How Many Transactions Does The Average Person Make Per Day?

How many transactions to does the average person make per day, one, two, three or more? For the last eight months I’ve been averaging about 1.3 transactions per day but I suspect the typical person averages closer to 2.

Since the beginning of January I’ve been religiously tracking my spending. This has been a departure from my normal budgeting routine but it’s been extremely interesting because of how much detail I now have on my spending habits.

For the longest time, I was an anti-budgeter. I would set a savings goal and then each month I would put away enough money to cover my savings goal plus any fixed expenses, then I would leave the rest in my checking account and spend freely. Over time I created good spending habits and most months I would have a bit left over.

Personally, I found the anti-budget to be a great balance between managing my money and my time. I could hit my financial goals but didn’t have to spend much time tracking expenses.

This all changed when I came across this super simple way to track your spending. You don’t need to give Mint all your passwords, you don’t need to pay YNAB a monthly fee, all you had to do was use Google Forms and Google Sheets to setup your own semi-automated spend tracking.

Adding a new transaction didn’t mean opening a spreadsheet, you could do it right from your phone. Tracking your spending took just 10-15 seconds after each transaction.

So, since January I’ve been tracking every transaction I’ve made and one thing I find super fascinating is how many transactions I make.

More Transactions = More Spending

Spending money can be a bit of a habit and the more transactions you make the stronger that habit becomes. Pulling out your credit card can be a very satisfying routine. The more you do it the stronger that routine becomes.

Tracking the number of transactions you make is a good way to see how you’re doing with your spending habits. Even a lot of small transactions can start to add up.

Breaking bad spending habits is one reason why doing a no-spend month can be a fantastic tool. It’s a great way to break those bad habits and routines. A no-spend month isn’t necessarily about saving money, it’s about making fewer transactions and breaking bad spending habits.

Related Posts:

- It’s Not Just How Much You Spend, It’s How Many Transactions You Make

- Creating A Budget? Focus On The Big Stuff

- The Step-By-Step Guide to Creating a Budget

Average Transactions Per Day

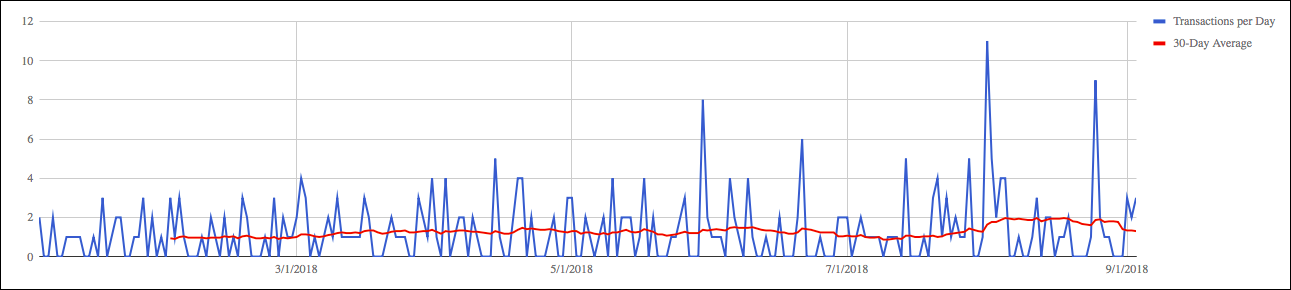

For the last eight months I’ve been averaging 1.3 transactions per day. Some months it’s been as high as 2.0 transactions per day and other months as low as 0.9, but as you can see from the graph below the number of transactions I make is pretty consistent.

This is just my spending. My wife and I split our finances using the you/me/us approach. We each have separate budgets/banks accounts and then a joint budget/account for house expenses. This is just my spending, it doesn’t include my wife’s expenses or joint expenses (although I checked and we only average slightly over four transactions per month from our joint account, mostly for home utilities, insurance and property tax etc).

No surprise, frequent spending has coincided with vacations. The big spike in the graph is the first day of our trip to Vancouver when eleven transactions were made. The other spikes are related to other mini-breaks.

For the most part the number of transactions per day is steady. Strong habits means my spending is fairly predictable. No major spending binges, except for vacations : )

Other interesting stats:

- The longest streak of “no-spend” days? Four days.

- The category with the largest number of transactions? Groceries with ninety-nine, almost once every other day.

- Lowest month? July with 0.9 transactions per day.

- Highest month? August with 2.0 transactions per day (mostly due to vacations).

- Number of days with no transaction? Ninety-six days.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Related Posts…

1 Comment

Trackbacks/Pingbacks

- October’s Great Reads | Spring Financial Planning - […] How Many Transactions Does The Average Person Make Per Day? | Owen Winkelmolen […]

Wow super cool chart!! 🙂 I probably average that amount too but hard to say. Would be interesting to check it though I suck at Excel.