by Owen | Nov 1, 2021 | Financial Goals, Financial Planning, Income, Investment Planning, Retirement Planning, Tax Planning

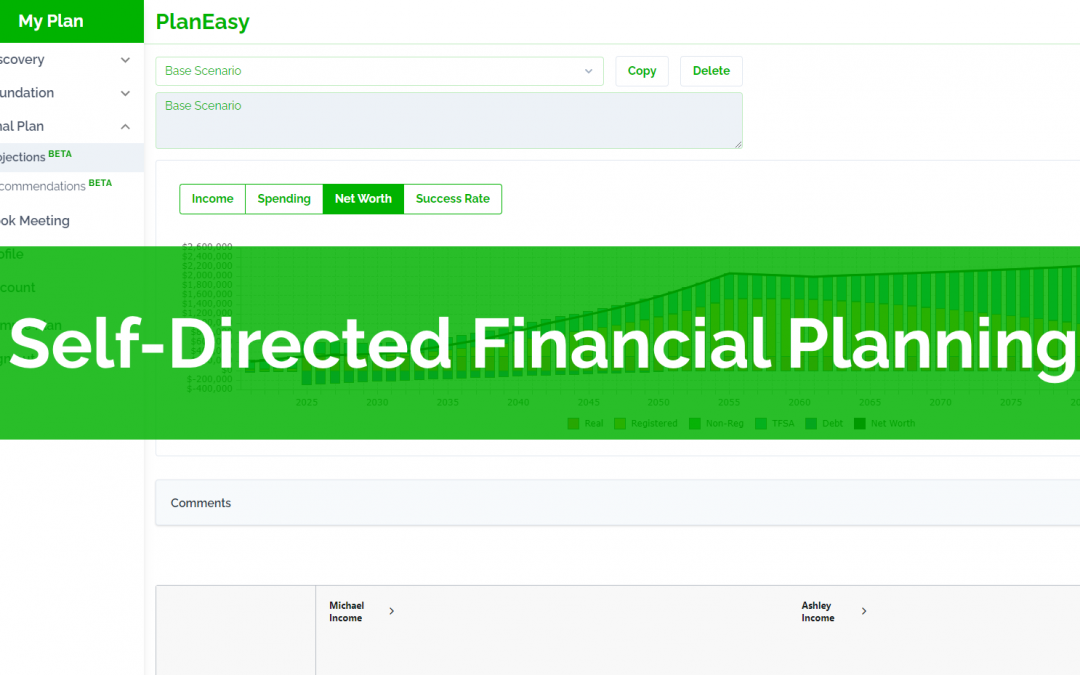

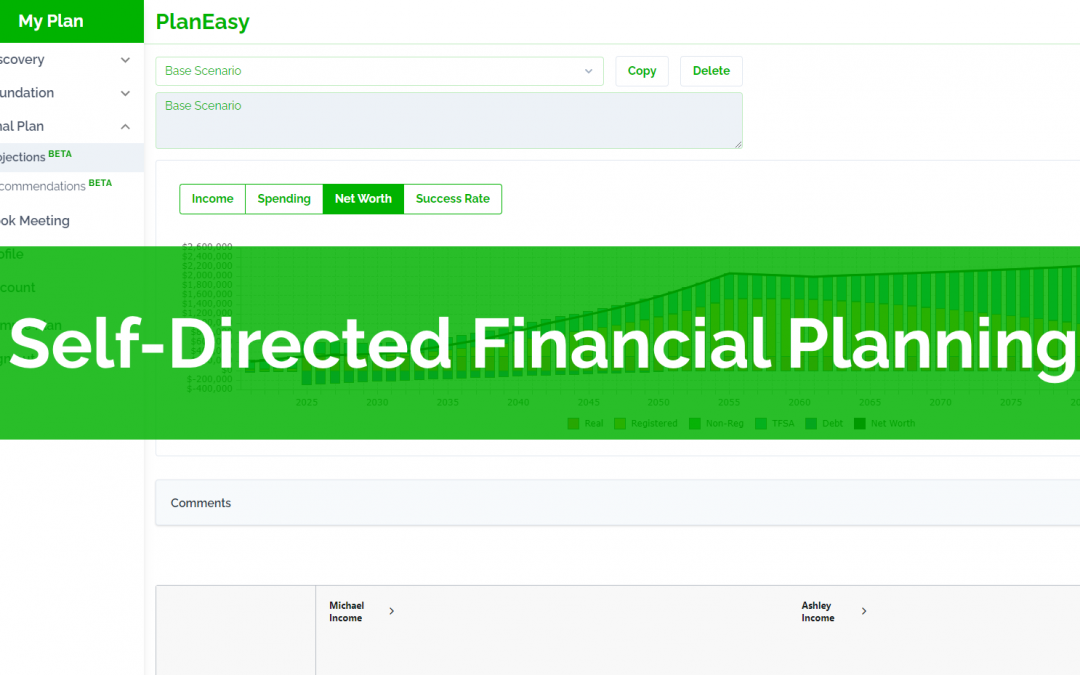

We’re excited to introduce self-directed financial planning, a new way to access advice-only financial planning.

At PlanEasy our mission is to make advice-only financial planning easy, accessible, and inexpensive, and our new self-directed financial planning platform helps make that even more of a reality.

Self-directed planning uses our innovative financial planning platform to create a truly customized financial plan in just three simple steps.

The platform intelligently tailors to every individual, couple, and household to create a unique financial plan that is customized to your exact situation.

Unlike other financial planning options, our platform is completely unbiased, there are no products, no sales goal, just advice.

Our platform helps you optimize your financial plan for income tax, tax credits, and multiple governments benefits including the big ones like Guaranteed Income Supplement (GIS) and the Canada Child Benefit (CCB) as well as multiple smaller government benefits too.

Most importantly, a self-directed financial plan is just a fraction the cost of a typical one-on-one advice-only financial planning engagement, making it easier and less expensive to create an unbiased financial plan.

Interested? Get early access to self-directed financial planning, join the waitlist now.

Let’s take a look at just a few of the ways a self-directed financial planning can help you make the most of your money…

by Owen | Aug 9, 2021 | Behavioral Finance, Investment Planning

Are actively managed portfolios guaranteed to underperform passively managed portfolios? That’s what William F. Sharpe argued when he wrote The Arithmetic Of Active Management.

The idea is quite simple, and the paper is quite short if you’d like to read it.

It presents a very simple argument for low-cost passive investing versus high-cost active investing.

Through simple arithmetic, Sharpe argues that it’s easy to see that passive portfolios will outperform active portfolios. The argument is built on a few simple concepts so let’s take a look…

by Owen | Jun 21, 2021 | Behavioral Finance, Investment Planning

In general, there are two types of investing, passive investing, and active investing. Passive investing means purchasing broad index funds that will match market returns at the lowest possible cost. It means focusing on the aspects of investing that are directly in the investors control like investment fees, asset allocation, and diversification.

Active investing, on the other hand, means purchasing specific investments with the hope of outperforming the market over the long run. Active investing can be very appealing and very exciting, but it has its risks. When you’re an active investor there is the possibility of beating the market return and growing your portfolio substantially over time, but there is also the possibility of losing everything.

The issue with active investing is that it generally doesn’t deliver. After investment fees, time, effort etc., the active investment portfolio typically does not outperform the market. In fact, individual investors are known to be very poor active investors, trying to time the market, putting all their eggs in one basket, taking on too much risk etc. etc.

As we’ll see, even the pros don’t have a great track record with active investing. Over a long period of time the majority of actively managed funds fail to outperform their passive peers.

Despite the risk of lower returns, active investing is still very appealing for many investors.

So how do you get the benefit of passive investing with its low fees, high diversification, more consistent returns, and still have a bit of fun with active investing?

The solution is to allocate a small portion of your portfolio to active investing. Basically, the idea is to create your own personal “hedge fund” with a portion of your portfolio. It’s a small amount of money which can be more actively managed without risking your entire nest egg. But how do you do this properly and without risking the rest of your portfolio?

by Owen | May 31, 2021 | Behavioral Finance, Budgeting, Investment Planning, Saving Money

One amazing thing to consider about personal finances is the sheer amount of money that will flow through our hands over a lifetime.

Knowing how much money we’ll touch over a lifetime provides a very good incentive to get better at managing income and spending, to learn more about investing, to understand how income tax works etc. etc.

Given the amount of money we’ll handle over a lifetime, learning more about personal finances will pay dividends over many years. If you’re able to manage money well, then you’ll have a life that is free from financial stress (for the most part, it’s never possible to completely avoid financial stress).

Because of the sheer amount of money that will flow through our hands over a lifetime even a small positive change can have a significant effect.

So how much money will we “touch” over a lifetime… is it $500,000? $1,000,000? $2,000,000? $5,000,000? You might be surprised…

by Owen | Apr 26, 2021 | Financial Planning, Insurance And Risk Management, Investment Planning, Retirement Planning

If we knew how things would unfold in the future, then financial planning would be easy.

If we knew things like future investment returns and future inflation rates, then that would remove a lot of uncertainty in a financial plan.

If we also knew when we’re going to die, then we could make sure that we spend every penny and “bounce the last check”.

But because of all the unknowns, we have a lot of uncertainty within a financial plan. To create a great financial plan, we have to evaluate and plan for that uncertainty. We have to understand both the average and the extremes. We don’t want to run out of money in the future, so it’s important that we manage this uncertainty properly and avoid making bad assumptions.

Life expectancy is one of those assumptions and it’s a big assumption within a financial plan. Assume a life expectancy that is too short and there could be years (or possibly decades) of meager retirement income.

When it comes to life expectancy, we can’t just assume the average, we need to know how much longer our money needs to last. Is it 5-years past the average, 10-years, 20-years, or more? Hopefully it’s for a very long time.

by Owen | Apr 12, 2021 | Financial Planning, Investment Planning, Tax Planning

Getting married is a big step in a relationship. It often means changes to personal finances. Some of these changes can be quite positive. These changes can actually make it much, much easier to achieve financial goals.

In this post we’ll explore the financial benefits of marriage (or entering a common-law relationship).

There are obviously a lot of considerations when combining finances, but there are certain financial advantages that couples have versus individuals. These advantages can make it easier to achieve financial goals. There are tax advantages, saving advantages, spending advantages, debt advantages, and risk reduction advantages.

If you’ve recently entered into a common-law relationship, or if you’ve recently gotten married, then you might be interested to know the financial benefits of marriage.

Page 7 of 15«...56789...»