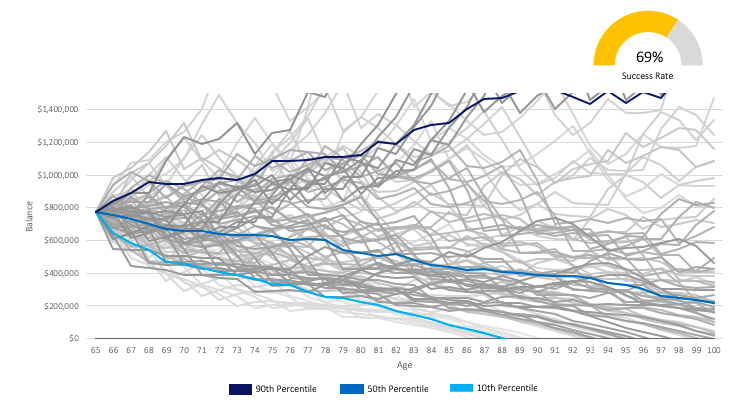

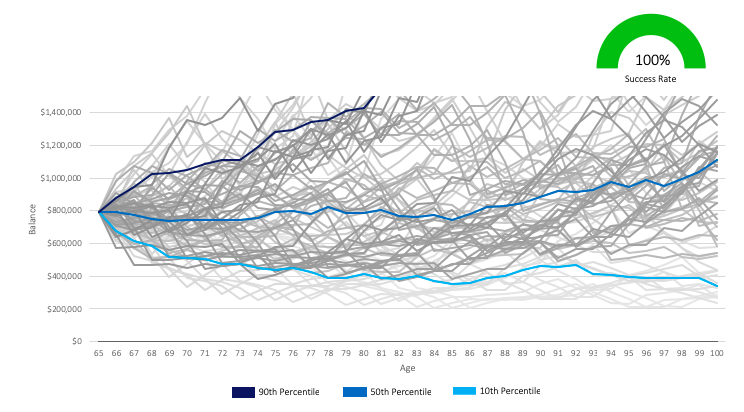

Decumulation requires some additional planning and foresight. When entering retirement it’s a good idea to know how successful your withdrawal strategy is based on historical results. Not only does this provide a lot of peace of mind but it also lets us plan ahead so that we know what to do if we find ourselves in one of those lower scenarios.

During the decumulation phase, poor investment returns are exacerbated by the annual withdrawals required to create retirement income. Unlike the accumulation phase, retirement withdrawals during a recession, especially in early retirement, are particularly impactful to long-term success. This sequence of returns risk is one of the largest risks in a retirement plan.

This example has a success rate of 69%. This means 31% of historical scenarios will end up with $0 in investment assets before the end of the retirement projection. This is a concern, especially if a retiree faces a recession early in retirement. If faced with this scenario they may need to make some small changes to ensure success over the long-term.

That change will depend on many factors, their tax rate, tax efficiency, asset allocation, government benefits, pension benefits etc. In this case, a reduction in spending of $10,000 per year leads to a success rate of 100% based on historical scenarios, including the great depression!

A small reduction in spending, a bit of extra income, downsizing earlier than planned, these are just some of the options to help increase the success rate of a retirement plan. Having this plan ready in advance means there is less to worry about when retirement assets drop by 20%-30% during a recession, which is likely to happen at least a few times during the typical retirement.

How To Prepare For A Recession

It’s natural to feel uneasy when there is so much uncertainty, but a good plan will help reduce that uncertainty considerably.

Making a plan in advance is always best, but there is no time like the present to start preparing for a recession. Implementing even just a few of these best practices can have a significant impact. They can improve the success rate of your financial plan, but more importantly they can provide peace of mind.

Most people are in good financial shape already and by making just a few small changes they can make their personal finances even more robust. By implementing some of these best practices they’ll be able withstand a recession, depression, or another financial emergency relatively unscathed.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments