Planning On Starting A Family? Six Ways Your Finances Will Change

Starting a family is expensive. Estimates are thrown around that it costs in the low six figures to raise each child. Amounts like $100,000 or $200,000 per child are often quoted. While these are probably a bit dramatic, and include the opportunity cost of one parent staying at home, the fact is that starting a family can cause a number of changes to your personal finances.

Anticipating these expenses can ease the financial cost of starting a family (or at least make it a bit less stressful). If you know what’s coming, you can plan accordingly.

When you’re starting a family it’s easy to get caught up in the excitement. There are lots of new things that need to be purchased and there’s a strong desire to do the best for your future family. All these emotions can mean that things sometimes get a bit out of control (I speak from personal experience!) Purchases for beds, strollers, car seats, clothing etc. etc. can quickly add up to thousands of dollars.

In addition to new purchases, families often go through major cash flow changes when starting a family.

On the income side, parental leaves from work can significantly reduce income when starting a family. Of course there are sometimes “top ups” from employers, but those only last for weeks or a few months at best, and employment insurance is only 55% to 33% of your pay up to the max (depending on if you choose the 12-month or 18-month option). Even with these programs there is often a large decrease in income when starting a family.

One the expenses side, the big one is of course daycare expenses. Daycare expenses last for a few years but for most families this expense will go away once kids start school. But even when daycare expenses disappear there are still ongoing expenses for things like food, clothing, activities etc. etc., and these can add up over time.

And if all of that wasn’t challenging enough, starting a family also comes with new tax advantaged accounts like the RESP and new government benefits like the Canada Child Benefit (CCB).

To avoid being too overwhelming let’s look at the six major ways that your finances can change when you’re starting a family and how you might go about making the best decisions for your financial future.

Anticipating One-Time Expenses

One-time expenses can range in the $1,000’s to $10,000’s depending on your choices. Typically we’re talking about expenses like a crib, change table, dresser, stroller, car seat, baby carrier, etc etc.

These one-time expenses will vary greatly depending on your needs. They’ll also vary greatly depending on if you purchase new or used. One of the secrets of starting a family is that baby stuff is typically very lightly used and makes for great second hand purchases.

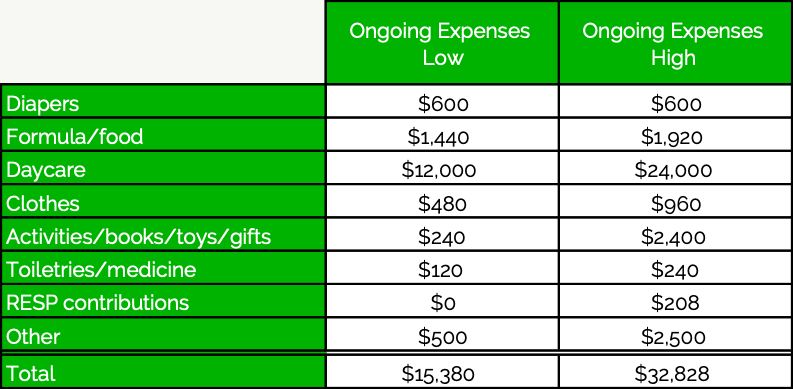

Minimize Ongoing Expenses

The ongoing expenses when raising a family can also vary greatly depending on your specific choices. There could be expenses like diapers and wipes, unless you choose to use cloth. There could also be expenses for activities/programs, unless you use the many free programs offered by libraries and community centers. It’s important to review the options and decide what will work best for you and your family.

One of the largest ongoing expenses when raising a family is childcare and education. Childcare in early years can be $1,000’s per month. But this depends on where you live and the choices you have available. It’s also a cost that will go away at some point in the future.

Education is another expense that can cost very little or a whole lot depending on your choices. A private education can be $10,000+ per year per child whereas a public education can be as low as a few hundred in random incidental costs per year.

Taking Parental Leave

Taking parental leave is probably one of the largest costs of starting a family. It causes a large disruption to income and that “opportunity cost” can be significant. At the same time, it’s an amazing opportunity to take 12 to 18-months off with a newborn child. Employment laws now allow up to 18-months of combined maternity and parental leave in Canada.

There are programs that can help offset some of the impact of taking parental leave. One program is an income “top up” from an employer. Typically, this amount “tops up” income from employment insurance and closes the gap to regular earnings. The top up might increase parental leave income to 75%, or 90% of 100% of earnings but its not a common benefit offered by employers.

The most common form of income support during a parental leave is employment insurance benefits. This amount is paid weekly. It’s 55% of pre-leave income up to a maximum amount but for those who choose an 18-month leave this amount is reduced to 33% of pre-leave income up to a maximum.

Plan Ahead For Daycare Expenses (Or Have One Parent Stay At Home)

The other major cost of starting a family is child care. Daycare expenses can easily add up to $1,000+ per month per child. The alternative is to have one parent stay at home, which also has a cost in the form of decreased income.

Daycare expenses can significantly increase household spending for a period of 3+ years. For families who choose to have multiple children, these daycare expenses can last for 5-7+ years. These expenses may start and stop as the family has more children and one parent goes on leave and then back to work.

The phasing in and out of this major expense can make it difficult to save and invest while starting a family. It can be advantageous to plan ahead, increasing savings rates and saving a bit more before starting a family in anticipation of saving a bit less while children are young and not in school.

A family who spends 90%+ of their net income before having children will find it difficult to manage these extra expenses after starting a family. Ideally, saving 20%+ of net income should be the goal before starting a family.

Maximize RESP Matching

The Registered Education Savings Plan (RESP) is a tax advantaged account that is available to families to save for their children’s post secondary education.

Along with tax free growth on investments, the other major appeal of the RESP is the grant. The CESG provides up to $500 per year per child up to the lifetime maximum of $7,200. To reach the maximum grant a parent needs to contribute $2,500 per year for 14.4 years.

There are other nuances to the RESP but it is certainly a great way to save for a child’s future education.

Optimizing Government Benefits

Most families in Canada will receive some form of government benefit. The Canada Child Benefit (CCB) is one of the most generous government benefits and it’s available to all families with children under the age of 17.

The exact amount that a family will receive depends on their family net income (line 236 on your tax return). As this amount increases the CCB decreases. This can be calculated using the clawback rates for your income level. At some point, as income increases, a very high income family won’t receive any CCB.

In addition to CCB there are other government benefits that may change when starting a family. Moderate and low-income families could expect to see an increase in GST/HST credits and/or provincial benefits like the Trillium benefit in Ontario.

The combination of these government benefits can often add up to $1,000’s per year for an average family and up to $10,000+ per year for a lower income family. It’s an important consideration when starting a family and it can help offset some of the costs of raising children.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments