Negotiate Your Salary And Move Employers Often

One of the most important pieces of a financial plan is income. Without an income it’s simply impossible to achieve any financial goals. Plus, having a higher income makes financial goals significantly easier to achieve.

While expenses often get a lot of focus because they’re entirely within our control, the fact is that without a certain level of household income it becomes much harder to save, invest, and still cover monthly spending.

This is why income, and specifically how income changes, should be an important part of every financial plan. Increasing income over time will make financial goals significantly easier to achieve, it makes debt payments a smaller proportion of net income, and it makes it possible to juggle competing priorities.

But unlike spending, income is unfortunately not completely within our control.

Increasing your annual income can be done a number of different ways. There are “side hustles”, there are second jobs, there is semi-passive income from rental properties etc. etc.

But the best and easiest way to increase income is to get paid more for what you’re already doing. You’re already at work, why not get paid more for doing the same thing?!? No “side hustle” required. No extra work. No stress of rental properties and bad tenants.

Increasing income is quite common, especially in a persons early 20’s and 30’s. On average income increases 7% per year during this phase. Once we reach our 40’s the pace of increases starts to slow down but those 15-20 years of steady increases can make a big difference.

How do you get salary increases of 7% per year (on average)? It takes a few things to make it easier, negotiating your salary is one, and unfortunately, switching employers often is another.

How impactful is increasing your income? Massive. In our example below, over a person’s working career, it’s equal to about $585,000 or 20,000 hours of extra work.

So, what would you prefer? Negotiating your salary every few years? Or putting in an extra 20,000 hours work (or about 10 years!)

You Have To Ask

The term “salary negotiation” makes it seem much more intense than it actually is. When we think of “negotiation” we think about an FBI negotiator trying to defuse a tense hostage situation. During an actual salary negotiation there is no hostage, no one will live or die, all you have to do is ask.

A salary negotiation isn’t a negotiation at all, it’s a question, just a simple question.

There are a few important things to do before asking that question…

- Do some prep work before asking for a raise…

- Ask for feedback – do this throughout the year

- Step up – Take on more responsibility, ask for more responsibility if you have to

- Document achievements – It’s tough to remember what happened a month ago let alone a year ago, document your great achievements as they happen

- Keep a record of any praise – If you receive praise from a manager or co-worker, keep it!

- What is your value? – How do you add value to the business? The more value you add the more likely you’ll get a raise

- Do some research – What is the typical pay for your position? This will help you know how much to ask for

- Know what you want and what is fair – You might get asked what you think your increase should be, don’t get caught without an answer or with an answer that is unrealistic

- Have options – Even if you don’t intend to leave your current employer it’s nice to have options and it will come through in your confidence. Brush up your LinkedIn and start expanding your network

- Think about the future – You want to sell your boss on your dream for yourself and for the company

- Decide when to ask, align your request with typical compensation review periods at your company

- Get comfortable, rehearse your ‘pitch’ with a partner or a friend, you want to be confident and clear the reasons you deserve a raise

There are also a few important things NOT to do…

- Don’t ask via email. It’s too easy to do, and just as easy to dismiss. It shows a lack of commitment. Setup a meeting instead

- Don’t compare yourself to others

- Don’t tell your manager why you need a raise, it doesn’t matter

- Don’t ask during a busy period. Everyone is stressed, and the quick answer is ‘no’

- Don’t give an ultimatum. Having options will to boost your self-confidence but never put your loyalty into question, it won’t help

- Don’t expect an answer right away, rarely will your manager be able to give you a raise on the spot, be patient

(More details on how to ask for a raise and get it.)

Moving Employers Often

Unfortunately, sometimes asking for a raise doesn’t work and one of the best ways to increase income is to move employers often.

It’s sometimes possible to negotiate a large salary increase with a current employer, but it’s much easier to do with a new employer when starting a new role.

The are many reasons why negotiating salary with your current employer is more difficult (whether they’re good reasons is another question).

The current employer might be biased by the current salary they pay you, they may have a cap on the % raise they can provide (which doesn’t apply to new hires), they may have salary “bands” that are difficult to break for existing employees (but somehow easier to break for new hires), they also, for better or worse, have a better idea of your gaps and how you’ll perform in the future (whereas a new hire always is presenting the best version of themselves during the few brief interviews that happen).

Moving jobs is quite common. For the younger age groups (25 to 34) the average number of years in a position is just 2.8. That means younger employees are changing roles quite often. This could be within the organization or outside. But for reasons we mentioned above, the largest income increase typically happens when moving employers.

The Impact of Higher Income

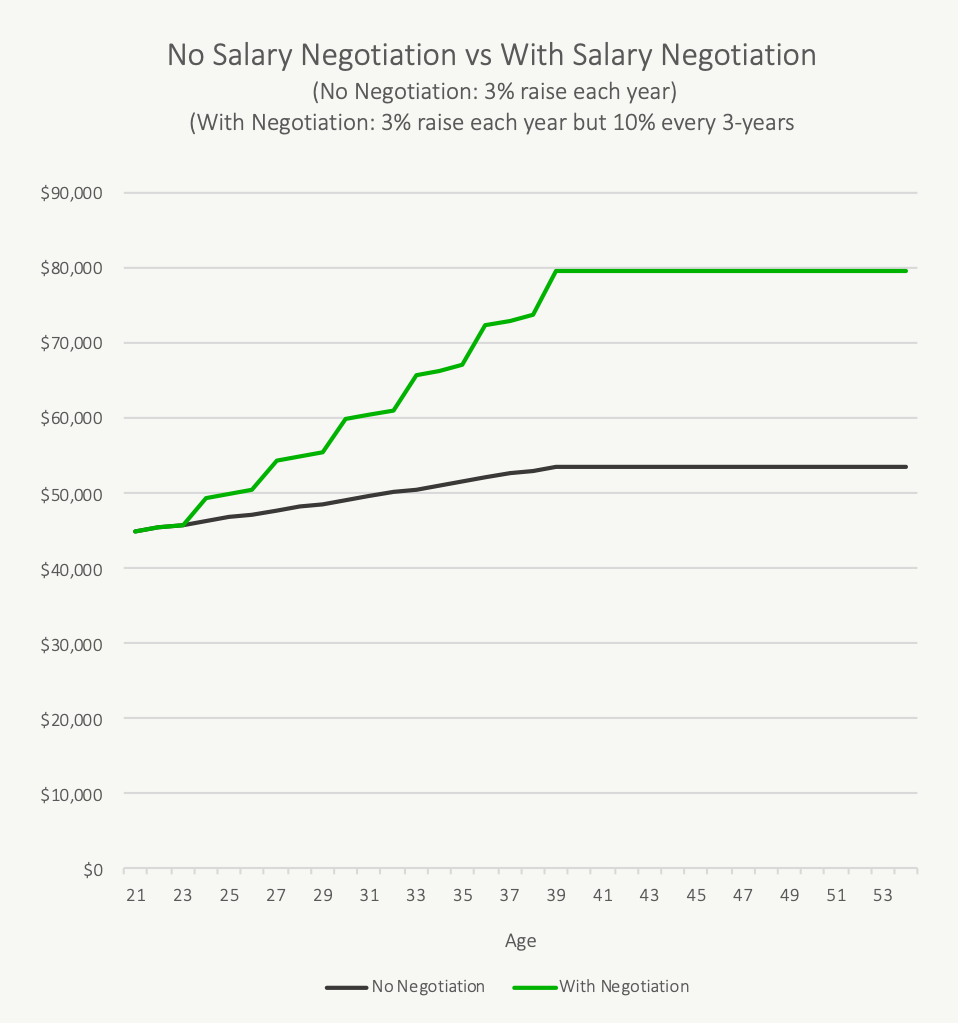

How large an impact can negotiating your salary have on your income over time? Let’s look at an example. In this example we have two “paths” a person can take. Both paths start at age 21 with a salary of $45,000 per year.

The first “path” is the easy route. They receive a 3% salary increase each year. It’s a salary increase that is equal to the cost of living increase of 2% plus an extra 1% for performance. At age 40 we assume increases slow down and are only equal to cost of living of 2%.

The second “path” is a bit more difficult but comes with a much higher increase every 3-years. For 2-years they receive the same 3% increase as the first example but on the 3rd year they either negotiate a larger salary increase or switch employers. This increase every 3-years is worth 10%, a significant boost. At age 40 we assume increases slow down and are only equal to cost of living of 2%.

The difference is staggering. Over time, the total difference in salary earned is nearly $585,000 in today’s dollars. Over half a million!

For the first path to catch-up in terms of salary would require an extra 10.9 years of full-time employment or… it would require an extra 20,500 hours of “side hustle”. That’s a lot of hours! Over the 33-years from age 21 to 55 this “side hustle” would require at least 12-hours of extra work per week, every week, for 33-years… an exhausting amount of extra work.

While this example is somewhat extreme, it highlights the amazing impact that salary increases can have over time. Even if the gap was closed by half, it would still require years of extra work to catch up.

It also highlights the limitation of “side hustles” as a way to increase income. It’s a great idea in the short-term but over the long-term a focus on increasing employment income (more money for the same time) is the best way to balance time and money in the future.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments